Market Definition

The market encompasses the global industry dedicated to the design, production, and distribution of standardized containers and pallets. These devices are used for the efficient transportation of cargo, baggage, and mail aboard aircraft.

Unit load devices play a critical role in aviation logistics by streamlining the loading and unloading processes, ensuring cargo safety and stability during flight, and maximizing the utilization of aircraft cargo space.

The report presents an overview of the primary growth drivers, supported by a regional analysis and regulatory frameworks expected to impact market development over the forecast period.

Unit Load Device Market Overview

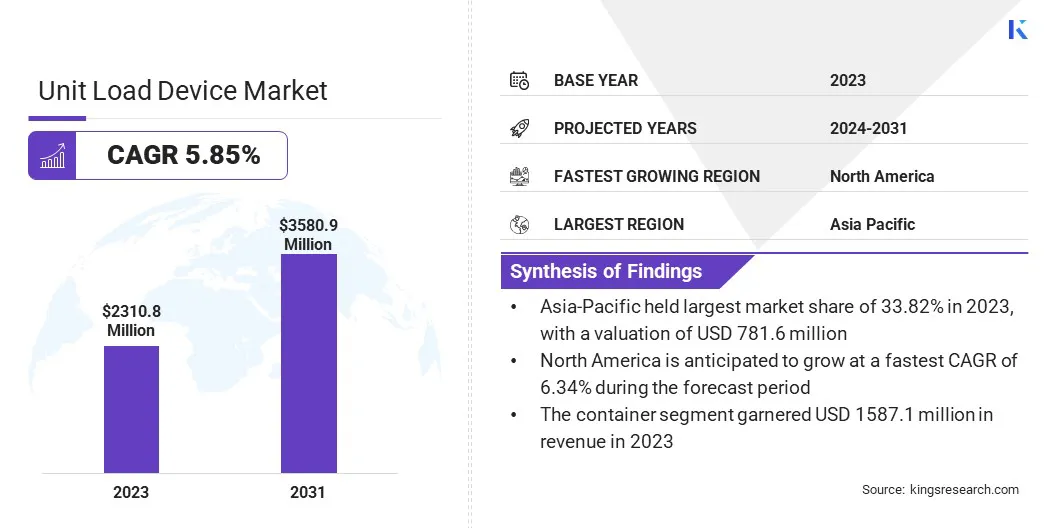

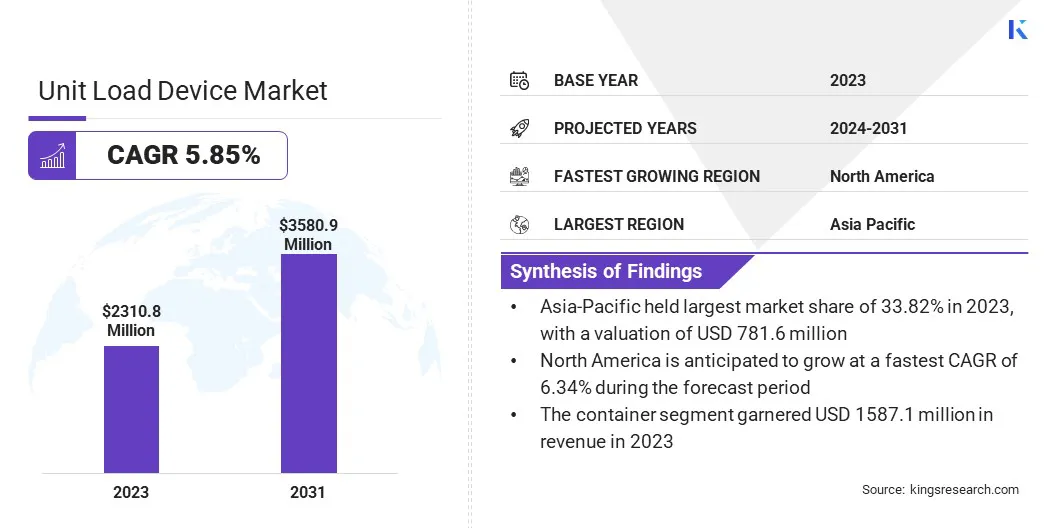

The global unit load device market size was valued at USD 2310.8 million in 2023 and is projected to grow from USD 2404.6 million in 2024 to USD 3580.9 million by 2031, exhibiting a CAGR of 5.85% during the forecast period. This growth is attributed to the rising demand for air cargo services, the rapid expansion of online shopping worldwide, and the need for faster and more efficient transportation of goods.

Major companies operating in the unit load device industry are AEROTUF, Nordisk Aviation Products AS, ACL Airshop, Brambles Limited, Envirotainer, DoKaSch GmbH, Jettainer GmbH, PalNet GmbH Air Cargo Products, VRR, Satco Inc, Safran Group, AEROTRANSCARGO, AviusULD, Speedcargo Technologies Pte. Ltd., and Transdigm.

