Market Definition

The 2D materials market involves the production, development, and commercialization of materials that are typically just one or two atoms thick. These two-dimensional materials exhibit unique properties that set them apart from their bulk counterparts, including exceptional electrical conductivity, mechanical strength, and distinctive optical characteristics, differentiating them from bulk counterparts.

2D Materials Market Overview

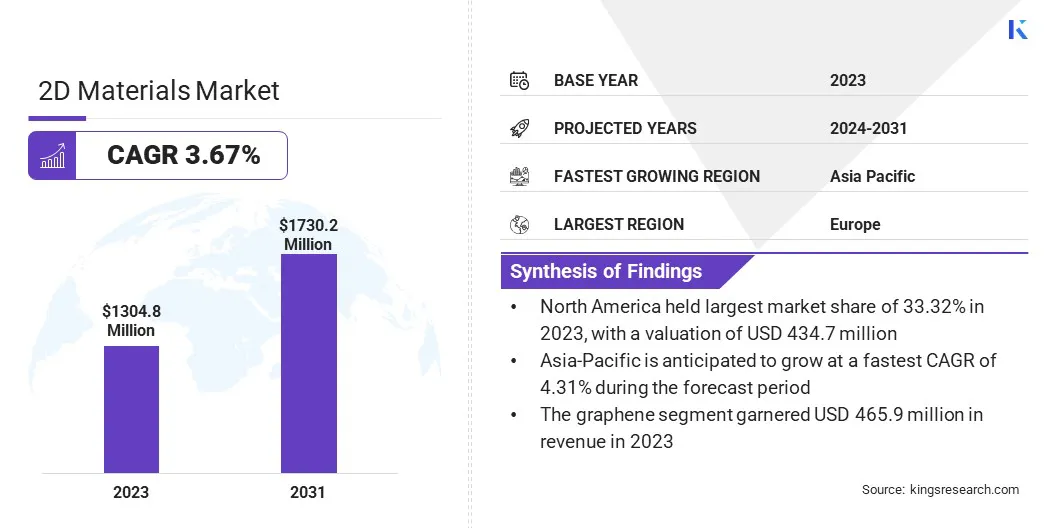

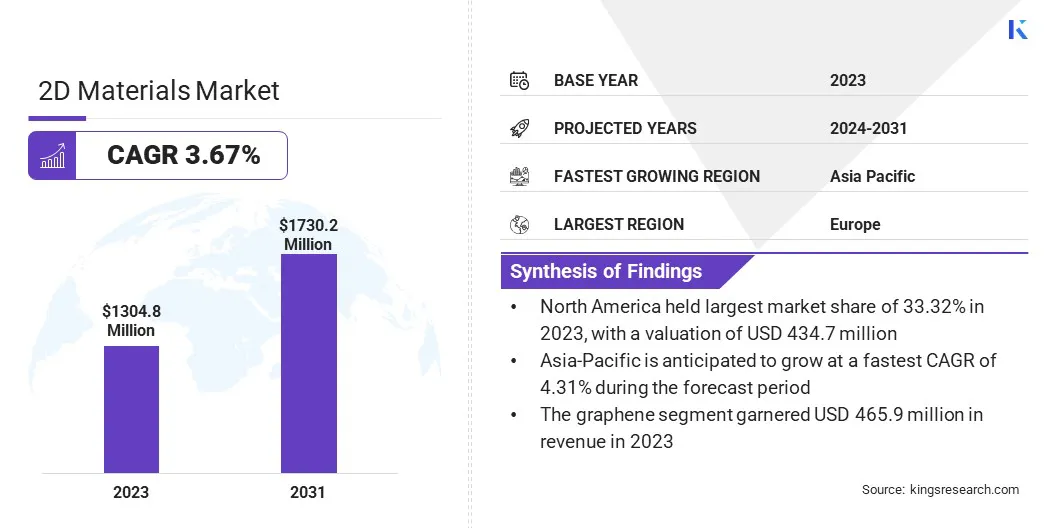

The global 2D materials market size was valued at USD 1304.8 million in 2023 and is projected to grow from USD 1344.1 million in 2024 to USD 1730.2 million by 2031, exhibiting a CAGR of 3.67% during the forecast period. This growth is driven by the increasing demand for advanced materials in industries such as electronics, energy storage, aerospace, and biotechnology.

Innovations in graphene, transition metal dichalcogenides (TMDs), and other 2D materials are expected to foster innovation in flexible electronics, high-performance batteries, and quantum computing, fueling market expansion.

The continuous advancements in production methods, coupled with rising investments in research and development, are expected to enhance the scalability and commercial viability of 2D materials.

