Market Definition

The market focuses on the development, production, and distribution of products and services used to remove dead, damaged, or infected tissue from wounds to promote effective healing.

This market encompasses various debridement methods, including surgical, mechanical, autolytic, enzymatic, and biological techniques, and supports the treatment of chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Wound Debridement Market Overview

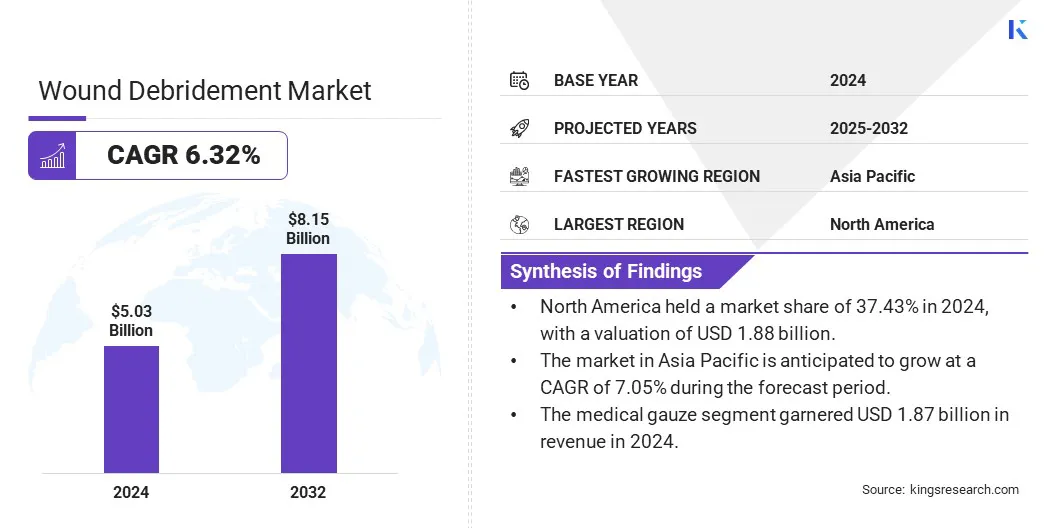

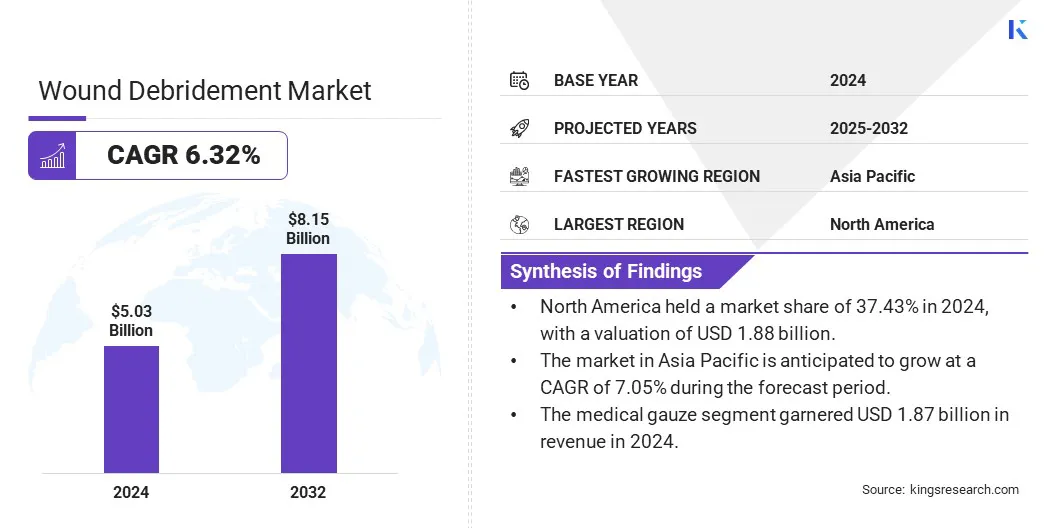

The global wound debridement market size was valued at USD 5.03 billion in 2024 and is projected to grow from USD 5.31 billion in 2025 to USD 8.15 billion by 2032, exhibiting a CAGR of 6.32% during the forecast period.

