Market Definition

The tire material market encompasses the production and application of elastomers, reinforcing fillers, plasticizers, chemicals, metal reinforcements, and textile reinforcements in manufacturing tires for passenger cars, LCVs, and HCVs across radial, bias, and solid tire segments, focusing on performance, durability, and sustainability.

Tire Material Market Overview

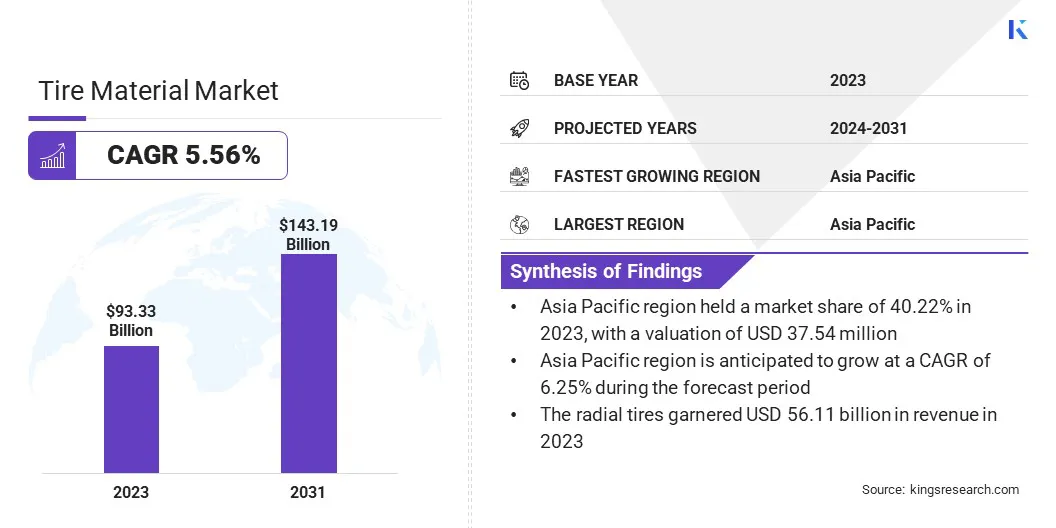

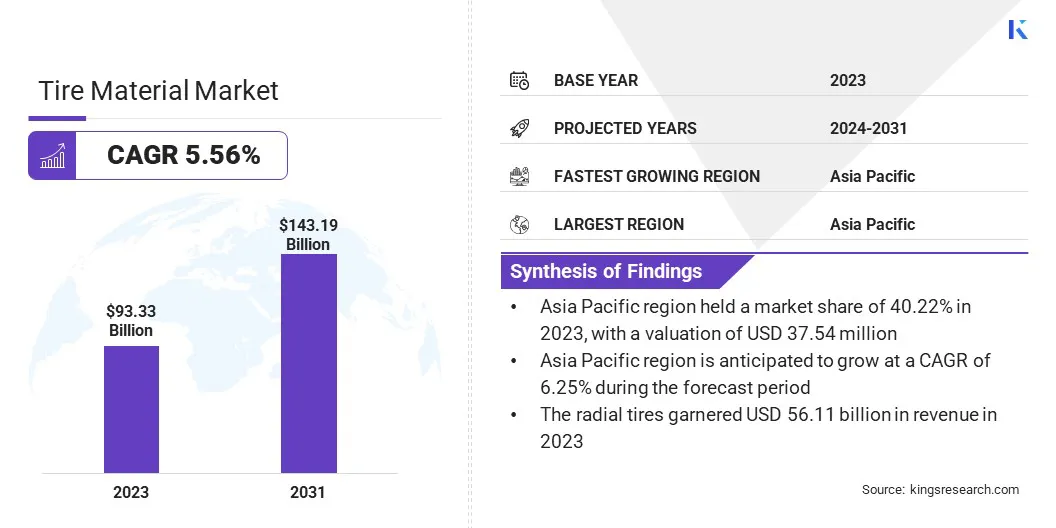

The global tire material market size was valued at USD 93.33 billion in 2023 and is projected to grow from USD 98.02 billion in 2024 to USD 143.19 billion by 2031, exhibiting a CAGR of 5.56% during the forecast period. This growth is driven by increasing production of vehicles, rising demand for fuel-efficient tires, and advancements in material technology.

The shift toward sustainable and high-performance materials, such as silica-based compounds, bio-based elastomers, and recycled rubber, is reshaping the industry by enhancing durability, improving fuel efficiency, and reducing environmental impact, aligning with evolving regulatory and consumer demands.

