Wound Care Market Size

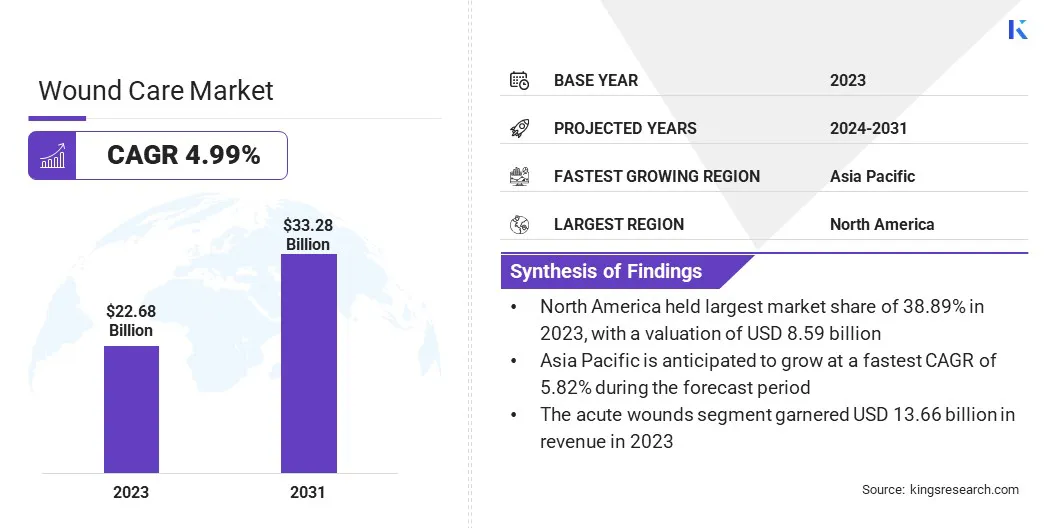

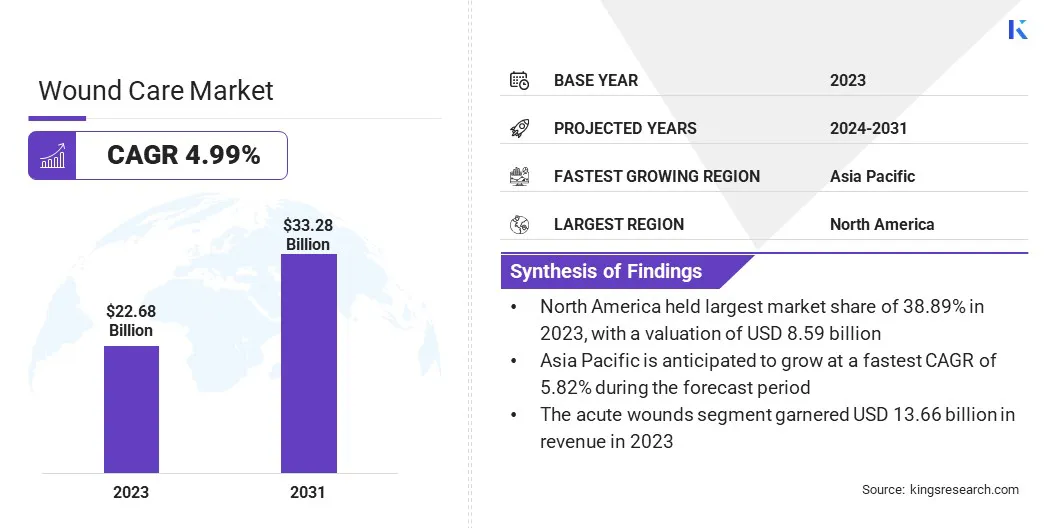

The Global Wound Care Market size was valued at USD 22.68 billion in 2023 and is projected to grow from USD 23.67 billion in 2024 to USD 33.28 billion by 2031, exhibiting a CAGR of 4.99% during the forecast period.

The increasing prevalence of chronic conditions such as diabetes, obesity, and peripheral vascular diseases has significantly contributed to the growth of the market. These patients often develop complications, such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, which require long-term and advanced wound care solutions.

- The American Diabetes Association reports that around 20% of individuals with a diabetic foot ulcer will eventually require a lower-extremity amputation.

In the scope of work, the report includes products and services offered by companies such as Smith+Nephew, Molnlycke Health Care AB, ConvaTec Group PLC, 3M, Coloplast Corp, Medline Industries, LP, B. Braun SE, INTEGRA LIFESCIENCES, Johnson & Johnson (Medical Devices Business Services, Inc.), Medtronic, and others.

