Market Definition

The market encompasses the development, production, and application of ultrasonic cleaning systems that utilize high-frequency sound waves to remove contaminants from surfaces. These systems operate by generating cavitation bubbles in a liquid cleaning medium, which collapse and dislodge dirt, grease, biofilms, and other residues at a microscopic level.

Formulations include water-based, solvent-based, and biodegradable cleaning solutions tailored for specific materials. Ultrasonic cleaning ensures precision cleaning of surgical instruments, engine components, circuit boards, and delicate optical devices in industries such as healthcare, automotive, electronics, and aerospace.

Ultrasonic Cleaning Market Overview

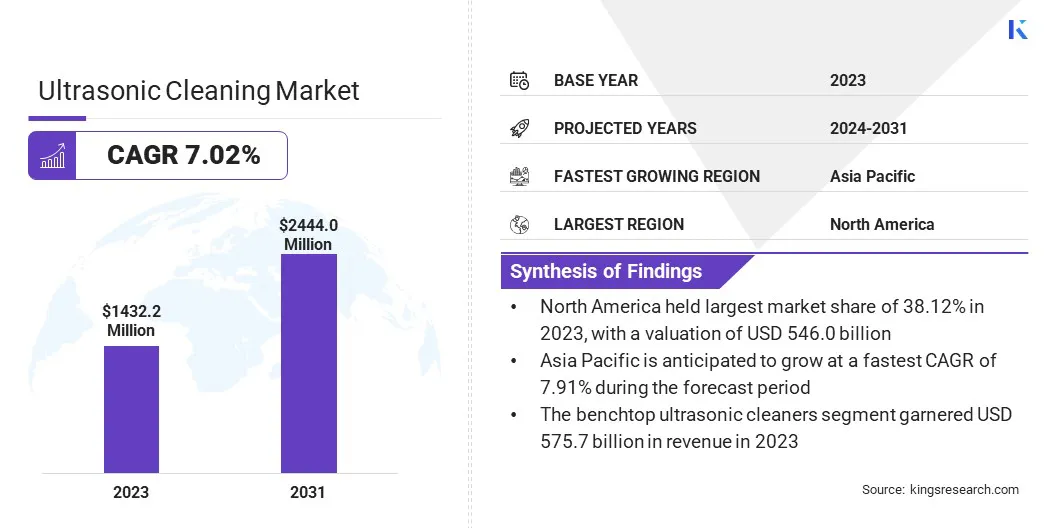

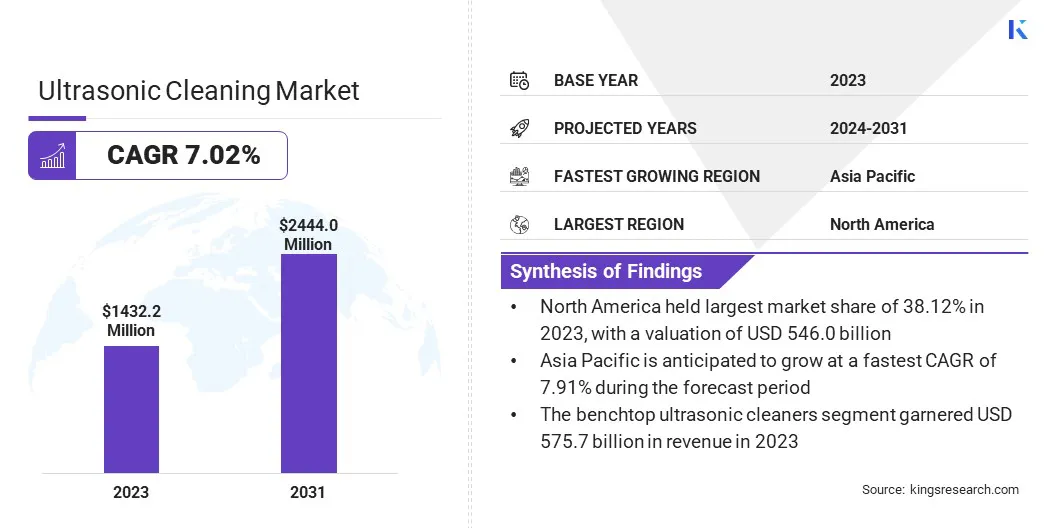

The global ultrasonic cleaning market size was valued at USD 1,432.2 million in 2023 and is projected to grow from USD 1,519.9 million in 2024 to USD 2,444.0 million by 2031, exhibiting a CAGR of 7.02% during the forecast period.

