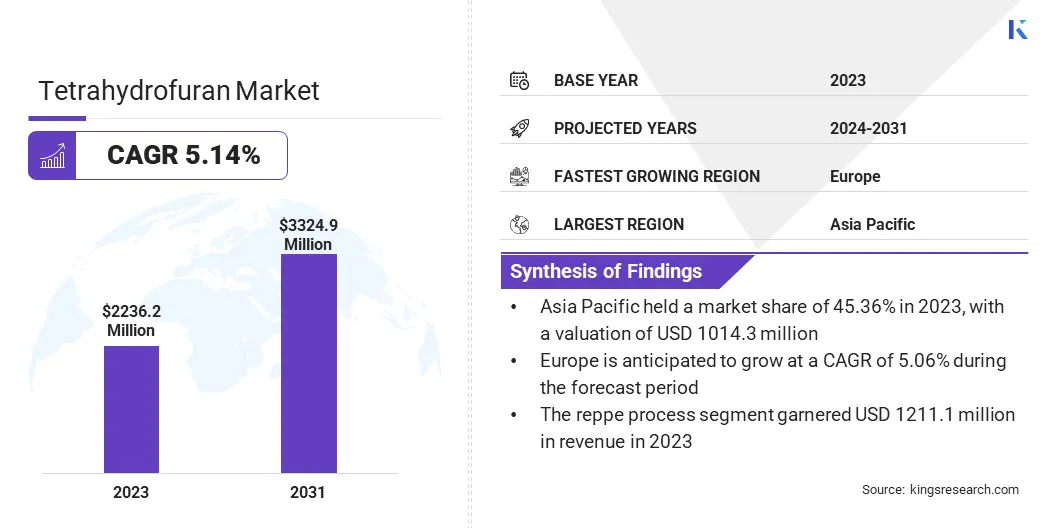

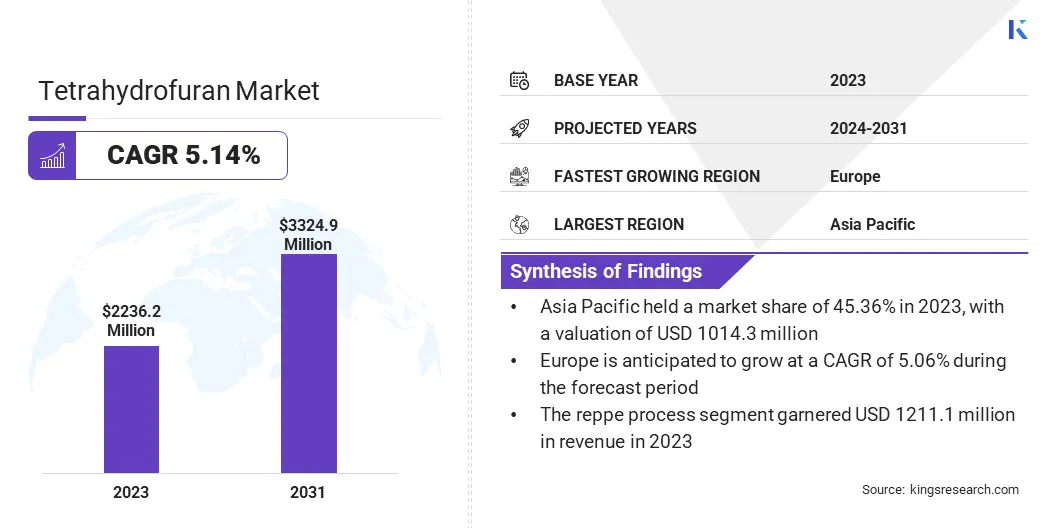

Tetrahydrofuran Market Size

The global Tetrahydrofuran Market size was valued at USD 2236.2 million in 2023 and is projected to grow from USD 2341.0 million in 2024 to USD 3324.9 million by 2031, exhibiting a CAGR of 5.14% during the forecast period. The growth of the market is primarily driven by increasing demand in the pharmaceutical, textile, and adhesive manufacturing industries.

