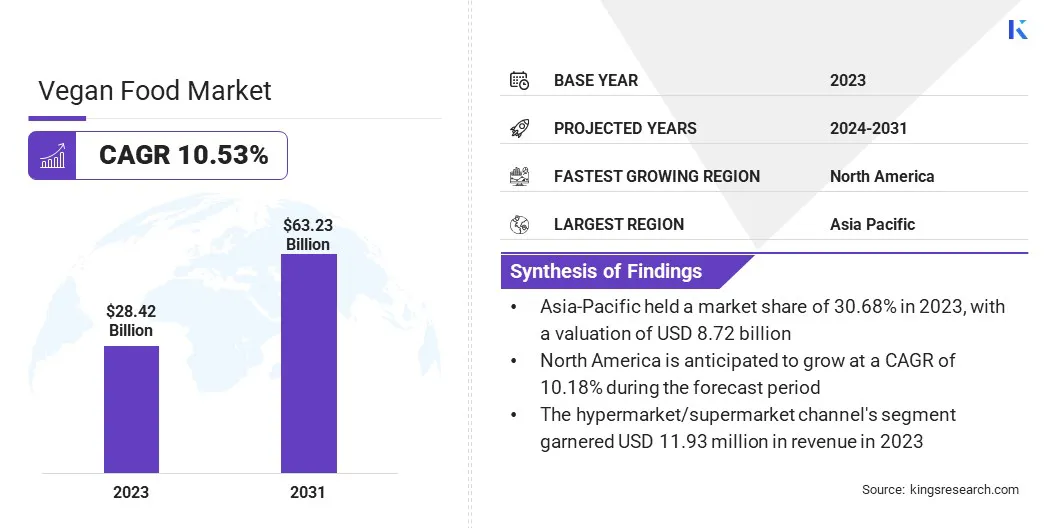

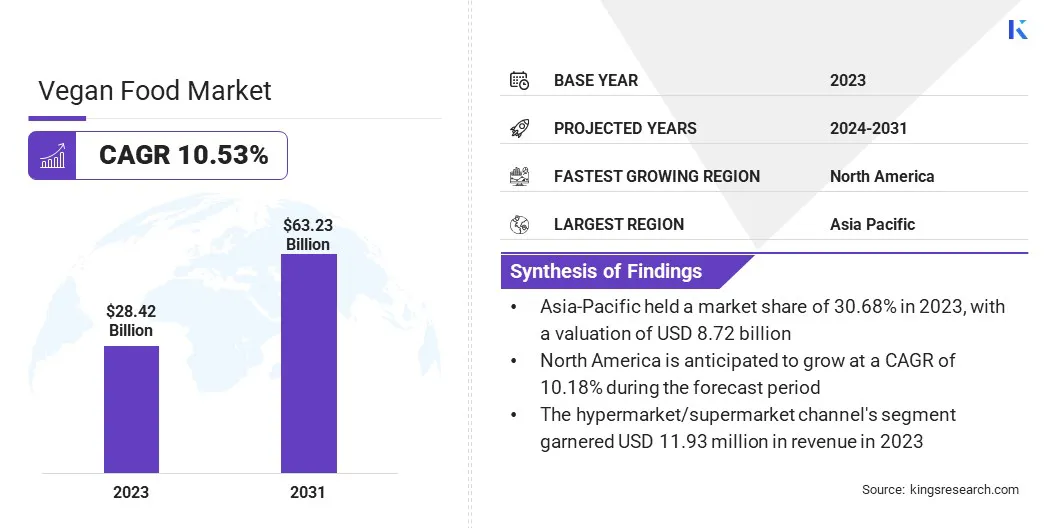

Vegan Food Market Size

According to Kings Research, the global Vegan Food Market size was valued at USD 28.42 billion in 2023 and is projected to reach USD 63.23 billion by 2031, growing at a CAGR of 10.53% from 2024 to 2031.

In the scope of work, the report includes products offered by companies such as Amy's Kitchen, Inc., ADM, Axiom Foods, Inc., Conagra Brands, Inc., Daiya Foods, Danone S.A., Eden Foods, Impossible, Kellanova, SunOpta, The Hain Celestial Group, Inc., Tofutti Brands, Inc. and Others.

The increasing health consciousness among consumers is a significant factor propelling the growth of the vegan food market. As more people become aware of the correlation between diet and health, there is a growing preference for plant-based foods, which are considered healthier alternatives to animal products.

Plant-based diets are often associated with lower risks of chronic diseases such as heart disease, diabetes, and certain cancers. This trend is prompting food companies to innovate and offer a wider range of vegan products to cater to the growing demand from health-conscious consumers.

