Market Definition

The SiC (silicon carbide) wafer polishing market focuses on the polishing and surface treatment of silicon carbide wafers, critical for semiconductor manufacturing.

SiC is widely used in power electronics, electric vehicles (EVs), high-temperature devices, and renewable energy due to its high thermal conductivity, electrical efficiency, and durability. Wafer polishing is essential for achieving smooth, defect-free surfaces, enhancing device performance and manufacturing yield.

SiC Wafer Polishing Market Overview

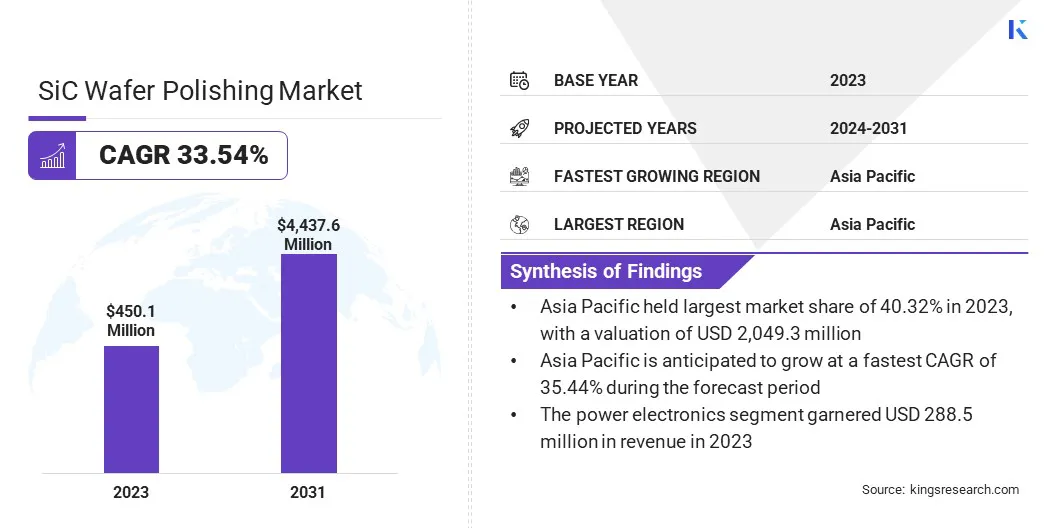

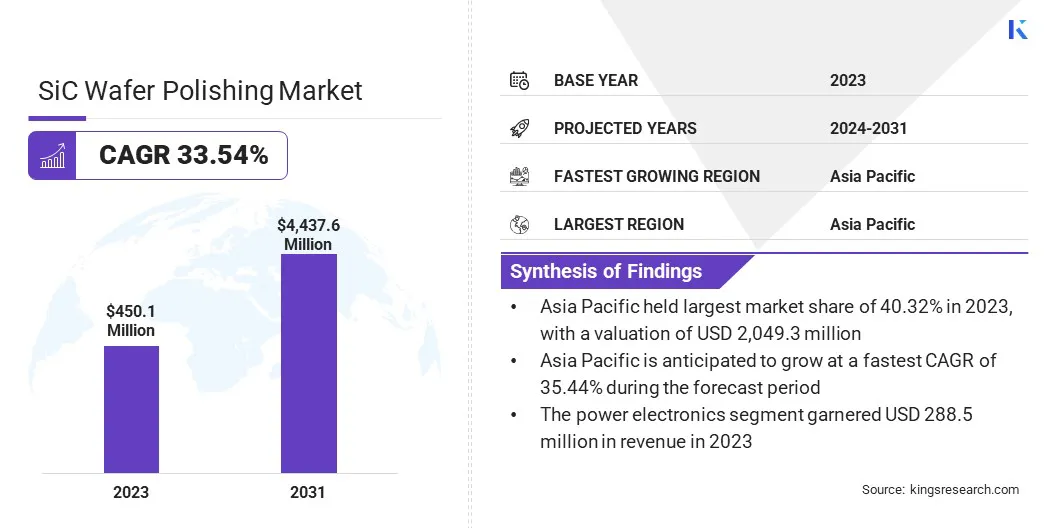

The global SiC wafer polishing market size was valued at USD 450.1 million in 2023 and is projected to grow from USD 586.0 million in 2024 to USD 4,437.6 million by 2031, exhibiting a CAGR of 33.54% during the forecast period.

