Generic Drugs Market Size

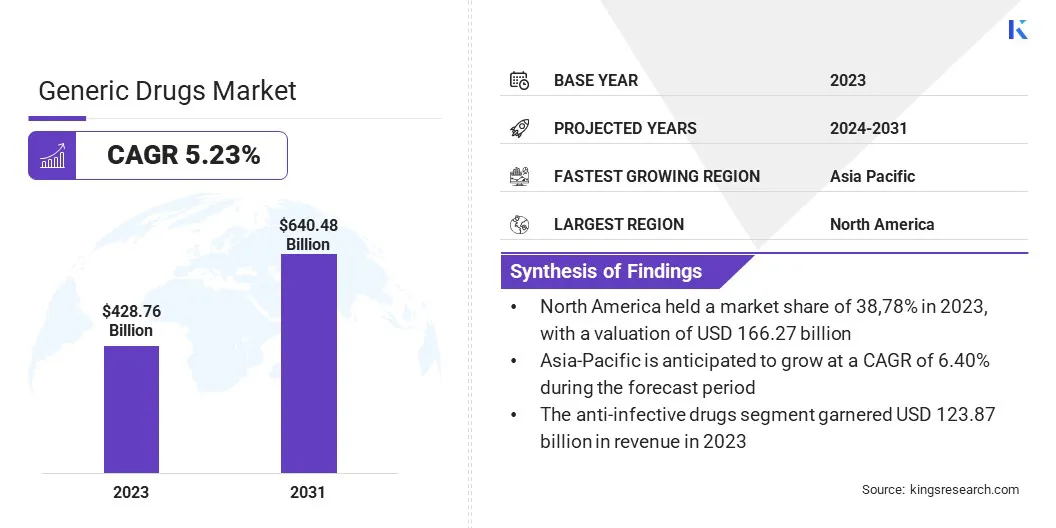

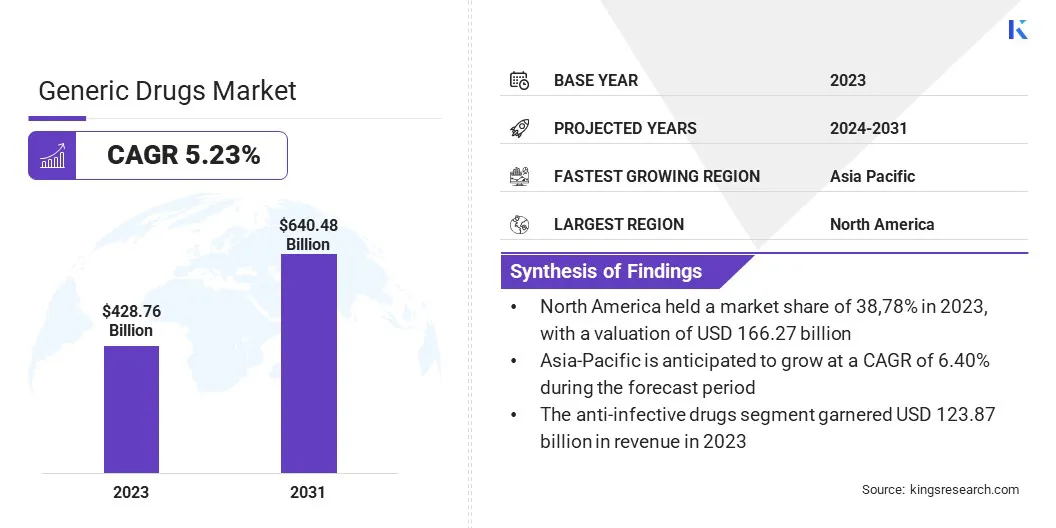

The global Generic Drugs Market size was valued at USD 428.76 billion in 2023 and is projected to grow from USD 448.28 billion in 2024 to USD 640.48 billion by 2031, exhibiting a CAGR of 5.23% during the forecast period. In the scope of work, the report includes solutions offered by companies such as Viatris Inc., Abbott, Teva Pharmaceutical Industries Limited, Sun Pharmaceutical Industries Ltd., STADA Arzneimittel AG, GlaxoSmithKline PLC, Baxter, Pfizer Inc., Sanofi, Novartis AG (Sandoz International) and others.

Generic drugs are pharmaceutical equivalents of brand-name medications, containing the same active ingredients and producing identical therapeutic effects. They are marketed after the patent of the original drug expires, offering cost-effective alternatives. These drugs undergo rigorous regulatory scrutiny to ensure safety, efficacy, and quality comparable to branded counterparts.

The expansion of the generic drugs market is driven by the increasing demand for affordable alternatives to branded medications. Moreover, this demand is spurred by patent expirations and rising healthcare costs. Regulatory support for generics, particularly in fast-tracking approvals, further boosts market expansion. The growing prevalence of chronic diseases necessitates continuous medication, thereby boosting the demand for generic drugs as a cost-effective solution.

