Market Definition

The market focuses on the production of TPO materials, which are widely used for their durability, flexibility, and resistance to heat, chemicals, and UV radiation. The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Thermoplastic Polyolefin Market Overview

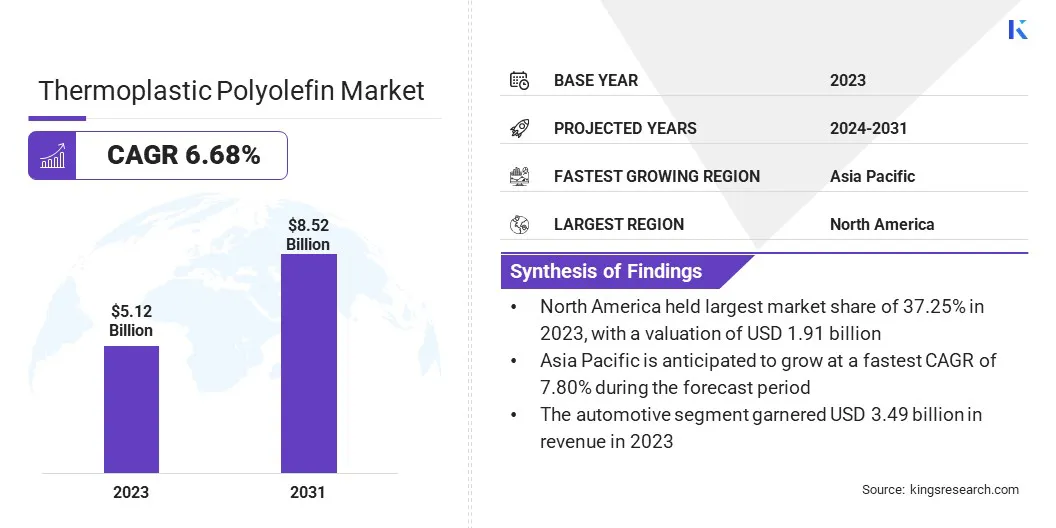

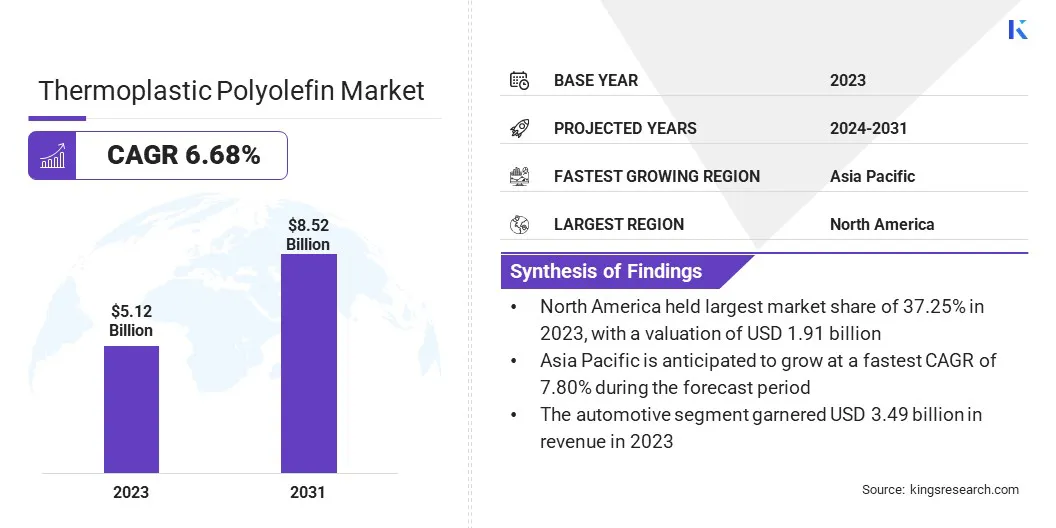

Global thermoplastic polyolefin market size was USD 5.12 billion in 2023, which is estimated to be valued at USD 5.42 billion in 2024 and reach USD 8.52 billion by 2031, growing at a CAGR of 6.68% from 2024 to 2031.

This growth is mainly driven by the rising adoption of solar energy, with TPO membranes gaining popularity in rooftop solar systems due to their durability, UV resistance, and ability to withstand high temperatures and environmental conditions.

