Aircraft Manufacturing Market Size

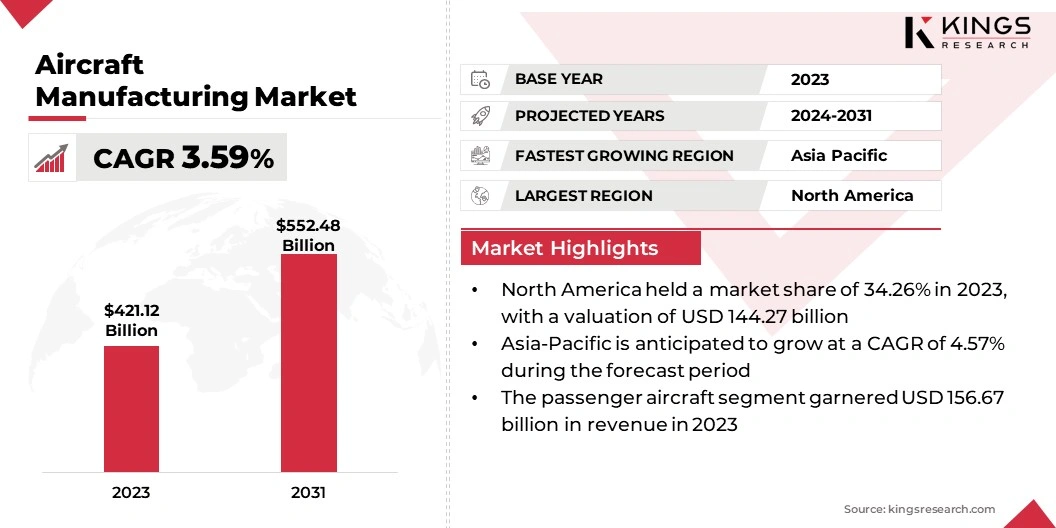

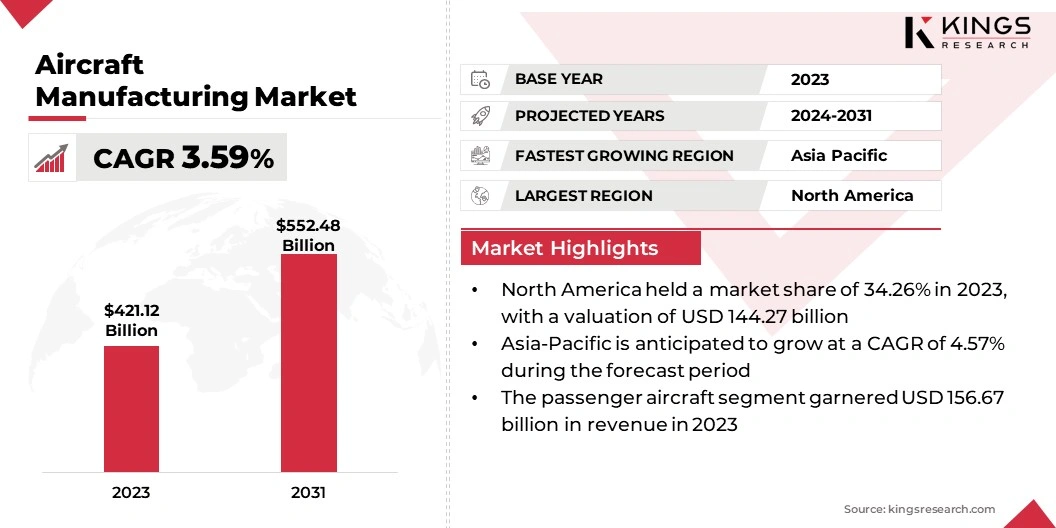

The global Aircraft Manufacturing Market size was valued at USD 421.12 billion in 2023 and is projected to grow from USD 431.49 billion in 2024 to USD 552.48 billion by 2031, exhibiting a CAGR of 3.59% during the forecast period. The market is witnessing robust growth, mainly due to rising global air travel demand across commercial, military, and private sectors.

Growing environmental concerns are increasingly fostering innovation towards sustainable solutions, such as electric aircraft. Technological advancements in materials and manufacturing processes further bolster growth. This dynamic landscape compels manufacturers to innovate rapidly, aiming to meet diverse market needs while advancing toward eco-friendlier aviation solutions.

In the scope of work, the report includes solutions offered by companies such as Boeing, Airbus, Bombardier, Embraer, United Aircraft Corporation, COMAC, Honeywell, Safran Group, Pilatus Business Aircraft Ltd, Gulfstream Aerospace Corp, and others.