The market is witnessing substantial growth, fueled by the increasing demand for high-performance semiconductors in sectors such as electric vehicles (EVs), renewable energy, and power electronics.

Silicon carbide, known for its superior thermal conductivity, energy efficiency, and high voltage resistance, is playing a pivotal role in advancing these technologies. Additionally, ongoing innovations and investments in semiconductor manufacturing are further accelerating market expansion.

Major companies operating in the global SiC wafer polishing industry are Applied Materials, Inc., 3M Company, Saint-Gobain Ceramics & Plastics, Inc., Fuji Bakelite Co., Ltd., Entegris, Inc., Logitech Ltd., EBARA Precision Machinery Europe GmbH, Valley Design Corp., NORITAKE CO., LIMITED, Henkel Corporation, KINIK COMPANY, Vibrantz Technologies, Inc., KYOCERA Corporation, Pureon Group, and Lapmaster Wolters GmbH.

Additionally, the rapid advancement in power semiconductor technologies and the rising need for energy-efficient devices are contributing to market expansion. The automotive industry's shift toward electric mobility further boosts the need for SiC wafers, essential for electric drivetrains, chargers, and energy management systems.

Moreover, the focus on reducing carbon emissions and improving energy efficiency is accelerating investments in advanced materials such as silicon carbide, highlighting the need for wafer polishing.

- In September 2024, Axus Technology introduced the Capstone CS200 platform, otimizing CMP processes for 200mm SiC wafers with the industry's lowest cost of ownership. The platform delivers 2x higher throughput, reduced power and water consumption, and integrated temperature control for improved polishing efficiency.

Key Highlights

- The global SiC wafer polishing market size was valued at USD 450.1 million in 2023.

- The market is projected to grow at a CAGR of 33.54% from 2024 to 2031.

- Asia Pacific held a share of 40.32% in 2023, with a valuation of USD 181.5 million.

- The chemical-mechanical polishing (CMP) segment garnered USD 248.0 million in revenue in 2023.

- The polishing pads & slurries segment is projected to generate a revenue of USD 2,504.0 million by 2031.

- The 6-inch wafers segment is likely to reach USD 2,483.5 million by 2031.

- The power electronics segment is estimated to register a valuation of USD 2,237.4 million by 2031.

- The market in North America is anticipated to grow at a CAGR of 33.20% over the forecast period.

Market Driver

"Growing Adoption of Silicon Carbide Wafers"

The SiC wafer polishing market is witnessing robust growth, fueled by the growing adoption of silicon carbide in electric vehicles and renewable energy systems. SiC wafers are increasingly favored for their exceptional thermal conductivity, high power efficiency, and ability to withstand extreme voltage conditions, making them indispensable in power electronics.

As EV manufacturers strive to enhance battery efficiency and extend driving ranges, SiC-based power devices are being integrated into inverters, onboard chargers, and DC-DC converters.

Furthermore, solar inverters and wind power converters use SiC components to improve energy conversion efficiency, reduce power loss, and ensure reliability. This expanding application scope is underscording the need for precise wafer polishing to meet quality and performance standards.

- In April 2024, ROHM Group Company SiCrystal and STMicroelectronics expanded their multi-year agreement for 150mm silicon carbide substrate wafers. The deal increases wafer production in Nuremberg, Germany, supporting STMicroelectronics' manufacturing capacity growth for automotive and industrial customers while enhancing supply chain resilience.

Additionally, the increasing focus on improving wafer yield and surface quality is leading to the adoption of advanced polishing techniques. SiC wafers are prone to defects due to their hardness and brittle nature, making efficient polishing crucial to achieving smooth, defect-free surfaces.

Manufacturers are investing in innovative chemical mechanical planarization solutions, precision polishing equipment, and advanced metrology tools to enhance wafer quality, reduce surface irregularities, and improve production yield.

