Veterinary Medicine Market Size

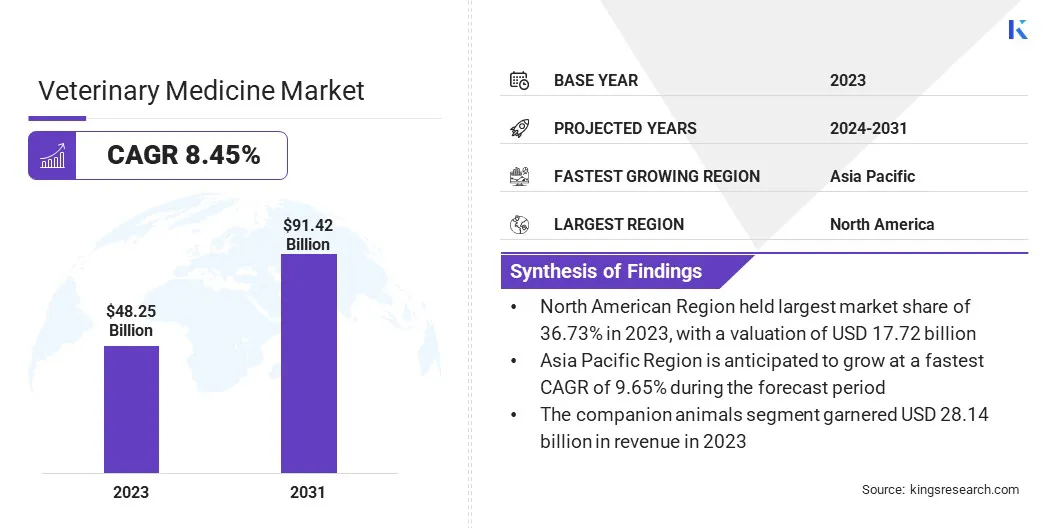

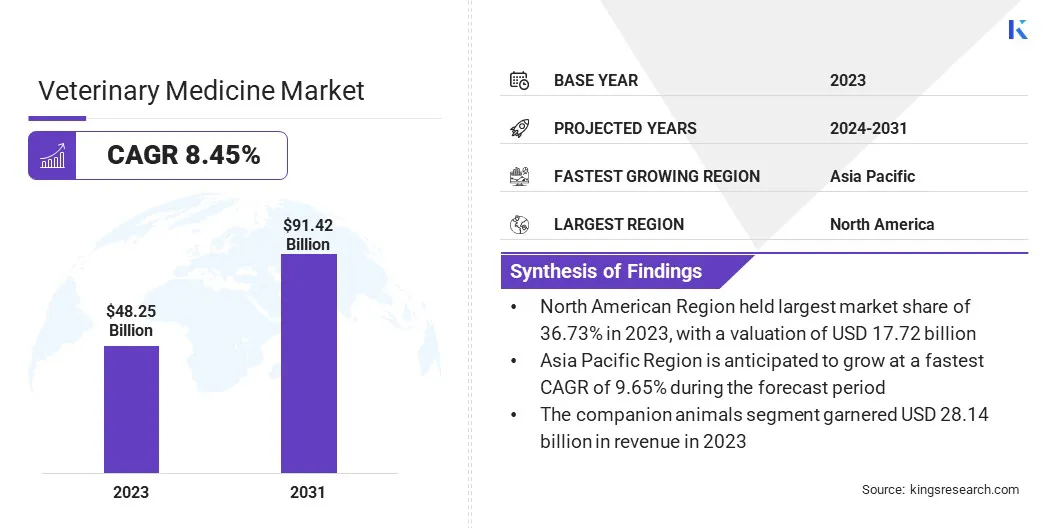

The global veterinary medicine market size was valued at USD 48.25 billion in 2023, which is estimated to be USD 51.80 billion in 2024 and reach USD 91.42 billion by 2031, growing at a CAGR of 8.45% from 2024 to 2031.

The global increase in demand for veterinary medicine is attributed to the growing pet ownership, rising prevalence of animal disease, and advancement in veterinary medicine and technology. Furthermore, the growing global population is fueling the demand for animal-derived protein sources and increasingly focusing on animal health and veterinary medicine.

In the scope of work, the report includes products offered by companies such as Zoetis Services LLC, Merck & Co., Inc., Boehringer Ingelheim International GmbH, Elanco, Idexx, Proclinica, Dechra Pharmaceuticals Limited, Vetoquinol, Virbac, and Hester Biosciences Limited, among others.

The expanding population of companion animals, including cats, dogs, horses, birds, and other small mammals, and the growth of livestock production contribute to the increased demand for vaccinations and advanced veterinary medical care. The demand for telemedicine and virtual care solutions, particularly among pet owners in remote areas is growing.

This demand is prompting the development of digital health platforms and apps to help pet owners manage their animals' health, track medications, and access veterinary information.

