Market Definition

Sterile medical packaging refers to specialized packaging solutions designed to maintain the sterility and integrity of medical devices, pharmaceutical products, and other healthcare materials. It serves as a protective barrier against microbial contamination, moisture, and physical damage, to ensure product safety and compliance with stringent regulatory standards.

These packaging are engineered to withstand sterilization processes while preserving the functional and structural properties of the enclosed medical products. The design and material composition of these packaging solutions adhere to industry standards, ensuring sterility throughout and playing a critical role in infection control and patient safety.

Sterile Medical Packaging Market Overview

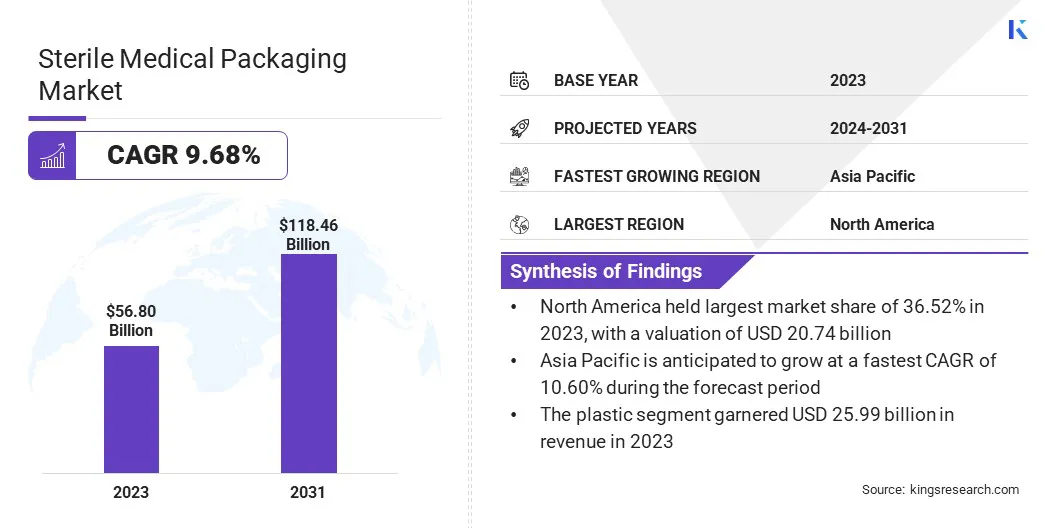

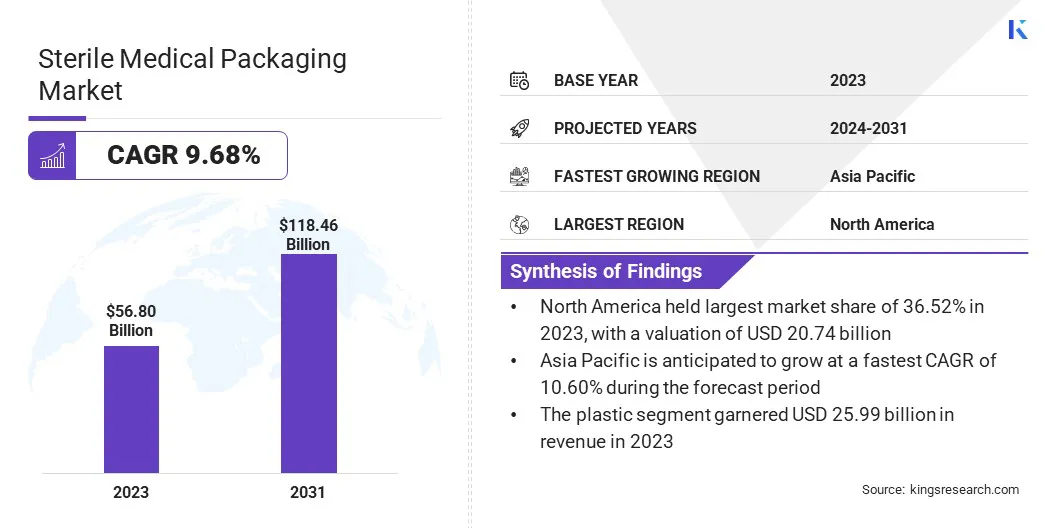

The global sterile medical packaging market size was USD 56.80 billion in 2023 and is projected to grow from USD 62.03 billion in 2024 to USD 118.46 billion by 2031, exhibiting a CAGR of 9.68% during the forecast period.

