Market Definition

The market encompasses the development, production, and distribution of uninterruptible power supply systems that provide backup power and safeguard electrical equipment from disruptions, voltage fluctuations, and outages.

These systems are vital for ensuring uninterrupted operations across various industries, including data centers, healthcare, industrial automation, and commercial enterprises. The report outlines major driving factors, regional analysis, and regulatory frameworks that are set to influence the marlet over the forecast period.

Uninterruptible Power Supply Market Overview

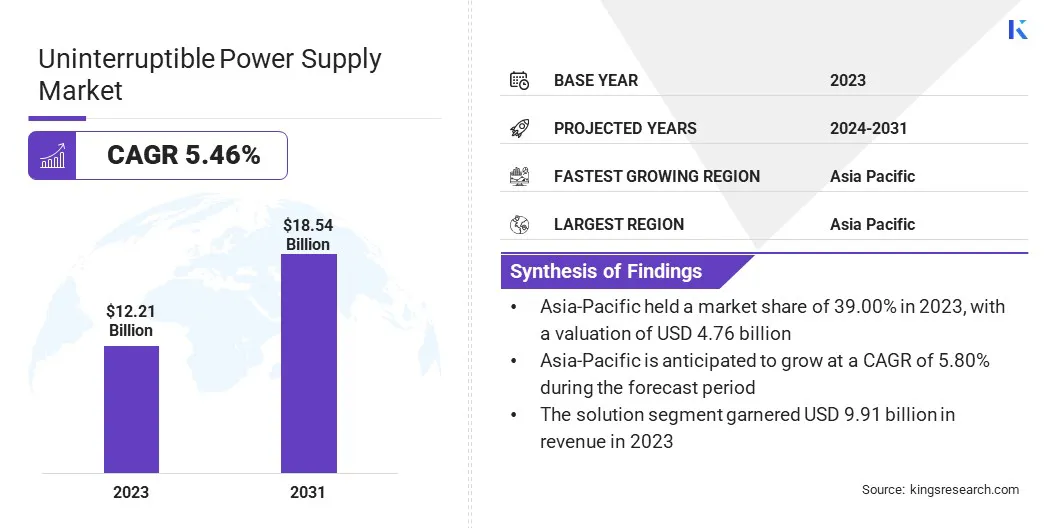

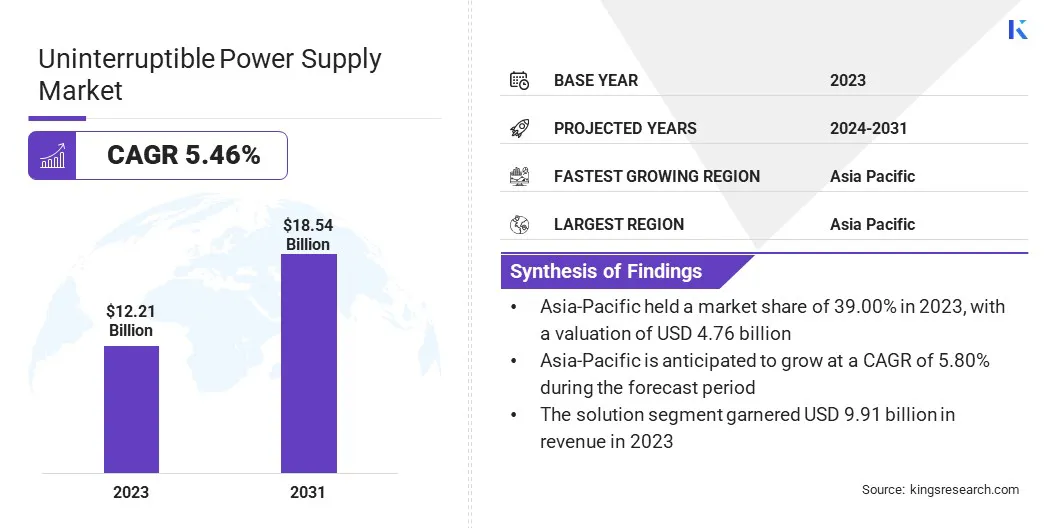

The global uninterruptible power supply market size was valued at USD 12.21 billion in 2023 and is projected to grow from USD 12.78 billion in 2024 to USD 18.54 billion by 2031, exhibiting a CAGR of 5.46% during the forecast period.

The market is expanding due to the rising demand for reliable power backup solutions across various industries, including data centers, healthcare, IT & telecom, and manufacturing. The rising frequency of power outages, coupled with the growing adoption of digital infrastructure and cloud computing, is further fueling market expansion.

Major companies operating in the uninterruptible power supply industry are Toshiba International Corporation, Qorvo, Inc., Analog Devices, Inc., Texas Instruments Incorporated, Mitsubishi Electric Power Products Inc., Panasonic Industry Co., Ltd., Infineon Technologies AG, Sumitomo Electric Industries, Ltd., Emerson Electric Co., ABB, Schneider Electric, Nexperia, Microchip Technology Inc., RPS Spa, and Eaton.

Furthermore, innovations in energy-efficient and modular uninterruptible power supply (UPS), combined with strict government regulations on power quality and energy conservation, are expected to boost market growth.

