Market Definition

The market encompasses a broad range of machinery and systems used at ports, terminals, warehouses, and logistics hubs to efficiently load, unload, move, and store cargo.

It includes equipment for air, sea, and land freight operations, supporting global trade by enabling seamless intermodal transport, enhancing productivity, and meeting the growing demand for automated and sustainable material handling solutions.The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Cargo Handling Equipment Market Overview

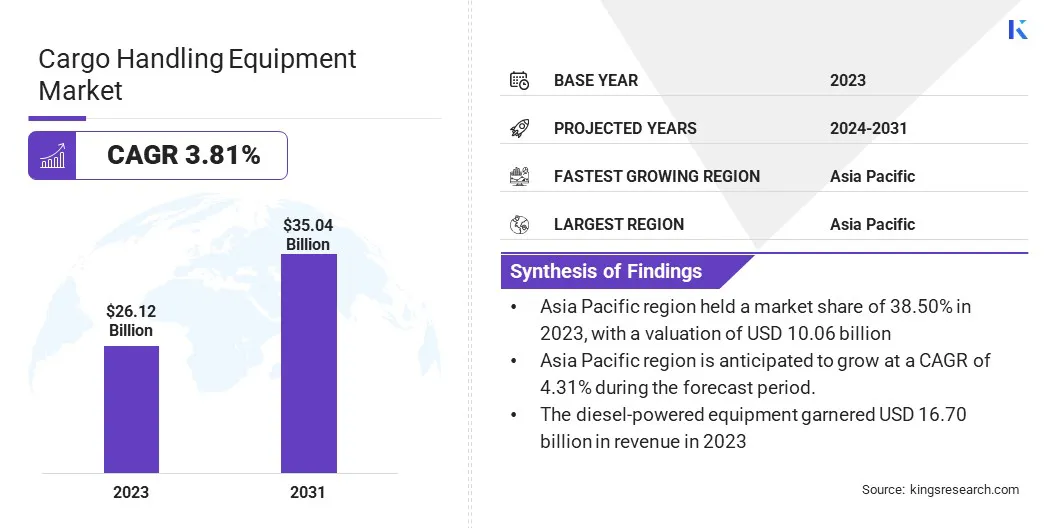

The global cargo handling equipment market size was valued at USD 26.12 billion in 2023 and is projected to grow from USD 26.97 billion in 2024 to USD 35.04 billion by 2031, exhibiting a CAGR of 3.81% during the forecast period.

This market is witnessing robust growth, driven by the rapid globalization of trade, expansion of seaborne transportation, and increasing investments in port infrastructure development worldwide. The growing need to improve operational efficiency at ports, warehouses, and intermodal terminals is pushing demand for advanced, automated cargo handling solutions.

Technological advancements such as automation, IoT integration, GPS tracking, and real-time monitoring are transforming traditional equipment into smart systems that enhance productivity, reduce downtime, and streamline cargo flow.

Major companies operating in the cargo handling equipment industry are Anhui Heli Co., Ltd., TOYOTA INDUSTRIES CORPORATION, KION GROUP AG, Hyster-Yale, Inc., Jungheinrich AG, Mitsubishi Group, Liebherr, Konecranes, Godrej Enterprises Group, Terex Corporation, Cargotec Corporation, CLARK, Hyster-Yale, Inc., The Manitowoc Company, Inc., and Taylor Machine Works, Inc.

Additionally, the growing e-commerce sector along with the rising consumer expectations for faster delivery is driving demand for efficient logistics and cargo movement. Supportive government initiatives and public-private partnerships for modernizing transport infrastructure further accelerate market growth.

Moreover, the rising preference for electric and hybrid equipment, aligned with sustainability goals and stricter emission regulations, is encouraging the adoption of eco-friendly handling machinery.

- In May 2023, IAG Cargo officially opened its state-of-the-art cargo handling facility, New Premia, at London Heathrow. Spanning over 10,000m². The facility is designed to handle more than double the volume of premium shipments, featuring 20 break and build workstations and 11 rapid-rise delivery doors for improved operational efficiency.

