Structural Adhesives Market Overview

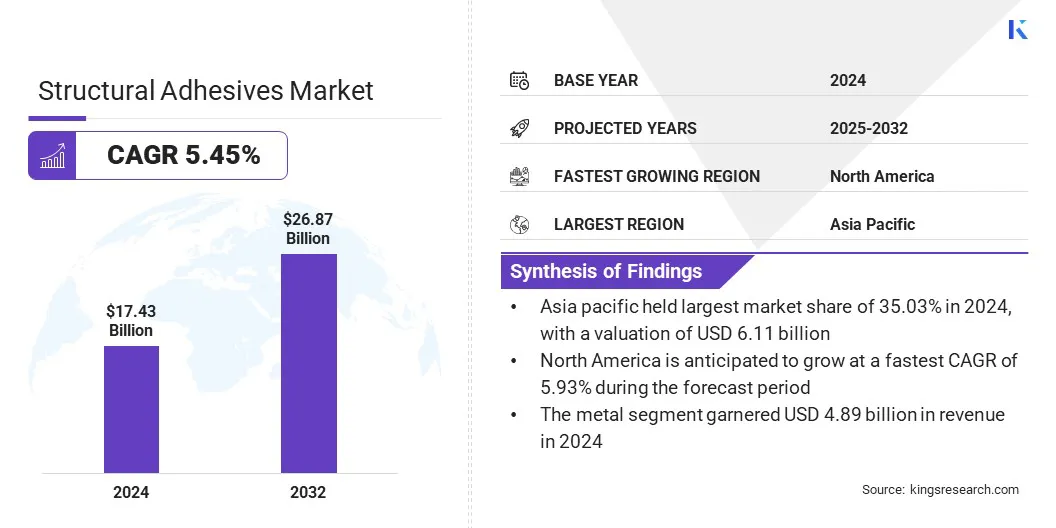

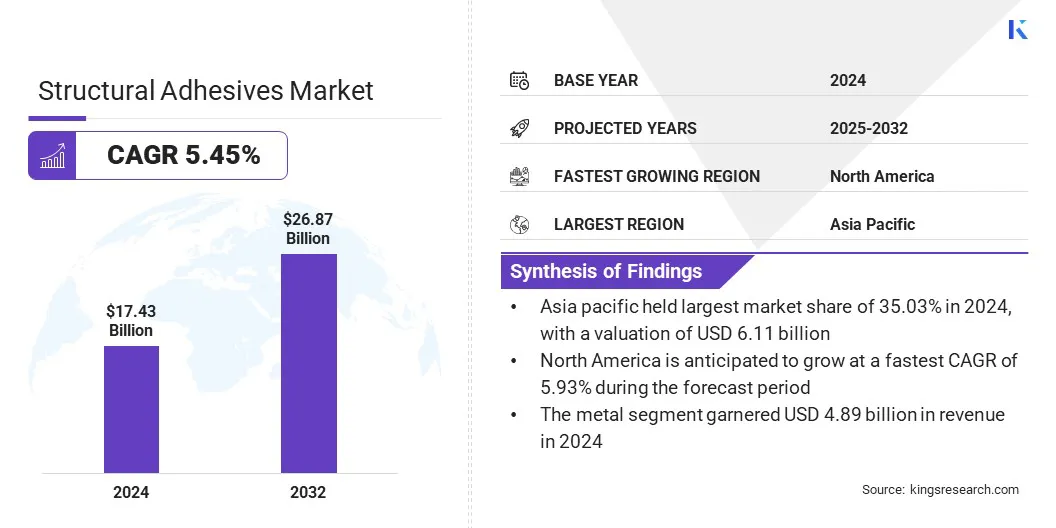

According to Kings Research, the global structural adhesives market size was valued at USD 17.43 billion in 2024 and is projected to grow from USD 18.30 billion in 2025 to USD 26.87 billion by 2032, exhibiting a CAGR of 5.45% during the forecast period. The growth of the market is driven by the expansion of aerospace manufacturing which demands high-performance bonding solutions for lightweight composite materials.

Additionally, the industry is witnessing a shift toward sustainable manufacturing, encouraging the use of low-emission, bio-based adhesives that meet environmental regulations without compromising strength or durability.

Key Market Highlights:

- The structural adhesives industry size was valued at USD 17.43 billion in 2024.

- The market is projected to grow at a CAGR of 5.45% from 2025 to 2032.

- Asia Pacific held a market share of 35.03% in 2024, with a valuation of USD 6.11 billion.

- The metal segment garnered USD 4.89 billion in revenue in 2024.

- The epoxy segment is expected to reach USD 7.38 billion by 2032.

- The water-based segment secured the largest revenue share of 40.47% in 2024.

- The wind energy is poised for a CAGR of 5.73% through the forecast period.

- North America is anticipated to grow at a CAGR of 5.93% during the forecast period.

