Market Definition

The market focuses on ensuring the absence of viable microorganisms in pharmaceutical, biotechnology, and medical device products. It includes testing methods such as membrane filtration, direct inoculation, and bioluminescence detection, along with related consumables, instruments, and related services.

The report provides insights into the fundamental drivers fueling market growth, complemented by a thorough evaluation of market trends and the regulatory frameworks governing industry operations.

Sterility Testing Market Overview

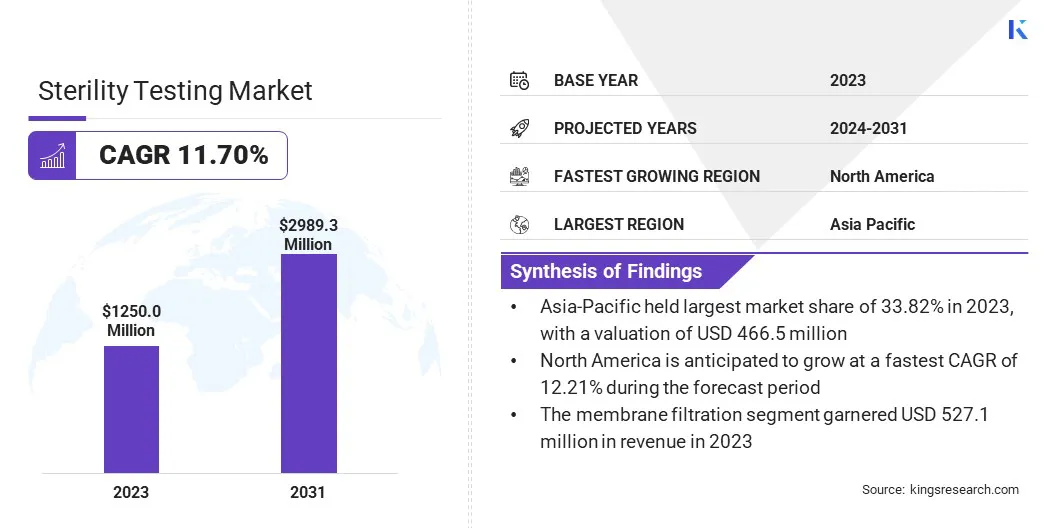

The global sterility testing market size was valued at USD 1250.0 million in 2023 and is projected to grow from USD 1377.9 million in 2024 to USD 2989.3 million by 2031, exhibiting a CAGR of 11.70% during the forecast period.

The increasing regulatory requirements for sterility assurance, the rising adoption of biologics and biosimilars, and the expanding pharmaceutical and medical device industries are stimulating market growth. Advancements in rapid microbiological testing technologies and the growing focus on quality control in drug development and manufacturing are further propelling market expansion.

Major companies operating in the sterility testing industry are Charles River Laboratories., Alcami Corporation, Sartorius AG, Thermo Fisher Scientific Inc., STERIS, BIOMÉRIEUX, Rapid Micro Biosystems, Inc, Pacific BioLabs, SGS Société Générale de Surveillance SA., Nelson Laboratories, LLC, Boston BioProducts, Sotera Health, LexaMed, North American Science Associates, LLC, and Samsung Biologics.

The demand for sterility testing is being fueled by increased investments in research and development, the rising prevalence of infectious diseases, and the growing need for personalized medicine, which necessitates stringent testing protocols.

- In March 2025, Nelson Labs, a Sotera Health company, expanded its rapid sterility testing services by implementing microbiological methods (RMMs) at three laboratories in the U.S. and Europe. This advanced solution accommodates a broad spectrum of medical devices and pharmaceuticals, expanding rapid sterility testing beyond biologics and short-shelf-life products.

Key Highlights

- The sterility testing industry size was recorded at USD 1250.0 million in 2023.

- The market is projected to grow at a CAGR of 11.70% from 2024 to 2031.

- Asia-Pacific held a share of 33.82% in 2023, valued at USD 380.0 million.

- The instruments segment garnered USD 480.6 million in revenue in 2023.

- The membrane filtration segment is expected to reach USD 1247.2 million by 2031.

- The medical device manufacturing segment is anticipated to witness the fastest CAGR of 11.82% over the forecast period

- North America is anticipated to grow at a CAGR of 12.21% over the forecast period.

Market Driver

Rising Pharmaceutical & Biotech Production

The increasing production of pharmaceuticals and biologics is fueling the growth of the sterility testing market, stimulated by increasing global demand for sterile pharmaceuticals, biologics, and vaccines.

