Market Definition

The market involves the use of advanced technologies to measure, analyze, and monitor vibrations in machinery, industrial equipment, and structures.

It is widely applied across industries such as manufacturing, aerospace, automotive, energy, and construction. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Vibration Monitoring Market Overview

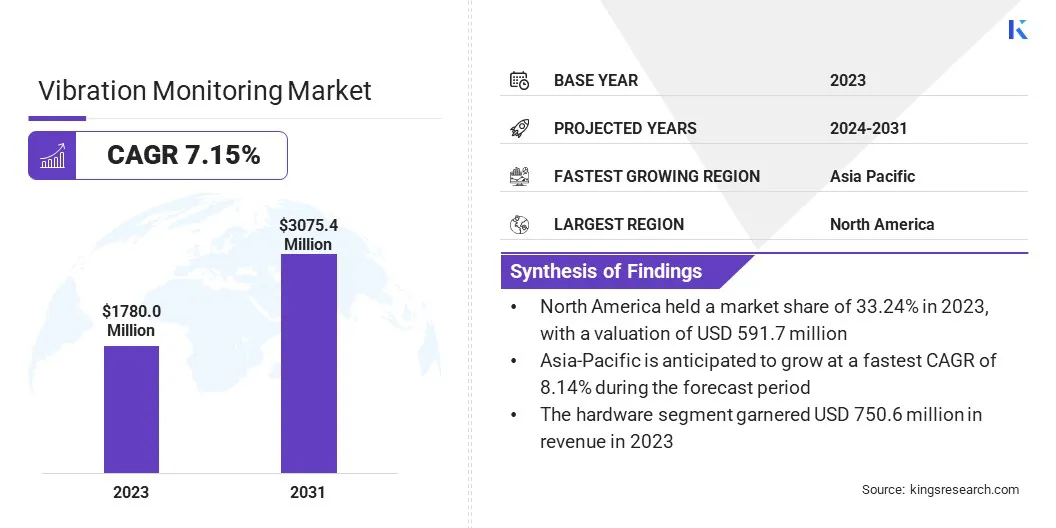

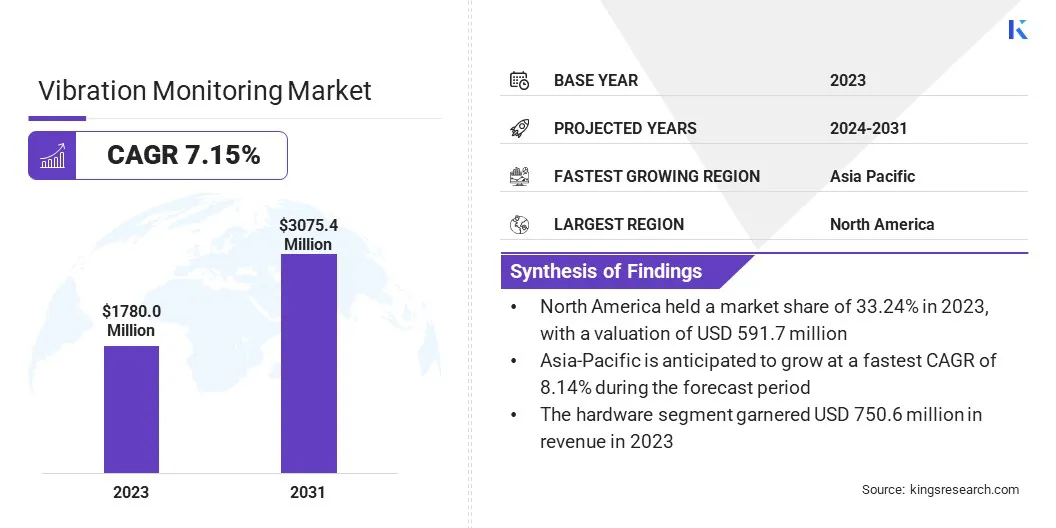

The global vibration monitoring market size was valued at USD 1780.0 million in 2023 and is projected to grow from USD 1896.6 million in 2024 to USD 3075.4 million by 2031, exhibiting a CAGR of 7.15% during the forecast period.

The expansion of manufacturing industries, construction activities, and infrastructure projects worldwide highlights the need for vibration monitoring to ensure the stability and safety of machinery and structures. Additionally, the development of advanced sensors and wireless monitoring systems is supporting this growth.

Major companies operating in the vibration monitoring industry are SKF AB, Emerson Electric Co., General Electric, Meggitt PLC, National Instruments Corp., Rockwell Automation, Inc., Honeywell International, Inc., Schaeffler Technologies AG & Co.KG, Analog Devices Inc., SPM Instrument AB, Azima DLI Corporation, Data Physics Corporation, Bruel & Kjaer Sound & Vibration Measurement, Banner Engineering, PCB Piezotronics Inc., and others.

