Market Definition

The market encompasses the collection, processing, and repurposing of end-of-life tires into reusable materials such as rubber, steel, and fibers. This industry plays a pivotal role in diverting waste tires from landfills, thereby mitigating environmental hazards and promoting sustainable waste management practices.

Tire recycling processes include mechanical shredding, ambient grinding, pyrolysis, and devulcanization, transforming discarded tires into products like crumb rubber, tire-derived fuel, and recycled carbon black.

These recycled materials find applications across various sectors, including construction, automotive, and manufacturing, contributing to the circular economy. The report provides insights into the key drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Tire Recycling Market Overview

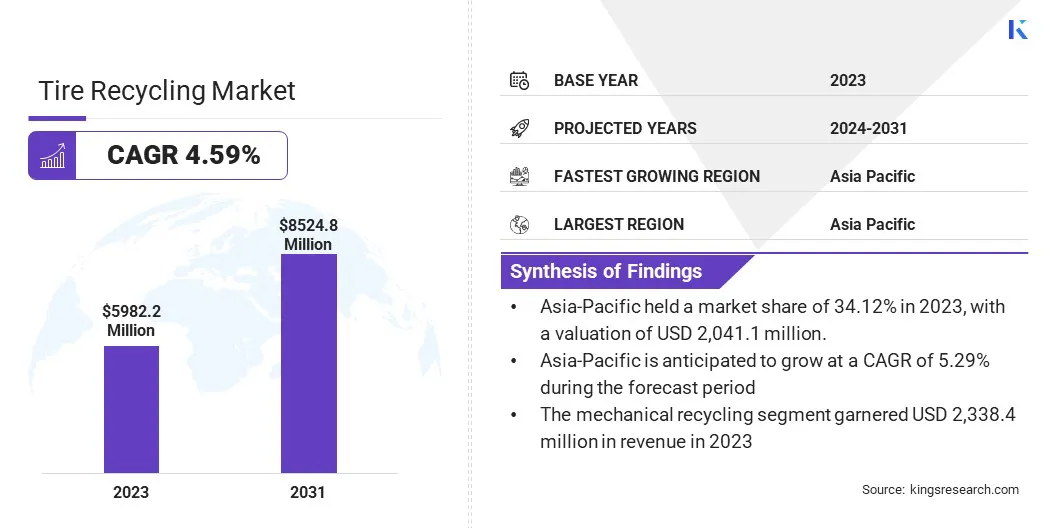

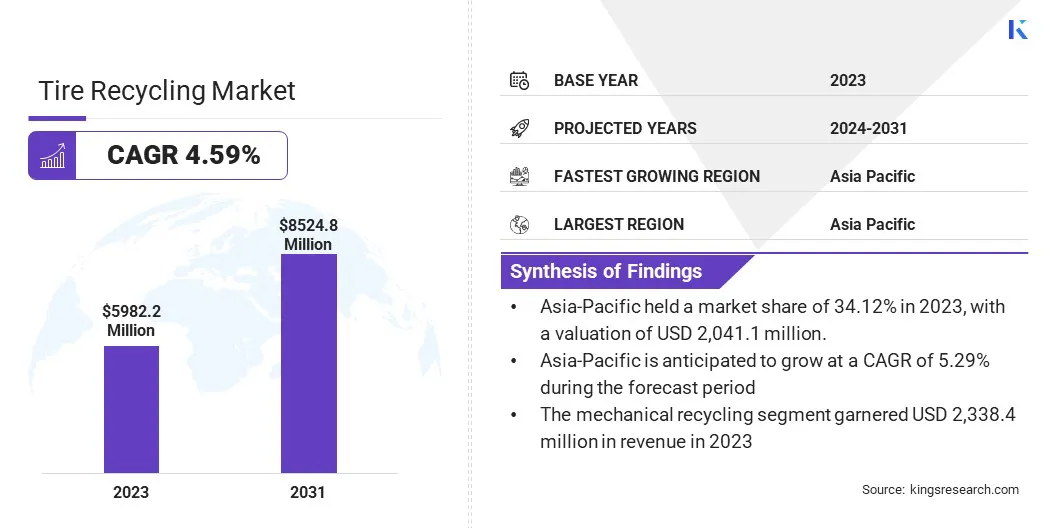

The global tire recycling market size was valued at USD 5,982.2 million in 2023 and is projected to grow from USD 6,226.8 million in 2024 to USD 8,524.8 million by 2031, exhibiting a CAGR of 4.59% during the forecast period. The market is experiencing steady growth, driven by increasing environmental concerns and stringent waste management regulations.