Market Challenge

"Material Hardness and Brittleness"

The SiC wafer polishing market faces challenges due to the material's extreme hardness and brittleness, which complicate processing. With a hardness close to diamond, SiC resists mechanical abrasion, leading to prolonged polishing times.

Additionally, it's brittle nature increases the risk of micro cracks, chipping, and surface defects, affecting wafer quality and semiconductor performance. To address this challenge, manufacturers are adopting advanced CMP techniques with specialized slurries, polishing pads, and enhanced process controls.

Precision-engineered abrasives and chemical formulations facilitate smoother material removal, while improved process control systems enhance pressure management and consistency, reducing defects.

Market Trend

"Advancements in CMP Technology and Expanding Applications"

Advancements in CMP technology are significantly enhancing the efficiency and precision of SiC wafer polishing, emerging as a notable market trend. These innovations address challenges posed by SiC’s extreme hardness, improving substance removal rates while minimizing surface defects.

As demand for high-performance SiC wafers increases, acieiving exceptional flatness and smoothness is critical for advanced semiconductor devices. Additionally, the growing adoption of SiC wafers in power electronics, including electric vehicles (EVs), renewable energy systems, industrial motor drives, and power grids, is propelling market expansion.

With industries prioritizing energy efficiency and high-performance components, the requirement for SiC wafers and advanced polishing processes continues to rise.

- In September 2024, Vibrantz announced advancements in its silicon carbide slurry technology designed for semiconductor chemical mechanical planarization, offering high removal rates, minimal defectivity, and smooth surface finishes. This innovation enhances polishing efficiency and supports improved semiconductor performance in applications such as EVs and renewable energy systems.

SiC Wafer Polishing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Mechanical Polishing, Chemical-Mechanical Polishing (CMP

|

|

By Product Type

|

Polishing Pads & Slurries, Diamond Powders & Abrasives, Others

|

|

By Wafer Size

|

6-inch wafers, 4-inch wafers, 8-inch wafers

|

|

By End-Use Industry

|

Power Electronics, RF & Communication Devices, Automotive & Aerospace, Industrial & Energy

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Mechanical Polishing and Chemical-Mechanical Polishing (CMP)): The chemical-mechanical polishing (CMP) segment earned USD 248.0 million in 2023 due to its superior ability to achieve ultra-smooth surfaces with minimal defects in SiC wafers.

- By Product Type (Polishing Pads & Slurries, Diamond Powders & Abrasives, and Others): The polishing pads & slurries segment held a substantial share of 60.12% in 2023, as a result of their essential role in achieving precision surface finishes during SiC wafer polishing.

- By Wafer Size (6-inch wafers, 4-inch wafers, 8-inch wafers): The 6-inch wafers segment is projected to reach USD 2,483.5 million by 2031, owing to their growing adoption in high-performance power electronics and automotive applications.

- By End-Use Industry (Power Electronics, RF & Communication Devices, Automotive & Aerospace, and Industrial & Energy): The power electronics segment is projected to reach USD 2,237.4 million by 2031, fueled by the increasing demand for efficient energy management solutions in electric vehicles, renewable energy systems, and industrial applications.

SiC Wafer Polishing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific SiC wafer polishing market accounted for a substantial share of 40.32% in 2023, valued at USD 181.5 million. This expansion is facilitated by its strong semiconductor manufacturing ecosystem and growing demand for SiC-based power electronics.

Countries with well-established supply chains and advanced manufacturing facilities contribute significantly to this dominance. The region's rapid industrialization, increasing adoption of EVs, and expansion of renewable energy systems are highlighting the rising need for SiC wafers.

Additionally, government initiatives supporting energy-efficient technologies and electric mobility have accelerated investments in SiC wafer production and polishing processes. The presence of major SiC wafer manufacturers and polishing solution providers further strengthens Asia Pacific’s leadership in the market.

North America SiC wafer polishing industry is expected to register the fastest CAGR of 33.20% over the forecast period. This growth is fueled by advancements in power electronics, automotive electrification, and renewable energy sectors.

The region hosts leading technological innovators and semiconductor research centers advancing SiC wafer manufacturing and polishing techniques. The growing adoption of electric vehicles in the United States, coupled with increased investments in charging infrastructure, is boosting the need for high-performance SiC wafers.

