Market Definition

Structural adhesive tapes are pressure-sensitive bonding solutions that provide high-strength adhesion for permanent or semi-permanent applications across materials such as metals, plastics, and composites.

The market has a wide range of products categorized by resin type into acrylic, epoxy, and silicone, and by backing materials into foam, film, and non-woven substrates. It is used in automotive, electronics, construction, and industrial sectors, covering both standard and customized solutions that meet specific performance requirements, such as temperature resistance, shear strength, and chemical stability.

Structural Adhesive Tapes Market Overview

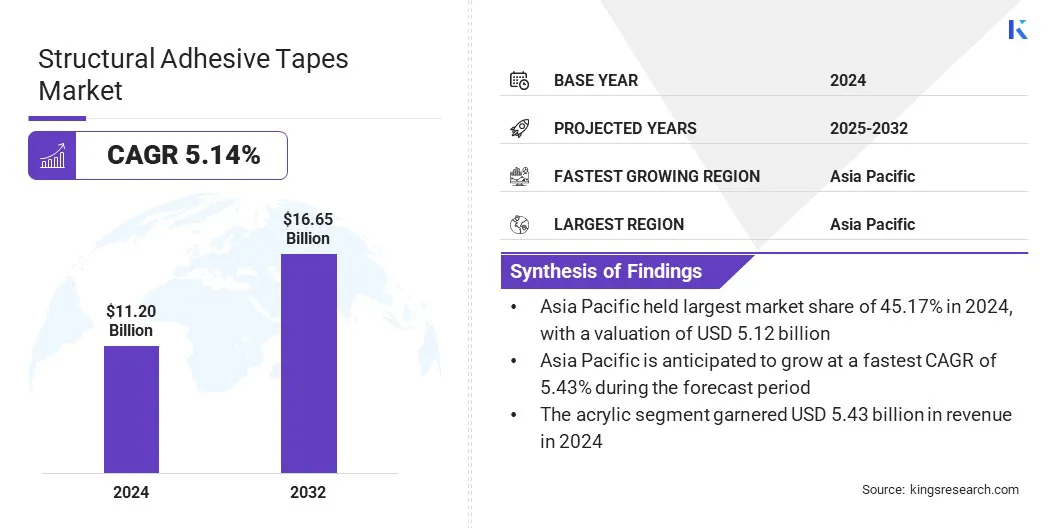

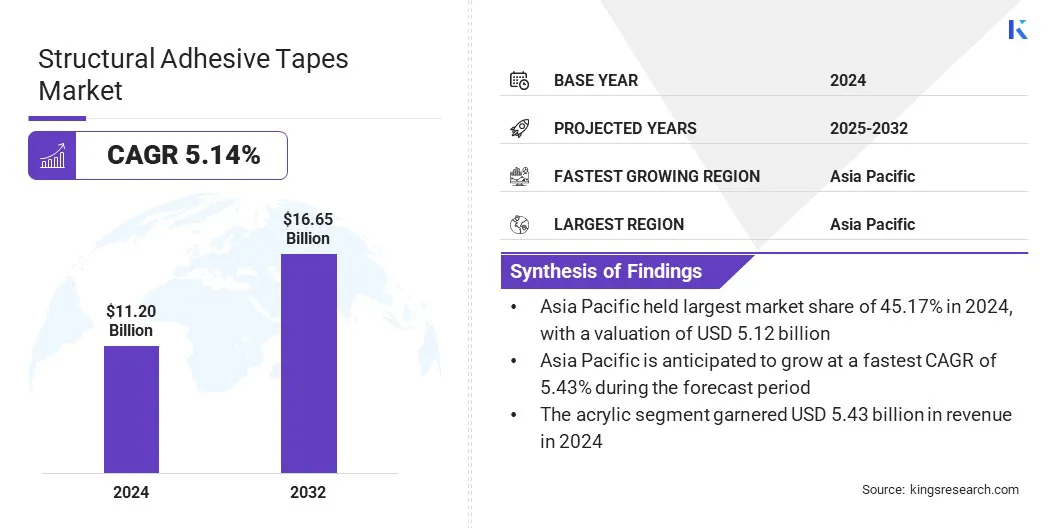

The global structural adhesive tapes market size was valued at USD 11.20 billion in 2024 and is projected to grow from USD 11.72 billion in 2025 to USD 16.65 billion by 2032, exhibiting a CAGR of 5.14% over the forecast period.

