Market Definition

The market involves the production and utilization of batteries that use zinc as a key material in their electrochemical cells. These batteries rely on zinc’s ability to efficiently store and release electrical energy through chemical reactions. The market covers various battery types such as zinc-air, zinc-carbon, and zinc-nickel.

Zinc batteries are valued for their safety, cost-effectiveness, and environmental benefits. They find applications in sectors like medical devices, hearing aids, electric vehicles, and grid storage. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Zinc Battery Market Overview

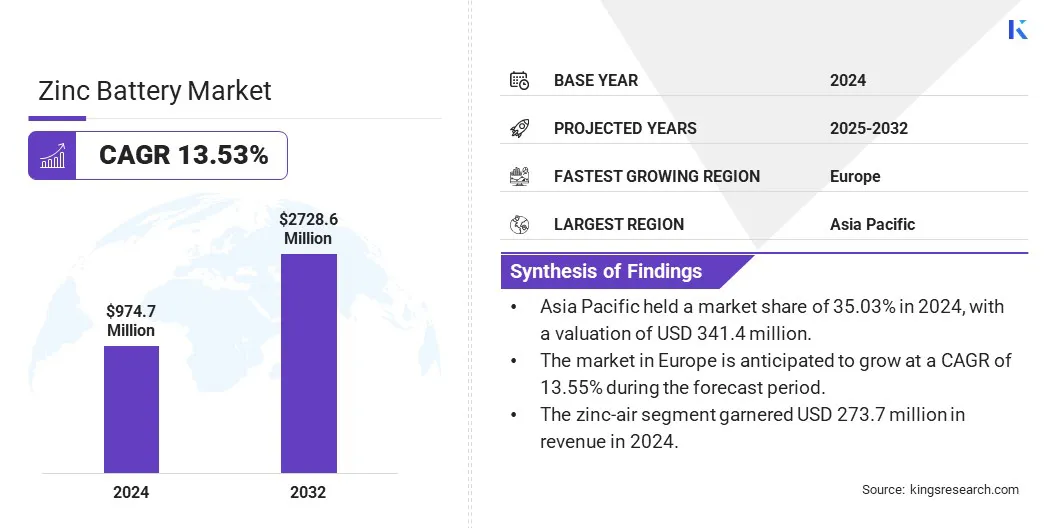

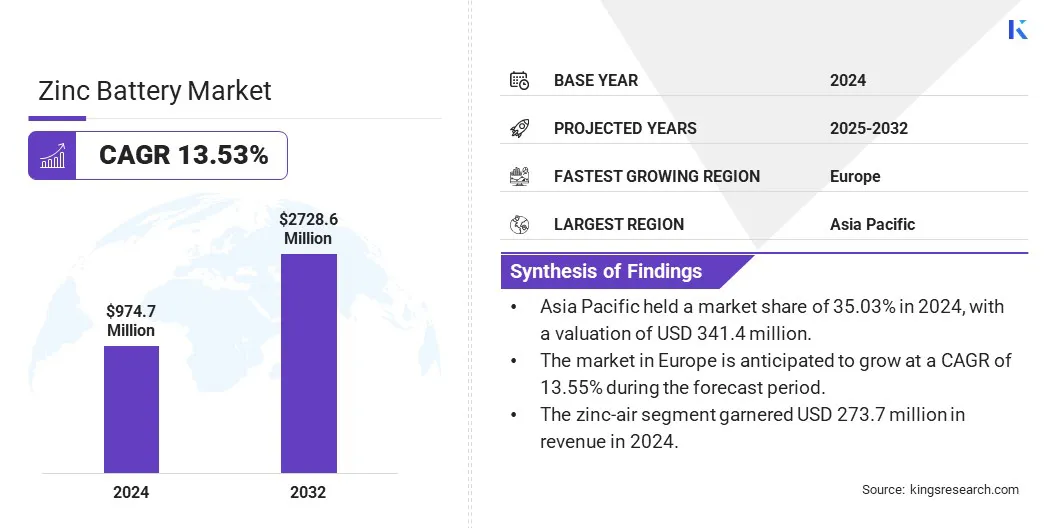

The global zinc battery market size was valued at USD 974.7 million in 2024 and is projected to grow from USD 1098.7 million in 2025 to USD 2728.6 million by 2032, exhibiting a CAGR of 13.53% during the forecast period.

The market growth is influenced by the rising need for safe, long-duration storage systems and increasing demand for sustainable alternatives to lithium-ion. Integration of renewable energy and innovations in zinc battery chemistry & design are further accelerating adoption across utility, industrial, and commercial sectors.

