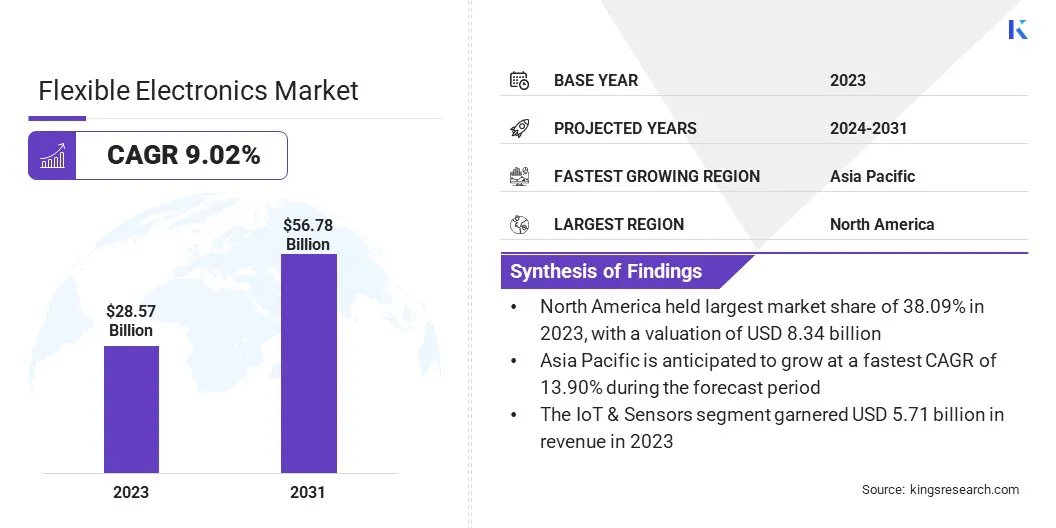

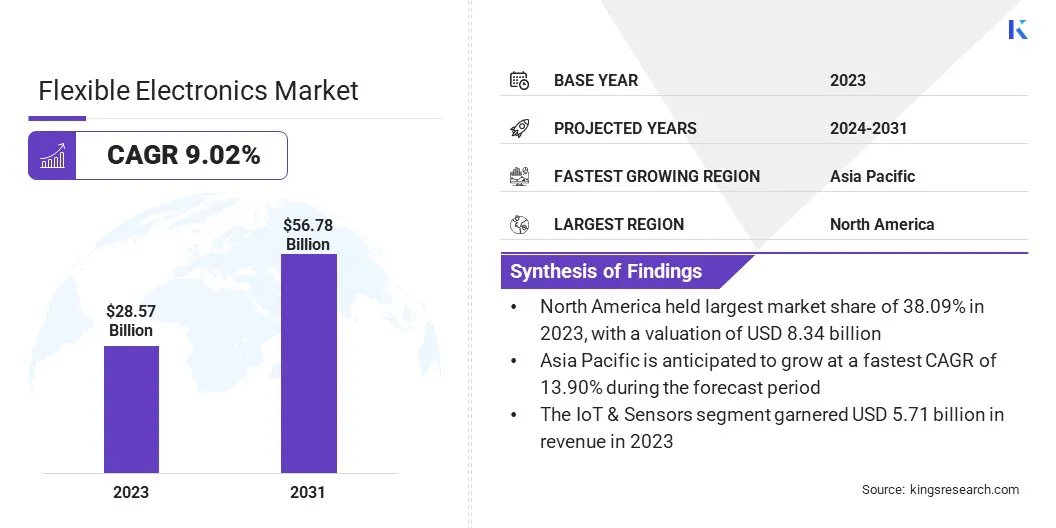

Flexible Electronics Market Size

The global Flexible Electronics Market size was valued at USD 28.57 billion in 2023 and is projected to grow from USD 31.01 billion in 2024 to USD 56.78 billion by 2031, exhibiting a CAGR of 9.02% during the forecast period. The market is expanding rapidly due to the growing adoption of IoT-enabled devices and advancements in material science.

The integration of flexible electronics into IoT systems for real-time data collection across industries such as healthcare, automotive, and consumer electronics is supporting market expansion. Additionally, innovations in materials such as conductive polymers and nanomaterials are enabling the production of durable, cost-effective flexible electronics, thereby boosting market growth.

In the scope of work, the report includes solutions offered by companies such as SAMSUNG, LG Electronics., INK HOLDINGS INC., MFLEX, OLEDWorks, GE Grid Solutions, LLC, Pragmatic, 3M, Henkel Maroc SA., FlexEnable, and others.

The flexible electronics market is experiencing robust growth, mainly driven by increasing demand for lightweight, adaptable devices across industries such as consumer electronics, healthcare, and automotive. The growth of wearable technology and IoT integration is fueling innovation in flexible sensors, displays, and circuits.