New developments in lightweight and strong unit load device materials, along with strict airline safety rules, are also helping the market grow. In addition, airlines and logistics companies are looking for cost-effective and environmentally friendly ways to handle cargo, which is boosting the demand for modern unit load device solutions.

- In February 2024, Mountain Air Cargo implemented the ULD (Unit Load Device) system on its international route from BQN to POS. This system, in collaboration with FedEx, was successfully integrated on aircraft 710FE, an ATR 72-600, to streamline cargo loading, improve efficiency, and reduce turnaround times.

Key Highlights

- The unit load device market size was valued at USD 2310.8 million in 2023.

- The market is projected to grow at a CAGR of 5.85% from 2024 to 2031.

- Asia-Pacific held a market share of 33.82% in 2023, with a valuation of USD 781.6 million.

- The container segment garnered USD 1587.1 million in revenue in 2023.

- The metal segment is expected to reach USD 1896.8 million by 2031.

- The commercial segment is anticipated to witness the fastest CAGR of 6.12% during the forecast period.

- The market in North America is anticipated to grow at a CAGR of 6.34% during the forecast period.

Market Driver

Growth in Air Cargo and Passenger Traffic

The market is experiencing steady growth, driven by the increasing volume of air cargo and passenger traffic across global aviation networks. As international trade and air travel continue to expand, airlines are under growing pressure to enhance operational efficiency, cargo handling speed, and aircraft space utilization, all of which contribute to the rising adoption of unit load devices.

Unit load devices, which include standardized containers and pallets, are essential for ensuring secure, efficient, and organized transportation of baggage, freight, and mail, particularly on wide-body aircraft and a few narrow-body models.

Moreover, the growing number of passenger aircraft being used for cargo transport, coupled with ongoing investments in airport infrastructure and logistics systems, is further supporting the demand for advanced, lightweight, and durable unit load device solutions.

- In July 2023, Jettainer GmbH collaborated with SATCO, to introduce the certified fireproof AMX unit load device (ULD), designed to enhance cargo safety. The AMX ULD offers advanced fire protection for sensitive cargo, ensuring higher security during air transport.

Market Challenge

Weight Constraints and Fuel Efficiency Trade-offs

Weight constraints and fuel efficiency trade-offs pose a persistent challenge in the unit load device market, as these devices contribute to the overall mass carried by an aircraft during operations.

The added weight of unit load devices, particularly those made from traditional aluminum or steel, can lead to increased fuel consumption, which directly impacts operating costs and carbon emissions, creating key concerns for airlines under growing environmental and regulatory pressures.

While advanced materials such as carbon fiber composites offer significant weight reductions and improved fuel efficiency, their higher cost presents a financial hurdle, especially for cost-sensitive operators and budget airlines. Moreover, adopting lighter unit load devices requires careful consideration of safety, durability, and compliance with aviation standards, which adds complexity to product design and manufacturing.

To address this issue, manufacturers and operators are increasingly investing in the research and development of lightweight yet robust unit load device alternatives.

Airlines are also optimizing cargo loading strategies and adopting data-driven tools to balance weight distribution and fuel efficiency. Despite these efforts, achieving the ideal trade-off between reduced unit load device weight and cost-effectiveness remains a challenge in the push toward more sustainable and economically viable air transport solutions.

Market Trend

Increasing Investment in Digitalization and Automation

Increasing investments in digitalization and automation are significantly transforming the market by improving operational efficiency, asset management, and overall cargo handling performance. Innovations in unit load device tracking systems, such as real-time GPS and RFID technology, are enabling better monitoring and management of unit load device fleets, reducing misplacement and ensuring timely availability.

Automation technologies, including robotic handling systems and smart conveyor belts, are streamlining the loading and unloading processes, reducing the need for manual labor and increasing throughput. Additionally, advancements in software solutions for unit load device management allow for optimized fleet utilization, predictive maintenance, and improved operational decision-making.

- In January 2025, Qatar Airways Cargo partnered with Unilode Aviation Solutions, which aimed at enhancing cargo tracking and operational efficiency. The partnership involves equipping Qatar Airways Cargo's entire fleet of unit load devices with Bluetooth technology for real-time monitoring and data insights.

Unit Load Device Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Container, Pallet

|

|

By Material

|

Composite, Metal

|

|

By Application

|

Commercial, Cargo

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Container, Pallet): The container segment earned USD 1587.1 million in 2023 due to its widespread use in optimizing cargo space and ensuring secure transportation of goods.

- By Material (Composite, Metal): The metal segment held 53.63% of the market in 2023, owing to its durability, cost-effectiveness, and long-established use in the manufacturing of Unit Load Devices.

- By Application (Commercial, Cargo): The cargo segment is projected to reach USD 1979.5 million by 2031, on account of the increasing demand for efficient air cargo transportation and the growth of global trade and e-commerce.

Unit Load Device Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific unit load device market share stood at around 33.82% in 2023, with a valuation of USD 781.6 million. This dominance is driven by the region's rapidly expanding aviation sector, growing international trade, and a high volume of air cargo shipments, particularly in countries like China, India, and Japan.

