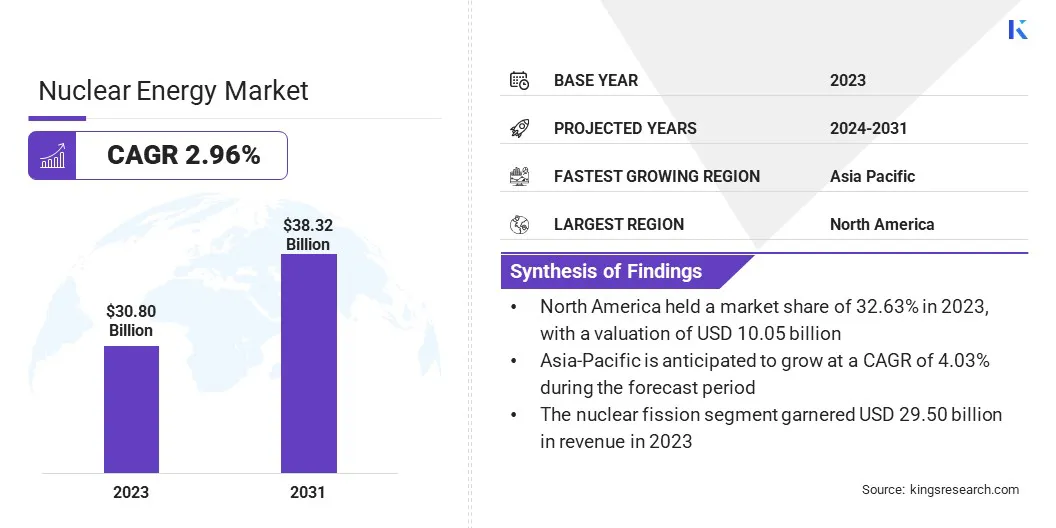

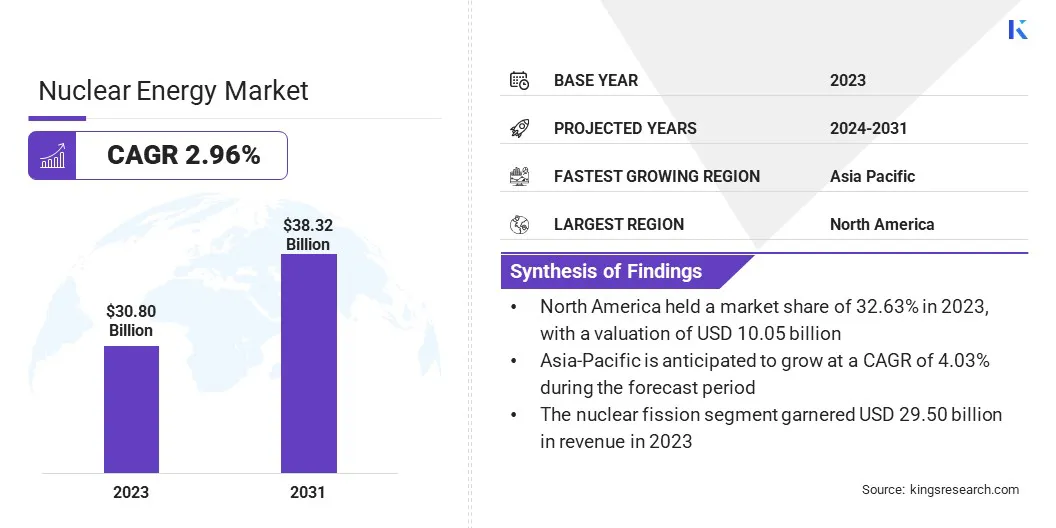

Nuclear Energy Market Size

Global Nuclear Energy Market size was recorded at USD 30.80 billion in 2023, which is estimated to be at USD 31.25 billion in 2024 and projected to reach USD 38.32 billion by 2031, growing at a CAGR of 2.96% from 2024 to 2031. The market is witnessing significant growth due to increasing global demand for clean and reliable energy.

In the scope of work, the report includes solutions offered by companies such as NuScale Power, LLC, TerraPower, LLC, Cameco Corp., Westinghouse Electric Company LLC, GE Vernova, BWX Technologies. Inc., China National Nuclear Corporation, ROSATOM State Atomic Energy Corporation, EDF, MITSUBISHI HEAVY INDUSTRIES, LTD, and others.

As nations are striving to reduce their carbon footprint and meet ambitious climate targets, nuclear energy has emerged as a viable solution due to its low greenhouse gas emissions compared to fossil fuels. For instance, countries including Russia, China, the U.S., and France, among other countries, with burgeoning energy needs, are investing heavily in nuclear power to bolster their energy security while mitigating environmental impact.

- As reported by IEA, Russia expanded its nuclear power constructions from 1 in 2020 to 6 in 2021. Furthermore, China witnessed steady growth in nuclear power plant constructions during the same period, growing in number from 3 plants in 2020 to 4 plants in 2021.