Key Highlights:

- The cargo handling equipment industry size was recorded at USD 26.12 billion in 2023.

- The market is projected to grow at a CAGR of 3.81% from 2024 to 2031.

- Asia Pacific held a market share of 38.50% in 2023, with a valuation of USD 10.06 billion.

- The cranes segment garnered USD 9.37 billion in revenue in 2023.

- The diesel-powered equipment segment is expected to reach USD 22.12 billion by 2031.

- The marine cargo handling segment is expected to reach USD 14.02 billion by 2031.

- The ports & terminals segment is expected to reach USD 12.11 billion by 2031.

- North America is anticipated to grow at a CAGR of 4.05% during the forecast period.

Market Driver

Increasing Investments in Port Development

The market is experiencing strong growth, largely driven by the steady expansion of global trade and significant investments in port infrastructure development. As international trade volumes continue to rise ports are under increasing pressure to modernize and scale their operations to accommodate larger vessels and higher cargo throughput.

This has led to widespread upgrades of existing facilities and the construction of new terminals equipped with state-of-the-art cargo handling systems. Governments and private stakeholders are investing to expand berth capacity, automate container yards, and integrate intermodal logistics hubs to streamline cargo flow.

These infrastructure enhancements are improving operational efficiency and fueling demand for a wide range of advanced cargo handling equipment such as cranes, reach stackers, straddle carriers, and automated guided vehicles (AGVs).

- In November 2024, the U.S. Department of Transportation’s Maritime Administration (MARAD) announced a USD 580 million investment to support 31 port improvement projects across 15 states and one U.S. territory.

Market Challenge

High Initial Investment and Maintenance Costs

The major challenges facing the cargo handling equipment market are the high initial investment and maintenance costs associated with advanced equipment and automation technologies. As ports and logistics hubs move toward modernization, the shift to automated and electric cargo handling systems requires substantial capital expenditure.

This financial barrier is particularly challenging for small and mid-sized operators, limiting widespread adoption across emerging economies. These challenges can be addressed through public-private partnerships (PPPs) and leasing models, which can help distribute the financial load. These approaches can accelerate the integration of modern equipment while easing the financial pressure on operators.

Market Trend

Integration of Artificial Intelligence in Cargo Handling Operations

The market is experiencing a significant transformation driven by the integration of artificial intelligence (AI) across logistics and port operations. AI technologies are increasingly being used to enhance operational efficiency through predictive maintenance, real-time equipment monitoring, and intelligent scheduling.

By analyzing vast amounts of data from cargo movements, AI systems can anticipate potential equipment failures, optimize machine usage, and reduce unplanned downtime. Additionally, AI-powered automation is improving cargo flow by enabling dynamic route planning and adaptive resource allocation, especially in high-traffic port terminals.

These advancements reduce human error and contribute to faster turnaround times and better utilization of infrastructure, making AI a critical trend reshaping the future of cargo handling globally.

- In June 2024, Kalmar, a part of Cargotec Corporation, announced the launch of a new electric empty container handler during the TOC Europe 2024 event in Rotterdam. It is built on the G-generation platform, the electric empty container handler shares its electric drive system with Kalmar’s electric reachstacker and heavy electric forklift.

Cargo Handling Equipment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Equipment Type

|

Cranes, Forklift Trucks, Rubber-tired Gantry Cranes (RTGs), Loaders, Conveyor Systems, Automated Guided Vehicles (AGVs), Stackers, Pallet Jacks, Aviation Dollies, Other Equipment Types

|

|

By Propulsion Type

|

Diesel-powered Equipment, Electric-powered Equipment, Hybrid Equipment

|

|

By Application

|

Marine Cargo Handling, Warehouse Handling, Land Cargo Handling, Air Cargo Handling, Industrial Material Handling

|

|

By End-user Industry

|

Ports & Terminals, Warehouses & Distribution Centers, Airports, Rail Yards, Manufacturing Facilities, Logistics & Freight Forwarding Companies

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Equipment Type (Cranes, Forklift Trucks, Rubber-tired Gantry Cranes (RTGs), Loaders, and Conveyor Systems, Automated Guided Vehicles (AGVs), Stackers, Pallet Jacks, Aviation Dollies, Other Equipment Types): The cranes segment earned USD 9.37 billion in 2023 due to their widespread use in ports and terminals for lifting heavy containers and improving operational efficiency.

