Market Definition

The market encompasses the global trade, processing, and supply chain related to various forms of enriched uranium, including Low Enriched Uranium (LEU), High Enriched Uranium (HEU), and Micro Enriched Uranium.

This market forms a critical component of the nuclear fuel cycle and supports a diverse range of end-use sectors such as nuclear power generation, military and defense applications, and Research and Development (R&D) activities. The report presents a comprehensive assessment of the primary drivers propelling the market, alongside a detailed examination of regional analysis and the competitive landscape impacting industry dynamics.

Uranium Enrichment Market Overview

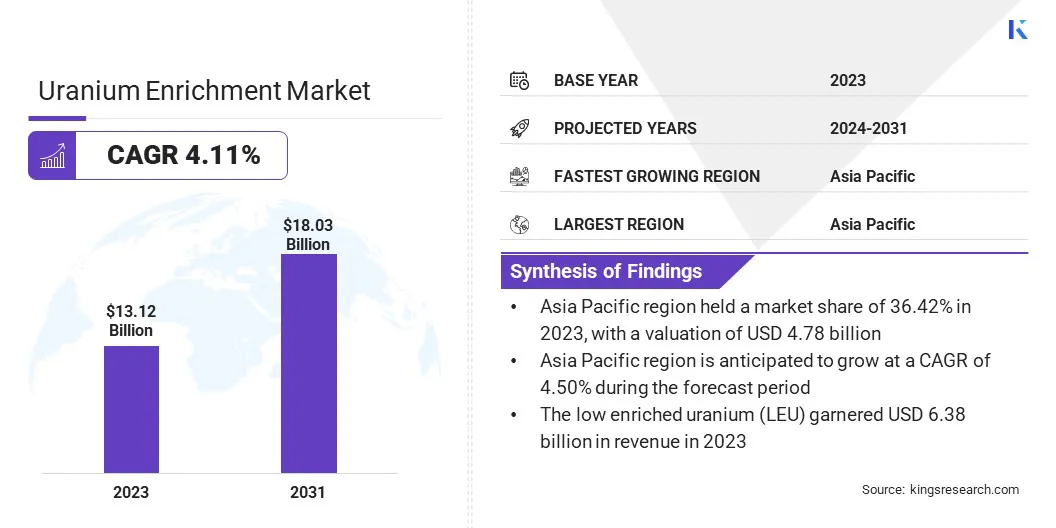

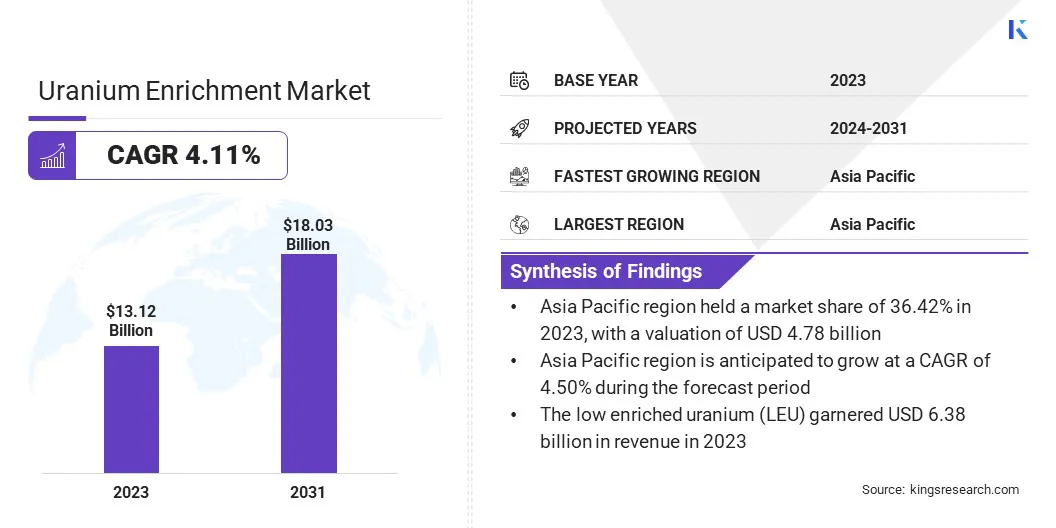

The global uranium enrichment market size was valued at USD 13.12 billion in 2023 and is projected to grow from USD 13.60 billion in 2024 to USD 18.03 billion by 2031, exhibiting a CAGR of 4.11% during the forecast period.