- According to Ericsson, smartphone subscriptions in North America is projected to reach 358 million by 2027, reflecting steady growth in mobile device usage.

This surge in smartphone use, particularly for foldable and flexible displays, is contributing significantly to market expansion. Additionally, advancements in healthcare and smart packaging are further boosting demand for flexible electronics.

Flexible electronics are electronic circuits and devices that are built on flexible substrates, allowing them to bend, stretch, and conform to various shapes while maintaining functionality. Unlike traditional rigid electronics, flexible electronics utilize materials such as conductive polymers, organic semiconductors, and thin metal foils, which facilitate lightweight and portable designs.

This technology has applications in multiple sectors, including consumer electronics (smartphones, wearables), healthcare (biosensors, implantable devices), and automotive (flexible displays, sensors). The ability to integrate seamlessly into diverse environments enhances their appeal, thereby stimulating growth and fostering innovation in the market.

Analyst’s Review

Key players in the flexible electronics industry are significantly increasing their investment in printed circuit boards (PCBs) to enhance applications in artificial intelligence and advanced sensors. This development allows PCBs to function as miniaturized computers for data sensing and processing, meeting the growing demand for miniaturization and improved performance in electronics.

- For instance, Würth Elektronik's launch of the HyPerStripes project in November 2023 exemplifies this trend, as it focuses on creating limitless flexible PCBs for healthcare applications and LED lighting.

Additionally, key players are forming strategic partnerships and collaborations to expand their technology portfolios and market reach. By tapping into emerging applications, particularly in wearable devices and the Internet of Things (IoT), these companies are capitalizing on new revenue streams. This proactive approach enhances product offerings and fosters a competitive edge, thereby aiding the growth of the flexible electronics market.

Flexible Electronics Market Growth Factors

The growing popularity of wearable technologies, such as fitness trackers, smartwatches, and health monitoring devices, is augmenting the expansion of the market. Consumers seek lightweight, durable, and comfortable wearable devices for daily use, leading to the growing adoption of flexible electronics.

These bendable and stretchable components allow for innovative designs that adapt to the human body, enhancing comfort and functionality. Additionally, health monitoring wearables, such as biosensors, leverage flexible electronic to provide continuous and unobtrusive data collection. This demand for user-centric, advanced wearable devices is prompting manufacturers to invest in flexible electronics, thus bolstering market expansion.

High production costs associated with advanced manufacturing techniques and materials present a considerable challenge to the development of the flexible electronics market. Additionally, ensuring the durability and reliability of flexible devices remains a major concern, as they must withstand repeated bending and stretching without compromising performance.

To mitigate these challenges, key players are investing in research and development to optimize manufacturing processes and reduce costs. By exploring new materials and innovative production techniques, companies aim to enhance the durability and performance of flexible electronics.

Collaborations with material science experts and investments in automation technology are streamlining production, lowering costs while upholding high-quality standards. This strategic approach is supporting market growth and addressing consumer demands.

Flexible Electronics Industry Trends

Innovation in flexible electronics is revolutionizing healthcare, particularly through the development of stretchable biosensors and implantable devices. These technologies facilitate continuous, real-time monitoring of vital signs and other health metrics, offering improved accuracy and personalized diagnostics.

Flexible electronics enhance patient comfortby seamlessly integrating with the body, enabling effective long-term monitoring without discomfort or invasive procedures.

- In January 2024, BOE presented its display solutions at CES 2024, including a 14.6-inch oxide LCD display powered by ADS Pro technology. This oxide technology delivers superior image quality, featuring high transmittance and contrast levels. Additionally, the company introduced a dual-slidable flexible display utilizing f-OLED technology, enabling adjustable size and aspect ratio for diverse applications.

The growing emphasis on personalized medicine, which focuses on tailored treatment plans, is boosting the demand for wearable health tech using flexible electronics. As healthcare providers and consumers seek more efficient monitoring solutions, this innovation is fueling the expansion of the flexible electronics market.

The integration of flexible electronics with Internet of Things (IoT) applications is a key trend fueling market growth. Flexible sensors and circuits are increasingly used in smart packaging, environmental monitoring, and smart clothing, enabling real-time data collection in various industries.

In smart packaging, flexible electronics monitor product conditions such as temperature or freshness, thereby enhancing supply chain management. In environmental monitoring, they provide continuous, on-the-go data in challenging environments, while smart clothing integrates health and fitness tracking seamlessly into everyday wear.