The growth of the market is driven by the rising demand for infection control in healthcare settings and the increasing adoption of advanced sterilization techniques. Stringent regulatory requirements for medical device and pharmaceutical packaging further accelerate market expansion, driving manufacturers to develop high-quality, compliant solutions.

Additionally, the expansion of healthcare infrastructure and the growing volume of surgical procedures are fueling the need for reliable sterile packaging.

Major companies operating in the sterile medical packaging industry are Amcor Plc, DuPont, 3M, Wihuri Packaging Oy, ProAmpac, Nelipak, UFP Technologies, Inc., Vetter Pharma-Fertigung GmbH & Co. KG, Guardian Medical, Oliver, Technipaq, Inc., BEMIS, Sealed Air, Medline Industries, Inc., and Printpack.

The development of healthcare infrastructure, particularly in emerging economies, is supporting the demand for sterile medical packaging. Investments in hospitals, diagnostic centers, and surgical facilities are increasing the need for high-quality packaging solutions that comply with sterilization protocols.

The growing number of elective surgeries and minimally invasive procedures is further driving demand for sterile packaging in medical devices and surgical tools. Manufacturers are expanding production capacities to support the rising adoption of sterile healthcare products.

The focus on improving healthcare accessibility and surgical outcomes is accelerating the growth of the sterile medical packaging market.

The International Society of Aesthetic Plastic Surgery (ISAPS) reported in June 2024 a 5.5% increase from 2023 in surgical procedures, with plastic surgeons conducting more than 15.8 billion surgeries and 19.1 billion non-surgical treatments. Over the last four years, the total growth in surgical procedures has surged by 40%.

Key Highlights:

- The sterile medical packaging industry size was recorded at USD 56.80 billion in 2023.

- The market is projected to grow at a CAGR of 9.68% from 2024 to 2031.

- North America held a market share of 36.52% in 2023, with a valuation of USD 20.74 billion.

- The plastic segment garnered USD 25.99 billion in revenue in 2023.

- The thermoform trays segment is expected to reach USD 26.28 billion by 2031.

- The chemical sterilization segment secured the largest revenue share of 52.24% in 2023.

- The medical implants is poised for a robust CAGR of 11.19% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 10.60% during the forecast period.

Market Driver

Focus on Sustainable and Eco-Friendly Packaging Solutions

Sustainability is becoming a key focus in the sterile medical packaging market, with companies investing in recyclable and biodegradable materials. The growing emphasis on reducing medical waste is driving the adoption of eco-friendly packaging solutions that maintain sterility while minimizing environmental impact.

Regulatory authorities are encouraging the use of sustainable alternatives, prompting manufacturers to develop compostable films and lightweight sterile packaging options. Advances in material science are enabling the production of durable, sterile packaging with a lower carbon footprint.

In October 2023, researchers from the University of New South Wales partnered with Ecopha Biotech to enhance biodegradable plastic packaging solutions. The project received a USD 3 billion grant from the Cooperative Research Centres Projects (CRC-P) of Australia for a three-year development phase.

The initiative aims to develop advanced sustainable healthcare packaging utilizing polyhydroxyalkanoates (PHAs), a biodegradable polymer produced through the fermentation of canola oil. These solutions are intended to replace traditional petroleum-based healthcare packaging, offering safety, high performance, and environmental sustainability.

Market Challenge

Regulatory Compliance and Long Approval Timelines

Strict regulatory requirements pose a significant challenge to the growth of the sterile medical packaging market, as manufacturers must adhere to evolving global standards for material safety, sterilization validation, and packaging integrity.

Compliance with regulations such as the U.S. Food and Drug Administration's (FDA) 21 CFR Part 820, ISO 11607, and the EU MDR increases production costs and prolongs product approval timelines.

To address this, companies are investing in advanced quality control systems, automation, and research to develop packaging materials that meet compliance standards efficiently. Collaborations with regulatory bodies and third-party certification organizations further support streamlined approval processes, ensuring product reliability and market expansion.

Market Trend

Expansion of Biologic and Gene Therapy Products

The growth of biologics, gene therapy, and personalized medicine is driving demand for advanced sterile packaging solutions. These products require specialized containment solutions that maintain sterility and stability under specific temperature conditions.