Technological advancements in chemical manufacturing and a notable shift toward sustainable production methods are propelling market expansion. With rising investments in research and development (R&D) and growing industrial activities, the market is poised to expand significantly in the forecast years.

In the scope of work, the report includes products offered by companies such as BASF SE, Ashland Inc., Invista, Dairen Chemical Corporation, Mitsubishi Chemical Corporation, Shanxi Sanwei Group Co., Ltd., Sipchem, Zibo Hualiyuan Chemical Co., Ltd., LyondellBasell Industries Holdings B.V., Sinochem International Corporation, and others.

The growing demand for polytetramethylene ether glycol (PTMEG) in spandex production is a key factor fueling the expansion of the tetrahydrofuran market. PTMEG is essential in the production of spandex fibers, which are widely used in textiles, activewear, and medical devices. Spandex fibers are gaining immense popularity due to their superior elasticity and durability, leading to increased global demand.

- In 2022, the Malaysian Knitting Manufacturers Association (MKMA) projected that the spandex fiber market is anticipated to reach USD 15.2 billion by 2032, supported by rising demand for stretchable fabrics, activewear, and continual advancements in spandex technology.

These factors highlight the need for PTMEG, as it imparts the required stretch and recovery properties to spandex fibers. Tetrahydrofuran is the primary chemical intermediate used in the production of PTMEG through the polymerization process, making it an indispensable component in the supply chain. As the global fashion and textile industries continue to grow, the demand for spandex is expected to rise significantly.

Additionally, the increasing consumer preference for comfortable and high-performance clothing is fueling this demand. Manufacturers are increasingly focusing on optimizing the production processes of PTMEG to meet the surging demand, underscoring the critical role of tetrahydrofuran in the spandex manufacturing industry.

Tetrahydrofuran (THF) is an organic compound classified as a cyclic ether. It is a colorless, water-miscible liquid with a low viscosity and a distinct ether-like odor. THF is primarily used as a solvent due to its ability to dissolve a wide range of organic compounds, making it highly versatile in industrial applications. Key application areas of THF include its use in the production of polytetramethylene ether glycol (PTMEG), which is a precursor to spandex fibers, and in the formulation of adhesives, coatings, and pharmaceuticals.

The production and application of THF are continuously evolving, influenced by ongoing advancements in chemical engineering and increasingly stringent environmental regulations. For instance, the development of bio-based THF, derived from renewable resources, is gaining traction as a sustainable alternative to petroleum-based THF. Moreover, the stringent regulations imposed by environmental agencies regarding the handling and disposal of THF are prompting manufacturers to adopt greener production methods.

The increasing focus on sustainability is promoting research and development efforts in the field, leading to innovations designed to reduce the environmental impact of THF production and usage. As these technical advancements and regulatory measures are implemented, they are expected to reshape the global market by fostering safer and more sustainable practices.

Analyst’s Review

Leading players in the tetrahydrofuran market, such as BASF SE, Ashland Inc., Invista, and others, are employing a comprehensive strategy that integrates innovation, sustainability, and strategic partnerships. By leveraging their extensive R&D capabilities, these companies are prioritizing the development of bio-based THF and refining existing production techniques to minimize environmental impact and meet stringent regulatory standards.

- For instance, BASF invested approximately USD 2.5 billion in R&D in 2022 and plans to allocate over USD 2.2 billion for research in 2023 and 2024, underscoring their commitment to innovation and sustainability.

In addition to R&D efforts, these key players are expanding their global footprint through mergers, acquisitions, and collaborations. Forming strategic alliances within the chemical industry allows them to enter new markets, diversify product offerings, and leverage shared expertise. Emphasizing customer satisfaction through the delivery of high-quality, customized products is crucial for fostering long-term relationships and ensuring repeat business.

