Traction Control System Market Size

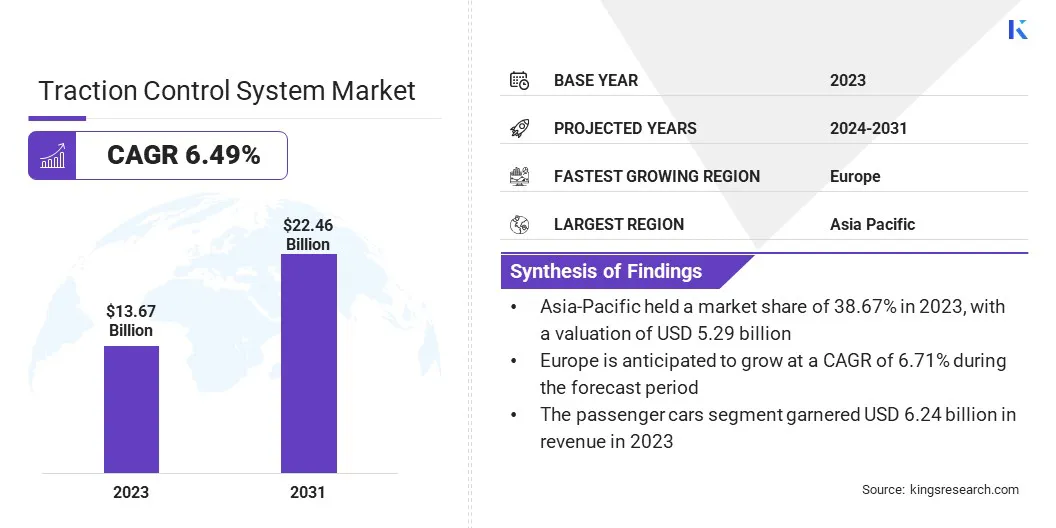

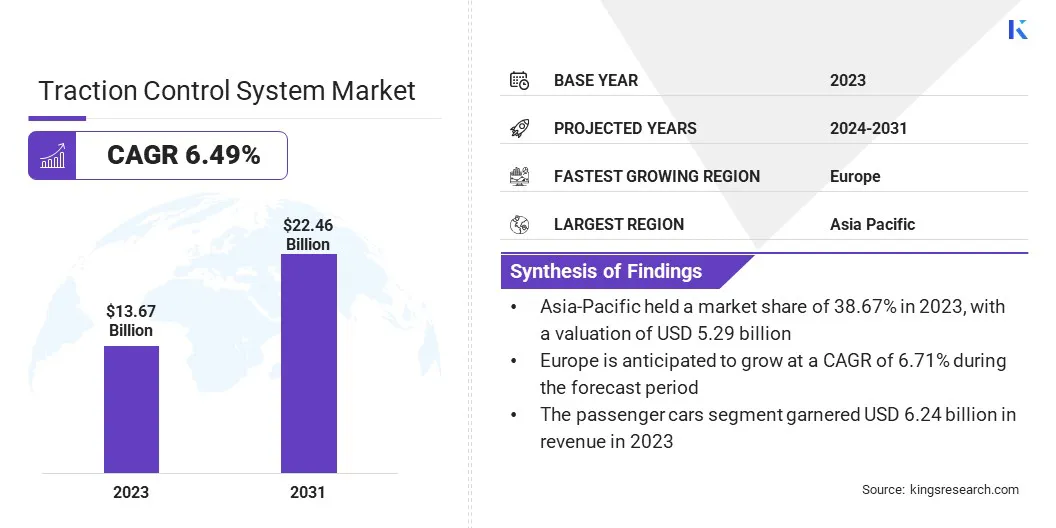

The global Traction Control System Market size was valued at USD 13.67 billion in 2023 and is projected to grow from USD 14.47 billion in 2024 to USD 22.46 billion by 2031, exhibiting a CAGR of 6.49% during the forecast period.

The expansion of the market is driven by increasing vehicle safety regulations, surging consumer demand for advanced safety features, rising vehicle sales, and the advancement of electric and autonomous vehicles.

In the scope of work, the report includes solutions offered by companies such as Autoliv, Continental AG, Ducati Motor Holding S.p.A, Eaton Cummins Automated Transmission Technologies, Hyundai Motors, Robert Bosch GmbH, ADVICS Asia Pacific Co.,Ltd, BMW AG, MAHLE GmbH, ZF Friedrichshafen AG, and others.

The expansion of the traction control system market is mainly fueled by the increasing demand for safety features in vehicles. Regulatory bodies across various regions mandate safety systems in automobiles, which is aiding market growth. Rising disposable income and technological advancements contribute to rise in vehicle sales, thereby propelling the growth of the market.