- For instance, in October 2024, Mella Pet Care, Chicago-based startup Mella Pet Care partnered with Vetster, a leading veterinary telemedicine platform. This partnership is designed to enhance access to veterinary care by providing 24/7 virtual consultations and streamlined appointment scheduling through the Vetster app.

Veterinary medicine is a branch of medicine that involves prevention, diagnosis, treatment of disorders, diseases, and injuries in companion animals and livestock. This market comprises pharmaceutical and biologics companies specializing in a range of products, including antibiotics, antiparasitics, vaccines, and gene therapies.

Veterinary medicine products and services are distributed through a variety of channels, including veterinary clinics & hospitals, pharmacies, online retailers, and pet stores.

Analyst’s Review

The veterinary medicine market encompasses a wide range of products, including antibiotic medications, vaccines, immunotherapies, diagnosing tests, and imaging equipment catering to both companion animals and livestock production animals.

The market is dominated by a few large multinationals and smaller specialized players. Increasing consumer focus on animal welfare and preventative healthcare is creating strong demand for innovative veterinary products.

In response, major pharmaceutical companies are prioritizing research and development (R&D) efforts aimed at developing advanced therapies with improved safety profiles.

- In April 2024, Vetcare, a Finnish animal wellbeing company signed a partnership agreement with the university of Helsinki to advance research and innovations in animal welfare. Vetcare was founded in 2023 to meet the demands of veterinarians and animals by importing veterinary medicines without distributors.

Furthermore, companies within the market are actively pursuing global expansion strategies through strategic acquisitions and partnerships. These collaborations enable companies to capitalize on growing demand in emerging markets, access specialized expertise and technologies, and broaden their product portfolios.

Veterinary Medicine Market Growth Factors

The global rise in animal diseases, including infections, pain, inflammation, and chronic diseases, is fueling the demand for veterinary medicine. Similar to humans, animals are affected by chronic diseases such as diabetes mellitus, cancer, and kidney disease, boosting the demand for long-term treatment and medication.

Furthermore, increased human-animal interaction has raised the risk of zoonotic disease transmission, including rabies, leptospirosis, and Lyme disease, which necessitates vaccination and preventive measures for animals.

- According to the report published by the World Organization for Animal Health in June 2024, zoonoses cause 2.5 billion cases of illness and 2.7 million human deaths annually. Zoonoses are infectious diseases transmitted from animals to humans and vice versa via direct and indirect contact.

The veterinary medicine market is registering significant growth however, it faces several challenges related to market access and regulatory compliance. Varying regulatory requirements across different countries regarding the development, manufacturing, and marketing of veterinary medicines create complexities, leading to increased time and expenses for companies.

Hence, companies are forming associations to engage in proactive dialogue with regulatory agencies, aiming to ensure compliance and streamline regulatory processes.

Veterinary Medicine Industry Trends

The global trend of humanization of pets is driving the veterinary medicine market. Pets are integral family members, hence, owners are allocating greater discretionary spending toward their care, including routine check-ups, vaccinations, and dental care. This factor is boosting the number of veterinary clinics and hospitals, with increased investment in infrastructure, equipment, and personnel.

- For instance, in October 2024, Petfolk, a leading urgent veterinary care provider raised USD 36 million in series C investment. The company aims to expand to forty clinics across ten major markets to provide high-quality and easily accessible veterinary care.

Rising incomes and pet population has increased the focus on preventive healthcare and wellness of animals. Pet owners are increasingly prioritizing preventative care, such as parasite control, nutritional management, and early disease detection, recognizing its value in maintaining long-term animal health and reducing future healthcare expenditures.

This trend is driving veterinary clinics to develop and market comprehensive wellness programs and lifestyle management services, enhancing their value proposition and capturing a growing market segment.

Segmentation Analysis

The global market has been segmented based on product type, animal type, distribution channel, route of administration, and geography.

By Product Type

Based on product type, the market has been categorized into pharmaceuticals and biologics. The pharmaceutical segment led the veterinary medicine market in 2023, generating USD 25.93 billion revenue.

Pharmaceuticals have expanded the market by offering a wide range of products, including antibiotics, antivirals, anti-inflammatory drugs, and cardiovascular drugs. They play a crucial role in the development of innovative products and therapies for animals, including infections, pain management, and chronic disease treatment.

Furthermore, numerous pharmaceutical companies are allocating substantial funding to research and development (R&D) efforts focused on developing drugs and therapeutics with minimized side effects for prevalent chronic conditions in animals, such as cancer, diabetes, and arthritis.

By Animal Type

Based on animal type, the market has been categorized into companion animals and livestock. The companion animal segment is registering rapid growth and is projected to generate USD 30.09 billion revenue in 2024.