The expansion of biopharmaceuticals, including gene therapy and monoclonal antibodies, is highlighting the need for stringent sterility testing to ensure safety and regulatory compliance. Increasing manufacturing facilities, particularly in emerging markets, further emphasizes quality assurance.

Additionally, the development of novel drug formulations and biosimilars necessitates rigorous testing for regulatory approval. With the growing prevalence of chronic diseases and an expanding biopharma pipeline, the demand for sterility testing is expected to rise significantly.

- In January 2024, Rapid Micro Biosystems, Inc. announced the availability of its Growth Direct Rapid Sterility application, delivering organism detection in 12 hours and final results within one to three days. Integrated with the Growth Direct system, it enhances efficiency, reduces human error, and accelerates pharmaceutical product release.

Market Challenge

Complexity in Testing Advanced Biologics

The sterility testing of advanced biologics, such as gene therapies, cell-based treatments, and monoclonal antibodies presents a significant challenge due to their complexity and sensitivity. These products demand specialized methodologies, as conventional tests may be ineffective due to factors like viscosity, formulation, or limited shelf life.

Differentiating microbial contaminants from viable therapeutic cells requires advanced techniques. Evolving regulatory guidelines are further underscoring the need for precise and rapid testing, requiring significant investment, technical expertise, and rigorous validation.

To mitigate this challenge, manufacturers are adopting rapid microbiological methods (RMMs) such as real-time PCR and flow cytometry, enhancing accuracy and reducing testing time. Developing specialized testing protocols ensures reliability for biologics with unique properties, while regulatory harmonization streamlines compliance.

Automation and AI-driven technologies improve precision and minimize errors, supported by investment in skilled personnel and advanced infrastructure. Implementing risk-based strategies optimizes testing efficiency, and industry-academic collaboration fosters innovation in next-generation sterility testing solutions.

Market Trend

Growth in Single-Use Technologies

A notable trend influencing the market is the increasing adoption of single-use technologies (SUTs) in biopharmaceutical manufacturing. These systems improve flexibility, reduce contamination risks, and streamline production by eliminating the need for extensive cleaning in traditional systems.

However, maintaining sterility across disposable components such as bioreactors and tubing remains a challenge. Stringent sterility validation is mandated by regulatory agencies, increasing demand for rapid and automated testing solutions.

As SUT adoption grows in biologics, vaccines, and cell and gene therapy production, sterility testing must advance to support regulatory compliance, product safety, and manufacturing efficiency.

Sterility Testing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Instruments, Kits & Reagents, Services

|

|

By Type

|

Membrane Filtration, Direct Inoculation, Others

|

|

By Application

|

Pharmaceutical & Biological Manufacturing, Medical Device Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Instruments, Kits & Reagents, and Services): The instruments segment earned USD 480.6 million in 2023 due to the increasing demand for advanced sterility testing equipment and automation in the pharmaceutical and biotechnology industries.

- By Type (Membrane Filtration, Direct Inoculation, and Others): The membrane filtration segment held a share of 42.17% in 2023, attributed to its efficiency and effectiveness in filtering microbial contaminants.

- By Application (Pharmaceutical & Biological Manufacturing, Medical Device Manufacturing, and Others): The pharmaceutical & biological manufacturing segment is projected to reach USD 1116.1 million by 2031, propelled by the increasing demand for biologics and pharmaceutical products.

