Wellness Supplements Market Size

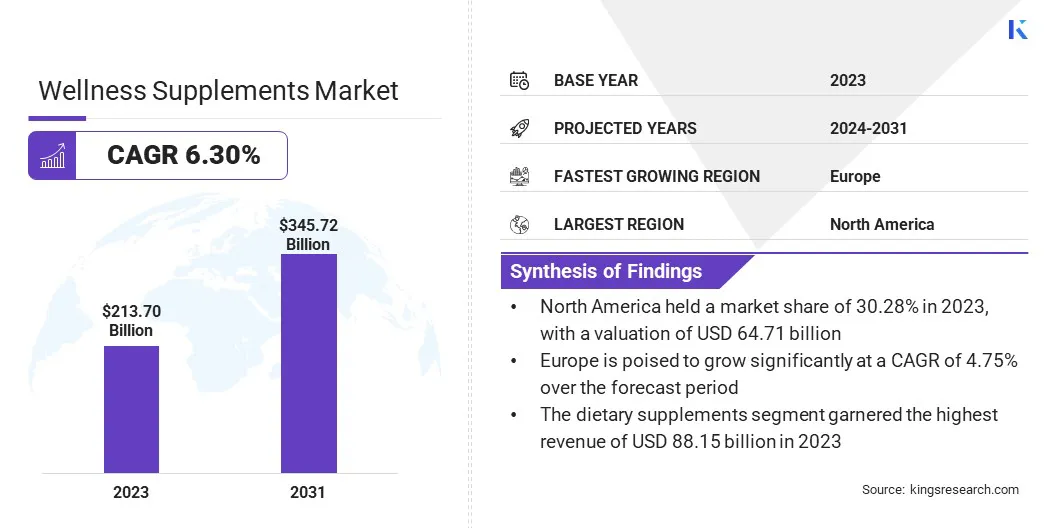

The global Wellness Supplements Market size was valued at USD 213.70 billion in 2023 and is projected to reach USD 345.72 billion by 2031, growing at a CAGR of 6.30% from 2024 to 2031. Increasing health awareness and preventive healthcare initiatives are significant factors driving the growth of the global wellness supplements market.

In the scope of work, the report includes products offered by companies such as Amway, Herbalife Nutrition Ltd., Nestlé Health Science, Abbott Laboratories, Glanbia plc, Nature's Bounty Co., GNC Holdings Inc., Pfizer Inc., ADM (Archer Daniels Midland), Nu Skin Enterprises Inc., Blackmores Limited, The Nature's Way Co. and others.

As more consumers become aware of the importance of maintaining good health and preventing diseases, they are proactively seeking ways to enhance their well-being. Increasing health awareness and preventive healthcare initiatives are being supported by various public health campaigns and educational initiatives that empower individuals to maintain and improve their health.

Preventive healthcare strategies emphasize the role of nutrition, exercise, and lifestyle choices in disease prevention and wellness, leading to a growing demand for wellness supplements that complement healthy lifestyles. Manufacturers are developing innovative formulations backed by scientific research to address specific health concerns and support wellness goals, thereby fueling market expansion.

Wellness supplements encompass a broad range of products designed to supplement dietary intake and promote overall health and well-being. They typically include vitamins, minerals, herbal extracts, probiotics, and other nutritional ingredients. These supplements find application across various areas such as immune support, bone and joint health, digestive health, cognitive function, energy enhancement, and sports nutrition.

The wellness supplements market is evolving with advancements in formulation techniques, ingredient sourcing, and delivery methods such as capsules, tablets, powders, and liquid forms. Regulatory bodies play a crucial role in ensuring product safety, efficacy, and labeling accuracy, thereby influencing market dynamics and fostering consumer trust.

Adhering to quality standards and transparency in ingredient sourcing and manufacturing processes is essential for building consumer confidence and meeting regulatory requirements, thus driving market competitiveness and sustainable growth.

Analyst’s Review

Companies in the global wellness supplements market are prioritizing several key strategies, notably investing in research and development to create innovative and scientifically validated products. Key players are focusing on building a strong brand reputation through quality assurance, transparency in labeling, and adherence to regulatory standards that enhance consumer trust and loyalty.

Key players are utilizing digital marketing channels, e-commerce platforms, and targeted advertising campaigns to effectively reach a wider audience and engage with health-conscious consumers.