The ownership of companion animals such as dogs, cats, horses, reptiles and birds has led to increased expenditure on veterinary care. Pet owners are slowly becoming aware about animal health and the benefits of preventative care, which is boosting the demand for essential services such as vaccinations, parasite control, dental care, and routine check-ups. This rising demand is a significant contributor to the expansion of the market.

By Distribution Channel

Based on distribution channel, the veterinary medicine industry has been categorized into veterinary clinics and hospitals, pharmacies, online retailers, and pet stores. The veterinary clinics and hospitals segment is the fastest-growing segment and is projected to generate USD 37.91 billion revenue in 2031.

The veterinary clinics and hospitals segment is growing rapidly, driven by the increasing demand for advanced diagnostics and specialized treatments. Veterinary medicine is becoming increasingly specialized and modernized. Many clinics and hospitals are now offering sophisticated diagnostic procedures such as MRI, CT scans, and ultrasound for animals.

Furthermore, the consumer demand for comprehensive, one-stop veterinary care is driving the proliferation of multi-service veterinary hospitals.

By Route of Administration

Based on route of administration, the market has been segmented into oral and injectable. The oral segment is gaining a high market share and is projected to register substantial growth, expanding at a CAGR of 8.97%.

The oral route of administration, encompassing medications in tablet, capsule, liquid, gel, and other forms, offers significant advantages in terms of animal comfort and ease of administration. Oral medications are generally preferred over injectables, due to their less invasive nature and suitability for long-term treatment protocols.

This ease of at-home administration by pet owners is a key driver of demand for oral dosage forms, including tablets, capsules, pastes, and gels.

- In October 2024, Elanco, a global animal health company received FDA approval for Credelio Quattro, an oral parasiticide protection against six parasites, including fleas, ticks, heartworm, roundworms, tapeworms and hookworms. The drug is expected to be available for sale in the first quarter of 2025.

Veterinary Medicine Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North American veterinary medicine market accounted for 36.73% share of the global market and was valued at USD 17.72 billion in 2023. The North American market is registering growth, primarily driven by the expanding companion animal population and the increasing availability of pet insurance.

The expansion of pet insurance offerings has significantly increased the utilization of veterinary care by mitigating the financial burden on pet owners. This enhanced financial accessibility is fueling the demand for high-quality veterinary services and advanced treatment options, contributing to market growth in the region.

- A report published by the North American Pet Health Insurance Association in April 2024 revealed that the North American pet insurance market generated USD 4.27 billion in premiums, representing a substantial 21% increase from 2022. This significant growth underscores the increasing adoption of pet insurance by households seeking to mitigate unexpected veterinary expenses.

Asia Pacific has emerged as the fastest-growing the market, which is projected to expand at 9.65% CAGR from 2024 to 2031. Rising disposable income and growing demand for animal protein are the key factors fueling the growth of veterinary medicine in this region. Livestock production is becoming more intensive to meet the growing demand for meat, milk ,and eggs.

This is increasing the need for veterinary services to prevent and control diseases in livestock populations. Furthermore, the increased awareness of zoonotic diseases in livestock production is driving the demand for preventive veterinary medicine.

Competitive Landscape

The global veterinary medicine market report will provide valuable insights with a major emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing numerous strategic initiatives, such as the expansion of services, investments in R&D, establishment of service delivery centers, and optimization of their service delivery processes, which are likely to create opportunities for market growth.

List of Key Companies in Veterinary Medicine Market

- Zoetis Services LLC

- Merck & Co., Inc.

- Boehringer Ingelheim International GmbH

- Elanco

- Idexx

- Proclinica

- Dechra Pharmaceuticals Limited

- Vetoquinol

- Virbac

- Hester Biosciences Limited

Key Industry Developments

- July 2024 (Acquisition): Dechra Pharmaceuticals Limited, a market leader in animal health, acquired Invetx, a protein-based animal health therapeutics company, in July 2024. The company aims to expand its product portfolio in monoclonal antibody therapeutics for chronic diseases in cats and dogs.

- July 2024 (Partnership): The Veterinary Cooperative (TVC) partnered with Elanco Animal Health, a global leader in animal health to provide high-quality veterinary care to their clients. Through this partnership, TVC’s clients can leverage Elanco’s products and comprehensive support across several animal health aspects, including disease and pain management.

- March 2024 (Acquisition): Boehringer Ingelheim, a leading biopharmaceutical company in human and animal health, acquired Saiba Animal Health, a company focused on the development of novel therapeutic medicines. Through this acquisition, the company aims to strengthen its R&D in animal health, particularly in pet-therapeutics segment.

The global veterinary medicine market is segmented as:

By Product Type

- Pharmaceuticals

- Biologics

By Animal Type

- Companion Animals

- Livestock

By Distribution Channel

- Veterinary Clinics and Hospitals

- Pharmacies

- Online Retailers

- Pet Stores

By Route of Administration

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America