Market Definition

The market focuses on the development, production, and distribution of sensor-based devices that monitor brain activity wirelessly. These sensors use advanced wireless technologies, such as Bluetooth, Wi-Fi, and radio frequency, to transmit real-time brain signals for medical diagnostics, neurofeedback, research, and therapeutic applications.

The report covers major factors driving the market, along with key trends and regulatory implications that are expected to influence the market during the forecast period.

Wireless Brain Sensors Market Overview

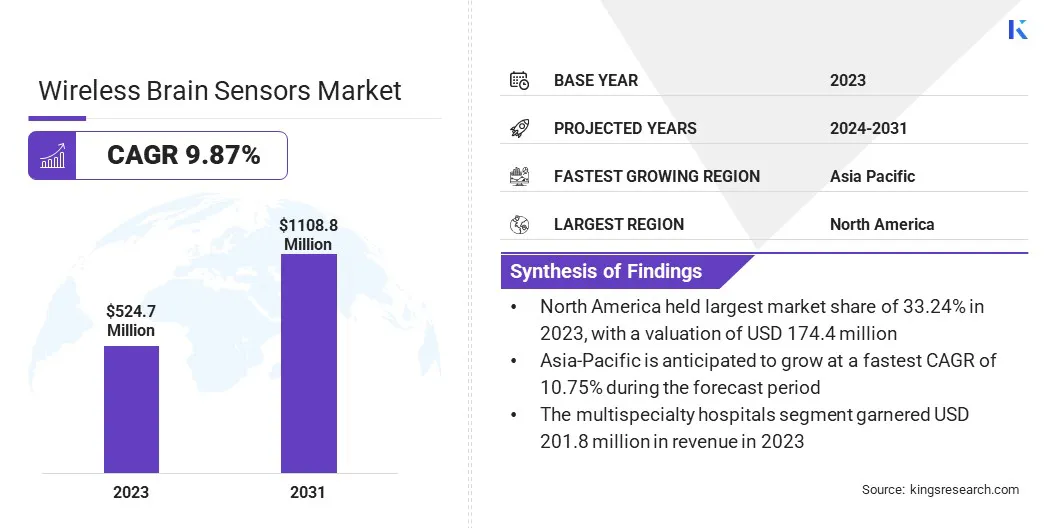

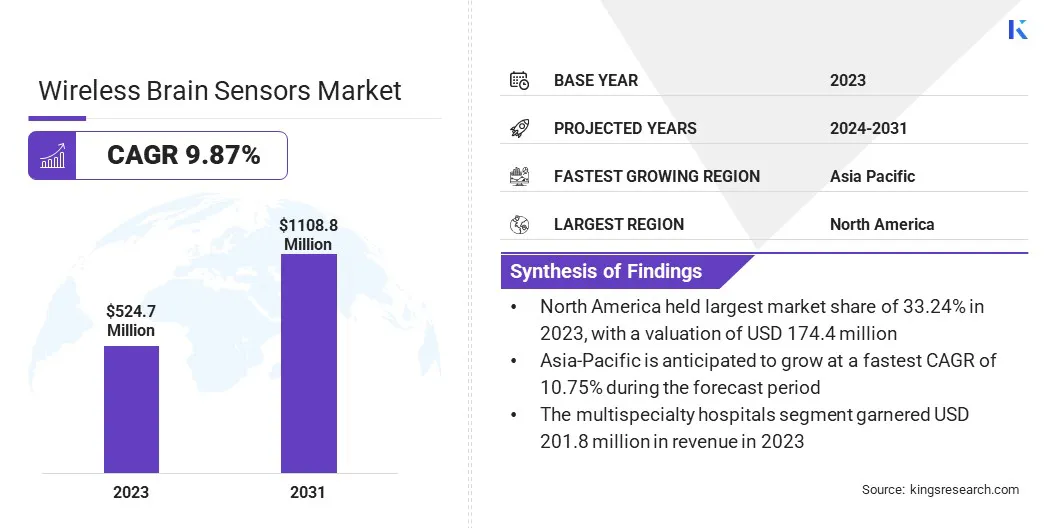

The global wireless brain sensors market size was valued at USD 524.7 million in 2023 and is projected to grow from USD 573.8 million in 2024 to USD 1108.8 million by 2031, exhibiting a CAGR of 9.87% during the forecast period. The market is propelled by the increasing prevalence of neurological disorders, rising demand for non-invasive brain monitoring, advancements in wireless technology and AI-driven data analysis.