- By Propulsion Type (Diesel-powered Equipment, Electric-powered Equipment, Hybrid Equipment): The diesel-powered equipment held 63.93% of the market in 2023, due to their high power output and reliability in handling heavy-duty cargo operations.

- By Application (Marine Cargo Handling, Warehouse Handling, Land Cargo Handling, and Air Cargo Handling): The marine cargo handling segment is projected to reach USD 14.02 billion by 2031, owing to the increasing global trade volumes and expansion of port infrastructure.

- By End-user Industry (Ports & Terminals, Warehouses & Distribution Centers, Airports, and Rail Yards): The ports & terminals segment is projected to reach USD 12.11 billion by 2031, owing to rising container traffic and investments in modernizing port handling systems.

Cargo Handling Equipment Market Regional Analysis

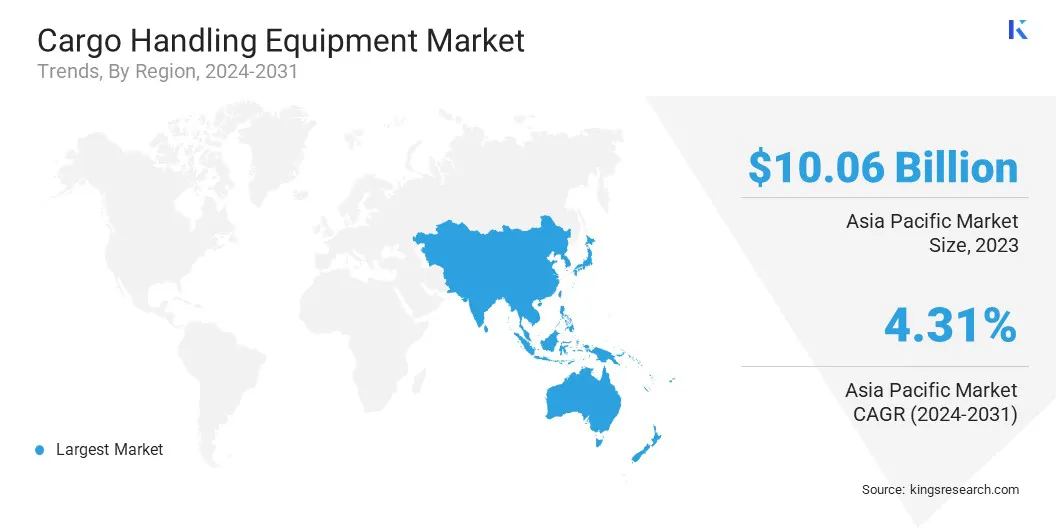

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific cargo handling equipment market share stood around 38.50% in 2023 in the global market, with a valuation of USD 10.06 billion. This dominant position is primarily attributed to the region's expanding trade activities, particularly across China, India, Japan, and Southeast Asia.

The presence of major global shipping hubs such as the ports of Shanghai, Singapore, and Busan underscores the region's strategic importance in global logistics. Moreover, sustained infrastructure investments, coupled with government-led initiatives to modernize ports and expand intermodal transportation networks, have fueled the demand for advanced cargo handling solutions.

The region's growing industrial output and increasing e-commerce penetration have also accelerated the movement of goods, reinforcing the need for efficient and automated handling equipment across maritime and inland logistics chains.

- In October 2024, the United Nations Conference on Trade and Development (UNCTAD) released its Review of Maritime Transport 2024, highlighting significant shifts in global shipbuilding dynamics. The report noted that in 2023, China, Japan, and the Republic of Korea collectively accounted for 95% of global ship production, with China surpassing the 50% mark for the first time.This concentration of shipbuilding activity, particularly in Asia, aligns with the region's expanding maritime infrastructure and reinforces the demand for advanced cargo handling equipment across shipyards, ports, and terminals

North America is poised to grow at a significant growth at a CAGR of 4.05% over the forecast period. This growth is fueled by robust investments in upgrading aging port infrastructure and the rising adoption of automation and electrification technologies across cargo terminals.