- In March 2025, the Press Information Bureau (PIB) reported that India’s Centre for Fuel Cell Technology (CFCT) at ARCI developed hydrogen-based fuel cells for UPS to telecom towers. The Proton Exchange Membrane Fuel Cell (PEMFC) system provides a clean and efficient alternative to diesel generators, emitting only water vapor.

Key Highlights

- The uninterruptible power supply industry size was recorded at USD 12.21 billion in 2023.

- The market is projected to grow at a CAGR of 5.46% from 2024 to 2031.

- Asia-Pacific held a share of 39.00% in 2023, valued at USD 4.76 billion.

- The solution segment garnered USD 9.91 billion in revenue in 2023.

- The large enterprise segment is expected to reach USD 12.29 billion by 2031.

- The data centers segment is anticipated to witness the fastest CAGR of 6.14% over the forecast period

- North America is anticipated to grow at a CAGR of 5.80% through the projection period.

Market Driver

Increasing Frequency of Power Outages

Aging electrical infrastructure, surging energy consumption, and more frequent extreme weather are driving increased power disruptions in both developed and emerging markets.

These interruptions pose substantial risks to mission-critical operations in sectors such as healthcare, financial services, telecommunications, and manufacturing, where power continuity is essential for ensuring operational efficiency, data integrity, and equipment safety.

Moreover, businesses and institutions are increasingly investing in advanced UPS solutions to mitigate the adverse impacts of grid instability and safeguard their infrastructure against potential downtime and financial losses, supporting the growth of the market.

- In July 2024, Vertiv Group Corp launched the Vertiv Trinergy UPS, designed to manage the dynamic load requirements of modern data centers. The company also introduced Vertiv PowerNexus, a compact solution for seamless integration of the UPS with system switchgear. Both products are now available worldwide, with Trinergy UPS offered in 1500, 2000, and 2500 kVA capacities.

Market Challenge

Battery Limitations and Lifecycle Issues

Battery limitations and lifecycle issues present a significant challenge to the development of the uninterruptible power supply market due to the relatively short lifespan, limited energy density, and frequent maintenance requirements of traditional battery technologies such as valve-regulated lead-acid (VRLA) batteries.

These factors increase the total cost of ownership and raise concerns regarding system reliability and long-term performance. While lithium-ion batteries offer improved durability, efficiency, and lower maintenance, their higher upfront cost and the need for advanced thermal management systems limit widespread adoption. Moreover, challenges related to disposal, recycling, and environmental compliance further complicate battery lifecycle management.

To address these challenges, industry players are adopting advanced technologies such as lithium-ion and solid-state batteries, which offer longer lifespans, higher efficiency, and lower maintenance. Integrating smart battery management systems (BMS) enhances reliability through real-time monitoring and predictive maintenance.

Additionally, promoting sustainable recycling and disposal practices, along with industry collaboration to foster innovation and reduce costs, is essential for ensuring long-term performance and environmental compliance.

Market Trend

Technological Advancements in UPS Systems

Technological advancements in UPS systems are influencing the market, as manufacturers focus on developing more efficient, scalable, and intelligent solutions. Modern UPS systems feature modular architectures that allow for flexible expansion, simplified maintenance, and improved fault tolerance.

Enhanced energy efficiency supports cost reduction and sustainability goals. Additionally, the integration of digital technologies, such as real-time monitoring, IoT-enabled diagnostics, and AI-powered predictive maintenance, further boosts system reliability and performance. Innovations in battery technologies, including the transition from VRLA to lithium-ion and emerging solid-state options, contribute to greater efficiency, longer lifespan, and smaller footprint.

- In December 2024, Schneider Electric launched the Galaxy VXL, a compact, high-density UPS system designed for AI data centers and large-scale industrial workloads. The system supports both lithium-ion and VRLA batteries, features IEC 62443-4-2 cybersecurity compliance, and offers remote monitoring via EcoStruxure IT.

Uninterruptible Power Supply Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solution (Standby (Offline), Line-interactive, Online UPS), Service (Professional, Managed)

|

|

By End User

|

SME, Large Enterprise

|

|

By Application

|

BFSI, Data centers, Healthcare, IT & telecom, Manufacturing, Media & entertainment, Residential, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Solution (Standby (Offline), Line-interactive, Online UPS), and Service (Professional, Managed)): The solution segment earned USD 9.91 billion in 2023 due to the high demand for reliable power backup solutions across various industries.

- By End User (SME and Large Enterprise): The large enterprise segment held a share of 67.56% in 2023, attributed to the increasing need for robust power backup solutions in data centers, industrial facilities, and large-scale operations.

- By Application (BFSI, Data centers, Healthcare, IT & Telecom, Manufacturing, Media & Entertainment, Residential, and Others): The data centers segment is projected to reach USD 6.63 billion by 2031, propelled by the growing demand for reliable power infrastructure to support increasing data processing and storage needs.

Uninterruptible Power Supply Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific uninterruptible power supply market share stood at around 39.00% in 2023, valued at USD 4.76 billion. The dominance is reinforced by the region’s rapid expansion of data centers, increasing industrial automation, and a growing emphasis on renewable energy integration.