Collaborating with healthcare professionals, influencers, and retail partners further strengthens market presence and product visibility. These strategies hold significant importance and are poised to shape the market outlook in the upcoming years by driving product innovation and consumer education on wellness supplementation.

Wellness Supplements Market Growth Factors

The expanding geriatric population has led to an increased focus on consuming wellness supplements to manage symptoms associated with aging. As people age, they often experience changes in metabolism, nutrient absorption, and organ function, which increases the risk of chronic conditions such as osteoporosis, cognitive decline, and cardiovascular diseases. This has driven the demand for wellness supplements that specifically target age-related health concerns.

Manufacturers are developing wellness supplements that cater to the specific needs of aging individuals. These supplements are enriched with vitamins, minerals, antioxidants, and botanical extracts to support healthy aging and improve age-related health outcomes. Given these considerations, the market for these wellness supplements is expected to grow in the coming years, as the aging population is increasing globally.

However, consumer skepticism and misinformation regarding supplement efficacy and safety are impacting market growth. Despite the scientific evidence substantiating the benefits of numerous supplements, misconceptions and exaggerated marketing claims have led to doubts among consumers regarding their effectiveness and potential side effects.

Overcoming this challenge requires industry players to prioritize transparency, education, and evidence-based marketing practices. Providing clear and accurate information about product ingredients, dosages, benefits, and potential risks helps build trust among consumers.

Collaborating with healthcare professionals, nutritionists, and researchers to communicate reliable information and educate consumers regarding supplement use, safety guidelines, and interactions with medications may enhance consumer confidence and foster a positive perception of wellness supplements.

Wellness Supplements Market Trends

The market is experiencing a notable shift toward natural, organic, and clean label products. This change reflects consumer preferences for healthier options and their inclination toward environmentally friendly choices. Consumers are increasingly seeking wellness supplements that are made from natural ingredients and do not contain any artificial additives, preservatives, or allergens. This growing demand is prompting manufacturers to develop supplements that meet these requirements.

Moreover, plant-based and vegan supplements are gaining immense popularity among health-conscious consumers seeking ethical and sustainable options aligned with plant-centric diets and lifestyle choices.

Manufacturers are responding by formulating supplements derived from plant sources such as algae, mushrooms, botanical extracts, and plant proteins, catering to vegan, vegetarian, and flexitarian consumers. This trend is shaping the current market landscape by addressing evolving consumer preferences while driving innovation in sustainable sourcing, eco-friendly packaging, and ethical practices across the supply chain.

Segmentation Analysis

The global wellness supplements market is segmented based on product type, application, form, distribution channel, and geography.

By Product Type

Based on product type, the market is segmented into dietary supplements, fortified/functional food & beverages, and dermo-cosmetic skin essentials. The dietary supplements segment garnered the highest revenue of USD 88.15 billion in 2023 on account of the growing awareness and adoption of preventive healthcare practices worldwide.

Increasing health consciousness among consumers, coupled with the aging population seeking wellness solutions, is propelling the demand for dietary supplements supporting health, immunity, and chronic disease management. The rising focus on product innovation, quality assurance, and strategic marketing initiatives is further aiding the growth of the segment.

By Application

Based on application, the market is classified into home care, hospital & pharmacy, and nutrition centers. The hospital & pharmacy segment accrued the largest market share of 42.55% in 2023 due to the growing integration of wellness supplements into clinical settings and healthcare facilities.

Increasing collaboration between supplement manufacturers, healthcare providers, and pharmacies is facilitating easier access to supplements as part of holistic healthcare regimens, preventive wellness programs, and post-treatment support. The recommendations of healthcare professionals, coupled with stringent quality standards, are boosting consumer confidence in supplement safety and reliability, thereby driving segment growth.

By Form

Based on form, the market is categorized into powder & tablets, and liquid & gummies. The liquid & gummies segment is poised to record a staggering CAGR of 7.68% through the forecast period owing to their convenience, palatability, and suitability for diverse consumer preferences and age groups. Liquid supplements offer easy consumption and faster absorption, making them popular among seniors, children, and individuals with swallowing difficulties.

Gummies, with their appealing flavors, chewable format, and added functional ingredients, resonate well with younger demographics and health-conscious consumers seeking enjoyable supplement experiences. Manufacturers are focusing on flavor variety and targeted formulations tailored to specific health needs and dietary preferences, which is driving the expansion of the segment.