The market is driven by the increasing demand for precision cleaning in industries such as healthcare, electronics, and aerospace, where stringent cleanliness standards are essential.

Advancements in ultrasonic technology, including improved frequency control and cavitation efficiency, are enhancing cleaning effectiveness. Additionally, the shift toward eco-friendly cleaning solutions is prompting industries to adopt ultrasonic systems as a sustainable alternative to traditional solvent-based methods.

Major companies operating in the ultrasonic cleaning industry are Emerson Electric Co., Skymen Technology Corporation Limited, Tangshan UMG Medical Instrument Co., Ltd., UltraSonic LLC, Crest Ultrasonics, L&R Manufacturing, COLTENE Group, Omegasonics, Ultrasonic Power Corporation, Sonicor Inc., Niagara Systems, NOVATEC S.R.L., Kemet International Limited, CO-Z, and Creworks Equipment.

The market is expanding, due to the increasing demand for precision cleaning in the electronics industry. Printed Circuit Boards (PCBs), semiconductors, and microelectronic components require non-invasive cleaning solutions that eliminate flux residues and microscopic debris without causing damage.

The growing complexity of electronic devices, including miniaturized components in consumer electronics and industrial equipment, is driving the need for advanced cleaning technologies. Ultrasonic cleaning ensures contamination-free assemblies, improving product reliability and supporting stringent industry quality standards.

Key Highlights:

- The ultrasonic cleaning industry size was valued at USD 1,432.2 million in 2023.

- The market is projected to grow at a CAGR of 7.02% from 2024 to 2031.

- North America held a market share of 38.12% in 2023, with a valuation of USD 546.0 million.

- The 250W–500W segment garnered USD 550.0 million in revenue in 2023.

- The 5–25 litres segment is expected to reach USD 973.7 million by 2031.

- The benchtop ultrasonic cleaners segment secured the largest revenue share of 40.20% in 2023.

- The electronics & semiconductors segment is poised for a robust CAGR of 7.68% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.91% during the forecast period.

Market Driver

"Expansion of the Automotive and Aerospace Industries"

Growing emphasis on performance efficiency and maintenance in the automotive and aerospace sectors is fueling the ultrasonic cleaning market. Engine components, fuel injectors, and precision parts require thorough cleaning to maintain optimal functionality.

The ability to remove carbon deposits, grease, and microscopic contaminants enhances the durability of critical parts. Amid rising production volumes and demand for high-performance vehicles and aircraft, manufacturers are integrating ultrasonic cleaning systems to improve component reliability and extend operational life.

- In November 2023, Tierratech unveiled the latest innovation in its MOTOR-CLEAN series: the MOT-400N ADVANCED, a high-performance ultrasonic cleaning system tailored for the automotive industry and beyond. Designed for precision cleaning, this advanced equipment effectively removes grease, carbon deposits, and metal shavings, making it ideal for engines, diesel injectors, turbos, gearboxes, and other automotive components. Leveraging ultrasonic technology, it delivers deep and thorough cleaning, enhancing the efficiency and longevity of critical equipment and components.

Market Challenge

"High Initial Investment and Equipment Costs"

The growth of the ultrasonic cleaning market is challenged by the high initial investment required for advanced ultrasonic cleaning systems, particularly for industries with budget constraints.

The cost of high-frequency transducers, precision control systems, and customized cleaning solutions can be a barrier to adoption, especially for small and medium-sized enterprises.