Furthermore, industries such as aerospace and defense increasingly rely on SiC-based components for their superior thermal conductivity and voltage resistance. The presence of prominent SiC wafer suppliers and CMP solution providers in North America ensures steady market growth, supported by ongoing R&D efforts to enhance polishing efficiency and reduce wafer defects.

Regulatory Frameworks

- In the United States, the Environmental Protection Agency (EPA) regulates the handling and disposal of chemicals used in Silicon Carbide (SiC) wafer polishing under the Toxic Substances Control Act (TSCA) to ensure environmental and worker safety.

- In Europe, the European Chemicals Agency (ECHA) oversees the use of chemicals in SiC wafer polishing through the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation.

- In China, the Ministry of Ecology and Environment (MEE) monitors chemical emissions and waste management from SiC wafer polishing processes to reduce environmental impact.

- In Japan, the Ministry of Economy, Trade and Industry (METI) regulates chemical substances used in SiC wafer polishing under the Chemical Substances Control Law (CSCL) to ensure safe handling and disposal.

- In India, the Central Pollution Control Board (CPCB) monitors industrial emissions and enforces environmental safety standards for SiC wafer polishing.

Competitive Landscape

The global SiC wafer polishing market is marked by a diverse range of players focused on meeting the increasing demand for high-quality semiconductor components.

Technological advancements in polishing techniques are central to ensuring the optimal surface quality and performance of silicon carbide wafers. Industry participants are prioritizing innovation, refining polishing processes to improve yield and reduce production costs.

- In July 2024, Axus Technology announced that it had received orders for its Capstone® CS200 Series CMP system from leading SiC device manufacturers. The system features a flexible architecture capable of processing up to four wafers simultaneously, supports both 150mm and 200mm wafers, and minimizes the overall cost of ownership. Additionally, it includes integrated post-CMP cleaning for streamlined processing and process temperature control technology to enhance removal rates, throughput, and cost efficiency.

Market dynamics are further shaped by a growing focus on customization to meet the specific needs of key sectors such as automotive, power electronics, and renewable energy.

Strategic initiatives, including collaborations, partnerships, and significant investments in research and development, are being leveraged to strengthen market positioning and gain a competitive edge. Additionally, as the demand for advanced semiconductors continues to rise, companies are increasingly focusing on sustainability and operational efficiency.

Technological advancements, product quality, and customer-centric solutions are key differentiators, enabling industry players to capitalize on long-term growth opportunities as SiC wafer demand expands.

List of Key Companies in SiC Wafer Polishing Market:

- Applied Materials, Inc.

- 3M Company

- Saint-Gobain Ceramics & Plastics, Inc.

- Fuji Bakelite Co., Ltd.

- Entegris, Inc.

- Logitech Ltd.

- EBARA Precision Machinery Europe GmbH

- Valley Design Corp.

- NORITAKE CO., LIMITED

- Henkel Corporation

- KINIK COMPANY

- Vibrantz Technologies, Inc.

- KYOCERA Corporation

- Pureon Group

- Lapmaster Wolters GmbH

Recent Developments (Expansion/Agreements/New Technology Launch)

- In August 2024, Entegris, Inc. entered a long-term supply agreement with onsemi to provide co-optimized chemical mechanical planarization solutions for silicon carbide applications. This partnership aims to enhance wafer polishing processes and support onsemi’s growing demand for SiC-based semiconductors with Entegris’ CMP solutions, including slurries, pads, brushes, and post-CMP cleans.

- In June 2024, Synova S.A. announced a breakthrough in silicon carbide wafer edge profiling with its Laser MicroJet (LMJ) technology. The innovative LCS 305 5-axis system significantly improves SiC wafer edge beveling and profiling, reducing process time by a factor of 3 compared to traditional diamond wheel edge grinding. LMJ technology eliminates chipping, enhances fracture strength, and improves wafer profile consistency.

- In May 2024, Axus Technology secured USD 12.5 million in funding from IntrinSiC Investment LLC to expand its CMP product offerings for SiC device manufacturing, particularly its Capstone and Aquarius platforms.