Major companies operating in the thermoplastic polyolefin industry are Dow, Mitsui Chemicals, Inc., Exxon Mobil Corporation, SABIC, Sumitomo Chemical Company, LyondellBasell Industries Holdings B.V., INEOS, Borealis AG, Formosa Plastics Corporation, Johns Manville, Aurora Material Solutions, Noble Polymers, HEXPOL AB, Arkema, RTP Company, and others.

The growth of the market is propelled by increasing demand for lightweight, durable, and cost-effective materials across automotive, construction, and packaging sectors. TPO’s excellent properties, such as UV resistance, flexibility, and chemical stability, make it ideal for automotive bumpers, roofing membranes, and consumer goods.

As the focus shift toward sustainability, TPO’s recyclability and biodegradability further enhance its market appeal. The growing adoption of eco-friendly materials and innovations in TPO formulations contributes to sustained market expansion.

- In Feb 2025, researchers from Shenyang University of Chemical Technology, Jilin University, and collaborators developed a high-performance polylactic acid (PLA) blend using a novel TPO(NV) elastomer. By introducing TPO(NV)-g-(GMA-co-St) and dibutyl itaconate (DBI) as dual compatibilizers, they significantly improved compatibility, toughness, and crystallinity. This advancement offers a cost-effective solution for expanding PLA’s applications in biodegradable materials.

Key Highlights:

- The thermoplastic polyolefin industry size was recorded at USD 5.12 billion in 2023.

- The market is projected to grow at a CAGR of 6.68% from 2024 to 2031.

- North America held a market share of 37.25% in 2023, with a valuation of USD 1.91 billion.

- The compounded TPO segment garnered USD 1.73 billion in revenue in 2023.

- The polyethylene segment is expected to reach USD 5.32 billion by 2031.

- The injection Molding segment accounted for a share of 46.89% in 2023.

- The medical segment is anticipated to grow at a CAGR of 7.60% between 2024 and 2031.

- Asia Pacific is estimated to grow at a CAGR of 7.80% during the forecast period.

Market Driver

"Rising Adoption of Solar Energy"

The rising adoption of solar energy is boosting the growth of the thermoplastic polyolefin (TPO) market. As the demand for energy-efficient solutions grows, TPO membranes are increasingly utilized in rooftop solar systems due to their superior durability, UV resistance, and weathering performance.

This trend is further fueled by the need for long-lasting roofing materials that can withstand the high temperatures and environmental conditions associated with solar panel installations. The integration of TPO membranes in solar applications is further fostering expansion and innovation.

- In February 2023, BASF partnered with Oriental Yuhong, a leading TPO roofing membrane producer in China, to develop advanced solar rooftop solutions. The collaboration focuses on enhancing TPO membranes with BASF’s optimized Tinuvin and Chimassorb formulations, increasing durability and performance to meet China's updated GB55030 standards for solar installations.

Market Challenge

"Limited Awareness of TPO's Benefits"

A significant challenge hindering the growth of the thermoplastic polyolefin market is limited awareness of its advantages, particularly in regions with underdeveloped manufacturing industries. This lack of knowledge can slow market adoption and hinder the widespread use of TPO in key sectors such as automotive, construction, and renewable energy.

To address this challenge, industry stakeholders can invest in educational initiatives, targeted marketing, and collaboration with local manufacturers to showcase TPO’s benefits, such as cost-effectiveness, durability, and sustainability.

Market Trend

"Notable Shift Toward Sustainable Recycling Methods"

The thermoplastic polyolefin (TPO) market is witnessing a growing trend toward more sustainable and efficient recycling methods. As environmental concerns intensify, industries are increasingly adopting cleaner, solvent-free technologies that enhance the recyclability of materials.

This shift reflects a rising focus on sustainability, which is expected to create a demand for TPO products, aligning with the growing need for eco-friendly and energy-efficient solutions in various applications.

- In March 2025, researchers from Northwestern University developed a solvent-free technique to decompose plastic waste, specifically targeting polyethylene terephthalate (PET).

While not directly related to Thermoplastic Polyolefin (TPO), the method offers a cleaner, more sustainable approach to plastic recycling, which could impact broader polymer-based industries, including TPO.

