Market Definition

A virtual data room is a secure online platform used for storing and sharing sensitive documents, typically during high-stakes business processes such as mergers & acquisitions (M&A), fundraising, legal proceedings and due diligence.

It’s designed to replace traditional physical data rooms by allowing secure document access and collaboration across different locations. The virtual data room (VDR) market refers to the industry and economic ecosystem centered around these virtual data room software and services.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Virtual Data Room Market Overview

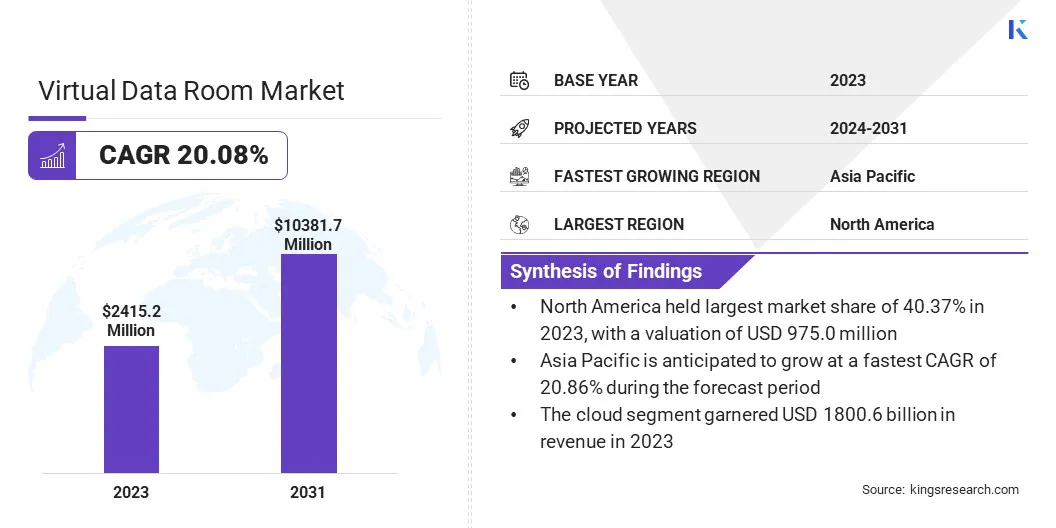

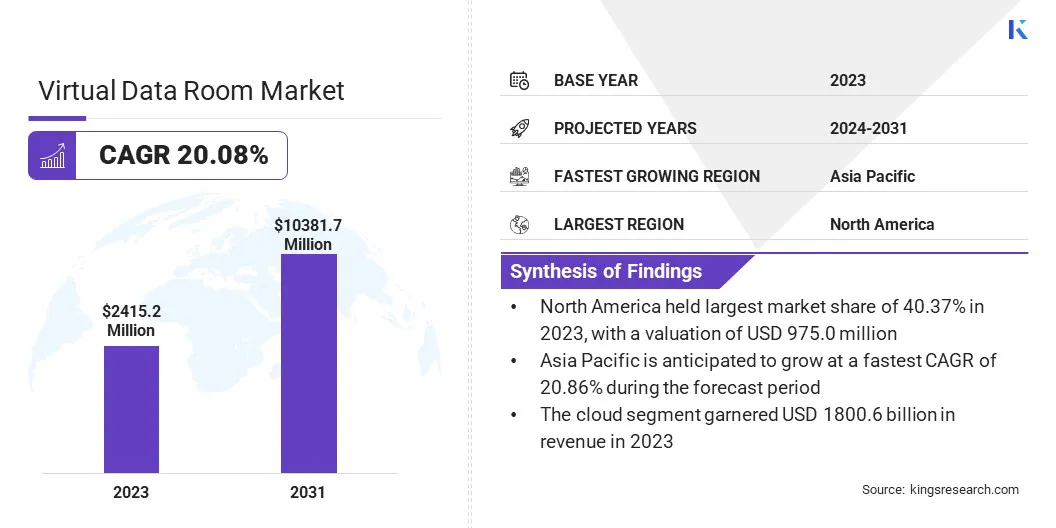

Global virtual data room market size was valued at USD 2415.2 million in 2023, which is estimated to be valued at USD 2883.1 million in 2024 and reach USD 10381.7 million by 2031, growing at a CAGR of 20.08% from 2024 to 2031.

Increasing regulatory compliance requirements are driving demand for secure digital solutions. Virtual data rooms offer organizations a reliable way to manage sensitive information while maintaining transparency, auditability, and control in regulatory workflows.