This growth is attributed to the rising prevalence of chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, driven by the aging global population and increasing incidence of diabetes and obesity. The demand for effective wound management solutions is prompting the widespread adoption of advanced debridement techniques across healthcare settings.

Major companies operating in the wound debridement industry are Smith+Nephew, Mölnlycke AB, Coloplast Ltd, B. Braun SE, Convatec Inc., Sanara MedTech, Medline Industries, Inc., Arobella Medical LLC, Cardinal Health, Axio Biosolutions Pvt Ltd, PAUL HARTMANN AG, MIMEDX Group, Inc., DeRoyal Industries, Inc., Söring GmbH, and AMERX Health Care Corporation.

The growing focus of healthcare providers on improving patient outcomes, reducing hospital stays, and minimizing the risk of wound-related complications is further driving the uptake of enzymatic, autolytic, and surgical debridement products.

In addition, continuous innovation in wound care products, increasing healthcare expenditure, and rising awareness among patients and clinicians about the importance of timely wound debridement are accelerating the development of the market.

- In March 2025, SolasCure Ltd. began its CLEANVLU2 Phase II trial by enrolling the first patient to evaluate a higher concentration of Aurase Wound Gel for venous leg ulcers. The gel contains Tarumase, an enzyme derived from medical maggots and offers a targeted, non-surgical debridement solution.

Key Highlights

- The wound debridement industry size was valued at USD 5.03 billion in 2024.

- The market is projected to grow at a CAGR of 6.32% from 2025 to 2032.

- North America held a market share of 37.43% in 2024, with a valuation of USD 1.88 billion.

- The medical gauze segment garnered USD 1.87 billion in revenue in 2024.

- The autolytic segment is expected to reach USD 2.66 billion by 2032.

- The diabetic foot ulcers (DFUs) segment is anticipated to witness the fastest CAGR of 7.35% during the forecast period.

- The hospitals segment garnered USD 1.81 billion in revenue in 2024.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.05% during the forecast period.

Market Driver

Growing Prevalence of Chronic Wound Disorders

The market is propelled by the growing prevalence of chronic wound disorders such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers. With the rising incidence of diabetes, obesity, and an aging global population, there is an increasing demand for effective wound care solutions that can address these complex, slow-healing wounds.

This is prompting healthcare providers and manufacturers to focus on advanced wound debridement techniques and products that facilitate faster healing and reduce the risk of infection. This is further supported by expanding healthcare infrastructure and increased awareness among clinicians and patients about the benefits of timely and appropriate wound management.

The increasing incidence of chronic wounds is driving stakeholders to invest in advanced, effective, and patient-centric debridement technologies, thereby fueling the expansion of the global wound debridement market.

- In February 2025, MediWound Ltd. initiated the global Phase III VALUE trial to assess the safety and efficacy of EscharEx in debriding venous leg ulcers (VLUs). The trial builds on positive Phase II data and aims to establish EscharEx as a non-surgical, rapid, and effective enzymatic treatment for chronic wounds, potentially offering a more accessible alternative to surgical debridement.

Market Challenge

High Cost of Advanced Debridement Products

The high cost of advanced debridement products poses a significant challenge to the growth and widespread adoption of these solutions, particularly in low- and middle-income regions. The manufacturing of specialized enzymatic agents, ultrasonic devices, and bioactive dressings involves complex processes and high research and development expenses, which contribute to elevated product prices.

Additionally, limited healthcare budgets and reimbursement constraints in many regions further restrict access to these advanced wound care options, thereby hindering market growth.

To address these challenges, manufacturers are focusing on optimizing production techniques and scaling operations to reduce costs without compromising quality. Collaborations with governments and healthcare organizations are facilitating subsidy programs and bulk purchasing agreements to improve affordability.