Major companies operating in the structural adhesives market are 3M, Henkel AG & Co. KGaA, Sika AG, H.B. Fuller Company, Arkema, Dow, DuPont, Huntsman International LLC, Parker Hannifin, Scott Bader Company Ltd., Avery Dennison Corporation, Illinois Tool Works Inc., Mapei S.p.A., PPG Industries, and Ashland.

The increasing use of structural adhesives in automotive manufacturing supports weight reduction and fuel efficiency goals. Automakers are replacing welds and mechanical fasteners with adhesives to join dissimilar substrates like aluminum and composites.

This shift helps meet emission norms and improve structural integrity. The push for electric and hybrid vehicles is further driving the growth of the market globally across OEM and component production segments.

- In May 2024, Henkel introduced three new potting and sealing solutions, Loctite SI 5035, AA 5832, and PE 8086 AB, specifically formulated for automotive electronics such as sensors, ECUs, and powertrain modules. These products offer resistance to fluids, temperature extremes, and mechanical stress, enabling adhesive-based protection across diverse EV components.

Expansion of Aerospace Manufacturing

The aerospace industry extensively uses structural adhesives for bonding composites and metals in aircraft structures. These adhesives help reduce weight while maintaining strength and durability, which is essential for performance and safety.

The increase in air travel, defense budgets, and aircraft fleet modernization is encouraging higher production volumes, which boosts the market. The demand from aircraft manufacturers and MRO service providers contributes significantly to the market’s global expansion.

- In September 2023, DuPont inaugurated an adhesives manufacturing facility in Zhangjiagang, China. This facility produces advanced adhesives, including BETAMATE structural adhesives, designed to enhance lightweighting and crash durability in aircraft structures. The plant's capabilities support the growing demand for sustainable and efficient bonding solutions in the aerospace industry.

Complex Bonding Requirements in Lightweight Material Assemblies

The structural adhesives market faces a significant challenge in addressing complex bonding needs associated with lightweight material assemblies, particularly in electric vehicles, aerospace, and advanced construction.

Materials like carbon fiber, aluminum, and composite laminates have different thermal and mechanical behaviors, making uniform bonding difficult. Traditional adhesives often fall short in meeting these demands, underscoring the need for advanced formulations capable of accommodating diverse material behaviors while maintaining structural integrity.

To address this, key players are developing application-specific adhesives with tailored flexibility, thermal stability, and hybrid curing systems. They are also using simulation-based testing and working closely with OEMs to optimize bond-line design.

Shift Toward Sustainable Manufacturing

A growing trend in the market is the shift toward sustainable manufacturing practices. Structural adhesives support these efforts by enabling lightweight design and reducing the need for mechanical fasteners, which in turn lowers energy consumption and material waste during assembly.

Their role in enhancing product durability also contributes to extended lifecycles and reduced environmental impact. In response, manufacturers are increasingly developing low-VOC and bio-based adhesive formulations.

This sustainability-focused innovation is gaining traction in sectors such as automotive, aerospace, electronics, and green building, where environmental compliance and performance efficiency are critical.

- In January 2025, a study published in Nature Communications revealed the development of a bio-engineered adhesive using poly(3-hydroxybutyrate) (P3HB), a biodegradable polymer produced by bacteria. This adhesive demonstrated adhesion strength 30% higher than conventional petroleum-based adhesives, outperforming common commercial alternatives such as epoxy resins and polyurethane-based adhesives. The research indicates that P3HB-based adhesives offer a sustainable and high-performance alternative in various applications, including packaging and biomedical devices.

Structural Adhesives Market Report Snapshot

|

Segmentation

|

Details

|

|

By Substrate

|

Metal, Wood, Composite, Plastic, Others

|

|

By Resin

|

Urethane, Epoxy, Acrylic, Cyanoacrylic, Others

|

|

By Technology

|

Water-based, Solvent-based, Hybrid

|

|

By End-use

|

Transportation, Construction, Electronics, Wind Energy, Automotive, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Substrate (Metal, Wood, Composite, Plastic, and Others): The metal segment earned USD 4.89 billion in 2024 due to its widespread use in automotive, aerospace, and industrial assemblies where high-strength bonding and durability are critical.

- By Resin (Urethane, Epoxy, Acrylic, Cyanoacrylic, and Others): The epoxy segment held 27.44% of the market in 2024, due to its superior mechanical strength, chemical resistance, and compatibility with a wide range of substrates across demanding industrial applications.

- By Technology (Water-based, Solvent-based, and Hybrid): The water-based segment is projected to reach USD 10.76 billion by 2032, owing to its low VOC content, regulatory compliance, and suitability for high-volume industrial applications across automotive, construction, and packaging sectors.

- By End-use (Transportation, Construction, Electronics, Wind Energy, Automotive, and Others): The wind energy segment is poised for a significant CAGR of 5.73% through the forecast period, attributed to the rising demand for high-strength, fatigue-resistant bonding solutions in large turbine blade manufacturing and assembly.

Structural Adhesives Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific structural adhesives market share stood at 35.03% in 2024 in the global market, with a valuation of USD 6.11 billion. This is attributable to the region's status as a global hub for electronics and white goods manufacturing.