The increasing number of clinical trials and regulatory approvals for biologics are creating opportunities for packaging companies to develop innovative sterile packaging materials. Pharmaceutical manufacturers are investing in cryogenic and ultra-cold storage packaging to meet the requirements of gene therapies and mRNA-based treatments.

The expanding biologics sector is significantly contributing to the sterile medical packaging market. Global Genes Organization reports that the number of cell and gene therapies introduced globally reached 76 by the end of 2023, more than doubling since 2013. In addition, spending on these therapies surged to $5.9 billion in 2023, reflecting a 38% year-over-year increase.

Sterile Medical Packaging Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Plastic, Metal, Paper and Paperboard, Paper and Paperboard, Others

|

|

By Type

|

Thermoform Trays, Sterile Bottle and Containers, Vials and Ampoules, Pre-Fillable Inhalers, Sterile Closures, Pre Filled Syringes, Blisters and Clamshells, Bags and Pouches, Wraps, Others

|

|

By Sterilization Type

|

Chemical Sterilization, Radiation Sterilization, High Pressure/ Temperature Sterilization

|

|

By Application

|

Pharmaceutical and Biological, Surgical and Medical Instruments, In Vitro Diagnostic Products, Medical Implants, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (Plastic, Metal, Paper and Paperboard, Paper and Paperboard, and Others): The Plastic segment earned USD 25.99 billion in 2023 due to its superior barrier properties, durability, cost-effectiveness, and compatibility with various sterilization methods, ensuring product integrity and compliance with stringent regulatory standards.

- By Type (Thermoform Trays, Sterile Bottle and Containers, Vials and Ampoules, Pre-Fillable Inhalers, Sterile Closures, Pre Filled Syringes, Blisters and Clamshells, Bags and Pouches, Wraps, and Others): The Thermoform Trays segment held 24.36% of the market in 2023, due to its superior durability, customizable design, and ability to provide a reliable sterile barrier, ensuring product protection and compliance with stringent healthcare regulations.

- By Sterilization Type (Chemical Sterilization, Radiation Sterilization, and High Pressure/ Temperature Sterilization): The Chemical Sterilization segment is projected to reach USD 62.18 billion by 2031, owing to its effectiveness in sterilizing heat-sensitive medical devices and pharmaceutical products while maintaining packaging integrity, ensuring widespread adoption across healthcare and pharmaceutical industries.

- By Application (Pharmaceutical and Biological, Surgical and Medical Instruments, In Vitro Diagnostic Products, Medical Implants, and Others): The Medical Implants segment is poised for significant growth at a CAGR of 11.19% through the forecast period, attributed to the critical need for contamination-free packaging that ensures sterility, integrity, and long-term biocompatibility, driven by the rising prevalence of orthopedic, cardiovascular, and dental implant procedures.

Sterile Medical Packaging Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America sterile medical packaging market share stood around 36.52% in 2023 in the global market, with a valuation of USD 20.74 billion. The U.S. Food and Drug Administration (FDA) and Health Canada enforce strict regulations on sterile medical packaging to ensure product safety and efficacy.

Compliance with standards such as ISO 11607, ASTM D4169, and USP Class VI is driving demand for high-quality packaging solutions. Manufacturers are investing in advanced sterilization techniques, barrier materials, and tamper-evident designs to meet regulatory requirements.

The focus on risk mitigation, validation processes, and quality assurance is fueling the market in North America.

Additionally, the push for sustainable medical packaging is gaining momentum in North America, with companies adopting recyclable, biodegradable, and reusable materials. The shift toward low-carbon packaging solutions, reduced plastic waste, and energy-efficient production methods is influencing market growth.

Leading packaging manufacturers are developing plant-based biopolymers, fiber-based sterile pouches, and recyclable thermoformed trays to align with environmental regulations and corporate sustainability goals. The increasing demand for green packaging solutions is reshaping the market.

- In February 2024, Sanofi Consumer Healthcare became a member of the Blister Pack Collective, an initiative led by PA Consulting and PulPac, aimed at developing recyclable fiber-based blister packs to minimize plastic waste in pharmaceutical packaging. The project focuses on replacing PVC, which accounts for a significant portion of the 100,000 tonnes of plastic used annually in medical packaging. By utilizing PulPac's Dry Molded Fiber technology, the initiative aims to achieve a more sustainable solution with an 80% lower CO₂ footprint compared to conventional packaging materials.