Sterility Testing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

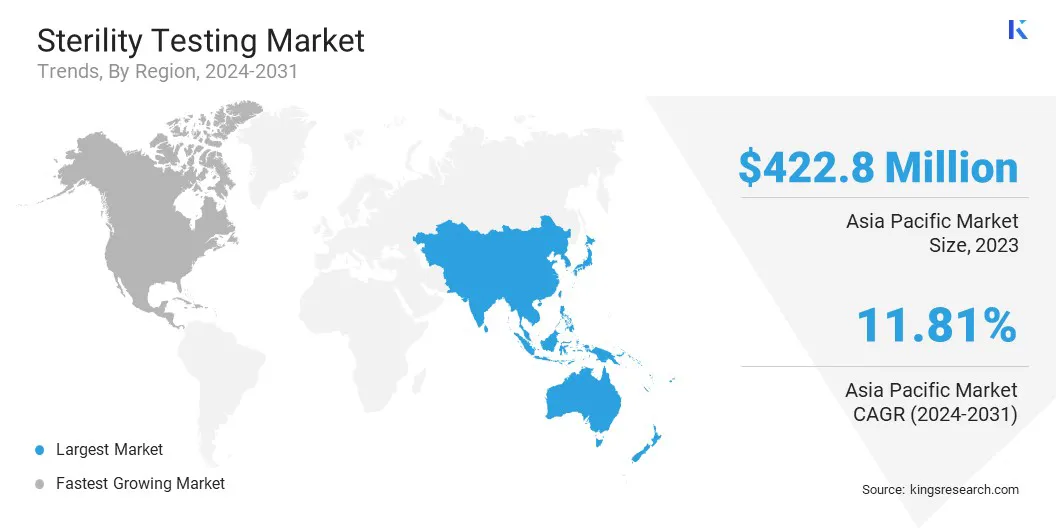

Asia Pacific sterility testing market share stood at around 33.82% in 2023, valued at USD 422.8 million. This dominance is reinforced by the region’s expanding pharmaceutical and biotechnology industries, increased investments in healthcare infrastructure, and the adoption of advanced sterility testing technologies.

Government initiatives, along with the presence of key market players and contract research organizations, further contribute to market expansion. The rising demand for biosimilars, vaccines, and cell and gene therapies has highlighted the need for stringent sterility testing protocols.

With evolving regulatory frameworks and the increasing outsourcing of pharmaceutical manufacturing to countries such as China and India, the regional market is set to witness notable growth.

North America sterility testing industry is likely to grow at a CAGR of 12.21% over the forecast period. This growth is fostered by the strong presence of leading pharmaceutical and biotechnology companies, increased R&D activities, and regulatory requirements set by agencies.

The rising adoption of rapid microbiological methods (RMMs) and automation in sterility testing further boosts this expansion. Furthermore, the increasing emphasis on personalized medicine, particularly in cell and gene therapies, has accelerated the demand for sophisticated sterility testing solutions to ensure product safety and regulatory compliance.

- In October 2024, LGM Pharma expanded its Analytical Testing Services (ATS) at its Irvine, California facility by introducing rapid sterility testing and endotoxin testing. The advanced equipment reduces sterility testing incubation from 14 days to five, accelerating product release and enhancing quality control for sterile compounds.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) 21 CFR Part 610.12 enforces sterility testing requirements for biological products to confirm the absence of viable contaminating microorganisms before human use.

- In the EU, the European Medicines Agency (EMA) – ICH Q5C establishes stability testing guidelines for biotechnological and biological products to maintain quality, safety, and efficacy throughout their shelf life.

- Australia's Therapeutic Goods Administration (TGA), under the Pharmaceutical Inspection Co-Operation Scheme GMP Guide Annexes, provides Good Manufacturing Practice (GMP) guidelines covering sterility assurance and quality control for medicinal products.

- ISO 11737-2:2019 specifies sterility testing requirements for medical devices to meet global safety and quality requirements.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) follows the Japanese Pharmacopoeia (JP) 4.06, which defines sterility testing procedures for pharmaceutical and biological products to ensure their safety and quality standards.

Competitive Landscape

The sterility testing industry is highly competitive, with key players focusing on innovation, strategic collaborations, and product expansion.

The rising adoption of automation and rapid microbiological methods (RMMs) has intensified competition, fueling investments in quality assurance and GMP-certified laboratories. Companies are further expanding their global presence through partnerships and facility expansions to meet growing industry demands.

- In July 2024, Charles River Laboratories introduced the Celsis ATP-bioluminescence system to enhance sterility testing for turbid pharmaceutical products, such as emulsions and suspensions. This system detects microbial contamination by measuring ATP, reducing reliance on visual inspection.

List of Key Companies in Sterility Testing Market:

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In March 2025, Sysmex Corporation and Japan Tissue Engineering Co., Ltd. (J-TEC) joined forces to develop faster sterility testing for regenerative medicine and cell therapy. Utilizing Sysmex’s flow cytometry technology and J-TEC’s expertise, the partnership aims to reduce testing times from weeks to minutes, improving product safety and expediting production.

- In July 2024, Celerion expanded its U.S. pharmacy services to include on-site rapid sterility testing and dose formulation analysis for Phase 1 investigational drugs. This enhancement ensures cGMP and FDA compliance while streamlining development, reducing costs, and accelerating drug quality assessments.

- In May 2024, Merck KGaA’s Life Science business launched M-Trace, a digital sterility testing solution for microbiology labs. Designed for cleanroom use, it automates documentation, reduces errors, and enhances regulatory compliance by providing real-time data traceability.

- In November 2023, miDiagnostics partnered with Galapagos NV to develop a closed-flow, ultra-rapid PCR sterility test for decentralized CAR-T cell therapy manufacturing. This collaboration aims to integrate miDiagnostics' chip-based point-of-care PCR technology with Galapagos' CAR-T CellPoint platform, enabling fully automated, near-patient production of fresh CAR-T therapies.