The rising demand for sustainable alternatives to traditional materials is further fueling this growth, with recycled tire products being widely used in applications such as asphalt production, playground surfaces, and automotive components.

Major companies operating in the tire recycling industry are Liberty Tire Recycling, Emanuel Tire, GENAN HOLDING A/S, Entech Inc., LakinTire.com, Continental AG, Bridgestone, Lehigh Technologies, Green Distillation Technologies, Michelin, Contec, APOLLO TYRES LTD, ResourceCo, GRP LTD, and BDS Tire Recycling.

Advancements in recycling technologies that improve the efficiency of processing and lower costs are contributing to the market's expansion. The growing focus on circular economy and reducing carbon footprints across industries is also playing a significant role in driving the demand for recycled tire materials.

- In April 2023, Bridgestone Americas, Inc. revealed the development of demonstration tires made with 75% recycled and renewable materials, such as recycled plastics, steel, and natural rubber from desert shrubs. These tires are intended for next-generation electric SUVs and crossovers, as part of Bridgestone's commitment to using 100% sustainable materials in its products by 2050.

Key Highlights

Key Highlights

- The tire recycling industry size was valued at USD 5,982.2 million in 2023.

- The market is projected to grow at a CAGR of 4.59% from 2024 to 2031.

- Asia-Pacific held a market share of 34.12% in 2023, with a valuation of USD 2,041.1 million.

- The mechanical recycling segment garnered USD 2,338.4 million in revenue in 2023.

- The passenger car tires segment is expected to reach USD 3,058.0 million by 2031.

- The energy generation segment is anticipated to witness the fastest CAGR of 5.17% during the forecast period

- The market in Europe is anticipated to grow at a CAGR of 4.98% during the forecast period.

Market Driver

"Rising Environmental Awareness"

The tire recycling market is experiencing robust growth, primarily driven by the increasing environmental awareness surrounding tire waste and the growing emphasis on sustainable waste management practices.

As concerns over landfill overflow and the environmental impact of non-recycled tires become more pronounced, governments, industries, and consumers are seeking solutions that mitigate these issues.

Traditional disposal methods, such as landfilling and incineration, contribute to pollution and waste accumulation, which is driving the demand for tire recycling as a more environmentally responsible alternative.

In response, tire recycling is gaining traction as it reduces waste but also recycles valuable materials like rubber, steel, and textile fibers, making it a key solution in reducing environmental harm and promoting sustainability.

- In December 2024, Trek Bicycle partnered with Liberty Tire Recycling to introduce a bike tire recycling program in all Trek-owned stores across North America. This initiative offers cyclists an eco-friendly solution for disposing of their old bike tires, contributing to waste reduction by repurposing the materials for applications such as landscaping and sustainable asphalt.

Market Challenge

"Limited Market for Recycled Materials"

One of the key challenges facing the tire recycling market is the limited market for recycled materials. Recycled tire products, such as rubber, are used in applications like asphalt, playground surfaces, and automotive parts, but the demand for these materials remains lower than the volume of tire waste generated annually.

Recycled products are often perceived as having lower performance compared to virgin materials, and cheaper alternatives are readily available. Additionally, the inconsistency in the quality of recycled tire products further limits their widespread adoption across various sectors.

To overcome this challenge, market players are focusing on expanding the range of applications for recycled tire materials and improving public perception. This includes educating consumers and businesses about the environmental benefits and long-term performance advantages of recycled tire products.

- In August 2023, Liberty Tire Recycling released its 2022 Environmental, Social, and Governance (ESG) report outlining the company's goal of achieving zero waste by 2030 and highlighting its efforts to advance sustainable products, enhance environmental stewardship, and engage local communities. The company collected over 195 million tires across the U.S. and Canada, producing 4.3 billion pounds of rubber for beneficial uses and avoiding more than 750,000 metric tons of CO₂ emissions.

Additionally, investments are being made in research and development to enhance the quality and performance of recycled materials, making them more competitive with virgin products.

Furthermore, governments are implementing policies to incentivize the use of recycled tire materials, such as offering subsidies or setting mandates for their use in public infrastructure projects, thereby creating a more stable demand for recycled products.