The growing need for predictive maintenance in industries is significantly driving the market. By using vibration monitoring systems, companies can detect early signs of equipment failure, allowing for timely interventions and reducing unexpected downtimes.

As industries aim to improve operational efficiency and reduce maintenance costs, vibration monitoring has become essential, contributing to the growth of the market.

Key Highlights:

- The vibration monitoring market size was recorded at USD 1780.0 million in 2023.

- The market is projected to grow at a CAGR of 7.15% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 591.7 million.

- The hardware segment garnered USD 750.6 million in revenue in 2023.

- The motors segment is expected to reach USD 840.7 million by 2031.

- The oil & gas segment is anticipated to witness the fastest CAGR of 7.21% over the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 8.14% through the projection period.

Market Driver

Ongoing Advancements in Sensor Technology

The growth of the market is driven by the increasing adoption of predictive maintenance strategies and advancements in sensor technology, which enable early detection of equipment issues and minimize downtime. This growth is further fueled by the rise of Industry 4.0 and the integration of IoT and AI technologies, allowing real-time data analysis and remote monitoring.

These technological advancements help optimize maintenance schedules, improve operational efficiency, and increase overall productivity, making vibration monitoring an essential part of modern industrial maintenance strategies.

- In October 2023, Allegro MicroSystems, Inc. completed the acusition of Crocus Technology for USD 20 million. A leader in advanced TMR (Tunnel Magnetoresistance) sensor technology, Crocus enhances Allegro’s position in the magnetic sensing market. This acqusition supports the broader adoption of TMR technology in high-growth areas such as e-Mobility, Clean Energy, and Automation.

Market Challenge

Integration of Modern Monitoring Systems with Legacy Equipment

A key challenge impeding the expansion of the vibration monitoring market is the integration of modern systems with legacy equipment. rely on outdated machinery that lacks compatibility with current monitoring technologies, leading to costly and time-consuming upgrades. Furthermore, the need for customized solutions across diverse equipment types further complicates integration efforts.

To address these challenges, companies are using wireless condition monitoring systems that integrate seamlessly with existing infrastructure. These systems are designed to be flexible easily deployable solutions reduce implementation time and cost. Modular designs further enable phased upgrades, facilitating equipment modernization without full system replacement.

Market Trend

Integration of AI and ML with Advanced Sensor Technologies

A key trend influencing the market is the integration of AI and machine learning with advanced sensor technologies, enabling more accurate and real-time predictive maintenance. Smart predictive maintenance systems offer a cost-effective, wireless, and scalable solution to reduce downtime and maintenance costs across entire facilities.

Designed with plug-and-play capabilities and an intuitive mobile app, the system simplifies installation and ongoing operation, ensuring rapid return on investment and widespread usability. This innovation aligns with the broader industry trend toward digitalization and smart manufacturing, where seamless data integration and automation are becoming essential for competitive advantage.

As industries increasingly shift toward predictive and condition-based maintenance strategies, solutions that support data driven decision making are gaining traction for their ability to support data-driven decision-making, reduce unplanned downtimes, and optimize resource allocation.

The growing demand for scalable, intelligent maintenance systems reflects a larger shift toward operational efficiency and sustainability in industrial operations.

- In May 2023, Schaeffler AG introduced the OPTIME Ecosystem, a unified predictive maintenance solution that integrates the OPTIME Condition Monitoring system (including sensor variants OPTIME 3, OPTIME 5, and OPTIME 5 Ex) with the intelligent lubricator OPTIME C1 for automated lubrication.

Vibration Monitoring Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Application

|

Motors, Pumps, Compressors, Turbines, Others

|

|

By End Use

|

Automotive, Oil & Gas, Energy & Power, Mining, Food & Beverages

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software, and Services): The hardware segment earned USD 750.6 million in 2023 due to its critical role in vibration data collection and real-time monitoring of machinery and equipment.

- By Application (Motors, Pumps, Compressors, and Turbines): The motors segment held a share of 27.30% in 2023, fueled by their widespread use across industries and the need to monitor vibrations to prevent failure and operational efficiency.

- By End Use (Automotive, Oil & Gas, Energy & Power, and Mining): The automotive segment is projected to reach USD 755.3 million by 2031, attributed to the increasing adoption of vibration monitoring systems for vehicle performance optimization, safety, and predictive maintenance in the automotive manufacturing process.

Vibration Monitoring Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America vibration monitoring market accounted for a share of around 33.24% in 2023, valued at USD 591.7 million. This dominance is fueled by the increasing demand for predictive maintenance solutions across industries such as manufacturing, automotive, and energy.

The presence of key market players, along with ongoing advancements in sensor technology and wireless monitoring solutions, further supports this expansion. Government initiatives promoting industrial automation and digital transformation are contributing significantly to regional market growth.

With robust infrastructure, high investment capacity, and growing awareness of the long-term cost benefits of predictive maintenance, North America is expected to maintain its dominance in the coming years. Additionally, stringent safety regulations and a focus on operational efficiency are boosting expansion.