Additionally, awareness campaigns that emphasize the long-term cost-effectiveness of timely and effective wound debridement through reduced hospital stays and fewer complications are supporting the adoption of advanced debridement solutions.

Market Trend

Technological Advancements in Debridement Methods

Advancements in debridement technologies are significantly reshaping the wound care landscape by improving treatment efficacy, patient comfort, and healing outcomes. Modern debridement methods incorporate enzymatic agents, ultrasonic devices, and autolytic dressings, which selectively remove necrotic tissue while preserving healthy tissue, thereby minimizing pain and risk of complications.

These innovations enable more precise and less invasive wound cleaning, making them suitable for a wide range of wound types and patient conditions, from chronic ulcers to acute injuries. Furthermore, ongoing research and development efforts are leading to the development of biocompatible and sustainable materials, which enhance patient safety and reduce environmental impact.

- In February 2024, a study published by Springer Nature Limited in Scientific Reports showed that treatment with Collagenase Santyl’s active ingredient encourages macrophages to adopt a fibroblast-like phenotype that enhances collagen and other extracellular matrix components essential for tissue repair. This cellular shift, mediated by the TGFβ-1 signaling pathway, is expected to improve healing outcomes in chronic wounds where normal repair processes are often disrupted.

Wound Debridement Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Medical Gauze, Gels, Ointments & Creams, Surgical Devices, and Others (Ultrasonic Devices, Mechanical Debridement Pads)

|

|

By Method

|

Autolytic, Enzymatic, Surgical, and Mechanical

|

|

By Wound Type

|

Diabetic Foot Ulcers (DFUs), Pressure Ulcers (Bedsores/Decubitus Ulcers), Venous Leg Ulcers (VLUs), Surgical & Trauma Wounds, and Others (Burn Wounds, Arterial Ulcers)

|

|

By End Use

|

Hospitals, Specialized Clinics (Wound Care Centers), Ambulatory Surgical Centers (ASCs), and Others (Homecare Settings, Nursing Home)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Medical Gauze, Gels, Ointments & Creams, Surgical Devices, and Others): The medical gauze segment earned USD 1.87 billion in 2024 due to its widespread use, cost-effectiveness, and versatility in wound cleaning and dressing.

- By Method (Autolytic, Enzymatic, Surgical, and Mechanical): The surgical segment held 40.48% of the market in 2024, due to its effectiveness in rapidly removing necrotic tissue and widespread adoption in clinical settings.

- By Wound Type (Diabetic Foot Ulcers (DFUs), Pressure Ulcers, Venous Leg Ulcers (VLUs), Surgical & Trauma Wounds, and Others): The diabetic foot ulcers (DFUs) segment is projected to reach USD 3.20 billion by 2032, owing to the rising prevalence of diabetes worldwide and the increasing incidence of chronic foot wounds requiring specialized debridement treatment.

- By End Use (Hospitals, Specialized Clinics, Ambulatory Surgical Centers (ASCs), and Others): The ambulatory surgical centers (ASCs) segment is anticipated to grow at a CAGR of 6.95% during the forecast period due to the increasing preference for outpatient procedures and cost-effective, convenient wound care services.

Wound Debridement Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America wound debridement market share stood at around 37.43% in 2024, with a valuation of USD 1.88 billion. This dominance is attributed to the region’s well-established healthcare infrastructure, high adoption of advanced wound care technologies, and the presence of leading wound care product manufacturers.

Additionally, increasing awareness about chronic wound management, coupled with favorable reimbursement policies and strong healthcare funding, is fueling market growth in this region. Robust investment in research and development, along with a growing patient population affected by diabetes and other chronic conditions, is further driving the demand for effective wound debridement solutions across North America.

Furthermore, ongoing advancements in medical technology and the focus on improving patient outcomes are enhancing the availability and utilization of innovative debridement products, thereby accelerating market expansion.