- In January 2024, LiBEST introduced its latest flexible batteries in Seoul, Korea, showcasing advancements in lithium-ion technology. The company introduced multi-structured batteries for augmented reality (AR) glasses and expandable head-mounted displays (HMDs). The AR glasses featured a distinctive design with a capacity of up to 1,500mAh, while the HMD batteries offered configurations for parallel or series expansion, integrated into the headband strap to support devices requiring higher output and capacity.

As industries adopt IoT solutions to boost efficiency and connectivity, the demand for flexible, adaptable electronics is rising.

Segmentation Analysis

The global market has been segmented based on application, component, and geography.

By Application

Based on application, the market has been categorized into consumer, electronics, automotive, medical and healthcare, energy and power, aerospace and defense, and others. The consumer segment led the flexible electronics market in 2023, reaching a valuation of USD 11.48 billion. This growth is driven by the increasing demand for innovative, portable, and multifunctional devices.

Wearable technology, including smartwatches, fitness trackers, and health monitoring devices, is contributing significantly to this growth, as consumers seek convenient solutions that integrate seamlessly into their daily lives. The rise of flexible displays in smartphones and tablets propels the growth of this segment, enabling manufacturers to offer sleek, lightweight designs that enhance user experience.

Additionally, advancements in manufacturing processes and materials are making flexible electronics more accessible and cost-effective, promoting its widespread adoption .

By Component

Based on component, the market has been categorized into flexible display, flexible battery, flexible sensors, flexible memory, flexible photovoltaics, and others. The flexible display segment captured the largest share of 35.10% in 2023.

Manufacturers are increasingly adopting flexible displays in smartphones, tablets, and wearables, spurred by the rising consumer demand for lightweight, portable devices with innovative form factors. The production of foldable and rollable screens is reshaping product designs, offering enhanced user experiences and functionality.

Additionally, the rising trend of incorporating flexible displays in automotive applications and smart home devices contributes to segmental growth. With ongoing technology evolution and declining production costs, the flexible display segment is expected to see sustained expansion.

Flexible Electronics Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific flexible electronics market accounted for the largest share of 45.64% in 2023, with a valuation of USD 13.04 billion. This growth is largely attributed to rapid technological advancements and increasing consumer demand for innovative electronic devices.

Countries such as China, Japan, and South Korea are at the forefront of manufacturing flexible electronics, with robust investments in research and development. The region's strong manufacturing infrastructure supports the production of flexible displays, wearable devices, and IoT applications, catering to both local and global markets.

Additionally, the rising adoption of smart devices and growing interest in eco-friendly materials are propelling the growth of the Asia-Pacific market . Government initiatives promoting electronics innovation and collaboration between academia and industry further enhance the region’s competitive edge.

North America flexible electronics market is anticipated to witness substantial growth, recording a robust CAGR of 9.24% over the forecast period. Leading technology companies and startups drive continuous innovation, particularly in healthcare, automotive, and consumer electronics. Increased focus on smart manufacturing and automation is enhancing production efficiency and product quality.

- In October 2023, Terran Orbital launched two advanced Printed Circuit Board Assembly (PCBA) lines in California, equipped with Surface Mount Technology (SMT) and post-SMT capabilities, including 3-dimensional X-ray testing, automated inspection, flying probe technologies, and Automated Optical Inspection (AOI). This expansion strengthened the company’s in-house manufacturing, inspection, and testing of PCBAs.

Additionally, the growing trend of personalized consumer experiences is fostering the development of flexible electronics for wearable devices and interactive displays in the region.

Competitive Landscape

The global flexible electronics market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Flexible Electronics Market

- SAMSUNG

- LG Electronics.

- INK HOLDINGS INC.

- MFLEX

- OLEDWorks

- GE Grid Solutions, LLC

- Pragmatic

- 3M

- Henkel Maroc SA.

- FlexEnable

Key Industry Developments

- January 2024 (Product Launch): Dracula Technologies launched the LayerVault, a device combining mini-organic photovoltaic (OPV) modules and a flexible film-based storage solution. Leveraging OPV inkjet technology, it captures both natural and artificial light to generate energy, offering an alternative to conventional batteries and increasing energy autonomy.

- January 2024 (Product Launch): Samsung Display introduced a variety of cutting-edge technologies at CES 2024, including foldable, rollable, and slidable displays. Highlights included micro-displays designed for immersive extended reality experiences, groundbreaking OLED products for vehicle interiors, and monitors for entertainment, video production, and healthcare. Additionally, a 360-degree display was showcased.

The global flexible electronics market is segmented as:

By Application

- Consumer Electronics

- Automotive

- Medical and Healthcare

- Energy and Power

- Aerospace and Defense

- Others

By Component

- Flexible display

- Flexible battery

- Flexible sensors

- Flexible memory

- Flexible photovoltaics

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America