Vegan food refers to products that are free from animal-derived ingredients or by-products. This includes foods made entirely from plants such as fruits, vegetables, grains, nuts, seeds, and legumes. Vegan foods are classified into various types, including plant-based meats, dairy alternatives, egg substitutes, and prepared vegan meals.

Plant-based meats mimic the taste, texture, and appearance of traditional meat products by using ingredients such as soy, pea protein, or mushrooms. Dairy alternatives include plant-based milk (such as almond, soy, or oat milk), yogurts, cheeses, and ice creams made from nuts, seeds, or grains. Egg substitutes are often made from ingredients such as tofu, chickpea flour, or flaxseed meal.

Prepared vegan meals encompass a wide range of dishes, including salads and sandwiches to burgers, pizzas, and various ethnic cuisines, all made without the use of any animal-derived ingredients.

The application of vegan food extends across various sectors, including retail, food service, and food manufacturing, catering to the diverse preferences and dietary requirements of consumers worldwide.

Analyst’s Review

The vegan food market is experiencing unprecedented growth, driven by a convergence of factors including increasing health awareness, environmental concerns, and ethical considerations. With a notable shift toward more sustainable and plant-based diets, the market is witnessing significant expansion in terms of both product offerings and consumer reach.

Mainstream supermarkets are increasingly stocking a variety of vegan alternatives to traditional animal products, while food service outlets are incorporating plant-based options into their menus.

The market is drawing attention from dedicated vegans, flexitarians, and health-conscious individuals seeking healthier and more environmentally friendly food options. This widespread acceptance and adoption of veganism indicate a promising outlook for the market, with substantial growth expected in the coming years.

Vegan Food Market Growth Factors

Technological advancements are playing a pivotal role in enhancing product variety and quality within the market. As the demand for plant-based alternatives continues to surge, food companies are investing heavily in research and development to innovate new technologies for creating vegan products that closely mimic the taste, texture, and sensory experience of traditional animal-based foods.

These advancements include techniques such as extrusion, fermentation, and molecular gastronomy, which enable the production of plant-based meats, dairy alternatives, and egg substitutes with improved flavor, texture, and nutritional profiles.

Moreover, technological innovations have led to the development of novel ingredients and processing methods, thereby expanding the range of plant-based options available to consumers in the market.

These technological advancements are driving the growth of the vegan food market by providing consumers with a wider selection of high-quality, delicious, and sustainable alternatives to animal-based products.

Price sensitivity among consumers remains a significant restraint to market growth. While some vegan products are competitively priced with their animal-based counterparts, others come with a premium price tag due to various factors such as the cost of alternative ingredients, production methods, and brand positioning.

For numerous consumers, particularly those with budget constraints or residing in regions with limited access to vegan options, the perceived high cost of vegan products act as a deterrent to transitioning to plant-based alternatives. Price sensitivity poses a major challenge for food companies seeking to increase their market share and reach a broader audience with vegan offerings.

However, efforts to improve cost-efficiency in production, distribution, and marketing, along with government subsidies or incentives supporting plant-based initiatives, are likely to help alleviate price concerns and make vegan products more affordable and accessible to a wider range of consumers.

Vegan Food Market Trends

The rising demand for plant-based proteins is a notable trend driving the growth of the vegan food market. As more consumers adopt plant-based diets for health, environmental, and ethical reasons, there is a growing need for alternative protein sources beyond traditional animal products.

Plant-based proteins, derived from sources such as soy, peas, lentils, chickpeas, and quinoa, offer numerous health benefits, including being lower in saturated fats and cholesterol while providing essential nutrients such as fiber, vitamins, and minerals.

This trend has led to a surge in the availability and variety of plant-based protein products, including plant-based meats, protein powders, bars, and snacks, catering to the diverse preferences and dietary requirements of consumers.

Moreover, the increasing popularity of plant-based diets among athletes, fitness enthusiasts, and health-conscious individuals has fueled the demand for plant-based protein supplements and fortified foods, thereby driving market growth.

As awareness regarding the health and environmental benefits of plant-based proteins increases, the demand for these products is expected to rise, thereby fostering innovation and expansion of the vegan food market.

Segmentation Analysis

The global vegan food market is segmented based on product type, nature, sales channel, and geography.

By Product Type

Based on product type, the market is categorized into plant-based meat, plant-based dairy, vegan ice-cream, ready to drink beverages, condiments & dressings, and others. The plant-based dairy segment dominated the market with a share of 58.98% in 2023 on account of a significant shift in consumer preferences toward plant-based alternatives over traditional dairy products such as milk, cheese, and yogurt.