The aircraft manufacturing market is growing substantially, primarily fueled by increasing global demand for air travel and continual advancements in technology. Commercial airlines are expanding their fleets to accommodate the rising number of passenger, especially in emerging markets. Moreover, defense sectors worldwide are upgrading their fleets to enhance operational capabilities.

The private aviation sector is further experiencing significant growth, fueled both corporate and individual demands for efficient air transportation. Technological innovations such as electric aircraft and advancements in materials and manufacturing processes are driving the industry's shift toward sustainability.

This dynamic market environment fosters intense competition among manufacturers, prompting them to innovate and optimize production to meet evolving market demands effectively.

- According to the GAMA (General Aviation Manufacturers Association), general aviation shipments and billings for 2023 exhibited growth across all aircraft segments compared to 2022. Preliminary aircraft deliveries were valued at $28.3 billion, reflecting a 3.3% increase from the previous year.

These increases in general aviation shipments and billings indicate robust demand and activity within the aircraft manufacturing sector, thereby contributing significantly to market growth.

Aircraft manufacturing involves the comprehensive process of designing, developing, producing, and assembling various types of aircraft, such as commercial airplanes, military jets, helicopters, and unmanned aerial vehicles (UAVs). This industry encompasses multiple stages, including engineering design, material selection, component fabrication, assembly, rigorous quality testing, and certification.

Advanced technology, skilled labor, and adherence to stringent safety and regulatory standards are crucial to ensure the reliability, performance, and safety of the aircraft. The industry plays a vital role in transportation, defense, and various other sectors, necessitating continuous innovation and efficiency to meet the growing global demand for air travel and aerospace solutions.

Analyst’s Review

The rise in government initiatives and collaborations is expected to aid the aircraft manufacturing market growth.

- For instance, the launch of the C-295 transport aircraft manufacturing facility in Gujarat, India, marks a significant advancement in the country's aerospace sector. This joint effort between Tata Advanced Systems Limited (TASL) and Airbus Defence & Space supports the Indian Air Force's modernization goals and aligns with the "Make in India" initiative. Additionally, the recent MoU signed between Embraer Defense & Security, Mahindra, and the Indian Air Force for acquiring the C-390 Millennium multi-mission aircraft underscores India's defense modernization and self-reliance.

Key players are leveraging these opportunities by focusing on technology transfer, local manufacturing partnerships, and skill development, collaborating closely with Indian entities, and adapting to evolving procurement frameworks to capture a larger market share.

Aircraft Manufacturing Market Growth Factors

The aircraft manufacturing industry is growing significantly due to increasing global population and rising disposable incomes, leading to higher demand for air travel across commercial, military, and private sectors. Airlines are expanding their fleets to accommodate the growing number of passenger, especially in emerging markets.

Moreover, military forces are upgrading their fleets for enhanced operational capabilities, while the private sector seeks efficient business and personal aviation solutions. Manufacturers are adopting advanced materials and technologies to sustainably meet these demands.

This growth necessitates substantial investments in production capacity and efficiency, positioning the industry to capitalize on evolving global travel trends and advancements in aviation technology.

- According to the IBEF (India Brand Equity Foundation), domestic air traffic in India reached nearly 97% of pre-COVID levels during the fiscal year 2022-23, with South Asia accounting for nearly 69% of total airline traffic through domestic flights. With India's population nearing 1.4 billion, the country is recognized as having the fastest-growing air passenger market globally. This growth is propelled by infrastructure developments and an expected annual rise in passenger numbers. The volume of air passengers is projected to increase from 158 million in 2017 to an estimated 572 million by 2037, largely driven largely by the expanding middle-class demographic.

Supply chain disruptions and rising material costs are hindering market growth in the aviation industry. These challenges are causing delays in the production schedules and increasing operational expenses. These challenges are limiting the industry's capacity to meet the growing demand for aircraft and related services, thereby impacting overall profitability and impeding market expansion.

Key players are addressing this challenge by diversifying their supplier networks, adopting advanced manufacturing technologies to streamline production, and implementing robust inventory management systems.

They are further forging strategic partnerships and alliances to secure a stable supply chain and explore cost-effective alternatives, enabling them to mitigate risks and sustain growth in a volatile market environment.

Aircraft Manufacturing Market Trends

In the aircraft manufacturing market, there is a growing emphasis on developing electric and hybrid-electric aircraft as part of efforts to address environmental concerns and improve operational efficiency. This trend reflects a strategic shift towards sustainable aviation solutions, propelled by ongoing advancements in battery technology and electric propulsion systems.

