Market Definition

Veterinary services refer to a broad range of medical and healthcare services provided to diagnose, treat, and prevent diseases and injuries in animals. These services include routine health check-ups, vaccinations, surgical procedures, dental care, diagnostic testing, and emergency medical care for pets, livestock, wildlife, and exotic animals.

Veterinary services aim to promote the health and well-being of animals while addressing zoonotic diseases that could affect human health. They are typically delivered by licensed veterinarians, veterinary technicians, and other professionals in animal clinics, hospitals, farms, or research facilities.

Veterinary Services Market Overview

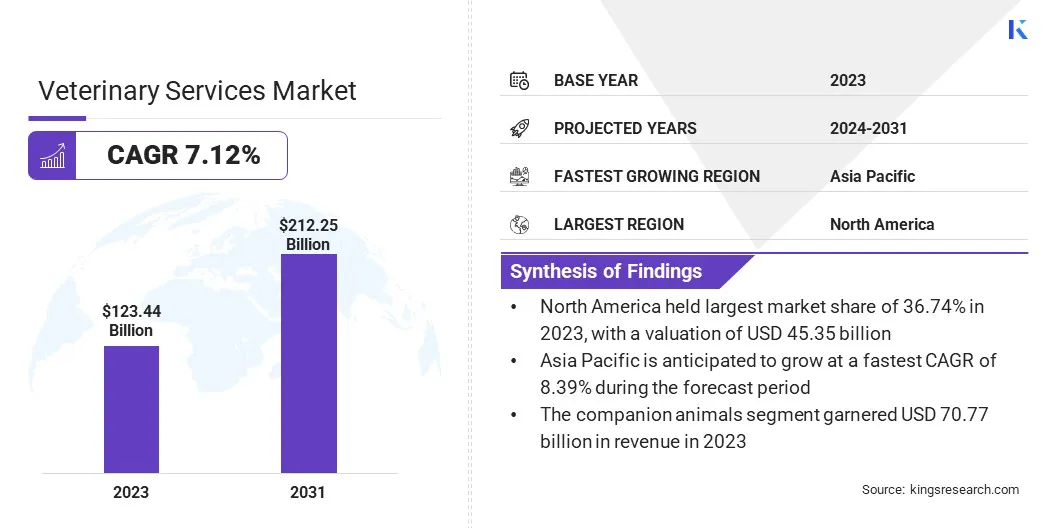

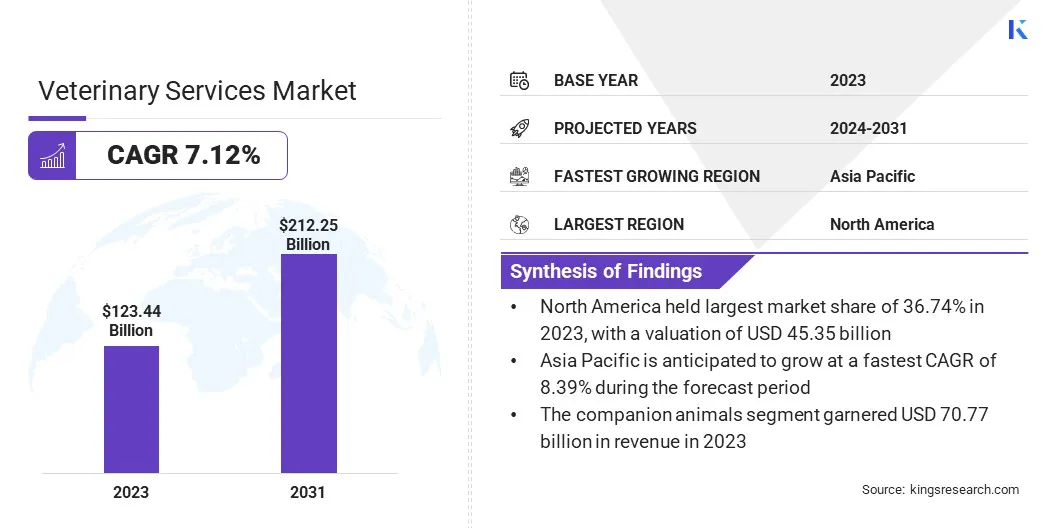

Global veterinary services market size was valued at USD 123.44 billion in 2023, which is estimated to grow to USD 131.11 billion in 2024 and reach USD 212.25 billion by 2031, growing at a CAGR of 7.12% from 2024 to 2031.

Rising pet ownership in urban areas has increased the demand for routine check-ups, vaccinations, and emergency care, driving the growth of the market. Growing awareness of animal health has led to an increasing focus on preventative care and diagnostics.

Technological advancements in telemedicine and diagnostic tools have enhanced service quality, while government regulations and public health initiatives on animal welfare and disease prevention propel market expansion.