Additionally, the surge in electric vehicle (EV) production, which often incorporates advanced safety features, fuels demand. Moreover, the focus on reducing road accidents and improving vehicle stability boosts the adoption of traction control systems. The integration of TCS with other advanced driver assistance systems (ADAS) supports market growth by addressing the growing consumer preference for comprehensive vehicle safety solutions.

The traction control system is an integral component of modern vehicles, designed to enhance stability and control by preventing wheel slip during acceleration. The market encompasses various vehicle types, including passenger cars, commercial vehicles, and electric vehicles, reflecting its broad applicability.

Key market players are investing significantly in research and development to innovate and improve TCS technology. Additionally, the increasing production of electric and autonomous vehicles, which require sophisticated safety systems, stimulates market growth. The market is characterized by intense competition among established automotive manufacturers and emerging technology firms.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), the global production of motor vehicles increased by 10.27% in 2023 from 2022.

The traction control system (TCS) is a safety feature designed to prevent wheel slip and loss of traction during acceleration. It operates by detecting wheel spin and automatically applying brakes or reducing engine power to maintain optimal grip and vehicle stability.

TCS is typically integrated with the vehicle’s electronic stability control (ESC) system, working in conjunction with anti-lock braking systems (ABS) and other safety mechanisms. This integration is crucial for maintaining control on slippery or uneven road surfaces, thereby enhancing overall vehicle safety.

Analyst’s Review

Manufacturers are increasingly focusing on innovation and research to enhance traction control systems, aiming to improve vehicle safety and performance. New products with advanced features, such as integrated ADAS and real-time data processing, are being introduced to the market, addressing the growing consumer demand for comprehensive safety solutions.

- For instance, in July 2024, Ducati launched the Panigale V2 Superquadro Final Edition as a tribute to the Superquadro engine. This limited-edition model featured a 955 cc Superquadro engine and incorporated advanced technologies such as DLC-coated rocker arms and a monocoque chassis. It included enhanced electronics such as Ducati Quick Shift (DQS) EVO 2 and Ducati Traction Control (DTC) EVO 2. The special edition showcased unique styling elements and was accompanied by a certificate of authenticity, highlighting the engine's legacy of over thirty years.

Moreover, companies are forming strategic partnerships to share technology and reduce production costs, making TCS more accessible. It is recommended that manufacturers continue to invest in developing cost-effective and efficient TCS technologies. Additionally, expanding the integration of TCS in electric and autonomous vehicles is likely to be crucial for maintaining competitiveness.

Traction Control System Market Growth Factors

Consumers and regulatory authorities are increasingly prioritizing safety features in vehicles, prompting manufacturers to integrate advanced systems such as TCS. Governments worldwide are implementing stringent safety regulations that require the inclusion of traction control systems in both new and existing vehicles.

This regulatory initiative is ensuring a steady demand for TCS across various vehicle segments.

Additionally, technological advancements are making TCS more efficient and cost-effective, promoting its wider adoption. As consumers become more safety-conscious, the demand for vehicles equipped with traction control systems is continuously increasing, thereby propelling the traction control system market growth.

The high cost associated with advanced TCS technology presents a barrier to widespread adoption, especially in developing regions. To overcome this challenge, manufacturers are focusing on cost-reduction strategies through innovation and economies of scale. Investing in research and development to produce more efficient and affordable TCS solutions is crucial.

Additionally, forming strategic partnerships and collaborations helps share technological advancements and reduce production costs. By making TCS more accessible and affordable, manufacturers are expanding their market reach and catering to a broader customer base, thereby boosting market growth despite the cost challenges.

Traction Control System Industry Trends

The increasing integration of advanced driver assistance systems (ADAS) is a significant trend impacting the market. As vehicle technology evolves, manufacturers are incorporating more sophisticated ADAS features, which include traction control as a critical component. These systems collectively contribute to enhancing overall vehicle safety and performance.

Consumers are demanding more comprehensive safety packages, prompting automakers to invest in and develop integrated solutions. This trend is leading to the widespread adoption of traction control systems, as they are essential for the effective functioning of ADAS. The shift toward autonomous driving technology further fuels this trend.

The rise of electric vehicles (EVs) is another crucial trend reshaping the landscape of the traction control system industry. As the automotive industry shifts toward sustainable and eco-friendly solutions, EVs are gaining immense popularity. These vehicles are often equipped with advanced safety features, including traction control systems, to ensure optimal performance and safety.

The growing EV market is fostering innovation in TCS technology, as manufacturers aim to provide enhanced stability and control specific to electric powertrains. Additionally, government incentives and policies promoting EV adoption are boosting the demand for advanced safety systems, including TCS, thereby impacting market dynamics and bolstering technological advancements.