Wellness Supplements Market Regional Analysis

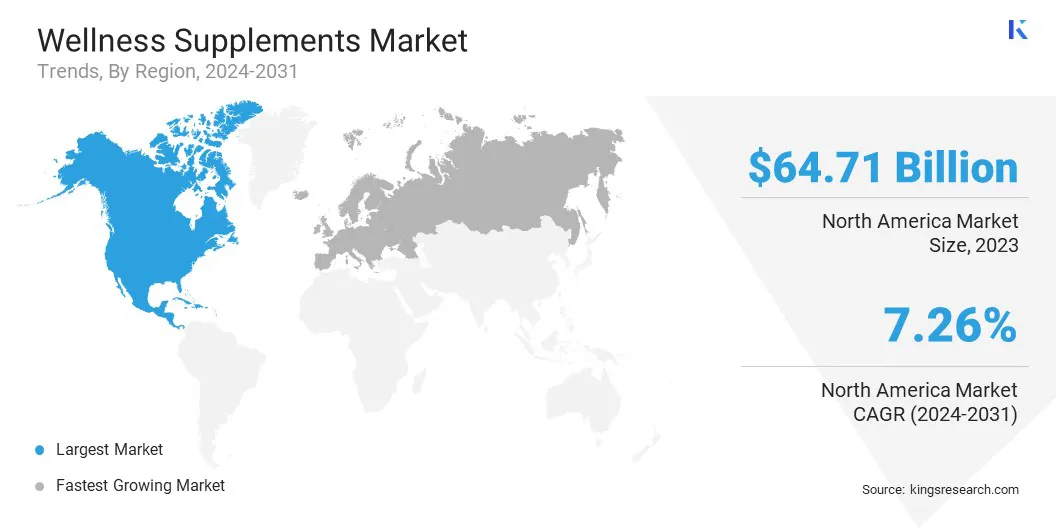

Based on region, the global wellness supplements market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Wellness Supplements Market share stood around 30.28% in 2023 in the global market, with a valuation of USD 64.71 billion. A well-established healthcare infrastructure, increased consumer awareness regarding preventive healthcare, and availability of a diverse range of wellness products are major factors fueling market growth in the region.

The presence of key market players, robust regulatory frameworks ensuring product safety and quality, and extensive distribution networks including pharmacies, supermarkets, and e-commerce platforms are contributing to the region’s dominance in the global marketplace.

Europe is poised to grow significantly at a CAGR of 4.75% over the forecast period owing to increasing consumer interest in holistic health approaches, preventive wellness strategies, and natural/organic supplement choices.

The aging population, coupled with rising health consciousness among younger demographics, is driving the demand for wellness supplements that support healthy aging, bolster immune support, and improve overall well-being. Regulatory initiatives promoting transparency, quality standards, and responsible marketing practices are enhancing consumer trust. Expansion of distribution channels, along with strategic partnerships with retailers and healthcare providers, is contributing to regional market growth.

Competitive Landscape

The global wellness supplements market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are undertaking effective strategic initiatives involving expansions & investments, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Wellness Supplements Market

- Amway

- Herbalife Nutrition Ltd.

- Nestlé Health Science

- Abbott Laboratories

- Glanbia plc

- Nature's Bounty Co.

- GNC Holdings Inc.

- Pfizer Inc.

- ADM (Archer Daniels Midland)

- Nu Skin Enterprises Inc.

- Blackmores Limited

- The Nature's Way Co.

Key Industry Developments

- March 2024 (Partnership): Nature Made, a leading vitamin and supplement brand, partnered with USA Pickleball, the National Governing Body for the sport, to promote feel-good health and wellness habits. Nature Made agreed to participate in pickleball events, aimed at curating opportunities for spectators to learn about wellness habits and experience their products firsthand. The partnership intended to encourage activities that educate people about overall well-being.

- May 2023 (Product Launch): GNC launched new wellness supplements, including Preventive Nutrition Sleep Support, Stress Relief, and Focus & Memory, as well as Beyond Raw Neuro Surge. These products are designed to improve focus, reduce stress, and enhance sleep quality. With these products, GNC aimed to meet the growing demand for cognitive support and mental wellness by offering science-backed solutions made from natural ingredients.

The Global Wellness Supplements Market is Segmented as:

By Product Type

- Dietary Supplements

- Fortified/Functional Food & Beverages

- Dermo Cosmetic Skin Essentials

By Application

- Home Care

- Hospital & Pharmacy

- Nutrition Centers

By Form

- Powder & Tablets

- Liquid & Gummies

By Distribution Channel

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America