Major companies operating in the global tire material industry are ARLANXEO, Cabot Corporation, SABIC, Birla Carbon, Exxon Mobil Corporation, BASF, ARLANXEO, Celanese Corporation, Evonik Industries, Huntsman International LLC., W. R. Grace & Co.-Conn., Orion Engineered Carbons GmbH, INEOS Capital Limited, Mitsubishi Chemical Group Corporation, Sumitomo Chemical Co., Ltd., and others.

The market is evolving with advancements in high-performance and sustainable materials, driving innovation in durability, efficiency, and environmental impact.

Manufacturers are integrating cutting-edge elastomers and recycled components to meet the demands of modern vehicles. This shift ensures long-term industry growth, aligning with performance, safety, and sustainability goals.

- In September 2024, Bridgestone launched the Potenza Sport tire, featuring 55% ISCC PLUS-certified recycled and renewable materials. This initiative aims to support the shift toward sustainability, advanced elastomers, and eco-friendly reinforcements to enhance performance and reduce environmental impact.

Key Highlights:

- The global tire material market size was recorded at USD 93.33 billion in 2023.

- The market is projected to grow at a CAGR of 5.56% from 2024 to 2031.

- Asia-Pacific held a share of 40.22% in 2023, valued at USD 37.54 billion.

- The elastomers segment garnered USD 35.47 billion in revenue in 2023.

- The passenger cars segment is expected to reach USD 53.12 billion by 2031.

- The radial tires segment is projected to generate a revenue of USD 77.07 billion by 2031.

- North America is anticipated to grow at a CAGR of 5.39% over the forecast period.

Market Driver

"Advancements in High Performance Tire Materials"

The tire material market is witnessing significant growth due to continuous advancements in high-performance materials that enhance fuel efficiency, durability, and safety. Manufacturers are focusing on materials that reduce rolling resistance, improve grip, and extend tire lifespan to cater to the needs of both traditional and electric vehicle.

Innovations such as silica-reinforced rubber compounds, advanced elastomers, and next-generation synthetic polymers are improving wear resistance, traction, and overall performance. These materials optimize fuel efficiency and reduce carbon emissions by minimizing energy loss and enhancing tread longevity.

- In May 2024, Bridgestone India launched the Dueler All-Terrain 002, a premium SUV and 4x4 tire designed for enhanced grip, stability, and durability across on-road and off-road terrains. Featuring 5 Rib-technology and advanced tread design, it ensures superior wear life and handling

Market Challenge

"Volatility in Raw Material Prices and Supply Chain Disruptions"

A key challenge hampering the growth of the tire material market is the volatility of raw material prices, particularly for natural and synthetic rubber. Fluctuations in crude oil prices directly impact synthetic rubber costs, while climate change and geopolitical factors affect natural rubber supply.

This uncertainty creates pricing pressures on manufacturers and disrupts supply chains. Adopting alternative materials like bio-based elastomers and recycled rubber, along with strategic sourcing, supplier diversification, and localized production, can help stabilize costs and reduce market dependency, ensuring production efficiency amid economic fluctuations.

Market Trend

"Increasing Adoption of Recycled and Sustainable Materials"

A significant trend influencing the tire material market is the increasing use of recycled and sustainable materials in production. As sustainability gains importance, manufacturers are incorporating reclaimed rubber, recycled carbon black, and bio-based polymers to reduce environmental impact and meet regulatory requirements for greener manufacturing.

Circular economy initiatives are fueling end-of-life tire recycling, closed-loop material recovery systems, and eco-friendly production. Advancements in pyrolysis technology are enabling the efficient extraction of valuable raw materials from used tires, further promoting sustainability.

Manufacturers are intensifying their efforts to develop high-performance sustainable tire materials that offer durability, fuel efficiency, and reduced carbon footprints without compromising safety or performance standards.

- In August 2024, the Mitsubishi Chemical Group (MCG Group) accelerated its chemical recycling of end-of-life tires (ELTs) at its Kagawa Plant leveraging coke oven technology , aiming to commercialize sustainable carbon black by March 2026.

Tire Material Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material Type

|

Elastomers, Reinforcing Fillers, Plasticizers, Chemicals, Metal Reinforcements, Textile Reinforcements

|

|

By Vehicle Type

|

Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Off-the-Road (OTR) Vehicles

|

|

By Tire Type

|

Radial Tires, Bias Tires, Solid Tires

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material Type (Elastomers, Reinforcing Fillers, Plasticizers, Chemicals, Metal Reinforcements, and Textile Reinforcements): The elastomers segment earned USD 35.47 billion in 2023 due to the critical role of natural and synthetic rubber in enhancing tire performance, durability, and resilience.

- By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), and Off-the-Road (OTR) Vehicles): The passenger cars segment held a share of 38.12% in 2023, fueled by the high global demand for personal vehicles, rising disposable income, and rapid urbanization.