Companies are developing modular and scalable ultrasonic cleaning systems, allowing businesses to invest gradually based on their needs. Additionally, manufacturers are focusing on energy-efficient designs and automation to enhance cost-effectiveness while offering leasing and financing options to make these technologies more accessible.

Market Trend

"Growing Applications in Watches, Jewelry, and Luxury Goods"

The luxury goods industry relies on high-quality cleaning solutions to maintain the esthetics and longevity of watches, jewelry, and precious metals. The ultrasonic cleaning market is expanding, due to increasing consumer preference for professional cleaning methods that restore the shine and remove dirt from intricate designs without damaging delicate materials.

Jewelers, watchmakers, and high-end retailers are investing in ultrasonic cleaning machines to enhance service offerings and ensure product preservation, further driving the market.

- In October 2024, Elma Schmidbauer introduced the Elmasonic Xtra, a high-performance ultrasonic cleaning system designed for superior efficiency. This new series sets a benchmark in professional ultrasonic cleaning with its advanced 37 kHz ultrasonic technology and a cavitation-resistant stainless steel tank. Engineered for precision and durability, the Elmasonic Xtra is well-suited for workshops, laboratories, and jewelry studios, delivering exceptional cleaning performance where reliability and maximum purity are essential.

Ultrasonic Cleaning Market Report Snapshot

|

Segmentation

|

Details

|

|

By Power Output

|

Up to 250W, 250W – 500W, Above 500W

|

|

By Capacity

|

Up to 5 Liters, 5–25 Liters, Above 25 Liters

|

|

By Product Type

|

Benchtop Ultrasonic Cleaners, Industrial Ultrasonic Cleaners, Medical Ultrasonic Cleaners

|

|

By Application

|

Healthcare & Medical Devices, Automotive & Aerospace, Electronics & Semiconductors, Precision Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Power Output (Up to 250W, 250W – 500W, above 500W): The 250W – 500W segment earned USD 550.0 million in 2023, due to its optimal balance of power efficiency and cleaning effectiveness, making it highly suitable for applications in industries such as healthcare, electronics, and precision manufacturing.

- By Capacity (Up to 5 Liters, 5–25 Liters, above 25 Liters): The 5–25 liters segment held 41.50% share of the market in 2023, due to its widespread adoption across industries such as healthcare, electronics, and automotive, offering an optimal balance between capacity, efficiency, and cost-effectiveness for cleaning precision components, medical instruments, and small to mid-sized industrial parts.

- By Product Type (Benchtop Ultrasonic Cleaners, Industrial Ultrasonic Cleaners, Medical Ultrasonic Cleaners): The benchtop ultrasonic cleaners segment is projected to reach USD 938.3 million by 2031, owing to its compact design, cost-effectiveness, and versatility, making it the preferred choice for laboratories, dental clinics, and small-scale industrial applications requiring precise and efficient cleaning solutions.

- By Application (Healthcare & Medical Devices, Automotive & Aerospace, Electronics & Semiconductors, Precision Manufacturing, Others): The electronics & semiconductors segment is poised for significant growth at a CAGR of 7.68% through the forecast period, due to the industry's stringent cleanliness standards, requiring precise and contamination-free cleaning of delicate components such as circuit boards, microchips, and semiconductor wafers to ensure optimal performance and reliability.

Ultrasonic Cleaning Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America ultrasonic cleaning market accounted for a share of around 38.12% in 2023, with a valuation of USD 546.0 million. The rapid expansion of Electric Vehicle (EV) manufacturing in North America, driven by companies such as Tesla, General Motors, and Ford, is contributing to the rising demand for ultrasonic cleaning solutions.

The need for high-precision cleaning technologies is growing, due to the increasing government incentives and private investments in EV production, fueling the market.