The market is driven by the increasing demand for low-carbon energy sources and the global shift toward clean energy transitions. Nuclear energy is gaining renewed focus, due to its ability to provide stable, large-scale electricity generation with minimal emissions as countries work to meet decarbonization targets.

Major companies operating in the uranium enrichment industry are Global Laser Enrichment, Centrus Energy Corp., Urenco Group, The South African Nuclear Energy Corporation SOC Ltd, China National Nuclear Corporation, Cameco Corporation, orano.group, Kazatomprom, KHNP CO., LTD., General Matter, Inc., MITSUBISHI HEAVY INDUSTRIES, LTD., and LIS Technologies Inc.

Growing reliance on LEU highlights its central role in advancing global nuclear energy programs, reinforcing its importance in meeting energy security, regulatory compliance, and sustainability objectives across both mature and emerging nuclear power markets.

- In October 2024, TerraPower reached a term sheet agreement with ASP Isotopes Inc. aimed at expanding the global production of high-assay low-enriched uranium (HALEU). Under the proposed agreement, TerraPower intends to invest in building a HALEU enrichment facility in South Africa and procure fuel from the site to support its Natrium reactor and energy storage system in Kemmerer, Wyoming.

Key Highlights:

- The uranium enrichment industry size was valued at USD 13.12 billion in 2023.

- The market is projected to grow at a CAGR of 4.11% from 2024 to 2031.

- Asia Pacific held a market share of 36.42% in 2023, with a valuation of USD 4.78 billion.

- The low enriched uranium (LEU) segment garnered USD 6.38 billion in revenue in 2023.

- The nuclear power generation segment is expected to reach USD 9.01 billion by 2031.

- The market in Europe is anticipated to grow at a CAGR of 4.31% during the forecast period.

Market Driver

Rising Global Demand for Nuclear Energy

The uranium enrichment market is primarily driven by the rising global demand for nuclear energy as countries seek reliable, low-carbon power sources to meet growing energy needs and climate goals. Nuclear energy provides stable baseload electricity with minimal Greenhouse Gas (GHG) emissions.

This shift has led to increased investment in new nuclear reactors, both traditional and advanced, across developed and developing nations. As a result, the need for enriched uranium, essential for fueling most commercial nuclear reactors, continues to grow, driving expansion in uranium enrichment capabilities globally.

- In September 2024, according to the International Atomic Energy Agency (IAEA), the projected rise in global nuclear generating capacity to 950 GW by 2050 highlights the growing demand for enriched uranium, reinforcing a strong long-term growth outlook for the market.

Market Challenge

High Capital Costs

A major challenge facing the uranium enrichment market is the high capital and operational costs associated with enrichment facilities. Establishing and maintaining uranium enrichment infrastructure requires significant financial investment, advanced technology, and strict regulatory compliance, making it difficult for new entrants and existing players to expand capacity.

These cost barriers can slow down the development of new enrichment plants, particularly in regions with emerging nuclear programs. A potential solution lies in international collaboration and shared enrichment services, where countries or companies form joint ventures to pool resources, share technology, and reduce individual financial burdens, enabling more efficient and cost-effective enrichment operations while maintaining regulatory standards.

Market Trend

Increasing Reliance On LEU

The trend in the market is the increasing reliance on LEU as the primary fuel source for both existing and future nuclear reactors. LEU, typically enriched to below 5% U-235, is widely used in commercial nuclear power generation due to its efficiency, safety profile, and compliance with non-proliferation standards.

Several countries aim to expand their nuclear capacity to meet low-carbon energy goals, boosting the demand for a stable and scalable supply of LEU. This trend is further supported by government favoring LEU over higher-enriched fuels, reinforcing its position as the cornerstone of the global civilian nuclear fuel cycle. The growing importance of LEU underscores its critical role in supporting nuclear energy as a reliable, clean, and secure power source.

- In December 2024, the U.S. Department of Energy awarded contracts worth up to USD 3.4 billion over 10 years to six companies: Urenco USA’s Louisiana Energy Services, Orano Federal Services, General Matter, LIS Technologies, Global Laser Enrichment (GLE), and Centrus Energy’s American Centrifuge Operating to supply LEU from new or expanded domestic enrichment facilities.

Uranium Enrichment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Enrichment Level

|

Low Enriched Uranium (LEU), High Enriched Uranium (HEU), Micro Enriched Uranium

|

|

By Application

|

Nuclear Power Generation, Military and Defense, Research and Development

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Enrichment Level (Low Enriched Uranium (LEU), High Enriched Uranium (HEU), Micro Enriched Uranium): The low enriched uranium (LEU) segment earned USD 6.38 billion in 2023, due to its widespread use as the primary fuel source in commercial nuclear power reactors globally.