Key Highlights:

- The veterinary services industry size was recorded at USD 123.44 billion in 2023.

- The market is projected to grow at a CAGR of 7.12% from 2024 to 2031.

- North America held a share of 36.74% in 2023, valued at USD 45.35 billion.

- The companion animals segment garnered USD 70.77 billion in revenue in 2023.

- The diagnostic services segment is expected to reach USD 104.24 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 8.39% over the forecast period.

Major companies operating in the veterinary services market are Mars, Incorporated, Greencross Vets, National Veterinary Care Ltd., Pets at Home PLC, CVS Limited, National Veterinary Associates, Addison Biological Laboratory, Armor Animal Health, PetIQ, LLC, Kremer Veterinary Services, Delaware corporation (FirstVet Inc.), C.H. Boehringer Sohn AG & Co. KG, Zoetis Services LLC, Vetoquinol, Merck & Co., Inc., and others.

The surge in pet ownership across urban and suburban areas is contributing significantly to the growth of the market. Consumers increasingly view pets as family members, leading to higher spending on veterinary care.

This includes routine health check-ups, vaccinations, and emergency treatments. This trend toward pet humanization is boosting the demand for high-quality, specialized care, further fueling market expansion.

- According to the HealthforAnimals report, over half of the global population owns a pet in 2023. During the pandemic lockdowns , pet adoptions surged, with over two million in the UK and more than one million im Australia.

Growing Adoption of Animal Insurance

The rising adoption of animal insurance is boosting the growth of the veterinary services industry by making veterinary care more affordable and accessible to a broader demographic. With an increasing number of pet owners opting for insurance coverage, there is a surge in demand for veterinary services, as insured pets are more likely to receive routine and emergency care.

This trend is particularly evident in regions with established pet insurance markets, such as North America and Europe. As the popularity of animal insurance rises, it contributes to the expansion of the market, benefiting both pet owners and service providers.

- The Insurance Information Institute reported that pet insurance premiums in the U.S. reached USD 3.9 billion in 2023, covering around 5.7 million pets, marking a 17% increase from 2022. Additionally, total U.S. pet industry spending grew from USD 97.1 billion in 2019 to USD 150.6 billion in 2024.

High Cost of Advanced Veterinary Services

The high cost of advanced veterinary services presents a significant challenge to the growth of the veterinary services market. Specialized treatments, diagnostic tools, and advanced surgical procedures often require substantial financial investments, making them less accessible to pet owners with limited budgets.

To address this challenge, companies are adopting innovative approaches such as offering flexible payment plans, subscription-based wellness programs, and pet insurance collaborations to make services more affordable.

Additionally, investments in telemedicine platforms are reducing costs by providing virtual consultations, while mobile veterinary clinics are extending affordable care to underserved and rural areas, ensuring broader accessibility.

Advancements in Veterinary Technology

Technological advancements in veterinary care are playing a pivotal role in fueling the growth of the veterinary services market. Innovations in telemedicine, diagnostic imaging, and minimally invasive surgical techniques are improving the quality, efficiency, and accessibility of veterinary services.

These technologies enable faster diagnosis, enhanced treatment options, and better outcomes for animals. Additionally, the integration of artificial intelligence in diagnostics and treatment planning is transforming the market.

- In November 2023, veterinarians at the University of California developed artificial intelligence (AI) algorithms to detect Addison’s disease and leptospirosis in dogs. For Addison’s disease, the team trained an AI program using routine blood work from over 1,000 dogs to identify complex patterns indicative of the condition, achieving over 99% accuracy. They also created an AI prediction model for leptospirosis, a disease linked to kidney failure, liver damage, and severe lung bleeding.

Veterinary Services Market Report Snapshot

| Segmentation |

Details |

| By Animal Type |

Companion Animals (Dogs, Cats, Birds, Reptiles, Small Mammals), Livestock (Cattle, Swine, Poultry, Sheep, Goats, Aquaculture) |

| By Service Type |

Preventive Care (Vaccinations, Parasite control, Wellness exams, Dental care, Spaying/Neutering), Diagnostic Services (Blood tests, Urinalysis, X-rays, Ultrasound, Others), Therapeutic Services (Surgery, Chemotherapy, Radiation therapy, Physical therapy, Others), Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Animal Type (Companion Animals and Livestock): The companion animals segment earned USD 70.77 billion in 2023, mainly due to the increasing adoption of pets globally, rising expenditures on pet healthcare, and growing demand for advanced veterinary treatments.

- By Service Type (Preventive Care, Diagnostic Services, Therapeutic Services, and Others): The diagnostic services segment held a share of 43.44% in 2023, largely attributed to the increasing prevalence of complex animal diseases requiring advanced diagnostic tools for accurate detection and effective treatment planning.

