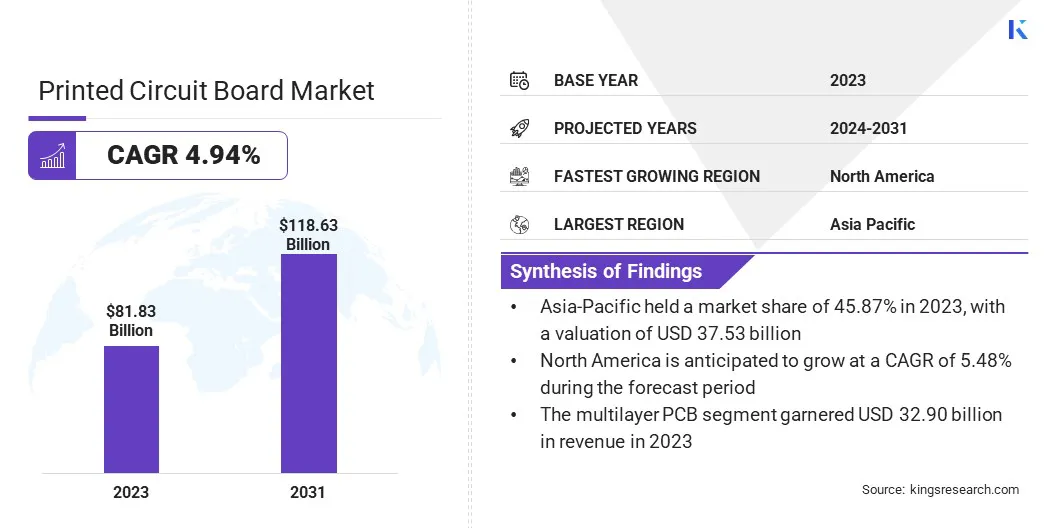

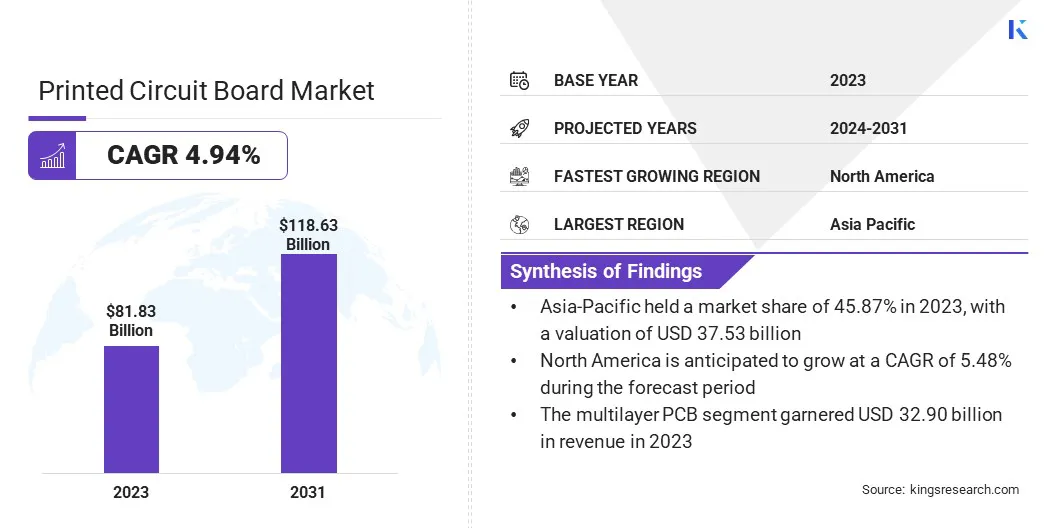

Printed Circuit Board Market Size

The global Printed Circuit Board Market size was valued at USD 81.83 billion in 2023 and is projected to grow from USD 84.65 billion in 2024 to USD 118.63 billion by 2031, exhibiting a CAGR of 4.94% during the forecast period.

The market is witnessing robust growth due to increasing demand in diverse sectors, including consumer electronics, automotive, and industrial automation. Innovations in materials and manufacturing processes are enhancing the performance and reliability of PCBs, making them more suitable for complex applications.

The shift toward miniaturization and the integration of Internet of Things (IoT) technologies are further driving market expansion.

In the scope of work, the report includes solutions offered by companies such as Jabil Inc., Würth Elektronik eiSos GmbH & Co. KG, Deutschland, TTM Technologies Inc., Becker & Muller Schaltungsdruck Gmbh, AdvancedPCB, Sumitomo Electric Industries Ltd, Murrietta Circuits, Unimicron, AT&S Austria Technologie & Systemtechnik Aktiengesellschaft, Zhen Ding Tech. Group Technology Holding Limited, and others.