- By Application (Nuclear Power Generation, Military and Defense, Research and Development): The nuclear power generation segment held 47.32% share of the market in 2023, due to increasing reliance on nuclear energy for stable, low-carbon electricity generation across multiple countries.

Uranium Enrichment Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for 36.42% share of the uranium enrichment market in 2023, with a valuation of USD 4.78 billion. This dominance is driven by rapid nuclear power expansion in countries like China, India, and South Korea, where rising electricity demand, government-backed energy policies, and long-term decarbonization goals are accelerating investments in nuclear infrastructure.

The development of domestic enrichment capabilities, coupled with strategic partnerships and regional supply chain enhancements, has further solidified the position of Asia Pacific in the global market. Additionally, the region’s focus on energy security and reducing dependence on imported fuels continues to boost uranium enrichment activities.

The market in Europe is poised to grow at a significant CAGR of 4.31% over the forecast period, supported by a steady resurgence in nuclear energy development and modernization. Nations such as France, the UK, and several Eastern European countries are maintaining or expanding their nuclear programs to meet clean energy targets and counteract energy supply disruptions.

The presence of leading enrichment technology providers, established regulatory frameworks, and collaborative initiatives under the EU to reinforce nuclear fuel independence have contributed to the market growth in the region. Europe’s commitment to sustainability, energy resilience, and innovation in reactor technology continues to drive the demand for enriched uranium.

- In May 2024, the UK government announced an investment of ~USD 250 million to establish Europe’s first high-tech nuclear fuel facility, awarding the contract to Urenco. The project aims to produce high-assay low enriched uranium (HALEU) by 2031, enhancing domestic energy security and eliminating reliance on Russian fuel supplies. The initiative is expected to support highly-skilled jobs in Cheshire and position the UK as the first European producer of advanced nuclear fuel.

Regulatory Frameworks

- In the U.S., the Nuclear Regulatory Commission (NRC) regulates uranium enrichment through licensing, safety, security, and environmental protection requirements for commercial facilities. These regulations ensure the safe handling and use of special nuclear material while maintaining compliance with non-proliferation obligations.

- In the EU, uranium enrichment is regulated under the Euratom Treaty, with oversight by the European Commission and national nuclear regulatory authorities.

- In India, uranium enrichment is controlled by the Department of Atomic Energy (DAE) and is governed by the Atomic Energy Act, 1962. The act grants the central government exclusive rights over nuclear materials and activities, including enrichment, and facilities must adhere to safeguards agreements with the IAEA where applicable.

Competitive Landscape:

The uranium enrichment market is characterized by a concentrated competitive landscape, with a limited number of players operating large-scale, capital-intensive facilities. Key participants in the market employ strategies such as long-term supply agreements with utility companies to ensure stable demand and revenue flow.

Many market players are investing in advanced enrichment technologies, including centrifuge upgrades and high-assay low enriched uranium (HALEU) capabilities, to align with the evolving needs of next-generation nuclear reactors. Companies focus on vertically integrated operations ranging from uranium conversion to enrichment and fuel fabrication to maintain their market position, allowing for cost optimization and supply chain control.

Strategic partnerships and government-backed collaborations are also leveraged to secure funding, technology transfer, and regulatory support. In addition, participants are actively expanding their global footprint by entering new regional markets and pursuing joint ventures to reduce geopolitical risk and strengthen their export potential.

- In August 2024, BWX Technologies, Inc. received a contract from the National Nuclear Security Administration (NNSA) to conduct a yearlong engineering study for a centrifuge pilot plant, establishing domestic uranium enrichment capabilities for national security. The project, part of the NNSA’s DUECE program and managed by Oak Ridge National Laboratory, will be executed by BWXT’s subsidiary, Nuclear Fuel Services, Inc., with Fluor providing engineering, procurement, and construction services.

List of Key Companies in Uranium Enrichment Market:

- Global Laser Enrichment

- Centrus Energy Corp.

- Urenco Group

- The South African Nuclear Energy Corporation SOC Ltd

- China National Nuclear Corporation

- Cameco Corporation

- orano.group

- Kazatomprom

- KHNP CO., LTD.

- General Matter, Inc.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- LIS Technologies Inc.

Recent Developments (Partnerships)

- In November 2024, Centrus Energy Corp. and Korea Hydro & Nuclear Power (KHNP) announced a long-term contingent supply commitment for LEU, supporting the expansion of uranium enrichment capacity at Centrus’ American Centrifuge Plant in Ohio.