- In April 2023, 3M’s Veraflo Therapy dressings including the Veraflo cleanse choice complete and V.A.C. Veraflo cleanse choice received FDA clearance for hydro mechanical removal of non-viable tissue and wound debris. These products aim to reduce surgical debridement, support granulation tissue formation, and create an optimal environment for wound healing. They also offer clinicians a less invasive treatment option.

The wound debridement industry in Asia-Pacific is poised for significant growth at a robust CAGR of 7.05% over the forecast period. This growth is attributed to the increasing healthcare investments, expanding medical infrastructure, and rising awareness about chronic wound management across the Asia-Pacific region.

The region’s large patient population, combined with improving access to advanced wound care products and technologies, supports the accelerating adoption of wound debridement solutions. The rising prevalence of diabetes and other lifestyle-related diseases such as obesity, cardiovascular disorders, and chronic respiratory conditions, is further drives demand for effective wound treatment options across urban and rural areas.

Additionally, government initiatives focused on healthcare modernization and the growing presence of local and international manufacturers are enhancing product availability and innovation, thereby propelling market growth in this region.

Regulatory Frameworks

- In the U.S., wound debridement devices are regulated under 21 CFR Part 820 — Quality System Regulation (QSR), enforced by the Food and Drug Administration (FDA). This framework requires manufacturers to implement comprehensive quality management systems to ensure the safety, effectiveness, and consistent manufacturing of medical devices throughout their lifecycle.

- In the European Union, wound debridement products are regulated under the Medical Device Regulation (MDR) 2017/745, enforced by the European Commission and notified bodies. This regulation mandates compliance with strict safety, performance, and clinical evaluation requirements to ensure that medical devices placed on the EU market meet high standards of quality and patient safety.

- Globally, the International Organization for Standardization (ISO) 13485: 2016 sets the standard for quality management systems in the design and manufacture of medical devices, including wound debridement products. This standard ensures manufacturers consistently meet regulatory requirements and maintain product safety and effectiveness across global markets.

Competitive Landscape

The wound debridement industry is characterized by a diverse mix of well-established global manufacturers and innovative regional players, each focusing on expanding their product portfolios and geographic presence through technological advancements, market expansion, and strategic collaborations.

Leading companies are heavily investing in research and development to enhance the efficacy, safety, and patient comfort of debridement products, with a focus on developing minimally invasive and user-friendly solutions. They are also working on cost-effective product offerings to address the growing demand across hospitals, specialized clinics, and homecare settings.

Additionally, firms are forming partnerships with healthcare providers, research institutions, and technology companies to accelerate the adoption and integration of advanced wound care therapies across a wider range of clinical applications.

- In April 2025, MediWound Ltd. announced it would present 10 scientific abstracts on EscharEx at the wound healing society (WHS) and Symposium on Advanced Wound Care (SAWC) Spring 2025 conferences. The presentations will highlight EscharEx’s mechanism of action, comparative data with existing treatments, and recent findings related to venous leg ulcers (VLUs) and diabetic foot ulcers (DFUs).

List of Key Companies in Wound Debridement Market:

- Smith+Nephew

- Mölnlycke AB

- Coloplast Ltd

- Braun SE

- Convatec Inc.

- Sanara MedTech

- Medline Industries, Inc.

- Arobella Medical LLC

- Cardinal Health

- Axio Biosolutions Pvt Ltd

- PAUL HARTMANN AG

- MIMEDX Group, Inc.

- DeRoyal Industries, Inc.

- Söring GmbH

- AMERX Health Care Corporation

Recent Developments (M&A/Agreements)

- In July 2024, Mölnlycke Health Care announced a USD 15 million investment in MediWound Ltd. to support the development of next-generation enzymatic wound debridement therapies. The partnership aims to advance innovative, non-surgical treatment options and improve patient outcomes in wound care.

- In April 2024, Mölnlycke Health Care announced its plan to acquire P.G.F. Industry Solutions GmbH, the developer of Granudacyn, a diverse range of wound care products currently distributed by Mölnlycke in over 50 countries. This move is expected to broaden Mölnlycke’s product lineup and strengthen its position as a prominent global provider of advanced wound care solutions.