Major companies operating in the global 2D materials industry are Graphenea, Inc., Haydale Graphene Industries plc, Versarien™ plc, NanoXplore Inc., Cabot Corporation, ACS Material, Graphene Industries, American Elements, Thomas Swan & Co. Ltd, 2-DTech Graphene, planarTECH, Smart-elements GmbH, Ossila, Nordic Bio-Graphite AB, and planarTECH (Holdings) Ltd.

The market is further benefiting from a growing emphasis on sustainability, with 2D materials offering eco-friendly alternatives in energy-efficient devices, renewable energy solutions, and next-generation electronics. The increasing adoption of 2D materials across various sectors is anticipated to contribute significantly to market growth over the coming years.

- In January 2023, LayerOne Materials partnered with 2D Tech to drive sustainable graphene-based innovations. This collaboration aims to advance the development of eco-friendly solutions by leveraging graphene's unique properties for various applications, including energy storage and electronics.

Key Highlights

- The global 2D materials market size was recorded at USD 1304.8 million in 2023.

- The market is projected to grow at a CAGR of 3.67% from 2024 to 2031.

- North America held a share of 33.32% in 2023, valued at USD 434.7 million.

- The graphene segment garnered USD 465.9 million in revenue in 2023.

- The consumer electronics segment is expected to reach USD 566.3 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 4.31% over the forecast period.

Market Driver

"Advancements in Electronics and Semiconductor Technology"

The 2D materials market is significantly influenced by advancements in electronics and semiconductor technology. Notably, materials such as graphene and transition metal dichalcogenides (TMDs) exhibit exceptional properties, including high electron mobility and flexibility, which are critical for the development of next-generation electronic devices.

As demand grows for smaller, faster, and more efficient devices, traditional materials are approaching their performance limits. 2D materials provide a solution by enabling compact designs and enhanced performance, making them ideal for flexible electronics, high-performance transistors, sensors, and quantum computing.

Their potential applications span flexible electronics, high-performance transistors, sensors, and quantum computing. This potential has driven considerable investment and research.

- In March 2024, the Graphene Flagship and the Advanced Materials 2030 Initiative organized an online workshop to present preparatory progress and outline highlight their proposed partnership's role in the "Advanced Materials for Industrial Leadership" initiative.

Market Challenge

"Scalability and Manufacturing"

Scalability and manufacturing pose significant challenges in the commercialization of 2D materials such as graphene and TMDs. While laboratory-scale production has shown their potential, scaling up to industrial levels remains difficult.

Existing production methods, including chemical vapor deposition (CVD), liquid-phase exfoliation, and mechanical cleavage, face limitations in efficiency, cost, and consistency. For instance, CVD can produce high-quality materials; however, it is expensive, slow, and requires high temperatures, limiting scalability.

Liquid-phase exfoliation, while more scalable, often results in inconsistent material quality and necessitates additional steps to remove solvents, which adds complexity and cost. Mechanical cleavage, although effective for small-scale production, is labor-intensive and unsuitable for mass manufacturing.

Roll-to-roll (R2R) processing offers a promising solution, enabling continuous, high-throughput production at reduced costs. Efforts to enhance chemical vapor deposition (CVD) focus on improving efficiency and increasing production rates.

Additionally, liquid-phase exfoliation is being optimized to produce higher-quality materials in larger quantities. The development of automated, high-throughput testing methods are being developed to ensure consistent material quality.

Furthermore, collaboration between academia and industry is essential to accelerate the development of cost-effective, scalable manufacturing solutions for 2D materials.

Market Trend

"Integration of 2D Materials with Emerging Technologies"

A major emerging trend influencing the 2D materials market is the increasing integration of these materials with emerging technologies, particularly in areas such as quantum computing, wearable devices, and nanomedicine.

Researchers are exploring the potential of materials such as graphene, MXenes, and TMDs to enable breakthroughs in these advanced fields. For instance, 2D materials are being used in quantum dots for quantum computing, biosensors for medical diagnostics, and flexible, stretchable electronics for wearables.

As these technologies advance, the demand for 2D materials is expected to grow, fostering innovation and commercialization in high-growth sectors. This trend highlights the expanding role of 2D materials in shaping next generation technological advancements.

- In May 2023, NanoXplore acquired complete ownership of both the equity and intellectual property in VoltaXplore, while Martinrea increased its equity stake in NanoXplore from 21.1% to 22.7%. This development positions NanoXplore as a key player in the emerging market, potentially driving further research and investment.

2D Materials Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Graphene, Transition Metal Dichalcogenide (TMDC), Black Phosphorus, Boron Nitride

|

|

By Application

|

Consumer Electronics, Aerospace, Healthcare, Energy, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (Graphene, Transition Metal Dichalcogenide (TMDC), Black Phosphorus, and Boron Nitride): The graphene segment earned USD 465.9 million in 2023, mainly due to its widespread adoption in applications such as electronics, energy storage, and sensors, supported by its exceptional electrical, thermal, and mechanical properties.