Major companies operating in the zinc battery industry are Eos Energy Enterprises, ABOUND, Primus Power, Urban Electric Power, Phinergy, EnZinc, Nexa, ZincFive, ABB, Z Power Impex Pvt Ltd., Enerpoly AB, Hindustan Zinc, Panasonic Energy Co., Ltd., Zhuhai Zhi Li Battery Co., Ltd., and e-Zinc Inc.

The market is growing, due to the rising demand for low-cost energy storage systems. Zinc batteries offer a favorable cost structure compared to lithium-ion, especially in large-scale applications. Their raw materials are abundant and less expensive, which helps reduce production costs. Utilities and storage solution providers are adopting zinc-based systems for grid stability and load balancing.

- In May 2024, ABB Inc. introduced nickel-zinc (NiZn) batteries tailored for data center uninterruptible power supply (UPS) systems. These batteries offer enhanced safety by reducing thermal runaway risks and provide improved energy efficiency, making them a sustainable alternative to traditional lead-acid and lithium-ion batteries in critical infrastructure applications.

Key Highlights

- The zinc battery market size was valued at USD 974.7 million in 2024.

- The market is projected to grow at a CAGR of 13.53% from 2025 to 2032.

- Asia Pacific held a market share of 35.03% in 2024, with a valuation of USD 341.4 million.

- The zinc-air segment garnered USD 273.7 million in revenue in 2024.

- The primary segment is expected to reach USD 1648.9 million by 2032.

- The healthcare segment secured the largest revenue share of 29.90% in 2024.

- The market in Europe is anticipated to grow at a CAGR of 13.55% during the forecast period.

How are renewable energy applications driving this market?

The need to store intermittent solar & wind energy is increasing the demand for efficient battery storage. Zinc batteries offer long-duration storage options that match the energy profiles of renewables. They can be deployed in both grid-scale and off-grid systems, making them a preferred choice for renewable integration.

Energy companies and government programs are considering zinc-based solutions to meet carbon reduction targets, which is boosting the expansion of the market.

- In September 2024, Swedish company Enerpoly inaugurated the world's first zinc-ion battery megafactory in Stockholm. The 6,500m² facility, named the Enerpoly Production Innovation Center (EPIC), is set to commence production in 2025, with a projected annual capacity of 100 MWh by 2026. This initiative aims to provide sustainable and cost-effective energy storage solutions for commercial, industrial, and utility applications, enhancing the integration of renewable energy sources.

What are the major obstacles for this market?

A significant challenge affecting the growth of the zinc battery market is the relatively lower energy density of zinc-based batteries when compared to lithium-ion alternatives. This limitation can reduce competitiveness in space-constrained applications, particularly in portable electronics or high-power mobility use cases.

Key market players are investing in advanced cathode materials, electrolyte formulations, and cell architecture improvements to enhance energy density without compromising safety or lifespan. Firms are also focusing on optimizing zinc batteries for stationary and long-duration storage, where high energy density is less critical but safety, cost, and recyclability offer a clear market advantage.

Which technological trends are shaping the market?

Continuous improvements in zinc-based battery designs are contributing to performance enhancements such as higher energy density, longer life cycles, and improved rechargeability. Innovations in zinc-air, zinc-nickel, and zinc-manganese technologies are making these batteries more competitive in commercial applications.

Companies are also focusing on improving electrolyte stability and reducing corrosion. These developments are helping to position zinc batteries as a reliable alternative to traditional chemistries, thereby advancing the market expansion.

- In October 2024, researchers from the Technical University of Munich introduced a porous organic polymer, TpBD-2F, as a protective layer for zinc anodes. This innovation significantly extends the lifespan of aqueous zinc-ion batteries, enabling them to endure several hundred thousand charge-discharge cycles. This enhances their viability for large-scale energy storage applications.

Zinc Battery Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Zinc-air, Zinc-chloride, Nickel-zinc, Zinc Bromine, Others

|

|

By Type

|

Primary, Secondary

|

|

By Application

|

Healthcare, Automotive, Data Center, Energy Storage, UPS, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Zinc-air, Zinc-chloride, Nickel-zinc, Zinc Bromine, and Others): The zinc-air segment earned USD 273.7 million in 2024, due to its high energy density, cost efficiency, and suitability for applications requiring long-duration, low-power discharge.

- By Type (Primary and Secondary): The primary segment held 61.92% share of the market in 2024, due to its widespread use in consumer electronics and medical devices, driven by low cost, long shelf life, and high reliability in single-use applications.