Market Trend

"Technological Advancements in Recycling Processes"

The tire recycling market is evolving rapidly due to technological advancements in recycling processes and expanding applications of recycled materials across various industries. A key trend is the development and implementation of advanced methods such as pyrolysis, cryogenic grinding, and solvent-based processes.

These innovations are improving efficiency, reducing costs, and enhancing the quality of recycled products, which makes tire recycling more economically viable and environmentally sustainable. Pyrolysis recycles rubber while producing valuable by-products like fuel oil, carbon black, and steel, creating new market opportunities.

Cryogenic grinding uses liquid nitrogen to freeze tires, yielding finer, higher-quality rubber particles for applications like sports surfaces and automotive parts. As industries prioritize sustainability, the adoption of these advanced recycling technologies is gaining momentum, facilitating a shift toward a circular economy.

- In October 2024, Bilfinger SE announced its role as the system integrator for Circtec’s innovative tire recycling plant in Delfzijl, the Netherlands. The facility employs Circtec’s CIF pyrolysis technology and it will process 200,000 tons of end-of-life tires annually, converting them into valuable chemicals and biofuels. The plant is expected to reduce CO₂ emissions by around 3% of the Netherlands' chemical industry emissions.

Tire Recycling Market Report Snapshot

|

Segmentation

|

Details

|

|

By Process

|

Mechanical Recycling, Pyrolysis, Crumb Rubber, Devulcanization

|

|

By Tire Type

|

Passenger Car Tires, Truck Tires, Off-the-Road (OTR) Tires, Others

|

|

By End Use Industry

|

Recycled Rubber Products, Road Construction & Asphalt, Energy Generation, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Process (Mechanical Recycling, Pyrolysis, Crumb Rubber, Devulcanization): The mechanical recycling segment earned USD 2,338.4 million in 2023 due to its widespread adoption and cost-effectiveness in processing used tires.

- By Tire Type (Passenger Car Tires, Truck Tires, Off-the-Road (OTR) Tires, and Others): The passenger car tires segment held 35.76% of the market in 2023, due to the high volume of tire waste generated from personal vehicles.

- By End Use Industry (Recycled Rubber Products, Road Construction & Asphalt, Energy Generation, and Others): The recycled rubber products segment is projected to reach USD 3,150.0 million by 2031, owing to the increasing demand for sustainable materials in various industries, including construction, automotive, and consumer goods.

Tire Recycling Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific tire recycling market share stood at around 34.12% in 2023, with a valuation of USD 2,041.1 million. This dominance is primarily attributed to the high volume of tire waste generated by rapidly expanding automotive industries in countries like China and India, coupled with increasing government support for sustainable waste management practices.

Asia Pacific tire recycling market share stood at around 34.12% in 2023, with a valuation of USD 2,041.1 million. This dominance is primarily attributed to the high volume of tire waste generated by rapidly expanding automotive industries in countries like China and India, coupled with increasing government support for sustainable waste management practices.

The presence of key recycling companies and advanced technologies has boosted capabilities, ensuring a steady supply of recycled materials to meet domestic and international demands.

The rising focus on environmental sustainability and the implementation of stricter regulations on tire disposal are further fueling the adoption of tire recycling technologies across Asia Pacific.

- In August 2024, Mitsubishi Chemical Group Corporation announced plans to chemically recycle end-of-life tires (ELTs) using coke ovens at its Kagawa Plant in Japan. The company aims to produce sustainable carbon black from end-of-life tires (ELTs) by March 2026, marking a world-first in utilizing coke ovens for this purpose, supporting the tire industry's shift toward sustainable materials.

The tire recycling industry in Europe is poised for significant growth at a robust CAGR of 4.98% over the forecast period. This growth is driven by the region’s stringent regulations on tire disposal and recycling, which are pushing industries to adopt more sustainable waste management practices.

Furthermore, Europe’s commitment to a circular economy and resource recovery is encouraging the expansion of tire recycling facilities and the use of recycled tire materials in various sectors, including construction and automotive. The demand for eco-friendly alternatives, such as rubber for road construction and energy generation, is also fueling the market's growth.

- In February 2024, MICHELIN, Antin Infrastructure Partners, and Scandinavian Enviro Systems revealed their plan to invest in the development of their inaugural end-of-life tire recycling plant in Uddevalla, Sweden. The facility will utilize Enviro's patented pyrolysis technology to process approximately 35,000 tons of used tires each year, generating valuable by-products such as recovered carbon black and pyrolysis oil.