- By Application (Consumer Electronics, Aerospace, Healthcare, Energy, and Others): The consumer electronics segment held a share of 33.32% in 2023, largely attributed to the increasing demand for lightweight, flexible, and high-performance materials in devices such as smartphones, wearables, and displays.

2D Materials Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America 2D materials market captured a share of around 33.32% in 2023, valued at USD 434.7 million. This dominance is attributed to the region's strong presence of leading technology companies, academic institutions, and research organizations driving innovations in advanced materials.

The United States, in particular, is contributing significantly to this growth, with significant investments in R&D and the commercialization of 2D materials for applications in electronics, energy storage, and aerospace. The increasing adoption of 2D materials in industries such as automotive and healthcare is expected to contribute to regional market growth.

- In December 2024, semiconductor startup Destination 2D announced the successful achievement of wafer-scale synthesis of high-quality graphene under CMOS-compatible process conditions, leveraging its expertise in graphene process technology.

Asia-Pacific 2D materials industry is set to grow at a CAGR of 4.31% over the forecast period, charaterized by rapid industrialization, increasing demand for advanced electronics, and a strong focus on energy-efficient technologies.

Countries such as China, Japan, and South Korea are at the forefront of research and commercialization, with major investments in graphene and other 2D materials for applications in semiconductors, energy storage, and renewable energy.

The region's expanding manufacturing capabilities, coupled with favorable government policies supporting innovation in nanotechnology, are expected to further accelerate regional market growth.

Regulatory Frameworks

- The U.S. Environmental Protection Agency (EPA) administers the Toxic Substances Control Act (TSCA), which regulates the manufacturing, use, and distribution of chemicals, including nanomaterials such as 2D materials. Under the TSCA, manufacturers must submit a Pre-Manufacture Notice (PMN) to the EPA for new chemicals, including graphene and other 2D materials, before they are introduced into commerce.

- The U.S. Food and Drug Administration (FDA) provides guidance on the use of ISO 10993-1 for the biological evaluation of medical devices. This standard outlines the evaluation and testing of the biocompatibility of materials such as graphene and MXenes, used in medical devices to ensure they are safe for human use.

- The United States Patent and Trademark Office (USPTO) oversees intellectual property rights, including patents for innovations in 2D materials such as graphene and transition metal dichalcogenides. It ensures the protection of novel technologies and processes through its patent examination and granting procedures.

- The International Electrotechnical Commission (IEC) is a global standards organization that develops and publishes international standards for electrical, electronic, and related technologies. It plays a key role in developing regulations and frameworks that ensure the safety, reliability, and interoperability of emerging technologies, including those involving 2D materials.

Competitive Landscape

The global 2D materials market is characterized by a number of participants, including both established corporations and emerging players. These companies are focusing on the development of applications involving 2D materials such as graphene, molybdenum disulfide, and hexagonal boron nitride.

Through strategic partnerships, joint ventures, and extensive research and development (R&D) efforts, industry players are focusing on commercialize these materials for advanced technologies, including flexible electronics, next-generation batteries, and medical devices.

Numerous emerging startups are targeting niche markets, particularly in areas where 2D materials offer a competitive advantage, such as sensors, photodetectors, and energy-efficient devices.

- In June 2023, The Graphene Flagship and Advanced Materials 2030 Initiative (AMI2030) jointly called for a European partnership under Horizon Europe and its successor FP10 in the field of advanced materials, including 2D materials. This initiative seeks to accelerate the development and commercialization of cutting-edge materials, with a strong emphasis on graphene and related 2D materials, to enhance Europe's global leadership in advanced materials technologies.

List of Key Companies in 2D Materials Market:

- Graphenea, Inc.

- Haydale Graphene Industries plc

- Versarien™ plc

- NanoXplore Inc.

- Cabot Corporation

- ACS Material

- Graphene Industries

- American Elements

- Thomas Swan & Co. Ltd

- 2-DTech Graphene

- planarTECH

- Smart-elements GmbH

- Ossila

- Nordic Bio-Graphite AB

- planarTECH (Holdings) Ltd.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In October 2024, Toyota Research Institute of North America (TRINA) and Xanadu, a leader in quantum computing, launched a new project to leverage quantum computing in advancing materials science simulations. The collaboration highlights the increasing significance of quantum computing in overcoming challenges that have traditionally slowed progress in materials science.

- In January 2024, a collaboration between Azo Nano partners, Uppsala University, and Columbia University led to the discovery of a novel 2-dimensional quantum material. Composed of atom-thin layers of cerium, silicon, and iodine (CeSiI), this material represents the first known example of a two-dimensional structure featuring heavy fermions, offering significant potential for advancements in quantum materials research.

- In February 2023, Haydale received an Innovate UK grant to develop an image-based characterization technique for 2D materials. The project aims to advance the analysis of materials such as graphene and other nanomaterials using imaging technologies to better understand their properties and performance.