The United States is investing heavily in improving supply chain resilience, particularly in port efficiency and cargo movement. These efforts aim to address logistics bottlenecks and streamline trade flows. Additionally, the region’s strong regulatory frameworks that encourage the shift toward low-emission and electric cargo handling solutions are further driving market growth North America.

Regulatory Frameworks

- In the United States, the regulatory framework for Cargo Handling Equipment is primarily governed by the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA). The EPA’s Tier 4 emissions standards mandate strict limits on nitrogen oxides and particulate matter for non-road diesel engines, which include many types of cargo handling equipment used at ports and terminals. These regulations drive the adoption of cleaner and more efficient engines.

- In Europe, the European Union (EU) enforces Stage V emission standards for non-road mobile machinery (NRMM), aimed at reducing engine emissions in cargo handling equipment. The Machinery Directive also regulates the design and safety of such equipment.

Competitive Landscape

The cargo handling equipment market is characterized by key players focusing on strategic initiatives to strengthen their market presence and expand their global footprint. A major strategy includes continuous investment in research and development to introduce technologically advanced, automated, and energy-efficient equipment that meets evolving operational needs and environmental standards.

Companies are also pursuing strategic collaborations, partnerships, and joint ventures with port authorities, logistics firms, and technology providers to enhance product offerings and enter new markets. Additionally, mergers and acquisitions are commonly employed to gain access to complementary technologies and increase market share. Key players are also adopting vertical integration strategies to streamline manufacturing and distribution processes, ensuring better control over the value chain.

- In May 2024, Yusen Terminals launched the world’s first hydrogen-powered, zero-emission rubber-tired gantry (RTG) crane at its container terminal in the Port of Los Angeles. The H2-ZE RTG Transtainer Crane is developed by PACECO Corp. in partnership with MITSUI E&S Co. Ltd.

List of Key Companies in Cargo Handling Equipment Market:

- Anhui Heli Co., Ltd.

- TOYOTA INDUSTRIES CORPORATION

- KION GROUP AG

- Hyster-Yale, Inc.

- Jungheinrich AG

- Mitsubishi Group

- Liebherr

- Konecranes

- Godrej Enterprises Group

- Terex Corporation

- Cargotec Corporation

- CLARK

- Hyster-Yale, Inc.

- The Manitowoc Company, Inc.

- Taylor Machine Works, Inc

Recent Developments

- In October 2024, Exide Technologies launched the Solition Material Handling battery, an advanced lithium iron phosphate solution designed to improve performance and sustainability across industrial applications. Engineered for use in forklifts, automated guided vehicles, and port equipment, the Solition battery delivers enhanced reliability, safety, and total cost of ownership.

- In August 2023, Konecranes secured an order for eight fully electric rubber-tired gantry (RTG) cranes for a new container terminal at Puerto Antioquia in Colombia. The cranes were ordered by Puerto Bahia Colombia de Uraba, whose key shareholder is the CMA CGM Group, in support of its commitment to decarbonizing port operations. Powered by cable reels connected to the local grid, the RTGs are part of Konecranes’ broader efforts to reduce the environmental impact of cargo handling through sustainable and energy-efficient solutions.

- In May 2023, Etihad Cargo, the logistics division of Etihad Airways, launched AI-powered solutions to enhance airfreight operations and optimize cargo capacity across its network. Following successful trials of Speedcargo’s Amplifi, Cargo Eye, and Assemble tools, the solutions will be initially deployed in Singapore before expanding globally. The initiative aims to increase operational efficiency, maximise cargo loads, and elevate service quality, marking a significant advancement in Etihad Cargo’s digital transformation strategy.

The initiative highlights Yusen Terminals’ commitment to zero-emission technologies, utilizing hydrogen fuel cell systems that generate electricity with only water vapor as a by-product.