- For instance, in October 2023, BASF SE began supplying biomass-balanced tetrahydrofuran (THF BMB) to Asahi Kasei's ROICA division, facilitating the production of sustainable stretch fibers for textiles. This collaboration aims to achieve a 50% reduction in CO2 emissions by utilizing renewable energy and innovative materials, highlighting the industry's notable shift toward sustainability.

Tetrahydrofuran Market Growth Factors

The expansion of the pharmaceutical industry is a key factor fueling the growth of the tetrahydrofuran market. Due to its exceptional solvent properties, THF is widely used in the synthesis and purification of active pharmaceutical ingredients (APIs), which are essential in drug formulation.

Over recent years, the pharmaceutical sector has experienced significant growth, fueled by various factors such as the increasing prevalence of chronic diseases, rising healthcare expenditures, and continual advancements in drug development technologies. As pharmaceutical companies continue to innovate and broaden their product pipelines, the demand for high-purity solvents such as THF has increased.

The ongoing research in biopharmaceuticals and personalized medicine further amplifies the need for specialized solvents that meet the rigorous purity and quality standards required in drug manufacturing.

- According to the U.S. Senate Health, Education, Labor, and Pensions Committee, the pharmaceutical industry is experiencing rapid growth, with major companies such as Johnson & Johnson, Merck, and Bristol Myers Squibb making substantial profits. In 2022, Johnson & Johnson allocated USD 14.6 billion to R&D, while Bristol Myers Squibb earned USD 6.3 billion in profits and invested USD 9.5 billion in R&D.

THF’s versatility in dissolving a wide range of compounds makes it crucial in pharmaceutical processes such as extraction, crystallization, and polymerization. As the pharmaceutical industry continues its expansion, particularly in emerging markets, the demand for THF is expected to increase, underscoring its vital role in advancing global healthcare.

However, the environmental and health concerns associated with tetrahydrofuran present significant challenges in its handling and use. THF is classified as a flammable and volatile organic compound, which poses risks such as fire hazards and exposure-related health issues. Prolonged inhalation or direct contact with THF may lead to respiratory irritation, dizziness, and, in severe cases, damage to the liver and kidneys.

Additionally, THF's high solubility in water raises concerns about its potential to contaminate water sources, making proper disposal and spill management more critical. These hazards necessitate strict adherence to safety protocols and regulations during the storage, transportation, and usage of THF. To mitigate these challenges, industry players are increasingly focusing on developing safer alternatives and improving existing safety measures.

For instance, the adoption of bio-based THF, derived from renewable resources, is being explored as a less hazardous alternative with a reduced environmental impact. Moreover, advances in chemical engineering are leading to the development of THF formulations with lower volatility and toxicity. By addressing these environmental and health concerns, market players are ensuring safer handling of THF and minimizing its impact on both human health and the environment.

Tetrahydrofuran Market Trends

The growing shift toward sustainable production methods and rising investments in research and development are significant trends reshaping the landscape of the global tetrahydrofuran market. As global environmental concerns intensify, there is a growing emphasis on adopting greener and more sustainable production methods in the chemical industry.

In the THF market, this shift is reflected in the increasing interest in bio-based THF, which is derived from renewable resources and offers more environmentally sustainable alternative to traditional petroleum-based THF. Companies are investing heavily in developing and increasing these sustainable production technologies to meet the rising demand for eco-friendly chemicals.

Moreover, the industry is witnessing a surge in R&D investments aimed at improving the efficiency and performance of THF in various applications. Innovations in chemical processes, such as the development of advanced catalysts and energy-efficient production techniques, are enhancing the sustainability and cost-effectiveness of THF production.

As sustainable practices and technological advancements become more widespread, these trends are expected to impact the THF market, leading to more environmentally responsible and economically viable production processes in the years ahead.

Segmentation Analysis

The global market is segmented based on process, application, end use industry, and geography.