The aging population is fueling the growth of the wound care market. Older individuals are more prone to conditions that slow down the healing process, such as reduced skin elasticity, impaired circulation, and chronic illnesses. This demographic also experiences a higher incidence of pressure ulcers and surgical site infections, highlighting a need for effective wound care solutions.

Wound care involves medical practices and treatments that help wounds heal, prevent infections, and minimize complications. It includes cleaning, disinfecting, and dressing wounds, as well as utilizing advanced therapies such as negative pressure wound therapy, skin grafting, or specialized wound dressings for chronic or complex wounds.

It also involves managing underlying conditions, such as diabetes or vascular issues, that impede the healing process. The goal is to restore skin integrity , allevitae pain, and improve the patient's quality of life.

Analyst’s Review

Companies and healthcare institutions are leveraging innovative strategies to aid the growth of the wound care market. The adoption of smart bandages with sensors to monitor wound conditions in real-time has improved treatment outcomes. These advanced dressings track factors such as moisture, temperature, and pH, enabling precise interventions and faster healing.

- In June 2024, researchers from the Keck School of Medicine of USC and the California Institute of Technology (Caltech) developed advanced technologies aimed at transforming wound care.Their innovations include smart bandages capable of detecting and adapting to changes conditions in wound conditions. These badges offer continuous monitoring of healing progress and potential complications, such as infections or abnormal inflammation, while delivering medications or treatments to accelerate recovery.

Organizations are further integrating technologies such as bioengineered skin substitutes and 3D-printed dressings to enhance wound care effectiveness. Collaboration with research institutions to develop cutting-edge therapies and personalized care approaches further contributes to market expansion by meeting the evolving needs of patients and providers.

Wound Care Market Growth Factors

The rise in surgical procedures, including orthopedic, cardiovascular, and cosmetic surgeries, has boosted the growth of the wound care market. Surgical wounds require specialized care to prevent infections, minimize scarring, and ensure faster recovery.

- In June 2024, the International Society of Aesthetic Plastic Surgery reported a 5.5% rise in cosmetic surgical procedures, with over 15.8 million surgeries and 19.1 million non-surgical procedures performed. This marks a 40% overall growth in cosmetic procedures over the past four years.

The increased frequency of surgeries has created a strong demand for effective post-operative wound management solutions, including advanced dressings, antiseptic formulations, and wound closure systems.

Additionally, consumers and healthcare providers are prioritizing high-quality products that enhance healing and reduce the risk of infection. Governments and private organizations in emerging economies have invested significantly in healthcare infrastructure, improving access to advanced therapies.

However, a significant factor restraining the growth of the wound care market is the high cost of advanced wound care treatments. The expenses associated with specialized dressings, biologic therapies, and advanced wound management technologies can be prohibitive for both patients and healthcare systems, particularly in developing regions.

To address this challenge, companies are focusing on reducing production costs through technological advancements and economies of scale. Several companies are exploring partnerships with government organizations and healthcare providers to enance the affordability of these treatments.

Wound Care Industry Trends

Innovative technologies are fueling the growth of the wound care market. Developments such as negative pressure wound therapy (NPWT), bioengineered skin substitutes, and advanced hydrocolloid and foam dressings are revolutionizing wound care.

- In September 2023, Cutiss developed a manufacturing process for denovoSkin, a personalized, autologous bioengineered human skin grafts. Currently in Phase II trials, denovoSkin can be mass-produced from a small biopsy. This innovative skin graft is designed to grow with the patient, minimize scarring, and reduce the need for multiple follow-up corrective surgeries, particularly in pediatric cases.

These advancements promote faster healing, minimize complications, and improve patient outcomes. Smart dressings with real-time wound monitoring sensors is further enhancing treatment efficiency.

The growing preference for home-based wound care is creating opportunities for the growth of the wound care market. Patients recovering from surgeries or managing chronic wounds increasingly seek user-friendly solutions that reduce the need for hospital visits.

This trend is further supported by advancements in portable devices, advanced dressings, and telemedicine, enabling as shift toward home healthcare solutions.

Segmentation Analysis

The global market has been segmented based on product, end-user, application, and geography.

By Product

Based on product, the market has been segmented into advanced wound dressing, surgical wound care, traditional wound care, and wound therapy devices. The advanced wound dressing segment led the wound care market in 2023, reaching a valuation of USD 7.84 billion.

Advanced wound dressings are designed to maintain optimal moisture levels, protect against infections, and accelerate tissue regeneration. The rising prevalence of chronic wounds, such as diabetic ulcers and pressure sores, has increased the demand for advanced solutions that manage complex wound conditions more effectively than traditional dressings.

By End Use

Based on end use, the market has been divided into hospitals, specialty clinics, home healthcare, and others. The home healthcare segment is projected to grow at a CAGR of 5.82% through the forecast period.