Additionally, advancements in nuclear technology, such as next-generation reactors, modular designs, and improved safety features, are enhancing the efficiency and safety of nuclear power plants, thereby bolstering market growth. For instance, the development of small modular reactors (SMRs) offers scalability and flexibility, making nuclear energy more accessible to regions with limited grid infrastructure or smaller energy demands.

Moreover, the increasing focus on electrification and decarbonization across sectors such as transportation and manufacturing presents a significant opportunity for nuclear energy expansion. Nuclear power's capacity to provide baseload electricity reliably complements intermittent renewable sources such as wind and solar, thus ensuring grid stability while reducing reliance on fossil fuels.

The global nuclear energy market encompasses the production, distribution, and utilization of nuclear power for electricity generation and various other industrial applications. It includes the construction, operation, and maintenance of nuclear power plants, as well as the associated supply chain activities related to nuclear fuel production and waste management. This market is characterized by a diverse range of stakeholders, including governments, regulatory bodies, utilities, technology providers, and investors.

Analyst’s Review

Key factors impacting market dynamics include rising energy demand, environmental considerations, technological advancements, and geopolitical influence, among others. Key players in the market are strategically focusing on research and development initiatives to enhance the safety, efficiency, and cost-effectiveness of nuclear power generation. They are further expanding their global footprint through collaborations, partnerships, and acquisitions to capitalize on emerging opportunities in both established and nascent markets.

Additionally, they are investing heavily in innovative reactor designs, such as small modular reactors (SMRs), and advanced fuel technologies to maintain competitiveness and sustainability in the evolving energy landscape.

Nuclear Energy Market Growth Factors

Increasing emphasis on decarbonization and the non-intermittent nature of nuclear energy are among the prominent factors propelling market expansion. As nations are striving to meet ambitious climate goals and reduce their carbon footprint, there is a growing demand for low-carbon energy sources. Nuclear energy is a large-scale, low-carbon electricity source that pairs well with intermittent renewables, including wind and solar energy. Countries such as Sweden, France, and South Korea have successfully integrated nuclear power into their energy mix, resulting in lower carbon intensity and enhanced energy security.

- According to the World Nuclear Association, as of May 2024, nuclear energy accounted for 10% of global electricity. This was facilitated by approximately 440 operable reactors, with an additional 61under construction. The total capacity of nuclear energy in 2023 was 396,269 MWe.

Moreover, rising energy security concerns play a pivotal role in driving concentration in nuclear power. Geopolitical instability and volatile fuel markets are emphasizing the importance of diversifying energy sources and reducing dependence on imported fuels. Nuclear-powered countries have greater control over their energy security, as they are less vulnerable to supply disruptions and fluctuations in fuel prices.

For instance, the United Arab Emirates is investing heavily in nuclear energy to reduce reliance on natural gas for electricity generation, thus enhancing its energy security.

However, despite these growth factors, the significantly high upfront costs associated with building and operating new nuclear power plants pose a major challenge to market development. Regulatory requirements, complex construction processes, and financing hurdles are impacting the high adoption of nuclear projects.

Key players are aiming to establish partnerships with governments to foster the development of sustainable processes to address these challenges. Innovation in project management, modular construction techniques, and financing models to make nuclear energy more cost-competitive with other forms of electricity generation are estimated to overcome these challenges over the forecast period.

Nuclear Energy Market Trends

The rising focus on advanced reactor designs, particularly Generation IV reactors, which offer enhanced safety, efficiency, and waste management capabilities, is augmenting market growth. These advanced designs, characterized by features such as inherent safety and proliferation resistance, are addressing key concerns regarding nuclear power, thereby fostering greater public acceptance and regulatory support.

Furthermore, refurbishment and life extension of existing nuclear power plants are gaining traction as cost-effective means to maintain clean energy generation capacity. Compared to building entirely new plants, extending the lifespan of existing facilities minimizes upfront investment while leveraging existing infrastructure and expertise.

Additionally, small modular reactors (SMRs) are increasingly garnering attention in the market due to their potential for lower upfront costs, modular construction, and inherent safety features. SMRs present opportunities for nuclear deployment in smaller grids or remote locations, addressing energy needs in regions with limited infrastructure while enhancing grid resilience.

Segmentation Analysis

The global nuclear energy market is segmented based on type, application, and geography.

By Type

Based on type, the market is categorized into nuclear fission, nuclear fusion, and nuclear decay. The nuclear fission segment garnered the highest revenue of USD 29.50 billion in 2023. This significant market share can be attributed to the widespread adoption and maturity of fission technology in commercial nuclear power plants. Nuclear fission remains the most established method for large-scale electricity generation, with numerous operational plants worldwide, particularly in countries such as the U.S., France, and China, where fission reactors have played a pivotal role in nuclear energy production.