Segmentation Analysis

The global market is segmented based on vehicle type, component, linkage, and geography.

By Vehicle Type

Based on vehicle type, the market is categorized into passenger cars, LCVS, HCVS, and others (2 wheelers & 3 wheelers). The passenger cars segment led the traction control system market in 2023, reaching a valuation of USD 6.24 billion.

This expansion is mainly propelled by the high demand for safety features in passenger vehicles, as consumers prioritize safety and stability. Passenger cars are being increasingly equipped with advanced safety systems, including traction control, in response to stringent regulatory requirements and growing consumer awareness.

Additionally, the rising disposable income and rapid urbanization in emerging markets contribute to increased passenger car sales, thus boosting the demand for traction control systems. Automakers are focusing on integrating TCS in new models to meet safety standards and consumer expectations, thereby augmenting segmental growth.

By Component

Based on component, the market is classified into hydraulic modulators, wheel-speed sensors, and electronic control module. The wheel-speed sensors segment is poised to register significant growth at a CAGR of 7.56% through the forecast period (2024-2031).

This growth is attributed to the critical role wheel-speed sensors play in the effective functioning of traction control systems. These sensors provide real-time data on wheel speed, which is essential for detecting and preventing wheel slip. Advances in sensor technology, which enhances the accuracy and reliability of data, are leading to their widespread adoption.

Additionally, the increasing integration of wheel-speed sensors in various vehicle types, including electric and autonomous vehicles, is boosting segmental expansion. The focus on enhancing vehicle safety and performance continues to propel the growth of the segment.

By Linkage

Based on linkage, the market is segmented into mechanical and electric. The electric segment secured the largest traction control system market share of 65.44% in 2023. Electric systems offer superior performance, precision, and efficiency compared to mechanical systems, making them highly desirable in modern vehicles.

The shift toward electric vehicles (EVs) further supports this trend, as EVs often incorporate advanced electric traction control for optimal stability and safety. Additionally, regulatory mandates and the emphasis on greener, more efficient technologies are promoting the adoption of electric traction control systems.

Manufacturers are continuously innovating to enhance the capabilities of electric systems, solidifying their dominance in the market.

Traction Control System Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific traction control system market held a major share of around 38.67% in 2023, with a valuation of USD 5.29 billion. This dominance is attributed to the substantial growth of the automotive industry in countries such as China, Japan, and India. These countries are major manufacturing hubs, producing a high volume of vehicles equipped with advanced safety features.

Additionally, rising disposable incomes and rapid urbanization are resulting in the increased demand for passenger and commercial vehicles, thereby boosting regional market expansion.

Government regulations mandating vehicle safety systems and increasing consumer awareness about safety are further contributing to regional market development. The strong presence of leading automotive manufacturers in the region supports this dominance.

Europe is poised to experience significant growth at a CAGR of 6.71% through the projection period. This growth is facilitated by the region's stringent vehicle safety regulations and the strong emphasis on advanced safety features in automobiles.

The increasing production and widespread adoption of electric vehicles, supported by government incentives and environmental policies, are fostering the demand for traction control systems.

Additionally, Europe's automotive industry is known for its innovation and technological advancements, which is supporting domestic market growth. The region's focus on reducing road accidents and improving vehicle safety standards is enhancing the adoption of TCS, positioning Europe as a rapidly growing market.

Competitive Landscape

The global traction control system market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Traction Control System Market

- Autoliv

- Continental AG

- Ducati Motor Holding S.p.A

- Eaton Cummins Automated Transmission Technologies

- Hyundai Motors

- Robert Bosch GmbH

- ADVICS Asia Pacific Co.,Ltd

- BMW AG

- MAHLE GmbH

- ZF Friedrichshafen AG

Key Industry Developments

- April 2024 (Launch): The Bajaj Pulsar N250 was launched, introducing several enhancements, including a 37 mm upside-down front fork and a traction control system. The new model featured a full-digital instrument console with Bluetooth connectivity and ABS with three intervention levels: Rain, Road, and Off-Road. The traction control system could be deactivated in Off-Road mode, while the ABS remains active.

- February 2024 (Launch): Kawasaki launched its retro-styled Z650RS 2024 model and integrated it with a traction control system. This update aligned with Kawasaki's strategy to enhance safety and rider confidence, as previously implemented in the Versys 650 and Ninja 650. The Z650RS features a round LED headlight, digital-analog dials, single-piece seat, and alloy wheels, combining modern-retro styling with improved control and safety for riders.

The global traction control system market is segmented as:

By Vehicle Type

- Passenger Cars

- LCVs

- HCVs

- Others (2 Wheelers & 3 Wheelers)

By Component

- Hydraulic Modulators

- Wheel-Speed Sensors

- Electronic Control Module

By Linkage

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America