- By Tire Type (Radial Tires, Bias Tires, and Solid Tires): The radial tires segment is projected to reach USD 77.07 billion by 2031, owing to its enhanced durability, fuel efficiency, and high-speed stability.

Tire Material Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific tire material market share stood at around 40.22% in 2023, valued at USD 37.54 billion. This dominance is reinforced by rapid industrialization, expanding automotive production, and rising vehicle ownership across key economies such as China, India, and Japan.

The region's strong presence of leading tire manufacturers, coupled with increasing investments in advanced material technologies, is further fueling regional market growth.

Additionally, government initiatives promoting infrastructure development and fuel efficiency standards are accelerating demand for high-performance and sustainable tire materials. The availability of low-cost raw materials and labor strengthens Asia Pacific’s position as a global manufacturing hub.

North America tire material industry is poised to grow at a CAGR of 5.39% over the forecast period, charaterized by strong demand for high-performance and sustainable tire materials. The regional market benefits from a well-established automotive industry, advanced manufacturing capabilities, and continuous innovations in tire technology.

The increasing adoption of electric vehicles (EVs) and stringent fuel efficiency regulations are prompting manufacturers to develop low-rolling-resistance and eco-friendly tire materials that enhance vehicle efficiency and reduce carbon emissions.

- In May 2024, the Tire Industry Association (TIA) and the U.S. Tire Manufacturers Association (USTMA) established the Tire Recycling Foundation. This initiative will fund research, education, and projects addressing gaps in the U.S. tire recycling supply chain. The foundation aims to achieve 100% recycling of end-of-life tires into sustainable markets.

Regulatory Frameworks

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) oversees tire safety by setting performance, durability, and quality standards. It ensures compliance with traction, endurance, and environmental resistance requirements to enhance road safety, fuel efficiency, and overall vehicle performance.

- In Europe, the European Union sets regulations for tire materials, focusing on safety, environmental impact, and performance. These standards support sustainability goals, fuel efficiency, and consumer safety standards while promoting innovation in eco-friendly and high-performance tire technologies across member states.

- In India, the Ministry of Road Transport and Highways monitors tire quality and safety standards, while the Bureau of Indian Standards (BIS) sets specifications for durability, load capacity, and manufacturing quality, ensuring compliance with industry benchmarks for safety and efficiency.

Competitive Landscape

The global tire material market is witnessing continuous advancements in material technology, sustainability initiatives, and strategic partnerships. Leading manufacturers are investing heavily in R&D to develop high-performance, fuel-efficient, and eco-friendly materials, such as bio-based elastomers and innovative synthetic rubber compounds.

Companies are expanding their global footprint through mergers, acquisitions, and collaborations with automotive OEMs and tire manufacturers to strengthen their market position. Additionally, the growing demand for electric vehicle (EV) tires has accelerated innovation, focusing on lightweight, durable, and noise-reducing tire materials.

Competitive pricing, supply chain efficiency, and compliance with regional quality and safety standards remain critical for market leadership, with ongoing consolidation and technological advancements shaping the industry.

- In July 2024, Continental Tires launched the ExtremeContact XC7, integrating ContiSeal and ContiSilent technologies. ContiSeal automatically seals punctures up to 5mm, preventing air loss, while ContiSilent reduces noise using polyurethane foam.

List of Key Companies in Tire Material Market:

- ARLANXEO

- Cabot Corporation

- SABIC

- Birla Carbon

- Exxon Mobil Corporation

- BASF

- ARLANXEO

- Celanese Corporation

- Evonik Industries

- Huntsman International LLC.

- W. R. Grace & Co.-Conn.

- Orion Engineered Carbons GmbH

- INEOS Capital Limited

- Mitsubishi Chemical Group Corporation

- Sumitomo Chemical Co., Ltd.

Recent Developments (M&A/New Product Launch)

- In March 2025, Orion S.A. was recognized as a “Key Innovator” on the European Commission’s Innovation Radar for pioneering the production of circular carbon black from 100% pyrolysis oil derived from end-of-life tires. This market-ready material offers a sustainable alternative to fossil-based carbon black.

- In March 2025, Nokian Tyres launched Seasonproof 2, an all-season tire for the Central European market. The tire range consists of up to 38% renewable, recycled, and ISCC PLUS-certified materials, including 2% from bio-based, bio-circular, or circular feedstock using the ISCC PLUS mass balance approach.

- In September 2024, BASF launched an innovative tire material solution under its ChemCycling initiative, enhancing durability, fuel efficiency, and sustainability.

- In December 2024, CEAT acquired Camso’s off-highway tires and tracks business from Michelin. This acquisition enhances CEAT’s expertise in reinforced tire materials and expands its portfolio in the specialty and off-highway tire segment.