Veterinary Services Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America veterinary services market accounted for a substantial share of around 36.74% in 2023, valued at USD 45.35 billion. The growing number of pet owners in North America, coupled with the rising humanization trend, where pets are viewed as family members, is leading to increased demand for high-quality veterinary services, including preventive care and specialized treatments.

- According to the 2023-2024 National Pet Owners Survey by the American Pet Products Association (APPA), approximately 66% of U.S. households, or around 86.9 million families, own a pet. In 2023, total pet industry expenditures in the U.S. reached USD 147 billion, a 7.5% increase from USD 136.8 billion in 2022.

Additionally, the growth of mobile veterinary clinics and the increased availability of veterinary care in rural and underserved areas are enhancing service access, contributing to market growth across both urban and rural regions of North America.

Furthermore, the increasing adoption of pet insurance in North America is enabling pet owners to afford veterinary services, including both routine and emergency care, which is boosting demand for a wide range of veterinary services.

Asia Pacific veterinary services industry is estimated to grow at a robust CAGR of 8.39% over the forecast period. The expansion of veterinary clinics, pet hospitals, and mobile veterinary services in rural and underserved areas is improving access to veterinary care, fostering regional market growth.

Moreover, governments in countries such as India and South Korea are implementing stricter animal welfare laws and regulations, creating a favorable environment for the expansion of the Asia Pacific market.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the FDA oversees the approval and regulation of veterinary drugs, ensuring their safety and efficacy. The USDA, through the Animal and Plant Health Inspection Service (APHIS), enforces regulations related to animal health and welfare, including the Animal Health Protection Act, which controls animal importation and movement to prevent disease spread.

- In the European Union, the European Medicines Agency (EMA) oversees the approval of veterinary medicines. Regulation (EU) 2019/6, effective from January 28, 2022, updates the authorization and use of veterinary medicines. This regulation aims to strengthen the EU's fight against antimicrobial resistance and establishes a modern, innovative, and fit-for-purpose legal framework for veterinary medicinal products.

- In Japan, veterinary regulations are managed by the Ministry of Agriculture, Forestry, and Fisheries (MAFF). The country’s regulatory framework ensures high-quality standards in veterinary medicine, with a focus on research and development in animal health technologies. Japan also has strict regulations for the import and export of animals, ensuring animal diseases are controlled.

- In Australia, the Australian Veterinary Association (AVA) sets veterinary practice standards, while the Australian Pesticides and Veterinary Medicines Authority (APVMA) regulates veterinary medicines.

Competitive Landscape

The veterinary services industry is characterized by a large number of participants, including both established corporations and rising organizations. Market participants are adopting strategies such as mergers and acquisitions (M&A) to expand their global footprint and boost market expansion.

Through strategic mergers, companies are strengthening operational capabilities, increasing service offerings, and broadening their geographical reach. This approach increases market share, acquires specialized expertise, fosters innovation, and improves service delivery.

- In July 2024, Merck Animal Health finalized its acquisition of Elanco Animal Health Incorporated's aqua business. This acquisition strengthens Merck Animal Health's presence in the aqua sector, enabling the company to adopt a comprehensive strategy focused on enhancing fish health, welfare, and sustainability in aquaculture, conservation, and fisheries.

Key Companies in Veterinary Services Market:

- Mars, Incorporated

- Greencross Vets

- National Veterinary Care Ltd.

- Pets at Home PLC

- CVS Limited

- National Veterinary Associates

- Addison Biological Laboratory

- Armor Animal Health

- PetIQ, LLC

- CityVet

- Delaware corporation (FirstVet Inc.)

- H. Boehringer Sohn AG & Co. KG

- Zoetis Services LLC

- Vetoquinol

- Merck & Co., Inc.

Recent Developments:

- In November 2024, Merck Animal Health received European Commission marketing authorization for BRAVECTO® TriUNO, an advanced formulation of BRAVECTO (fluralaner) targeting both internal and external parasites in dogs.

- In October 2024, Merck Animal Health announced the European Medicines Agency approval for BOVILIS® ROTAVEC® CORONA, a subcutaneous injection for pregnant cows and heifers to boost antibodies against E. coli adhesins F5 (K99) and F41, as well as rotavirus and coronavirus.

- In December 2024, Mars Veterinary Health entered the Indian veterinary industry with a minority investment in Crown Veterinary Services, enabling expansion and advanced training for its 240 employees, including 60 veterinarians.

- In January 2024, Covetrus®, a global leader in animal-health technology and services, renewed its long-term strategic partnership with National Veterinary Associates. This move establishes Covetrus as the primary partner for supplying veterinary products to NVA Group, which includes over 1,000 general practice, specialty, ER, and equine veterinary hospitals, as well as pet resorts across the U.S.