Countries such as China, India, and Japan are witnessing a surge in demand for uninterruptible power supply systems due to rising electricity consumption and the need for uninterrupted power supply in critical sectors.

Moreover, government initiatives aimed at infrastructure development and the expanding presence of small and medium-sized enterprises (SMEs) are bolstering regional market growth. The presence of key uninterruptible power supply manufacturers and technological advancements in battery storage solutions are further aiding domestic market expansion.

- In July 2023, Fuji Electric introduced the 7400WX-T3U, a high-efficiency UPS system tailored for large-scale data centers. Featuring a compact design, parallel redundancy, and up to 97% efficiency in double conversion mode, it enables energy savings and lowers operational costs for critical infrastructure.

North America uninterruptible power supply industry is likely to grow at a CAGR of 5.56% over the forecast period. This growth is fostered by the increasing demand for reliable power backup solutions across industries such as healthcare, IT & telecom, and manufacturing.

The rising adoption of advanced technologies, including edge computing and artificial intelligence, is highlighting the need for robust uninterruptible power supply systems to ensure uninterrupted operations.

Furthermore, increased investments in upgrading power infrastructure and improving grid reliability are stimulating regional market growth. A major focus on sustainability and energy efficiency has accelerated the adoption of lithium-ion battery-based uninterruptible power supply systems, contributing to regional market expansion.

Regulatory Frameworks

- The IEC 62040-1:2017 by the International Electrotechnical Commission outlines safety requirements for the design, installation, and operation of uninterruptible power supply (UPS) systems to protect users and equipment from electrical hazards.

- In India, the Bureau of Indian Standards (BIS) IS 16242 (Part 1):2014 standard specifies design, performance, and testing to protect users and equipment from potential hazards.

- The U.S. Department of Energy the DOE's enforces energy conservation standards for UPS systems to improve efficiency, reduce energy consumption, and support federal sustainability goals.

- India's Telecommunication Engineering Centre (TEC) standard TEC-GR-PI-UPS-001-05 specifies technical specifications for UPS systems used in telecommunication networks, ensuring reliability, performance, and industry compliance.

- In the United States, the ENERGY STAR Version 2.0 specification sets energy efficiency criteria for UPS systems to reduce power consumption and environmental impact, promoting the use of high-efficiency uninterruptible power supply systems.

Competitive Landscape

The uninterruptible power supply market is highly competitive, fueled by continuous innovation, strategic alliances, and M&A activities. Leading companies are focusing on enhancing their product portfolios with energy-efficient and scalable uninterruptible power supply solutions to cater to diverse industry needs.

Moreover, manufacturers are allocating resources to R&D to incorporate advanced technologies such as artificial intelligence and remote monitoring, enhancing system efficiency and enabling predictive maintenance. Furthermore, key players are offering cost-effective solutions, intensifying the competitive landscape.

- In August 2024, Kohler Uninterruptible Powerand ZincFive partnered to integrate ZincFive's BC Series Uninterruptible Power Supply (UPS) Battery Cabinets into Kohler's data center backup power solutions. These nickel-zinc (NiZn) batteries offer a compact footprint, minimal maintenance, and enhanced safety by eliminating thermal runaway risks.

List of Key Companies in Uninterruptible Power Supply Market:

- Toshiba International Corporation

- Qorvo, Inc

- Analog Devices, Inc.

- Texas Instruments Incorporated

- Mitsubishi Electric Power Products Inc.

- Panasonic Industry Co., Ltd.

- Infineon Technologies AG

- Sumitomo Electric Industries, Ltd.

- Emerson Electric Co.

- ABB

- Schneider Electric

- Nexperia

- Microchip Technology Inc.

- RPS Spa

- Eaton

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In January 2025, YorPower Power introduced a new uninterruptible power supply (UPS) lineup featuring 12 models with capacities from 1kVA to 800kVA, targeting IT, healthcare, industrial, and security applications. The systems emphasize reliability, ease of use, and cost-effeciency.

- In October 2024, Schneider Electric launched a circular economy initiative for its APC Smart-UPS systems, starting in France in collaboration with Ingram Micro. This program focuses on reducing, reusing, and recycling to enhance sustainability without compromising performance.

- In August 2024, Vertiv India partnered with Savex Technologies to enhance its e-commerce presence. This collaboration aims to provide channel partners with easier access to Vertiv's products, including single-phase and three-phase uninterruptible power supply (UPS) systems and small room cooling solutions

- In May 2024, Eaton launched the 9395X UPS, a next-generation uninterruptible power supply tailored for hyperscale and colocation data centers. Developed at Eaton’s new Helsinki facility, the system incorporates silicon carbide (SiC) converters, delivering up to 97.5% efficiency in double-conversion mode.

- In March 2024, Schneider Electric launched the APC Back-UPS BE Series (900 & 1050 VA) to deliver reliable home power backup for devices such as routers and computers. With over 100 minutes of runtime, USB-A and USB-C ports, user-replaceable batteries, and a compact design, the UPS supports uninterrupted connectivity.