Major companies operating in the virtual data room industry are Intralinks, SS&C Inc., Thomson Reuters Corporation, FIRMEX INC., Katalyst Data Management, Orangedox Media, Inc., Egnyte, Inc., Vitrium Systems Inc., Ideals, Midaxo, Docully SaaS Technologies Co. LLC, Box, Donnelley Financial Solutions (DFIN), Ansarada Pty Ltd., ShareVault, and CapLinked.

The market is experiencing significant growth, driven by increasing demand for secure, efficient data management and accelerated decision-making processes across industries. As businesses handle rising volumes of sensitive information, VDRs offer streamlined access, robust collaboration tools, and enhanced data security.

Moreover, the growing emphasis on digital transformation, regulatory compliance, and real-time analytics is driving the virtual data room (VDR) market by positioning VDRs as essential infrastructure for managing data-intensive workflows and enabling strategic business operations.

- In September 2024, Bloomberg launched a virtual data room to accelerate data evaluation for enterprise use. Hosted in the cloud via customizable Jupyter Notebooks, it enables faster, hands-on analysis of Bloomberg’s datasets reducing traditional review times and boosting confidence in data-driven decision-making.

Key Highlights

- The virtual data room industry size was recorded at USD 2415.2 million in 2023.

- The market is projected to grow at a CAGR of 20.08% from 2024 to 2031.

- North America held a market share of 40.37% in 2023, with a valuation of USD 975.0 million.

- The cloud segment garnered USD 1800.6 million in revenue in 2023.

- The large enterprises segment is expected to reach USD 6564.4 million by 2031.

- The mergers and acquisitions, initial public offerings segment had a market of 50.27% in 2023.

- The healthcare and life science segment is anticipated to grow at a CAGR of 21.58% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 20.86% during the forecast period.

Market Driver

"Increasing Regulatory Requirements"

Growing regulatory compliance demands are a key driver of the virtual data room (VDR) market. Organizations are under pressure to manage sensitive data securely and transparently across complex workflows.

VDRs provide the necessary infrastructure with secure access controls, real-time audit tracking, and structured data sharing capabilities. These features enable businesses to meet compliance standards efficiently while minimizing risk.

As regulatory environments evolve, the VDR market continues to expand, driven by the need for dependable, scalable solutions that support ongoing compliance and governance.

- In March 2025, DFIN introduced the EDGAR Next Enrollment Portal to simplify compliance with new SEC filing rules. The portal streamlines the process for filers to manage access credentials, verify identities, and submit documents securely under the new EDGAR Next system.

Market Challenge

"Data Privacy and Security Risks"

Data privacy and security risks are a significant challenge in the virtual data room (VDR) market. Although VDRs are specifically designed for secure document sharing and storage, they remain vulnerable due to increasing sophistication of cyberattacks, potential system misconfigurations, and human errors.

These vulnerabilities can lead to unauthorized access, data breaches, and potential regulatory violations, which may affect user trust and organizational compliance.

To address this, providers are increasingly investing in advanced encryption protocols, multi-factor authentication, and continuous security audits. These measures help strengthen data protection, build user confidence, and ensure compliance with evolving cybersecurity standards and best practices.

Market Trend

"Adoption in Private Equity and Venture Capital"

A significant trend in the virtual data room (VDR) market is the increasing adoption of virtual data rooms (VDRs) by private equity and venture capital firms. These firms are leveraging VDRs to securely manage investment documents, streamline due diligence processes, and share sensitive financial information with stakeholders.

By utilizing VDRs, private equity and venture capital firms enhance collaboration, reduce the risk of data breaches, and improve efficiency during critical transactions, such as mergers, acquisitions, and investments, while ensuring compliance with regulatory requirements.

- In February 2025, DiligentIQ raised USD 12 million in Series A funding to expand its AI-powered due diligence platform. This technology helps private equity firms streamline the analysis of VDR documents, accelerating deal evaluation, improving decision-making, and identifying risks and opportunities with greater accuracy.

Virtual Data Room Market Report Snapshot

|

Segmentation

|

Details

|

|

By Deployment

|

Cloud, On-premise

|

|

By Enterprise Type

|

Large Enterprises, Small and Medium Enterprises

|

|

By Business Function

|

Mergers and Acquisitions, Initial Public Offerings, Enterprise Activities, Document Warehousing

|

|

By Application

|

BFSI, Retail and E-commerce, Healthcare and Life Science, IT and Telecom, Government, Construction and Real Estate, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Deployment (Cloud, On-premise): The cloud segment earned USD 1800.6 million in 2023 due to increasing demand for scalable, cost-effective, and secure data storage and easy access for global collaborations in VDR solutions.