- By Application (Healthcare, Automotive, Data Center, Energy Storage, UPS, and Others): The healthcare segment is projected to reach USD 9 million by 2032, owing to the high demand for reliable, compact, and safe power sources in medical devices such as hearing aids and diagnostic equipment.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for 35.03% share of the zinc battery market in 2024, with a valuation of USD 341.4 million. Asia Pacific benefits from strong manufacturing ecosystems and access to essential raw materials such as zinc. Countries in the region have well-established metal processing industries that support battery-grade zinc production at competitive costs.

This local availability reduces reliance on imports and ensures consistent supply for battery manufacturers. The proximity of raw materials and large-scale production capabilities is contributing to the growth of the market in the region.

- In June 2024, Hindustan Zinc Limited, India's largest zinc producer, signed a Memorandum of Understanding with U.S.-based AEsir Technologies to develop advanced zinc-based batteries. Under this agreement, Hindustan Zinc will supply zinc to AEsir, facilitating the production of cost-effective and durable batteries suitable for large-scale energy storage, thereby supporting the global transition to renewable energy.

Rapid urbanization in Asia Pacific has increased energy consumption and the demand for safe, scalable storage systems in buildings, transportation hubs, and smart city projects. Governments and real estate developers are prioritizing safety in energy infrastructure, which increases the adoption of zinc-based storage.

The market in North America is poised for significant growth at a robust CAGR of 13.55% over the forecast period. North America is actively investing in energy storage systems that support grid reliability during peak demand and outages. Utilities are seeking battery technologies with longer discharge durations and lower fire risks, which makes zinc batteries a practical solution.

Zinc battery systems, offering 3–12 hour durations, are aligning with state and federal targets for intraday storage, driving the zinc battery market in the region.

Regulatory Frameworks

- The U.S. Consumer Product Safety Commission (CPSC) enforces safety standards for button cell and coin batteries under Reese’s Law (P.L. 117-171). This law mandates secure battery compartments and child-resistant packaging for products containing such batteries. Notably, zinc-air button cell batteries used in hearing aids are currently exempt from these packaging requirements until March 8, 2024, under an enforcement discretion policy.

- The European Union's Battery Directive (Directive 2006/66/EC) regulates the manufacture, labeling, collection, and recycling of batteries, including zinc-based types. It sets limits on hazardous substances like mercury & cadmium and mandates proper waste management practices to minimize environmental impact.

- China's GB 24427-2021 standard specifies limits for mercury, cadmium, and lead in zinc-based batteries, including zinc-manganese dioxide and zinc-air types. Additionally, GB 30484-2013 sets emission standards for pollutants from battery manufacturing processes, aiming to control environmental pollution from the manufacturing industry .

Competitive Landscape

Market players are adopting strategies such as advancing proprietary zinc-based chemistries, extending battery life cycles, and improving recyclability. These efforts are focused on creating longer-duration energy storage solutions that can replace lithium-ion systems in specific applications.

By targeting utility and industrial use cases with more durable and safer zinc battery technologies, companies are positioning themselves to meet the rising demand for grid-scale storage.

- In March 2025, Eos Energy Enterprises introduced its latest generation Z3 battery module, utilizing proprietary Znyth zinc hybrid cathode technology. The Z3 battery offers a 3–12 hour duration, a 20-year lifespan, and is fully recyclable. Designed for utility, industrial, and commercial applications, it addresses the limitations of conventional lithium-ion batteries in intraday energy storage.

List of Key Companies in Zinc Battery Market:

- Eos Energy Enterprises

- ABOUND

- Primus Power

- Urban Electric Power

- Phinergy

- EnZinc

- Nexa

- ZincFive

- ABB

- Z Power Impex Pvt Ltd.

- Enerpoly AB

- Hindustan Zinc

- Panasonic Energy Co., Ltd.

- Zhuhai Zhi Li Battery Co., Ltd.

- e-Zinc Inc

Recent Developments (Agreements)

- In June 2024, PetroChina deployed its first zinc-bromine flow battery energy storage system at the Mahu 078 well site in Xinjiang. This milestone marks the system's integration into off-grid remote oil production, supporting the company’s "zero carbon" initiative. The battery uses a water-based zinc bromide electrolyte, which acts as a natural flame retardant.

- In May 2024, ZincFive secured financing to accelerate its expansion plans in the U.S., focusing on battery manufacturing, systems assembly, pack assembly, and product development. The company specializes in nickel-zinc (NiZn) battery-based solutions for immediate power applications, offering safe and recyclable alternatives to traditional battery chemistries.