Structural adhesives are preferred for bonding lightweight and heat-sensitive materials used in appliances, TVs, smartphones, and other devices.

High production volumes and the need for cost-effective bonding techniques are driving adhesive consumption. This ongoing demand for high-quality consumer electronics is fueling the market growth across Asia Pacific.

- In February 2025, Henkel opened a cutting‑edge Application Engineering Center in Chennai, India, and expanded its electronics adhesive manufacturing at Kurkumbh. Positioned within India’s growing electronics hub, facility features five R&D labs for advanced adhesive and thermal management materials, equipped with vacuum impregnation and precision dispensing systems.

Additionally, significant private and public sector investments are being directed toward rail and metro infrastructure in countries like India and China. These projects require durable bonding solutions capable of withstanding vibration, temperature variations, and structural stress.

This focus on expanding public transport systems is contributing to increased structural adhesive demand across the Asia Pacific transportation sector.

North America is expected to grow at a CAGR of 5.93% over the forecast period, driven by the increasing adoption of modular and offsite construction methods. These techniques are being widely implemented in residential, commercial, and healthcare infrastructure to reduce build time and improve quality control.

Structural adhesives play a critical role in bonding prefabricated components such as walls, floors, and façade panels, offering high strength and seamless finishes without mechanical fasteners. This construction shift is significantly boosting demand for structural adhesives across the region, thereby driving market growth.

Furthermore, adhesive manufacturers in North America are actively developing next-generation adhesive technologies with localized R&D efforts, enabling the broader adoption of structural adhesives.

Regulatory Frameworks

- In the U.S., structural adhesives must comply with the Environmental Protection Agency (EPA) limits on volatile organic compounds (VOCs) under the Architectural Coatings Rule. The Occupational Safety and Health Administration (OSHA) mandates hazard communication through the Globally Harmonized System (GHS), requiring Safety Data Sheets (SDS) and proper labeling. Under the Toxic Substances Control Act (TSCA), new adhesive formulations must be pre-notified if their chemicals are not listed in the TSCA Inventory.

- In the EU, structural adhesives fall under the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) Regulation, which mandates chemical registration and notification of substances of very high concern (SVHCs). The Classification, Labelling and Packaging (CLP) Regulation ensure proper hazard communication using GHS symbols.

- In China, structural adhesives are regulated under the Ministry of Ecology and Environment’s VOC standards, with GB 18582 governing indoor adhesives. Adhesive producers must comply with the Measures for the Environmental Management of New Chemical Substances. Hazard communication follows China’s implementation of the Globally Harmonized System (GHS). Permits are also required for facilities under the Integrated Environmental Permit framework, which sets emission limits on VOCs and ensures safe handling of chemical raw materials.

- Japan governs adhesives through the Chemical Substances Control Law (CSCL), requiring prior notification and assessment of new substances. Structural adhesive manufacturers must also comply with the Pollutant Release and Transfer Register (PRTR) Law, which mandates annual reporting of specific chemical discharges. The Industrial Safety and Health Act enforces SDS labeling and workplace exposure limits, aligned with the GHS. These laws are enforced by the Ministry of Economy, Trade and Industry and the Ministry of the Environment.

Competitive Landscape

Major players in the structural adhesives market are pursuing strategies such as focused R&D investment, product innovation, and the development of environmentally responsible formulations.

These sustainability-driven formulations include low-VOC adhesives, bio-based chemistries, and recyclable bonding systems aimed at reducing environmental impact throughout the product lifecycle.

In the electric vehicle (EV) sector, companies are introducing advanced structural adhesives with features such as primer-free bonding, accelerated curing, and compatibility with lightweight substrates.

Collaborations with automotive OEMs and energy storage system providers are further enabling practical validation and adoption of these solutions in real-world applications.

Key Companies in Structural Adhesives Market:

- 3M

- Henkel AG & Co. KGaA

- Sika AG

- B. Fuller Company

- Arkema

- Dow

- DuPont

- Huntsman International LLC

- Parker Hannifin

- Scott Bader Company Ltd.

- Avery Dennison Corporation

- Illinois Tool Works Inc.

- Mapei S.p.A.

- PPG Industries

- Ashland

Recent Developments (Product Launches)

- In November 2023, Henkel released Loctite SI 5972FC, a one-component RTV silicone FIPG designed for inline sealing of electronics modules (ECUs, ADAS components). It provides immediate leak resistance after cure and complies with sustainability standards, enabling seamless integration of adhesives in structures traditionally sealed by mechanical methods.

- In November 2023, Henkel introduced two bio-based polyurethane (PUR) adhesives for load-bearing timber construction, named Loctite HB S ECO and Loctite CR 821 ECO. These adhesives utilize renewable materials and achieve significant reductions in CO₂ emissions, 66% and 62% respectively, compared to their fossil-based counterparts. Loctite HB S ECO is composed of 63% bio-based materials and Loctite CR 821 ECO contains 71% bio-based content.