Asia Pacific is poised for significant growth at a robust CAGR of 10.60% over the forecast period. Asia Pacific has emerged as a leading hub for pharmaceutical and biopharmaceutical production, with major players expanding their manufacturing capacities across China, India, Japan, and South Korea.

The rising demand for vaccines, biosimilars, and injectable drugs is driving the need for high-quality sterile medical packaging. Governments are supporting the development of local pharmaceutical supply chains, further strengthening the sterile medical packaging market.

Increasing exports of generic drugs and biologics from the region are prompting manufacturers to adopt advanced sterilization techniques and regulatory-compliant packaging solutions to meet international quality standards.

Furthermore, the rising incidence of chronic diseases such as diabetes, cardiovascular disorders, and cancer is increasing the demand for injectable medications, diagnostic products, and surgical procedures, all of which require sterile packaging solutions.

Additionally, the region’s rapidly aging population, particularly in Japan, South Korea, and China, is driving the need for sterile pharmaceutical packaging for elderly care and long-term treatments. The growing demand for pre-filled syringes, blister packaging, and sterilized medical kits contributes to the expansion of the market.

Regulatory Frameworks

- In The U.S., the Food and Drug Administration (FDA) regulates medical devices and their packaging under the Quality System Regulation (QSR) 1 CFR Part 820. This regulation mandates that manufacturers establish and maintain procedures to ensure that device packaging maintains sterility and integrity.

- In Europe, the Medical Device Regulation (MDR) (EU) 2017/745 governs medical devices within the EU. The MDR emphasizes stringent requirements for device safety and performance, including packaging integrity to maintain sterility. Compliance with harmonized standards, such as EN ISO 11607, is essential for demonstrating conformity.

- In China, the National Medical Products Administration (NMPA) regulates medical devices in China. Manufacturers must comply with national standards, such as YY/T 0681, which align with aspects of ISO 11607, to ensure packaging integrity and sterility.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) oversees medical device regulations in Japan. The country has adopted standards harmonized with ISO 11607, focusing on the quality and safety of sterile medical packaging.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates medical devices in India. The Medical Devices Rules, 2017, mandate that packaging ensures the sterility and quality of medical devices, encouraging compliance with international standards like ISO 11607.

Competitive Landscape:

The sterile medical packaging industry is characterized by a number of participants. Market players are implementing strategic initiatives such as expanding production facilities and strengthening supply chain networks to enhance their market presence and meet the increasing demand for sterile medical packaging.

These efforts enable companies to scale manufacturing capabilities, improve distribution efficiency, and ensure the availability of high-quality sterile packaging solutions for medical devices and pharmaceuticals.

By investing in new production sites and optimizing logistics, industry leaders are reinforcing their global footprint and addressing the stringent regulatory requirements for sterile packaging, ultimately driving the growth of the market.

- In November 2024, Nelipak Healthcare Packaging inaugurated its first North American flexible packaging production facility in North Carolina, U.S. The 110,000-square-foot, Class A industrial building features ISO-7 clean room space, state-of-the-art production equipment, and ISO 13485 certification. This expansion enhances Nelipak's capacity to supply high-quality flexible healthcare packaging products including sterile medical packaging to meet the growing demand in the Americas region.

List of Key Companies in Sterile Medical Packaging Market:

- Amcor Plc

- DuPont de Nemours, Inc.

- 3M

- Wihuri Packaging Oy

- ProAmpac

- Nelipak

- UFP Technologies, Inc.

- Vetter Pharma-Fertigung GmbH & Co. KG

- Guardian Medical

- Oliver

- Technipaq, Inc.

- BEMIS

- Sealed Air

- Medline Industries, Inc.

- Printpack

Recent Developments (Expansion/Partnerships/New Product Launch)

- In February 2025, Recipharm introduced an aseptic filling system at its Wasserburg, Germany facility. This system is designed for process development, pilot-scale production, and clinical supply, ensuring sterile drug products are filled into containers such as vials, syringes, and cartridges without contamination.

- In January 2023, Nelipak Healthcare Packaging launched sterile barrier packaging, manufactured utilizing Eastar Renew 6763, a medical-grade copolyester produced by Eastman through molecular recycling technologies. This material offers the same durability, safety, and performance as traditional copolyester by incorporating recycled content.