Additionally, the expansion of biosimilars for biologic drugs, facilitated by regulatory approvals and cost advantages, presents lucrative growth opportunities. Pharmaceutical companies are strategically investing in these areas, aiming to capitalize on evolving market dynamics and meet global healthcare needs efficiently.

- For instance, in May 2024, Gland Pharma Limited, Hikma Pharmaceuticals USA Inc., Long Grove Pharmaceuticals LLC, and Dr. Reddy's Laboratories Limited received approval for Edaravone Intravenous Solutions, a generic alternative to Radicava, for treating amyotrophic lateral sclerosis (ALS).

Generic drugs are pharmaceutical products that are bioequivalent to brand-name drugs in terms of dosage form, strength, safety, efficacy, administration route, quality, and intended use. These medications are marketed after the patent protection of the original branded drug expires.

Generic drugs contain the same active ingredients as their branded counterparts and typically provide identical therapeutic effects. They are often marketed at lower prices due to competition from multiple manufacturers once exclusivity periods expire, making them more accessible and cost-effective alternatives for both patients and healthcare systems.

Analyst’s Review

The expansion of the generic drugs market is fueled by substantial cost savings and increased accessibility.

- For instance, according to IBEF, Indian pharmaceutical companies supplied 47% of US generic prescriptions in 2022.

Their dominance spans critical therapeutic areas such as mental health and hypertension, where they supply over half of the prescriptions, underscoring their pivotal role in enhancing affordable healthcare globally.

To sustain market growth, key players are employing a dual approach of implementing organic and inorganic strategies. This includes expanding R&D efforts to develop a broader portfolio of generics and biosimilars, strategically entering new markets through partnerships and acquisitions, and maintaining stringent regulatory compliance to ensure quality and market acceptance.

These initiatives are poised to further propel market expansion, with projections indicating potential savings of US$ 1.3 trillion over the next five years, reinforcing generics' essential contribution to cost-effective healthcare management worldwide.

Generic Drugs Market Growth Factors

The rising prevalence of chronic diseases is significantly bolstering the growth of the generic drugs market. Chronic conditions such as diabetes, hypertension, and heart disease require ongoing, long-term treatment, thereby making cost-effective solutions such as generic drugs essential. An aging population, lifestyle changes, and urbanization are contributing to the increasing incidence of these diseases, thereby boosting market progress.

Governments and healthcare systems, facing the challenge of rising costs, promote the use of generics through supportive policies and insurance incentives. These factors are projected to fuel the demand for generic medication as it remains a vital component of global healthcare strategies, providing accessible and affordable medication for chronic disease management.

- According to World Health Organization (WHO) projections, by 2050, chronic diseases are likely to account for 86% of the 90 million deaths each year, representing a 90% increase since 2019. This highlights the critical need for affordable medication.

A significant challenge impeding the growth of the generic drugs market is ensuring regulatory and quality compliance. Manufacturers must meet stringent regulatory standards, such as those set by the FDA and EMA, to secure drug approval, which involves demonstrating bioequivalence through extensive testing. Maintaining consistent quality is critical and requires investments in advanced quality control and supply chain management.

However, large multinational pharmaceutical companies are allocating substantial resources to enhance their R&D capabilities, aiming to ensure robust clinical trials and data integrity to meet regulatory requirements. They are further establishing strong partnerships with local manufacturers in emerging markets to streamline manufacturing processes and ensure compliance with local regulations. These efforts by manufacturers are expected to stimulate market progress.

Generic Drugs Market Trends

As biologic drugs used for conditions such as cancer and autoimmune diseases approach the expiration of their patent protection, the biosimilars market (generic versions of biologic) is rapidly expanding. This trend is likely to rise as several biologics face patent cliffs. Healthcare systems seek cost-effective alternatives to expensive biologics, and regulatory bodies are streamlining approval processes for biosimilars, enhancing product market entry.

Advances in biotechnology are improving biosimilar production, ensuring efficacy and safety comparable to reference biologics.

- In April 2024, the FDA published draft guidance on data integrity for bioavailability and bioequivalence studies, providing industry recommendations that support the reliability of data in drug applications, thereby contributing significantly to the growth of this evolving market.

Local production and strategic partnerships are becoming increasingly prominent in emerging markets as multinational generic drug manufacturers collaborate with local companies to enhance the accessibility and affordability of generic medications. These partnerships involve establishing manufacturing plants and robust distribution networks within the regions. By leveraging local infrastructure and market knowledge, multinational companies are able to reduce production and logistics costs, thereby lowering the prices of generic drugs.

Moreover, these collaborations enable quicker and more efficient regulatory approvals as local companies are often more familiar with the regional regulatory landscape. This trend is expected to strengthen the global presence and increase the market share of multinational generic drug manufacturers, thereby fostering generic drugs market development.