Major companies operating in the wireless brain sensors industry are Advanced Brain Monitoring, Inc., Neuroelectrics, Brain Products GmbH, EMOTIV, Muse, Jordan NeuroScience, Inc, Nihon Kohden Corporation, EPITEL, Zeto Inc, BIOPAC Systems Inc., and mbraintrain.

The expanding adoption of remote patient monitoring, brain-computer interfaces (BCIs), and neurofeedback applications further accelerates market growth. North America leads due to strong healthcare infrastructure and R&D investments, while the Asia-Pacific region is set for the fastest expansion, supported by growing healthcare awareness and government initiatives in neuroscience and medical technology.

- In March 2025, Epitel's REMI Wireless Wearable EEG System received FDA clearance for use in patients starting at one year of age. This clearance also allows the system to monitor brain activity in pediatric patients, especially for conditions such as epilepsy, enhancing its utility for both clinical and home monitoring.

Key Highlights

- The wireless brain sensors industry size was recorded at USD 524.7 million in 2023.

- The market is projected to grow at a CAGR of 9.87% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 174.4 million.

- The electroencephalography (EEG) segment garnered USD 149.4 million in revenue in 2023.

- The dementia segment is expected to reach USD 334.3 million by 2031.

- The multispecialty hospitals segment is anticipated to witness the fastest CAGR of 9.89% during the forecast period

- The market in Asia Pacific is anticipated to grow at a CAGR of 10.75% during the forecast period.

Market Driver

Growing Demand for Non-Invasive Brain Monitoring

The demand for non-invasive brain monitoring is a key driver of growth in the wireless brain sensors market. This demand is driven by the need for more patient-friendly and efficient neurological assessment solutions.

Unlike invasive implants and wired EEG systems, wireless sensors provide portable, real-time monitoring, which improves clinical efficiency and enhances patient comfort. Their adoption is rising in home healthcare, telemedicine, and remote monitoring, supported by the increasing prevalence of neurological disorders and advancements in wearable neurotechnology and brain-computer interfaces (BCIs).

- In January 2023, Northwestern University unveiled a wireless, battery-free brain implant that can monitor dopamine signals in real-time. This device is intended for use in small animals to allow researchers the study of brain activity in freely behaving subjects. It offers the potential for advancing the understanding of neurochemical roles in neurological disorders.

Market Challenge

High Cost of Advanced Wireless Brain Sensors

The high cost of advanced wireless brain sensors represents a significant barrier to market growth, particularly in price-sensitive regions. The development of these devices involves high-precision sensors, AI-powered data analytics, and advanced wireless communication systems, which elevates manufacturing costs.

To mitigate this challenge, manufacturers are focusing on cost-efficient production techniques, miniaturization, and cloud-based data processing.

Market Trend

Rising Demand for Remote Patient Monitoring & Telemedicine

A key trend in the market is the growing demand for remote patient monitoring & telemedicine. As healthcare shifts towards greater accessibility, cost-efficiency, and convenience, wireless brain sensors are being increasingly used for continuous, real-time monitoring.

These sensors enable remote management of neurological conditions such as epilepsy, sleep disorders, and traumatic brain injuries, reducing the need for frequent in-person visits. This trend is reshaping healthcare delivery by enhancing patient outcomes and enabling more efficient and accessible care, particularly in underserved or remote areas.