- By Enterprise Type (Large Enterprises, Small and Medium Enterprises): The large enterprises segment held 64.74% of the market in 2023, due to the growing need for secure data sharing, efficient due diligence processes, and advanced compliance management in large-scale transactions.

- By Business Function (Mergers and Acquisitions, Initial Public Offerings, Enterprise Activities, Document Warehousing): The mergers and acquisitions, initial public offerings segment is projected to reach USD 5282.2 million by 2031, owing to the increasing need for secure, efficient data rooms to manage sensitive documents during complex corporate transactions.

- By Application (BFSI, Retail and E-commerce, Healthcare and Life Science, IT and Telecom, Government, Construction and Real Estate, Others): The healthcare and life science segment is anticipated to have a CAGR of 21.58% during the forecast period, driven by rising regulatory requirements and the need for secure document sharing in clinical trials, research, and patient data management.

Virtual Data Room Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America virtual data room market share stood around 40.37% in 2023 in the global market, with a valuation of USD 975.0 million.

North America continues to dominate the market due to the presence of established financial institutions, legal firms, and a well-developed infrastructure for secure data management. The region benefits from stringent regulatory requirements, which drive the need for secure, compliant data-sharing platforms.

Additionally, the increasing adoption of cloud-based solutions and the growing demand for VDRs in industries like mergers and acquisitions and IPOs, as they enable secure, organized, and efficient sharing of confidential documents among multiple stakeholders during due diligence and regulatory review processes.

Asia Pacific virtual data room industry is poised for significant growth at a robust CAGR of 20.86% over the forecast period. Asia Pacific is expected to experience the fastest growth in the market, fueled by rapid digital transformation, increasing investments in technology, and the expanding presence of multinational companies.

Growing sectors such as real estate, manufacturing, and technology are increasingly relying on VDR solutions for secure document management during mergers, acquisitions, and joint ventures.

Additionally, evolving regulatory landscapes across countries in the region are propelling the demand for secure, compliant virtual data rooms, further driving the market's expansion.

Regulatory Frameworks

- In the U.S., the Health Insurance Portability and Accountability Act (HIPAA) mandates regulations for handling patient’s health information in VDRs used in the healthcare sector, requiring providers to implement robust security measures.

- In the EU, the General Data Protection Regulation (GDPR) governs the processing and storage of personal data. It mandates transparency, user consent, and the right to access, correct, and delete personal data.

- In India, the Digital Personal Data Protection Act, 2023 regulates the processing of digital personal data, balancing individuals' rights to data protection with the need for lawful data processing for legitimate purposes.

Competitive Landscape

Companies in the market are increasingly focusing on enhancing security features, improving workflow efficiency, and integrating additional tools to support end-to-end processes. They are adopting AI and machine learning technologies to automate document analysis and ensure faster, more accurate decision-making.

Furthermore, there is a strong push towards offering customizable, user-friendly platforms that cater to the specific needs of industries like private equity, mergers and acquisitions, and asset management.

- In November 2024, Bite Investments launched its virtual data room 2.0 as part of the Bite Stream platform. This enhanced solution streamlines workflows, improves security, and eliminates inefficiencies, offering integrated tools for document management and investor relations. With advanced security features and multimedia support, it simplifies investor onboarding and capital raising for alternative asset managers, driving greater operational efficiency across the investment lifecycle.

List of Key Companies in Virtual Data Room Market:

- Intralinks, SS&C Inc.

- Thomson Reuters Corporation

- FIRMEX INC.

- Katalyst Data Management

- Orangedox Media, Inc.

- Egnyte, Inc.

- Vitrium Systems Inc.

- Ideals

- Midaxo

- Docully SaaS Technologies Co. LLC

- Box

- Donnelley Financial Solutions (DFIN)

- Ansarada Pty Ltd.

- ShareVault

- CapLinked

Recent Developments (M&A/New Product Launch)

- In December 2024, Ideals acquired EthosData to enhance its VDR offerings for clients in India, providing improved functionality, advanced permissions, robust analytics, and transparent pricing.

- In October 2023, Egnyte launched its virtual document room, designed to streamline the secure sharing and management of sensitive business information. This new solution provides enhanced security, granular access controls, and customizable features, enabling businesses to manage external file-sharing activities effectively. It supports various use cases, including M&A transactions, legal proceedings, and compliance processes, offering a seamless, integrated platform for users.