Additionally, continuous advancements in fission reactor technology, including safety enhancements and efficiency improvements, have bolstered adoption and thereby investment in this segment. The development of next-generation fission reactors, such as small modular reactors, further supports the growth of the segment by offering scalable and cost-effective solutions for diverse energy needs.

By Application

Based on application, the market is divided into electricity generation, industrial process heat, research and development, and desalination. The electricity generation segment captured the largest share of 78.58% in 2023. This dominance is driven by the pressing need for reliable and large-scale power generation, a demand effectively addressed by nuclear energy. Countries with substantial energy demands and stringent emissions targets, such as the United States, China, and France, are investing heavily in nuclear power plants to ensure a stable and low-carbon electricity supply.

Moreover, advancements in reactor technology, such as the development of more efficient and safer Generation III and III+ reactors, have bolstered the expansion of the segment. The push towards extending the operational lifespan of existing nuclear plants through refurbishment and life extension programs contributes significantly to maintaining and expanding the electricity generation capacity. Furthermore, the integration of nuclear power with renewable energy sources to form hybrid energy systems enhances grid stability and supports segment expansion.

Nuclear Energy Market Regional Analysis

Based on region, the global nuclear energy market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Nuclear Energy Market share stood around 32.63% in 2023 in the global market, with a valuation of USD 10.05 billion. The clean energy policies in U.S. and Canada are creating a favorable environment for nuclear energy. These policies are prioritizing carbon-free sources, particularly nuclear energy, potentially encouraging the initiation of new plant construction or refurbishment projects to meet energy demands while reducing carbon emissions.

The region is witnessing developments in advanced recycling technologies and centralized waste repositories, offering potential solutions to mitigate these costs and enhance the attractiveness of nuclear energy.

Moreover, North America's vast remote areas with limited grid access present opportunities for micro reactors, which are even smaller than SMRs, thus enabling the provision of clean and reliable power solutions. The development and deployment of such micro reactors are projected to address increasing energy needs in these areas, further diversifying the region's energy portfolio and enhancing energy security.

- As reported by IEA, in 2022, Canada announced an investment tax credit of up to 30% for clean energy technologies, specifically including small modular reactors (SMRs). Additionally, Canada’s Infrastructure Bank provided a loan to support the construction of an SMR at an existing nuclear site, with a targetedcompletion date set for 2028.

- United States, the Inflation Reduction Act of 2022 established a tax credit for producing zero-emission nuclear power. This measure significantly enhanced the economic viability of existing nuclear reactors and included additional support for the construction of new nuclear facilities.

Asia-Pacific is anticipated to witness the fastest growth at a CAGR of 4.03% over 2023-2031. Rapidly growing energy demand, fueled by population growth, urbanization, and industrialization, is mainly propelling regional market expansion. Countries such as China and India, with burgeoning economies and surging energy needs, are aiming to increase nuclear power generation to meet their electricity demands while reducing reliance on fossil fuels.

Furthermore, the Asia-Pacific region presents opportunities for nuclear energy expansion through innovative technologies and deployment strategies. Small modular reactors are gaining traction due to their potential for lower upfront costs, modular construction, and suitability for smaller grids or remote areas. Countries including South Korea and Japan are actively investing in SMR development and deployment to diversify their energy mix and enhance energy security.

Additionally, partnerships and collaborations among key players in the region are offering opportunities for technology transfer, knowledge sharing, and capacity building in the nuclear sector. For instance, international cooperation initiatives, such as the International Atomic Energy Agency (IAEA) Technical Cooperation Program, facilitate collaboration among Asia-Pacific countries, fostering advancements in nuclear technology and infrastructure development.

Competitive Landscape

The global nuclear energy market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Nuclear Energy Market

- NuScale Power, LLC

- TerraPower, LLC

- Cameco Corp.

- Westinghouse Electric Company LLC

- GE Vernova

- BWX Technologies. Inc.

- China National Nuclear Corporation

- ROSATOM State Atomic Energy Corporation

- EDF

- MITSUBISHI HEAVY INDUSTRIES, LTD

Key Industry Developments

- November 2023 (Acquisition): Cameco acquired Westinghouse in a strategic collaboration with Brookfield Asset Management. Brookfield Renewable Partners and institutional partners were also involved in the acquisition. Following the acquisition, Cameco now holds a 49% stake in Westinghouse, while Brookfield owns the remaining 51%. Westinghouse is recognized as one of the largest nuclear services businesses globally.

- March 2023 (Acquisition): Vistara, a Texas-based retail electricity and power generation firm, agreed to acquire Energy Harbor, an Ohio-based company specializing in nuclear power and retail energy services, in a USD 3.43 billion agreement. This move allows Vistra to expand its presence in the nuclear energy sector, leveraging federal tax incentives to facilitate the acquisition.

The Global Nuclear Energy Market is Segmented as:

By Type

- Nuclear Fission

- Nuclear Fusion

- Nuclear Decay

By Application

- Electricity Generation

- Industrial Process Heat

- Research and Development

- Desalination

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America