The printed circuit board market is experiencing significant growth, largely attributed to the increasing adoption of advanced technologies such as 5G. Rising investments from both government and private organizations are further fueling this trend.

- In March 2024, Ericsson launched a new entity to facilitating 5G-driven digital transformation in the U.S. federal government, underscoring the vital role of 5G in enhancing national security, economic growth, and defense modernization initiatives.

As 5G technology advances, it is expected to create new opportunities for innovative PCB solutions, thereby propelling market growth in the coming years.

A printed circuit board is a flat, rigid structure that supports and connects electronic components using conductive tracks, and pads on a non-conductive substrate. PCBs serve as the foundation of most modern electronic devices, including smartphones, computers, industrial equipment, and automotive systems.

They are available in various types such as single-layer, double-layer, and multilayer boards, depending on the complexity of the circuitry. The design and fabrication of PCBs are crucial for ensuring efficient signal transmission, power distribution, and compact, reliable performance in diverse electronic applications.

Analyst’s Review

key players operating in the market are increasingly adopting strategies such as partnerships, acquisitions, and expansions to strengthen their product portfolios and gain a competitive edge. The rising demand for advanced PCBs, supported by the proliferation of technologies such as 5G, automotive electronics, and Internet of Things (IoT) devices, is prompting companies to enhance their manufacturing capabilities and geographic reach.

- In April 2024, TTM Technologies Inc., a global leader in RF components and advanced printed circuit boards, inaugurated its first manufacturing plant in Penang, Malaysia, with a USD 200 million investment. The facility, located in Penang Science Park, features advanced automated PCB manufacturing capabilities.

- In November 2023, Jabil Inc. expanded its operations by opening a third production facility in Chihuahua, Mexico, spanning over 250,000 square feet. This expansion aims to support key industries, including energy, automotive, healthcare, and retail, enhancing operational efficiency and flexibility.

These developments reflect the growing demand for advanced PCBs across multiple sectors, fueled by increasing technology adoption and industrial expansion.

Printed Circuit Board Market Growth Factors

The increasing global demand for smartphones, laptops, tablets, and wearables is propelling the growth of the printed circuit board market. With consumer preferences shifting toward more compact, lightweight, and feature-rich devices, manufacturers are seeking high-density, multilayer printed circuit boards to accommodate complex electronic components in limited space.

These advanced printed circuit boards support faster processing, greater functionality, and enhanced performance while minimizing the device's form factor. The evolution of smart devices is highlighting the need for compact, efficient, and specialized printed circuit boards. This trend is prompting manufacturers to innovate, which is further propelling the expansion of the market.

The market is facing challenges due to the rising costs of raw materials, particularly copper and rare metals, which significantly affect profitability. Additionally, the increasing complexity of electronic devices requires more advanced manufacturing processes, leading to higher production costs and quality control issues.

Stricter environmental regulations concerning e-waste disposal and sustainable production further complicate operations for manufacturers.

To address these challenges, key players are investing in automation technologies to enhance production efficiency and reduce labor costs. They are further exploring the use of alternative, cost-effective materials to lessen the dependency on expensive raw components.

Companies are offering better pricing and ensuring supply chain stability, which is expected to boost the growth of the printed circuit board market in the coming years.

Printed Circuit Board Industry Trends

The increasing demand for printed circuit boards in the consumer electronics industry is prompting governments and organizations to initiate programs focused on raising awareness and providing essential training in PCB manufacturing.

- In February 2024, UMass Lowell established the Massachusetts Electronics Manufacturing Evolution (MEME) laboratory, funded by a USD 500,000 Massachusetts Skills Capital Grant to train students and industry professionals in PCB design and fabrication techniques.

Such initiatives are crucial for developing a skilled workforce capable of meeting the industry's evolving needs. By fostering innovation and enhancing technical expertise, these programs position various regions as leaders in PCB technology. This focus on education and training is further bolstering the progress of the market.

Companies in the consumer electronics industry are increasingly developing wearable Internet of Things (IoT) devices to reduce users' reliance on smartphones. These devices vary from basic, affordable options such as smartwatches and thermostats to advanced solutions, including smart home automation systems, smart clothing, hearables, and smart glasses.

Such innovations are transforming users workflows, communication, and manage task management. The growing usage and popularity of consumer IoT devices indicate a sustained trend, supported by rising consumer demand for more affordable, faster, and safer solutions.

- According to Ericsson, short-range IoT devices, particularly smart home appliances, are projected to reach 25.15 billion units by 2027.

This surging demand is fostering competition and propelling the development of the printed circuit board market .