Wireless Brain Sensors Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Electroencephalography (EEG), Sleep Monitoring, Intracranial pressure (ICP), Transcranial Doppler (TCD), Others

|

|

By Application

|

Dementia, Epilepsy, Parkinson's Disease, Traumatic Brain Injuries, Others

|

|

By End Use

|

Multispecialty Hospitals, Research Institutes, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Electroencephalography (EEG), Sleep Monitoring, Intracranial pressure (ICP), Transcranial Doppler (TCD), Others): The electroencephalography (EEG) segment earned USD 149.4 million in 2023 due to its widespread application in neurological disorder diagnosis and real-time brain activity monitoring.

- By Application (Dementia, Epilepsy, Parkinson's Disease, Traumatic Brain Injuries, Others): The dementia segment held 30.02% of the market in 2023, due to the growing incidence of neurodegenerative diseases and demand for early detection.

- By End Use (Multispecialty Hospitals, Research Institutes, Others): The multispecialty hospitals segment is projected to reach USD 426.9 million by 2031, owing to advanced healthcare infrastructure and increasing adoption of wireless brain monitoring technologies.

Wireless Brain Sensors Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America wireless brain sensors market share stood at around 33.24% in 2023 valued at USD 174.4 million. This dominance is attributed to the presence of advanced healthcare infrastructure and significant investments in research and development.

Moreover, continuous advancements in neurotechnology, particularly in areas such as telemedicine, remote patient monitoring, and brain-computer interfaces (BCIs), further drive the market in this region. Additionally, the region's favorable regulatory environment, along with the increasing adoption of non-invasive brain monitoring solutions fuels the growth of the market.

- In March 2024, Brown University announced the development of salt-sized wireless sensors designed for real-time monitoring of physiological conditions. These small sensors are intended for integration into the body, enabling non-invasive, continuous data collection, especially for conditions like neurological disorders.

Asia-Pacific wireless brain sensors industry is expected to grow at a CAGR of 10.75% over the forecast period. This growth is attributed to the increasing healthcare investments, rising awareness of neurological disorders, and the adoption of advanced medical technologies.

The region’s growing focus on healthcare infrastructure development, particularly in countries such as China, India, and Japan, is facilitating the integration of wireless brain sensors into both clinical and research applications. Moreover, the expanding adoption of telemedicine and remote patient monitoring solutions is further contributing to the market expansion.

Regulatory Frameworks

- In the U.S., the FDA's Radio Frequency Wireless Technology in Medical Devices Guidance ensures the safe and effective use of medical devices incorporating radio frequency (RF) wireless technology.

- In the EU, the Medical Device Regulation (MDR) 2017/745 ensures the safety and effectiveness of medical devices, by setting stringent requirements for their design, production, and clinical evaluation.

- The ISO 14971:2019 ensures the safety of wireless brain sensors by requiring manufacturers to identify and manage potential risks throughout the device lifecycle.

Competitive Landscape

The wireless brain sensors industry is highly competitive, with a mix of established industry leaders and emerging startups striving to leverage advancements in neurotechnology. Companies are focusing on strategic partnerships, product innovation, and technological advancements to differentiate their offerings and maintain a competitive advantage.

Significant investments in research and development are being made to improve the precision, functionality, and usability of wireless brain sensors, particularly in the areas of brain-computer interfaces (BCIs) and neurofeedback.

List of Key Companies in Wireless Brain Sensors Market:

- Advanced Brain Monitoring, Inc.

- Neuroelectrics

- Brain Products GmbH

- EMOTIV

- Muse

- Jordan NeuroScience, Inc

- Nihon Kohden Corporation

- EPITEL

- Zeto Inc

- BIOPAC Systems Inc.

- mbraintrain

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In January 2025, Syntiant Corp. and CeramicSpeed collaborated to develop autonomous wireless sensors for condition-based monitoring in Industrial IoT applications. The partnership focuses on utilizing Syntiant’s NDP120 Neural Decision Processor to create low-power sensors capable of real-time predictive maintenance, significantly improving operational efficiency while reducing maintenance costs.