Asia Pacific vibration monitoring industry is estimated to grow at a CAGR of 8.14% over the forecast period. This rapid growth is bolstered by rapid industrialization across countries such as China, India, Japan, and Southeast Asia, creating a strong demand for advanced asset monitoring technologies, including vibration monitoring systems.

As industries such as automotive, manufacturing, oil & gas, and energy expand, there is major focus on reducing unplanned downtime and improving operational efficiency. The increasing penetration of IoT, coupled with declining sensor costs and advancements in wireless technologies, is making vibration monitoring systems more accessible to small and medium-sized enterprises.

Regulatory Framework

- In Europe, Directive 2002/44/EC sets health and safety guidelines regarding the exposure of workers to physical agents, specifically vibration. It defines exposure limit values and action values for hand-arm and whole-body vibration to protect against musculoskeletal disorders and other health risks.

- In China, the Ministry of Ecology and Environment established the Technical Specifications for Environmental Vibration Monitoring (HJ 918-2017), effective from April 1, 2018. This standard outlines requirements for monitoring equipment performance, measurement conditions, site layout, installation of vibration pickups, sampling and data analysis, measurement period and quantity, measurement records, quality assurance, and quality control for environmental vibration monitoring

- In Japan, the Ministry of the Environment enforces the Vibration Regulation Law, which controls vibration from factories, construction sites, and road traffic to protect public health and the living environment. The law includes provisions for setting regulatory standards, monitoring vibration levels, and imposing penalties for non-compliance.

Competitive Landscape

Key players operating in the vibration monitoring market are prioritizing product innovation and investment in AI-enabled, wireless, and scalable monitoring systems that enhance predictive maintenance capabilities. Additionally, companies are teaming up with IoT providers and industry-specific OEMs to offer integrated, end-to-end solutions.

Mergers and acquisitions are being leveraged to expand portfolios and acquire niche technologies, such as AI-driven analytics and wireless sensor networks. Geographic expansion into emerging markets, particularly in Asia Pacific, allows companies to tap into high-growth sectors such as manufacturing and energy.

Companies are strategically positioning themselves to capitalize on the growing demand for intelligent, wireless, and AI-enabled vibration monitoring systems. Thess solutions aim to enhance predictive maintenance, reduce unplanned downtimes, and address skilled labor shortages in industrial environments. .

- In September 2024, Azima DLI partnered with Fluke Corporation to integrate its ExpertALERT Automated Diagnostic System (ADS) into the Fluke 810 Vibration Tester, enhancing its rapid diagnostic capabilities. This collaboration enables maintenance professionals to anticipate machinery issues such as misalignment, bearing problems, and imbalance without requiring deep expertise in vibration analysis. The Fluke 810, powered by Azima DLI's ADS technology, captures and interprets vibration data, providing clear, step-by-step fault diagnoses.

List of Key Companies in Vibration Monitoring Market:

- SKF AB

- Emerson Electric Co.

- General Electric.

- Meggitt PLC.

- National Instruments Corp.

- Rockwell Automation, Inc.

- Honeywell International, Inc.

- Schaeffler Technologies AG & Co.KG.

- Analog Devices Inc.

- SPM Instrument AB

- Azima DLI Corporation

- Data Physics Corporation

- Bruel & Kjaer Sound & Vibration Measurement

- Banner Engineering

- PCB Piezotronics Inc.

Recent Developments (M&A/ New Product Launch)

- In October 2024, Schaeffler completed its merger with Vitesco Technologies, significantly strengthening its global presence through the addition of new manufacturing sites and enhanced research and development capabilities. During CES 2025, Schaeffler unveiled its expanded product lineup, highlighting cutting-edge innovations in humanoid robotics, automotive systems, and industrial applications.

- In January 2024, Spectris plc announced the acquisition of Piezocryst Advanced Sensorics GmbH from AVL List GmbH for USD 146.5 million USD. Based in Graz, Austria, Piezocryst is a leading provider of high-precision piezoelectric sensors, specializing in pressure sensors and accelerometers for demanding applications in harsh environments. This acquisition strengthens Spectris Dynamics and integrates Piezocryst into HBK, expanding its product range and enhancing its offerings across the automotive, aerospace & defense, energy, and industrial markets.

- In November 2023, Worldsensing, a global leader in IoT-based remote monitoring, launched its latest wireless device, the Vibration Meter, designed for long-term, continuous vibration monitoring. Featuring a tri-axial MEMS accelerometer, the sensor offers extended battery life, improved communication range, and a more competitive price point compared to existing technologies while maintaining compliance with key regulatory standards.

- In November 2023, SKF expanded its condition monitoring portfolio with the launch of the SKF Enlight Collect IMx-1-EX sensor, a wireless device engineered for early detection of machine failures. The new solution enhances operational reliability by reducing unplanned downtime and contributes to more cost-effective and sustainable maintenance practices.