By Process

Based on process, the market is segmented into reppe process, furfural process, butadiene chlorination process, propylene oxide process, and others. The reppe process segment led the tetrahydrofuran market in 2023, reaching a valuation of USD 1211.1 million. This dominance is attributed to the efficiency and cost-effectiveness of the Reppe process. This process involves the reaction of carbon monoxide and ethylene in the presence of a catalyst, producing THF with high purity and yield.

The Reppe process is highly favored for its established technology and lower production costs compared to alternatives. Additionally, its ability to scale up efficiently and integrate well with existing chemical production facilities contributes to its leading market position, making it the preferred method for THF production.

By Application

Based on application, the tetrahydrofuran market is classified into polytetramethylene ether glycol (ptmeg), solvents, and other. The polytetramethylene ether glycol (PTMEG) segment secured the largest revenue share of 65.24% in 2023. PTMEG is a key polymer used to manufacture spandex fibers, which are highly valued for their exceptional elasticity and durability.

The widespread application of spandex in textiles, activewear, and medical devices generates a significant demand for PTMEG. As consumer preference for stretchable and high-performance fabrics grows, the demand for PTMEG is rising. The growth of the segment is further propelled by ongoing innovations and the expanding scope of its applications across various industries.

By End Use Industry

Based on end use industry, the market is divided into pharmaceutical, paints & coatings, sealants & adhesives, packaging, and others. The pharmaceutical segment is poised to witness significant growth at a robust CAGR of 6.04% through the forecast period. THF's solvent properties are essential for synthesizing and purifying APIs, making it indispensable in drug manufacturing.

The pharmaceutical industry is expanding rapidly due to factors such as the rising prevalence of chronic diseases, increased healthcare expenditure, and continual advancements in drug development technologies. Additionally, the growing focus on biopharmaceuticals and personalized medicine is boosting the demand for THF. As pharmaceutical companies innovate and expand their product pipelines, the need for THF in various pharmaceutical processes is projected to the growth of the segment.

Tetrahydrofuran Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia Pacific tetrahydrofuran market held a substantial share of around 45.36% in 2023, with a valuation of USD 1014.3 million. This dominance is attributed to the region's booming industrial sectors and strong demand for THF in key applications such as spandex production, pharmaceuticals, and adhesives.

Rapid economic growth, particularly in China and India, has led to increased manufacturing activities, resulting in a strong demand for THF as a solvent and intermediate chemical. Additionally, the expanding textile industry, with its growing preference for spandex fibers, boosts THF consumption. The region's large and continuously growing pharmaceutical sector further contributes to this growth, solidifying Asia Pacific's leading position in the global THF market.

Europe is poised to witness significant growth at a robust CAGR of 5.06% over the forecast period. This growth is mainly propelled by the region's increasing focus on sustainable chemical production and the strong presence of key industries such as pharmaceuticals, paints & coatings, and adhesives. Stringent environmental regulations are prompting companies to adopt greener production methods, which is boosting the demand for high-purity solvents such as tetrahydrofuran (THF).

Additionally, Europe's well-established pharmaceutical sector, which relies on THF for the synthesis and purification of active pharmaceutical ingredients (APIs), is contributing to this growth. The rising demand for advanced materials and the region's commitment to innovation in chemical manufacturing are further propelling regional market expansion.

Competitive Landscape

The global tetrahydrofuran market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Tetrahydrofuran Market

- BASF SE

- Ashland Inc.

- Invista

- Dairen Chemical Corporation

- Mitsubishi Chemical Corporation

- Shanxi Sanwei Group Co., Ltd.

- Sipchem

- Zibo Hualiyuan Chemical Co., Ltd.

- LyondellBasell Industries Holdings B.V.

- Sinochem International Corporation

The global tetrahydrofuran market is segmented as:

By Process

- Reppe Process

- Furfural Process

- Butadiene Chlorination Process

- Propylene Oxide Process

- Other

By Application

- Polytetramethylene Ether Glycol (PTMEG)

- Solvents

- Other

By End Use Industry

- Pharmaceutical

- Paints & Coatings

- Sealants & Adhesives

- Packaging

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America