Manufacturers are investing significantly in research and development to overcome technical challenges and optimize key performance indicators such as range and reliability. These innovations support environmental sustainability goals while also offering potential cost savings and reduced reliance on conventional fossil fuels, thereby reshaping the landscape of aircraft manufacturing toward eco-friendlier practices.

Technological advancements such as computer-aided design (CAD) and 3D printing are pivotal in boosting the growth of the aircraft manufacturing industry. CAD facilitates precise digital modeling and simulation, which optimizes design processes and reduces time-to-market. This capability enables enhanced customization and operational efficiency, which is contributing to cost savings.

Moreover, 3D printing revolutionizes production by enabling the direct fabrication of intricate aircraft components from digital designs. It offers advantages such as rapid prototyping, minimized material waste, and the ability to create lightweight yet robust parts.

These technologies bolster innovation, augment supply chain flexibility, and bolster overall market competitiveness, positioning companies to achieve sustainable growth and operational excellence in aerospace manufacturing.

Segmentation Analysis

The global arket is segmented based on aircraft type, application, and geography.

By Aircraft Type

Based on aircraft type, the market is categorized into helicopters, passenger aircraft, commercial aircraft, military aircraft, and others. he passenger aircraft segment led the aircraft manufacturing market in 2023, reaching a valuation of USD 156.67 billion. Increasing global air travel demand, attributed to rising disposable incomes, rapid urbanization, and expanding tourism, necessitates a greater number of passenger aircraft.

Additionally, the shift toward more fuel-efficient and technologically advanced aircraft propels innovation and production within passenger aircraft. Airlines are continually expanding and updating their fleets to meet customer expectations for comfort and efficiency, thereby boosting the demand for new passenger aircraft.

This segment further benefits from increased government investments in aviation infrastructure and favorable policies.

By Application

Based on application, the market is divided military & defense, civil, freight, and others. The civil segment captured the largest aircraft manufacturing industry share of 47.25% in 2023. Increasing global passenger traffic, fueled by economic growth, rapid urbanization, and rising tourism, is leading to a strong demand for new commercial aircraft.

Airlines are continuously updating and expanding their fleets to offer more efficient, comfortable, and environmentally friendly options, thus propelling segmental growth.

Additionally, the growing market for private jets, supported by increasing wealth and a growing preference for personalized travel, contributes to this expansion. Investments in advanced technologies and infrastructure improvements further boost the expansion of the civil segment.

Aircraft Manufacturing Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America aircraft manufacturing market share stood around 34.26% in 2023 in the global market, with a valuation of USD 144.27 billion. The region hosts major aerospace companies and a robust supply chain, which are fostering innovation and technological advancement in aircraft production. High demand for new commercial and military aircraft, supported by defense spending and airline fleet expansions, fuels regional market growth.

Moreover, North America benefits from a strong regulatory framework and government support for aerospace research and development. Investments in advanced materials, manufacturing techniques, and sustainability initiatives further strengthens the region's leading position in aerospace technology.

Asia-Pacific is anticipated to witness significant growth at a CAGR of 4.57% over the forecast period. Rapid economic development and urbanization are resulting in an increased air travel demand across the region. Countries such as China and India are expanding their commercial airline fleets to accommodate growing passenger traffic.

Moreover, rising defense budgets in countries such as Japan and South Korea are boosting demand for military aircraft. The regional market further benefits from a growing aerospace manufacturing sector, supported by increased investments in infrastructure and technology.

Furthermore, strategic partnerships and collaborations with global aerospace players are reinforcing Asia Pacific's standing in the global aircraft manufacturing supply chain.

Competitive Landscape

The global aircraft manufacturing market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Aircraft Manufacturing Market

- Boeing

- Airbus

- Bombardier

- Embraer

- United Aircraft Corporation

- COMAC

- Honeywell

- Safran Group

- Pilatus Business Aircraft Ltd

- Gulfstream Aerospace Corp

Key Industry Development

- October 2023 (Agreement): India’s leading aviation company Hindustan Aeronautics Limited (HAL) and Safran Aircraft Engines, the French global leader in aero engine design, development, and manufacturing, signed a Memorandum of Understanding (MoU). The agreement aims to develop industrial cooperation for the manufacturing of forging parts for commercial engines. This initiative is set to enhance HAL’s capabilities in aerospace manufacturing and strengthen the ties between the Indian and French aerospace industries.

The global aircraft manufacturing market is segmented as:

By Aircraft Type

- Helicopters

- Passenger Aircraft

- Commercial Aircraft

- Military Aircraft

- Others

By Application

- Military & Defense

- Civil

- Freight

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America