Segmentation Analysis

The global market is segmented based on application, route of administration, distribution channel, and geography.

By Application

Based on application, the generic drugs market is categorized into cardiovascular products, anti-infective drugs, anti-arthritis drugs, central nervous system drugs, anti-cancer drugs, respiratory products, and other applications (gastrointestinal, hormonal drug). The anti-infective drugs segment garnered the highest revenue of USD 123.87 billion in 2023.

Anti-infective drugs play a crucial role in combating infections globally, encompassing antibiotics, antivirals, antifungals, and antiparasitics. Moreover, the demand for anti-infective drugs is driven by rising infections and microbial resistance. Additionally, generic manufacturers' focus on producing affordable alternatives to branded medications is propelling segmental growth.

By Route of Administration

Based on route of administration, the market is divided into oral, topical, injectable, and other routes of administration (sublingual, rectal). The oral segment captured the largest generic drugs market share of 39.78% in 2023. This notable growth is attributed to its convenience, patient compliance, and cost-effectiveness compared to branded equivalents.

Key factors fueling segmental growth include patent expirations of branded drugs, which create lucrative opportunities for generic manufacturers, and the significant role these medications play in managing healthcare costs globally. In addition, technological advancements in drug formulation have improved the stability and efficacy of oral medications, further enhancing segment growth.

By Distribution Channel

Based on distribution channel, the market is categorized into hospitals & clinics, retail pharmacies/ pharmacy drug store, and online retail. The hospitals & clinics segment is projected to generate the highest revenue of USD 190.09 billion by 2031. The segment is poised to experience robust growth with increasing adoption of biosimilars and integration of digital health technologies, aiming to enhance treatment outcomes and operational efficiencies in healthcare facilities globally.

These settings rely heavily on generic medications due to their affordability and widespread availability, catering to diverse patient needs from emergency care to chronic disease management. Furthermore, key factors fostering segmental growth include regulatory support facilitating generic adoption and the imperative to contain healthcare costs.

Generic Drugs Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America generic drugs market share stood around 38.78% in 2023 in the global market, with a valuation of USD 166.27 billion. This considerable expansion is primarily fostered by its advanced healthcare infrastructure and robust regulatory framework. Moreover, the widespread adoption of cost-effective generics, supported by stringent oversight from regulatory bodies such as FDA is contributing to regional market development.

Generics play a vital role across diverse therapeutic areas, including cardiovascular health, neurology, and oncology, addressing the healthcare needs of a large and diverse population. The regional market benefits from competitive pricing pressures and continual innovation among manufacturers.

Asia-Pacific is anticipated to witness substantial growth, recording a robust CAGR of 6.40% over the forecast period. This notable progress is bolstered by its diverse and expansive healthcare landscape. With a population exceeding 4.6 billion and rising healthcare expenditures, the region demonstrates robust demand for affordable pharmaceutical solutions, including generics.

Governments across Asia Pacific are increasingly promoting the use of generic drugs to reduce healthcare costs and improve access to essential medications. Countries such as India and China at the forefront of generic drug production, capitalizing on their manufacturing capabilities and cost advantages.

Competitive Landscape

The global generic drugs market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Generic Drugs Market

- Viatris Inc

- Abbott

- Teva Pharmaceutical Industries Limited

- Sun Pharmaceutical Industries Ltd.

- STADA Arzneimittel AG

- GlaxoSmithKline PLC

- Baxter

- Pfizer Inc.

- Sanofi

- Novartis AG (Sandoz International)

Key Industry Development

- May 2023 (Partnership): Ginkgo Bioworks and Centrient Pharmaceuticals announced an expansion of their partnership, following the success of their initial project aimed at introducing sustainable innovation in the generic API space. The collaboration seeks to leverage Ginkgo Bioworks' expertise in biotechnology and synthetic biology to develop novel and sustainable manufacturing processes for generic APIs. Centrient Pharmaceuticals, a global leader in antibiotics production, benefited from Ginkgo's advanced technologies to enhance efficiency and sustainability in API production. This expansion highlighted both the companies' dedication toward advancing pharmaceutical manufacturing innovation while addressing the increasing global demand for sustainable healthcare solutions.

The global generic drugs market is segmented as:

By Application

- Cardiovascular Products

- Anti-infective Drugs

- Anti-arthritis Drugs

- Central Nervous System Drugs

- Anti-cancer Drugs

- Respiratory Products

- Other Applications (Gastrointestinal, Hormonal Drug)

By Route of Administration

- Oral

- Topical

- Injectable

- Other Routes of Administration (Sublingual, Rectal)

By Distribution Channel

- Hospitals & Clinics

- Retail Pharmacies/ Pharmacy Drug Store

- Online Retail

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America