The growing demand for home-based care, supported by advancements in telemedicine and remote monitoring, enables efficient treatment oversight by healthcare providers. This approach enhances personalized care, minimizes hospital visits, and reduces associated costs, fostering the growth of the home healthcare segment.

By Application

Based on application, the market has been bifurcated into acute wounds and chronic wounds. The acute wounds segment secured the largest revenue share of 60.23% in 2023, mainly due to the high prevalence of injuries from accidents, burns, and surgeries.

These wounds require immediate and effective treatment to avoid complications such as infection and delayed healing, contributing to increased healthcare costs. The demand for advanced wound care products, including dressings, antiseptics, and biologic therapies, is further bolstered by advancements such as smart bandages and rapid-healing dressings, which improve treatment outcomes.

Wound Care Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America wound care market accounted for a notable share of approximately 37.89% in 2023, valued at USD 8.59 billion. This dominance is largely attributed to the increasing prevalence of chronic conditions such as diabetes and peripheral arterial disease (PAD), which increase the demand for advanced wound care solutions.

North America wound care market accounted for a notable share of approximately 37.89% in 2023, valued at USD 8.59 billion. This dominance is largely attributed to the increasing prevalence of chronic conditions such as diabetes and peripheral arterial disease (PAD), which increase the demand for advanced wound care solutions.

In addition, the demand for wound care is increasing due to the growing adoption of advanced technologies, such as biological therapies, therapeutic devices, and dressings for autolytic debridement. These innovations are enhancing treatment effectiveness and precision in this region.

Asia-Pacific wound care market is projected to grow at a CAGR of 5.82% over the forecast period. This growth is mainly propelled by rising healthcare expenditure and favorable government initiatives aimed at improving healthcare infrastructure.

Increasing government investments in healthcare facilities, including hospitals and clinics, are enhancing access to wound care services and fueling demand in the regional market.

Furthermore, the expansion of hospitals and specialty clinics dedicated to wound care is stimulating the growth of the Asia-Pacific market. These centers provide advanced, tailored wound management services, enhancing access to effective solutions. The increasing number of such facilities is improving patient outcomes and fueling demand for advanced wound care products.

Competitive Landscape

The global wound care market is characterized by intense competition, with key players adopting diverse strategic approaches such as partnerships, mergers and acquisitions, product innovations, and collaborations to expand their product offerings and strengthen their market presence across various regions.

Leading companies are focusing on advancements in wound care technologies, including the development of novel dressings, bioactive wound care products, and smart wound management systems. Increased investments in R&D, along with the integration of artificial intelligence (AI) and data analytics in wound care solutions, are expected to create significant opportunities for industry growth.

List of Key Companies in Wound Care Market

- Smith+Nephew

- Molnlycke Health Care AB

- ConvaTec Group PLC

- 3M

- Coloplast Corp

- Medline Industries, LP

- Braun SE

- INTEGRA LIFESCIENCES

- Johnson & Johnson (Medical Devices Business Services, Inc.)

- Medtronic

Key Industry Developments

- October 2024 (Collaboration): Molnlycke Health Care entered a research collaboration with Transdiagen (TDG) to advance chronic wound healing and tissue regeneration. This partnership aims to leverage TDG's innovative wound gene signatures to enhance the understanding and development of Molnlycke's wound care products.

- April 2024 (Launch): Smith & Nephew launched the Renasys Edge negative pressure wound therapy system for treating chronic wounds, including ulcers. The system is discreet and portable, allowing patients to maintain daily activities during treatment.

The global wound care market has been segmented as:

By Product

- Advanced Wound Dressing

- Foam Dressings

- Hydrocolloid Dressings

- Hydrogel Dressings

- Alginate Dressings

- Film Dressings

- Antimicrobial Dressings

- Others

- Surgical Wound Care

- Sutures and Staples

- Tissue Sealants and Glues

- Hemostatic Agents

- Others

- Traditional Wound Care

- Wound Closure Products

- Basic Dressings

- Adhesive Tapes

- Antiseptics and Cleansers

- Others

- Wound Therapy Devices

- Negative Pressure Wound Therapy (NPWT)

- Oxygen and Hyperbaric Oxygen Therapy Devices

- Pressure Relief Devices

- Electrical Stimulation Devices

- Ultrasound Therapy Devices

- Others

By End-User

- Hospitals

- Specialty Clinics

- Home Healthcare

- Others

By Application

- Chronic Wounds

- Diabetic Foot Ulcers (DFUs)

- Pressure Ulcers (Bedsores)

- Venous Leg Ulcers

- Arterial Ulcers

- Acute Wounds

- Surgical Wounds

- Traumatic Wounds

- Burns

- Lacerations and Abrasions

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America