Moreover, the region's robust investments in airport infrastructure, logistics hubs, and airfreight facilities support the increased demand for unit load devices. The rise of e-commerce and the need for efficient cargo handling solutions, along with the growing adoption of digital technologies and automation in logistics operations, further propel the growth of the market.

Additionally, regional policies focused on enhancing operational efficiency and meeting global safety and environmental standards reinforce Asia Pacific’s strong position in the global market.

- In March 2024, Unilode Aviation Solutions partnered with Air India to support Air India’s fleet of more than 120 aircraft, serving over 100 domestic and international destinations, with digitalized ULD containers and pallets from Unilode's pool.

The unit load device industry in North America is poised for significant growth at a robust CAGR of 6.34% over the forecast period. This growth is fostered by the increasing demand for efficient and reliable air cargo solutions, particularly in light of the expanding e-commerce sector and the need for improved logistics operations.

The region’s ongoing investments in modernizing airport infrastructure and the rise of digital technologies in logistics management are enhancing the efficiency of cargo handling processes. Additionally, the strong presence of key players in the aviation and logistics industries is driving innovation in unit load device design, focusing on lightweight, durable, and sustainable solutions.

With a growing emphasis on reducing operational costs, improving fuel efficiency, and complying with environmental regulations, the North American market is well-positioned to embrace the next generation of unit load devices, fostering long-term growth and market expansion.

- In March 2025, Unilode Aviation Solutions partnered with American Airlines, which focused on the management and digitalization of unit load devices. The partnership includes the transition of American Airlines’ ULD fleet to Unilode’s digital containers equipped with Bluetooth technology to enhance tracking and operational efficiency.

Regulatory Frameworks

- In the European Union, Regulation (EC) No. 216/2008 regulates the safety of civil aviation. It sets safety and certification standards for unit load device (ULDs) used in air transport, enforced by the European Union Aviation Safety Agency (EASA) to ensure secure and safe cargo operations.

- In the International Civil Aviation Organization (ICAO), Annex 18 - Safe Transport of Dangerous Goods by Air regulates the transport of hazardous materials. This regulation sets global safety standards for packaging, labeling, and handling dangerous goods, ensuring secure and safe transport in ULDs aboard aircraft.

- In Canada, Transport Canada Civil Aviation (TCCA) regulates air navigation services under the Canadian Aviation Regulations (CARs), specifically Part VII. These regulations establish safety standards for the operations, handling, and transport of cargo, ensuring secure and efficient air transport.

Competitive Landscape

The unit load device market is characterized by the presence of several well-established players competing based on product quality, innovation, material technology, and global distribution networks. Leading manufacturers focus on developing lightweight, durable, and sustainable unit load devices to meet the evolving airline and cargo operator requirements.

Strategic collaborations, mergers, and acquisitions are common as companies seek to expand their geographic reach and strengthen their market positions. Additionally, investments in smart unit load device technologies such as real-time tracking, temperature monitoring, and digital fleet management are becoming key differentiators.

- In January 2024, Air France KLM Martinair Cargo expanded its partnership with SkyCell to enhance cold chain reliability and ULD tracking. The integration of SkyCell’s hybrid containers improves temperature stability and reduces product loss rates, while ensuring better tracking and visibility of temperature-sensitive shipments.

List of Key Companies in Unit Load Device Market:

- AEROTUF

- Nordisk Aviation Products AS

- ACL Airshop

- Brambles Limited

- Envirotainer

- DoKaSch GmbH

- Jettainer GmbH

- PalNet GmbH Air Cargo Products

- VRR

- Satco Inc

- Safran Group

- AEROTRANSCARGO

- AviusULD

- Speedcargo Technologies Pte. Ltd.

- Transdigm

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In February 2025, Jettainer GmbH and Oman Air Cargo extended their successful partnership to continue managing the airline’s unit load devices (ULDs). This partnership ensures the provision of high-quality ULD services, including maintenance and digital tracking, to optimize cargo operations and support Oman Air Cargo's growth.

- In October 2024, Cargolux renewed its partnership with Unilode Aviation Solutions for ULD management, continuing support for its fleet of over 172,000 ULDs. Unilode will provide digital connectivity, maintenance at 50 global facilities, and enhanced ULD tracking through its E-ULD app and customer portal.

- In January 2024, Silk Way West Airlines expanded its ULD agreement with ACL Airshop to further optimize its cargo operations. The agreement will see the supply and management of an increased fleet of ULDs, enhancing the airline's international network and boosting efficiency in its airfreight services.

- In August 2023, Unilode Aviation Solutions agreed with AviusULD, to supply unit load devices, strengthening Unilode’s ULD management and repair network. Under this agreement, AviusULD will supply over 160,000 ULDs annually, supporting Unilode’s global airline customers with high-quality and timely equipment.

- In May 2023, Speedcargo Technologies Pte. Ltd. partnered with Gudel Automation, to revolutionize air cargo handling with advanced automation solutions. The partnership focuses on enhancing efficiency and reducing operational costs through automated ULD handling systems, improving cargo throughput and minimizing human error.