Thermoplastic Polyolefin Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

In-situ TPO, Compounded TPO, Polyolefin Elastomers (POEs), Thermoplastic Vulcanizates (TPVs), Olefinic Block Copolymers (OBCs)

|

|

By Raw Material

|

Polypropylene, Polyethylene, Ethylene Propylene Rubber (EPR/EPDM)

|

|

By Processing Method

|

Injection Molding, Extrusion, Blow-Molding, Others

|

|

By Application

|

Automotive, Building & Construction, Medical, Wire and cables, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type [In-situ TPO, Compounded TPO, Polyolefin Elastomers (POEs), Thermoplastic Vulcanizates (TPVs), and Olefinic Block Copolymers (OBCs)]: The compounded TPO segment earned USD 1.73 billion in 2023, fueled by increasing demand for durable, energy-efficient materials in various industries.

- By Raw Material (Polypropylene, Polyethylene, Ethylene Propylene Rubber (EPR/EPDM)): The polypropylene segment held a share of 67.78% in 2023, propelled by its versatility, cost-effectiveness, and widespread application in automotive, construction, and packaging industries.

- By Processing Method (Injection Molding, Extrusion, Blow-Molding, and Others): The injection molding segment is projected to reach USD 4.08 billion by 2031, propelled by its growing adoption in the production of complex, high-precision components across various industries.

- By Application (Automotive, Building & Construction, Medical, Wire and cables, and Others): The medical segment is anticipated to grow at a CAGR of 7.60% over the forecast period, fueled by rising demand for high-quality, biocompatible materials in medical devices and equipment.

Thermoplastic Polyolefin Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America thermoplastic polyolefin market share stood at around 37.25% in 2023, valued at USD 1.91 billion. This dominance is reinforced by the region's strong automotive, construction, and roofing sectors. The growing demand for sustainable, energy-efficient materials in these industries supports TPO's widespread adoption.

Additionally, advancements in TPO manufacturing technologies and rising demand for eco-friendly solutions aid regional market growth. With robust infrastructure and increasing investments in renewable energy, North America is poised to maintain its leading market position.

Asia Pacific thermoplastic polyolefin industry is estimated to grow at a CAGR of 7.80% over the forecast period. This growth is propelled by the rapid industrialization and urbanization across countries such as China, India, and Japan. The region's automotive, construction, and electronics sectors are increasingly adopting TPO due to its durability, cost-effectiveness, and lightweight properties.

Additionally, growing environmental awareness and the rising demand for sustainable materials have bolstered TPO’s popularity, particularly in eco-friendly roofing, automotive, and packaging applications. With ongoing advancements in manufacturing and technology, Asia Pacific market is likely to witness robust expansion in the coming years.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) safeguards public health and the environment by conducting research and enforcing environmental regulations.

- In the EU, the registration, evaluation, authorisation and restriction of chemicals (REACH) regulation protect human health and the environment from the risks that can be posed by chemicals.

Competitive Landscape

Companies in the thermoplastic polyolefin (TPO) industry are advancing product innovations, improving the performance and durability of TPO membranes, and meeting environmental standards to gain a competitive edge.

They are investing in sustainable practices, including the development of eco-friendly formulations and enhanced recycling technologies. Additionally, companies are expanding their product offerings, focusing on key applications such as automotive, roofing, and medical sectors.

Strategic partnerships and acquisitions are being adopted to leverage technological advancements, address market demands, and meet evolving consumer preferences for higher-performance, environmentally conscious materials.

- In March 2024, McCLARIN Composites acquired select polyolefin thermoset molding facilities from Materia Inc., an ExxonMobil affiliate. The deal includes a supply agreement for Proxxima resin systems, focusing on advancing high-performance composites, supporting decarbonization, and enabling advanced recycling in high-growth sectors such as mobility and the built environment.

List of Key Companies in Thermoplastic Polyolefin Market:

- Dow

- Mitsui Chemicals, Inc.

- Exxon Mobil Corporation

- SABIC

- Sumitomo Chemical Company

- LyondellBasell Industries Holdings B.V.

- INEOS

- Borealis AG

- Formosa Plastics Corporation

- Johns Manville

- Aurora Material Solutions

- Noble Polymers

- HEXPOL AB

- Arkema

- RTP Company

Recent Developments (Product Launch)

- In April 2024, Versalis, Eni's chemical division, acquired Tecnofilm S.p.A., a specialist in polyolefin compounding. This acquisition expands Versalis' portfolio in elastomer-based compounding, particularly for industrial and footwear applications. Tecnofilm’s expertise in functionalised polyolefins, product innovation, and sustainable practices enhances Versalis' market position.