Regulatory Frameworks

- In the European Union, the Waste Framework Directive (2008/98/EC) regulates the management of waste. It sets requirements for waste prevention, recycling, and disposal, with a strong focus on reducing the environmental impact of waste.

- In the United States, the Resource Conservation and Recovery Act (RCRA), administered by the Environmental Protection Agency (EPA), regulates the disposal of solid waste. It ensures that tire recycling activities are managed in an environmentally safe manner.

- In Japan, the Waste Management and Public Cleansing Law sets out guidelines for the proper disposal and recycling of waste. The law mandates tire manufacturers to participate in collection and recycling programs and ensures the safe processing of ELTs.

Competitive Landscape

The tire recycling industry is characterized by key players focusing on strategic initiatives to enhance their market position and expand their global reach. Companies are investing heavily in the development of advanced recycling technologies and the expansion of their processing capacities to meet the rising demand for sustainable waste management solutions.

Strategic partnerships and collaborations with waste management firms, manufacturers, and government bodies are common approaches to secure long-term contracts and increase recycling rates.

In addition, key players are optimizing cost efficiencies and taking initiatives to streamline supply chains through technological upgrades and process improvements.

Market players are aiming to expand their presence in emerging markets through acquisitions and joint ventures while focusing on eco-friendly recycling solutions that align with increasing regulatory pressures and consumer demand for sustainable practices.

- In July 2024, Continental AG revealed a 10-year partnership with Pyrum Innovations to procure high-quality recovered carbon black (rCB) from end-of-life tires. This collaboration is set to support Continental's commitment to circular economy principles by incorporating sustainable materials and enhancing closed-loop recycling efforts in tire production.

List of Key Companies in Tire Recycling Market:

- Liberty Tire Recycling

- Emanuel Tire

- GENAN HOLDING A/S

- Entech Inc.

- LakinTire.com

- Continental AG

- Bridgestone

- Lehigh Technologies

- Green Distillation Technologies

- Michelin

- Contec

- APOLLO TYRES LTD

- ResourceCo

- GRP LTD

- BDS Tire Recycling

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In March 2025, Klean Industries and Viva Energy launched a tire recycling project at the Geelong Refinery in Victoria, Australia. This collaboration aims to process up to 80,000 tonnes of end-of-life tires annually, transforming them into valuable resources such as biogenic pyrolysis oil and recovered carbon black.

- In February 2025, Tiger Infrastructure Partners invested in Bolder Industries to support its expansion. Bolder’s technology recycles end-of-life tires into sustainable materials like recovered carbon black and pyrolysis oil, with new facilities planned in Indiana and Belgium. This investment aims to meet the rising demand for circular economy products derived from tires.

- In September 2024, Bridgestone EMEA, Versalis and Grupo BB&G collaborated to create closed-loop ecosystem for recycling end-of-life tires (ELTs) back into new tires. Using BB&G’s thermomechanical pyrolysis technology, ELTs will be converted into tire pyrolysis oil (TPO), which Versalis will process into high-quality elastomers for Bridgestone to manufacture new tires.

- In June 2024, Neste, Borealis, and Covestro collaborated to recycle end-of-life tires into high-quality plastics for automotive parts. This partnership aims to enhance circularity within the automotive industry by transforming waste materials into valuable resources.

- In March 2023, Zeppelin Systems GmbH introduced the "Zeppelin Sustainable Tire Alliance" at the Tire Technology Expo in Hannover. This collaborative initiative unites global partners to drive sustainability in tire production and recycling, with a focus on improving resource efficiency and supporting a circular economy within the tire industry.

Key Highlights

Key Highlights Asia Pacific tire recycling market share stood at around 34.12% in 2023, with a valuation of USD 2,041.1 million. This dominance is primarily attributed to the high volume of tire waste generated by rapidly expanding automotive industries in countries like China and India, coupled with increasing government support for sustainable waste management practices.

Asia Pacific tire recycling market share stood at around 34.12% in 2023, with a valuation of USD 2,041.1 million. This dominance is primarily attributed to the high volume of tire waste generated by rapidly expanding automotive industries in countries like China and India, coupled with increasing government support for sustainable waste management practices.