The market is growing as industries use high-performance bonding solutions instead of mechanical fasteners. Increasing demand for lightweight, durable, and temperature-resistant tapes in the automotive and electronics sectors boosts efficiency and encourages their use in automated manufacturing processes, thereby supporting global market expansion.

Key Highlights

- The structural adhesive tapes industry size was valued at USD 11.20 billion in 2024.

- The market is projected to grow at a CAGR of 5.14% from 2025 to 2032.

- Asia Pacific held a market share of 45.71% in 2024, with a valuation of USD 5.12 billion.

- The acrylic segment generated USD 5.43 billion in revenue in 2024.

- The foam tapes segment is expected to reach USD 7.34 billion by 2032.

- The automotive & transportation segment is expected to reach USD 5.00 billion by 2032.

- The market in North America is anticipated to grow at a CAGR of 5.16% over the forecast period.

Major companies operating in the structural adhesive tapes market are 3M, AVERY DENNISON CORPORATION, H.B. Fuller Company, Sika AG, Huntsman, Henkel AG & Co. KgaA, Wacker Chemie AG, Amcor plc, Arkema, LINTEC Corporation, Pidilite Industries Ltd., Bron Tapes, General Sealants, TOAGOSEI (THAILAND) CO., LTD., and NANPAO RESINS CHEMICAL GROUP.

Manufacturers are developing debonding technologies that allow adhesives to be removed cleanly, enhancing repairability, recyclability, and sustainability. These adhesives can now be used across automotive, electronics, and industrial sectors, boosting growth in the market.

- In June 2025, Tesa established a Debonding on Demand laboratory in Singapore in collaboration with A*STAR to create removable and recyclable adhesives for automotive and electronics, promoting sustainable solutions.

Market Driver

Rising Demand for Lightweight and Fuel-Efficient Aerospace Designs

The structural adhesive tapes market is driven by the shift toward lightweight and fuel-efficient designs in the aerospace industry. Manufacturers are replacing mechanical fasteners with high-performance adhesive tapes that maintain structural integrity while reducing component weight.

Lighter aircraft components improve fuel efficiency, increase range, and lower emissions. Additionally, the growing use of automated assembly in aircraft manufacturing is boosting the demand for structural adhesive materials.

- In May 2025, Hexcel Corporation presented its latest aerospace composite technologies at the Paris Air Show. The company showcased its latest structural adhesive tapes, rapid-curing prepregs, and advanced Liquid Compression Molding (LCM) epoxy resins. These products are designed to improve production speed, automation compatibility, and mechanical performance for both commercial and military aircraft.

Market Challenge

Limited Recyclability and Repairability

The structural adhesive tapes market faces challenges due to limited recyclability and repairability. Conventional adhesive tapes create permanent bonds, making disassembly, maintenance, and recycling difficult, particularly in automotive, electronics, and industrial applications.

This leads to a higher amount of waste, raises material costs, and reduces sustainability across supply chains. To address this, manufacturers are adopting advanced solutions such as AI-designed adhesives, conductive and safety coatings, and debonding technologies.

- In June 2025, Henkel showcased advanced EV battery solutions at The Battery Show Europe, highlighting AI-generated virtual adhesives, conductive and safety coatings, and structural adhesive debonding technologies.

Market Trend

Rising Use of Adhesive Tapes in Renewable Energy

The use of structural adhesive tapes is increasing in renewable energy systems. Solar panels, wind turbines manufacturers are using high-performance tapes for their lightweight, durable, and temperature-resistant properties. These tapes simplify assembly, improve structural integrity, and enhance energy efficiency. The shift toward advanced bonding solutions over traditional mechanical fasteners reflects changing product preferences and technological innovation within the industry.

- In April 2025, Avery Dennison Performance Tapes launched a Solar Panel Bonding Portfolio featuring durable, UV-resistant PSA tapes. These solutions enhance panel design, support automated and manual applications, and provide reliable bonding for multiple solar manufacturing processes.

Structural Adhesive Tapes Market Report Snapshot

|

Segmentation

|

Details

|

|

By Resin Type

|

Acrylic, Epoxy, Silicone, Others

|

|

By Backing Material

|

Foam Tapes, Film Tapes, Paper Tapes, Others

|

|

By End-Use Industry

|

Automotive & Transportation, Electronics & Electricals, Building & Construction, Industrial Manufacturing, Aerospace, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Resin Type (Acrylic, Epoxy, Silicone, Others): The acrylic segment earned USD 5.43 billion in 2024 due to its strong adhesion, chemical resistance, and versatility across multiple industries.