This shift is driven by various factors, including health concerns related to lactose intolerance, allergies, and cholesterol levels, and ethical and environmental considerations associated with animal agriculture. Plant-based dairy products offer a compelling alternative, often perceived as a healthier, cruelty-free, and more sustainable option.

Additionally, advancements in food technology have led to the development of plant-based dairy alternatives that closely mimic the taste, texture, and functionality of conventional dairy products, thereby fueling consumer acceptance and adoption.

The widespread availability of plant-based dairy options across retail channels, including supermarkets, specialty stores, and online platforms, has further contributed to the segment's dominance in the market.

By Nature

Based on nature, the market is bifurcated into organic and conventional. The organic segment is anticipated to witness the highest growth of 10.97% over the forecast period as a result of increasing consumer awareness and demand for organic vegan food products.

Organic products are manufactured without the use of synthetic pesticides, fertilizers, genetically modified organisms (GMOs), or irradiation, aligning with consumers' preferences for natural and sustainable food options.

As consumers become more health-conscious and environmentally aware, there is a growing preference for organic foods perceived as safer, more nutritious, and environmentally friendly options.

Moreover, the organic certification provides assurance of quality and authenticity, thereby fostering consumer trust and willingness to pay a premium for organic vegan products. With the expansion of organic farming practices and certification standards, coupled with the rising availability of organic vegan options in retail outlets and online platforms, the segment is poised to experience robust growth in the near future.

By Sales Channel

Based on sales channel, the market is divided into hypermarket/supermarket, online retails, specialty store, and others. The hypermarket/supermarket channel's segment generated the highest revenue of USD 11.93 billion in 2023.

This considerable growth can be attributed to its extensive reach, convenience, and diverse product offerings catering to a wide range of consumer preferences. Hypermarkets and supermarkets serve as key retail channels for vegan food products, offering a one-stop shopping experience for consumers seeking plant-based alternatives alongside conventional grocery items.

These retail outlets typically have dedicated sections or aisles for vegan and organic products, which makes it easier for consumers to find and purchase vegan options.

Additionally, hypermarkets and supermarkets leverage their purchasing power and supply chain networks to source a variety of vegan products from both mainstream brands and niche producers, thereby ensuring a comprehensive selection for consumers.

Growing consumer demand for vegan food products, coupled with the convenience and accessibility offered by hypermarkets and supermarkets, has propelled significant revenue growth in this retail channel, solidifying its position in the vegan food market.

Vegan Food Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific Vegan Food Market share stood around 30.68% in 2023 in the global market, with a valuation of USD 8.72 billion, owing to several factors, including the region's large and diverse population, increasing urbanization, and shifting dietary preferences toward plant-based options.

In countries such as China and India, characterized by traditional plant-based diets, there is a growing interest in vegan alternatives driven by health concerns, environmental awareness, and changing lifestyles.

Moreover, the Asia-Pacific region boasts a rich culinary tradition with a wide variety of plant-based ingredients and cuisines, facilitating the development and adoption of vegan food products. Moreover, government initiatives promoting sustainable agriculture and healthier food choices support the growth of the market in the region.

North America is likely to experience significant growth at 10.18% CAGR between 2024 and 2031, mainly driven by the growing awareness regarding health and wellness, environmental sustainability, and animal welfare concerns, prompting consumers to seek plant-based alternatives to traditional animal products.

This trend is further fueled by the increasing availability and variety of vegan options in retail outlets, restaurants, and food service establishments.

Additionally, the rise of plant-based startups and investments from large food companies are aiding the expansion of the regional vegan food market. Moreover, celebrity endorsements, social media influence, and educational campaigns raise awareness and drive consumer interest in veganism. Given these factors, North America is poised to experience significant growth in the market over the forecast period.

Competitive Landscape

The vegan food market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Vegan Food Market

- Amy's Kitchen, Inc.

- ADM

- Axiom Foods, Inc.

- Conagra Brands, Inc.

- Daiya Foods

- Danone S.A.

- Eden Foods

- Impossible

- Kellanova

- SunOpta

- The Hain Celestial Group, Inc.

- Tofutti Brands, Inc.

Key Industry Development

- December 2023 (Launch): Daiya introduced the Daiya Oat Cream blend, a proprietary cultured ingredient integrated into its dairy-free product line, including shreds, slices, blocks, and sticks. This innovation aims to provide consumers with a dairy-like melting experience and a perfectly balanced cheesy flavor profile.

The global Vegan Food Market is segmented as:

By Product Type

- Plant-based Meat

- Plant-based Dairy

- Vegan Ice-cream

- Ready to Drink Beverages

- Condiments & Dressings

- Others

By Nature

By Sales Channel

- Hypermarket/Supermarket

- Online Retails

- Specialty Store

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America