- The Environmental Defense Fund report published in January 2025 projects that by 2028, U.S. EV manufacturing facilities will have the capacity to produce around 4.7 million new EVs annually. This figure represents nearly one-third of the total new vehicle sales recorded in the U.S. in 2023. Production has commenced at multiple facilities since federal initiatives catalyzed nearly USD 200 billion in investments in EV manufacturing over the past two years. A total of 229 distinct manufacturing investments have been announced across 208 facilities nationwide.

Additionally, the presence of leading ultrasonic cleaning equipment manufacturers and R&D centers is leading to product advancements, increasing adoption across industries. The push for automation and smart ultrasonic cleaning systems is further strengthening the market growth in the region.

The ultrasonic cleaning industry in Asia Pacific is poised for significant growth at a robust CAGR of 7.91% over the forecast period. Asia Pacific is a global leader in electronics and semiconductor manufacturing, with China, Taiwan, and South Korea housing some of the world’s largest chip producers and electronics companies.

The demand for precision cleaning technologies is rising, due to increasing investments in semiconductor fabs and display panel production, strengthening the market in the region.

Furthermore, the adoption of ultrasonic cleaning systems is expanding, due to the rising Foreign Direct Investment (FDI) in industrial manufacturing and the relocation of production from China to Southeast Asia, supporting market growth across the region.

Regulatory Frameworks

- In the U.S., The market is regulated by multiple agencies, including the Environmental Protection Agency (EPA), which oversees the use and disposal of cleaning solvents to ensure environmental safety. The Occupational Safety and Health Administration (OSHA) enforces workplace safety standards related to ultrasonic equipment operation.

- The European Union (EU) enforces stringent regulations, including the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) directive, which controls chemical substances in ultrasonic cleaning solutions. The Restriction of Hazardous Substances (RoHS) directive limits hazardous materials in electronic cleaning equipment.

- Japan enforces stringent safety and environmental regulations through the Ministry of Health, Labour and Welfare (MHLW), which governs workplace chemical safety. The Electrical Appliance and Material Safety Law (DENAN) regulates ultrasonic cleaning devices to ensure their electrical safety. Compliance with these regulations is mandatory for both domestic manufacturers and foreign companies selling in Japan.

Competitive Landscape:

The ultrasonic cleaning industry is characterized by several market players, that are actively focusing on advancing precise cleaning technologies to enhance efficiency and meet industry-specific requirements.

Companies are integrating innovative solutions that optimize ultrasonic frequency and power monitoring, ensuring superior cleaning performance in sectors such as semiconductor manufacturing, medical devices, and high-precision engineering.

These advancements not only improve process reliability but also support compliance with stringent industry standards. Businesses are strengthening their market position by adopting cutting-edge measurement techniques and automation-driven cleaning systems.

- In August 2024, Ecoclean unveiled an advanced Acoustic Performance Measurement (APM) solution to monitor ultrasonic frequency and power in high-frequency ultrasound applications. This cutting-edge technology enhances cleaning efficiency and reliability across industries such as semiconductor manufacturing, microsystems technology, and medical applications. Featuring contamination-free, motionless, and inline measurement capabilities, it is set to revolutionize precision cleaning processes.

List of Key Companies in Ultrasonic Cleaning Market:

- Emerson Electric Co.

- Skymen Technology Corporation Limited

- Tangshan UMG Medical Instrument Co.,Ltd.

- UltraSonic LLC

- Crest Ultrasonics

- L&R Manufacturing

- COLTENE Group

- Omegasonics

- Ultrasonic Power Corporation

- Sonicor Inc.

- Niagara Systems

- NOVATEC S.R.L.

- Kemet International Limited

- CO-Z

- Creworks Equipment.

Recent Developments (Expansion)

- In October 2023, Niagara Systems, a leading manufacturer of industrial parts washers and ultrasonic cleaners, commenced a facility expansion project. The existing 35,000-square-foot facility, constructed in 2019, will be expanded by an additional 15,000 square feet to support the company’s growing manufacturing and machine-building operations. Presently, Niagara Systems is engaged in the design and production of custom wash and automated systems valued at over USD 12 million.