- By Backing Material (Foam Tapes, Film Tapes, Paper Tapes, Others): The foam tapes segment held 43.31% of the market in 2024, due to its superior shock absorption, gap-filling capability, and ability to reduce vibration in industrial and automotive applications.

- By End-Use Industry (Automotive & Transportation, Electronics & Electricals, Building & Construction, Industrial Manufacturing, Aerospace, Healthcare, Others): The automotive & transportation segment is projected to reach USD 5.00 billion by 2032, owing to growing demand for lightweight, durable, and high-strength bonding solutions.

Structural Adhesive Tapes Market Regional Analysis

The market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America, by region.

Asia Pacific structural adhesive tapes market share stood at around 45.71% in 2024, with a valuation of USD 5.12 billion. The region’s growth is driven by the expanding automotive industry, where rising production creates demand for lightweight, durable, and temperature-resistant bonding solutions.

Rapid development in electronics manufacturing and industrial sectors further increases the usage of structural adhesive tapes for assembly and component bonding. The high concentration of automotive and industrial hubs, along with growing production volumes, positions Asia Pacific as the largest market globally.

The structural adhesive tapes industry in North America is expected to register the fastest growth with a projected CAGR of 5.16% over the forecast period. This growth is fueled by the expansion of local manufacturing facilities, improving access to high-performance structural adhesive tapes for industrial and specialty applications.

Investments in advanced production plants, such as solvent-free adhesive facilities, shorten lead times and strengthen supply chains to meet the rising demand from automotive, aerospace, electronics, and construction sectors.

- In September 2025, ATP Adhesives launched its North America business with a USD 70 million manufacturing facility in Columbia, South Carolina. The plant will produce solvent-free adhesive tapes, support local product development, and serve industrial and specialty markets across the U.S. and Canada.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) regulate adhesives and chemical components used in tapes to ensure environmental safety, occupational health, and safe handling of hazardous substances.

- In Europe, the European Chemicals Agency (ECHA) enforces REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations, ensuring that chemical substances in adhesive products meet safety and environmental standards.

- In China, the Ministry of Ecology and Environment (MEE) and the State Administration for Market Regulation (SAMR) oversee chemical safety, labeling, and compliance for industrial adhesives.

- In Japan, the Ministry of Economy, Trade and Industry (METI) regulates industrial standards and chemical usage.

- In India, the Central Pollution Control Board (CPCB) ensures environmental compliance and regulates emissions and waste management related to chemical adhesives.

Competitive Landscape

Key players in the structural adhesive tapes industry are actively pursuing product innovation and mergers to strengthen their competitive positions. Companies are developing advanced adhesive formulations and high-performance tapes that offer high-strength bonding, temperature and chemical resistance, lightweight construction, and durability for automotive, electronics, and industrial applications. Companies are also focusing on mergers and acquisitions to expand their global footprint, integrate complementary technologies, and enhance operational efficiency.

- In November 2024, Nautic Partners acquired Berry Global’s Specialty Tapes business, including pressure-sensitive, foil, film, and duct tapes. The acquisition aims to improve Nautic Partners’ technical expertise in structural adhesives, increase product offerings, and boost growth across industrial, automotive, aerospace, and construction sectors.

Top Key Companies in Structural Adhesive Tapes Market:

- 3M

- AVERY DENNISON CORPORATION

- B. Fuller Company

- Sika AG

- Huntsman

- Henkel AG & Co. KGaA

- Wacker Chemie AG

- Amcor plc

- Arkema

- LINTEC Corporation

- Pidilite Industries Ltd.

- Bron Tapes

- General Sealants

- TOAGOSEI (THAILAND) CO., LTD.

- NANPAO RESINS CHEMICAL GROUP

Recent Developments

- In February 2025, Nautic Partners acquired Berry Global’s Specialty Tapes business and launched the newly branded Vybond. The company offers over 1,500 SKUs to industrial and specialty markets, including HVAC, automotive, aerospace, and building & construction sectors.

- In November 2024, Atlas Tapes SA acquired PPM Industries Group, creating a vertically integrated global leader in adhesive tape solutions. The combined entity will operate globally and use shared expertise in tape and paper manufacturing.