Segmentation Analysis

The global market has been segmented based on type, material, end user, and geography.

By Type

Based on type, the market jhas been categorized into single-sided, double-sided, multilayer PCB, rigid, flexible, and others. The multilayer PCB segment led the printed circuit board market in 2023, reaching a valuation of USD 32.90 billion. This growth is mainly stimulated by the increasing demand for compact, high-performance electronic devices across consumer electronics, automotive, telecommunications, and healthcare industries.

These multilayer PCBs enhance functionality, provide design flexibility, and improve signal integrity, making them ideal for complex applications such as smartphones, advanced driver-assistance systems (ADAS), and medical devices. With industries focusing on miniaturization and advanced technologies such as 5G and IoT, the demand for multilayer PCBs is surging.

This segment is projected to experience robust growth as manufacturers focus on innovation and new product development to meet evolving industry requirements.

By Material

Based on material, the market has been categorized into FR-4, polyimide, metal, and ceramic. The FR-4 segment captured the largest market share of 66.90% in 2023. This expansion is largely attributed to its flame-resistant glass-reinforced epoxy laminate material.

FR-4 is widely used in various industries due to its excellent electrical insulation, mechanical strength, and thermal resistance, making it a preferred choice for manufacturing multi-layer PCBs. This growth is further supported by the rising demand for consumer electronics, automotive electronics, and telecommunications equipment.

With the increasing demand for reliable and cost-effective PCB materials, FR-4 is gaining immense traction for its versatility and durability. The segment is expected to witness notable expansion as industries adopt advanced technologies such as 5G, IoT, and electric vehicles (EVs).

By End User

Based on end user, the market has been categorized into automotive, healthcare, telecommunication, industrial, consumer electronics, and others. The consumer electronics segment is expected to garner the highest revenue of USD 45.58 billion by 2031.

Increasing demand for smartphones, tablets, wearables, gaming consoles, and smart home devices is highlighting the need for compact, high-performance PCBs. As consumer electronics become more advanced, manufacturers require PCBs with higher layer counts, smaller footprints, and improved thermal management capabilities to support intricate designs.

Technological advancements such as 5G, IoT, and artificial intelligence (AI) are further boosting the demand for sophisticated PCBs in this segment. The rising trend of miniaturization and multifunctionality in devices is expected to stimulate the expansion of the consumer electronics segment.

Printed Circuit Board Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific printed circuit board market accounted for the largest share of 45.87% in 2023, with a valuation of USD 37.53 billion. This dominance is reinforced by lower production costs, enhanced management efficiency, and a strong supply chain infrastructure.

China’s leadership in manufacturing, supported by a complete PCB ecosystem spanning raw materials to finished products, is boosting regional market growth. The rrelocation of global PCB production to the region is fostered by advancmenets in sectors such as medical devices, electric vehicles, and consumer electronics. Additionally, collaborative initiatives in the region are promoting innovation.

- In March 2023, T-Works, India’s largest prototyping center, partnered with Qualcomm to set up an advanced multilayer PCB fabrication facility, promoting innovation in medical devices, electric vehicles, and consumer electronics.

North America is anticipated to witness significant growth, registering a CAGR of 5.48% over the forecast period. The region's focus on technological innovation, particularly with the adoption of 5G, autonomous vehicles, and advanced medical devices, is boosting demand for high-performance PCBs.

The regional market is seeing increased investments in reshoring manufacturing operations to reduce reliance on foreign suppliers and enhance supply chain resilience.

The United States, in particular, is focusing on strengthening its domestic PCB manufacturing capacity through government initiatives and defense sector investments. These factors, along with rising demand for consumer electronics and industrial automation, are supporting the sustained growth of the North America market.

Competitive Landscape

The global printed circuit board market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Printed Circuit Board Market

Key Industry Developments

- January 2024 (Collaboration): Amber Group signed an agreement with Korean Circuit, acquiring a 60% stake in the South Korean firm. This strategic collaboration aims to enhance Amber Group's printed circuit board (PCB) portfolio across various applications and strengthen its market presence.

- January 2024 (Product Launch): Jiva Materials, in partnership with the University of Portsmouth, launched Soluboard, a new laminate designed to replace the glass fiber epoxy used in most PCBs. This innovation seeks to tackle the global e-waste problem and reduce carbon emissions, pollution, and environmental impact.

The global printed circuit board market is segmented as:

By Type

- Single-Sided

- Double-Sided

- Multilayer PCB

- Rigid

- Flexible

- Others

By Material

- FR-4

- Polyimide

- Metal

- Ceramic

By End User

- Automotive

- Healthcare

- Telecommunication

- Industrial

- Consumer Electronics

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America