Market Definition

The sputter coater market involves the production, sale, and usage of sputter coating equipment and services. This market has registered significant growth, due to the increasing demand for thin film coatings across various sectors, including electronics, automotive, medical devices, solar energy, and optics. A sputter coater is a device that is used in materials science and surface engineering to apply thin films of metal or other materials onto a substrate.

Sputter Coater Market Overview

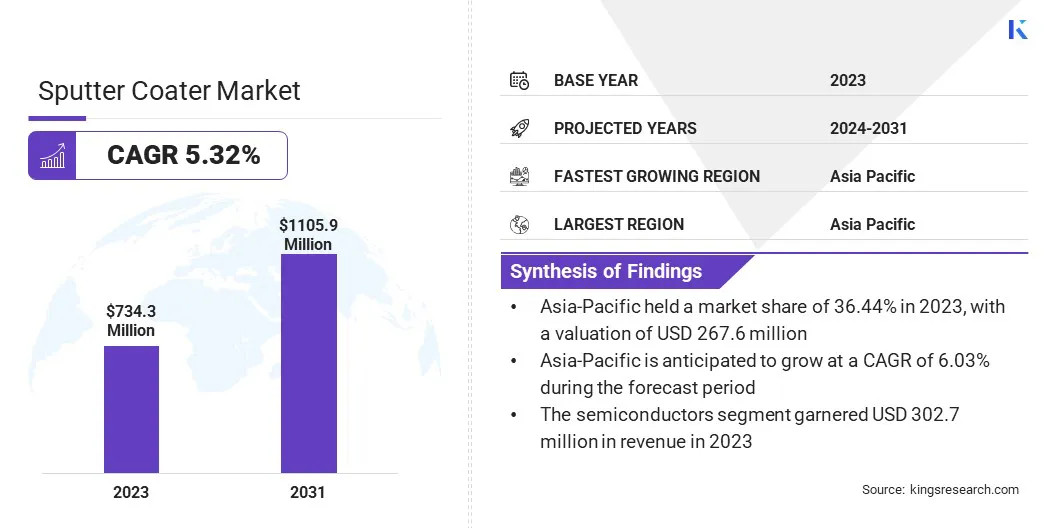

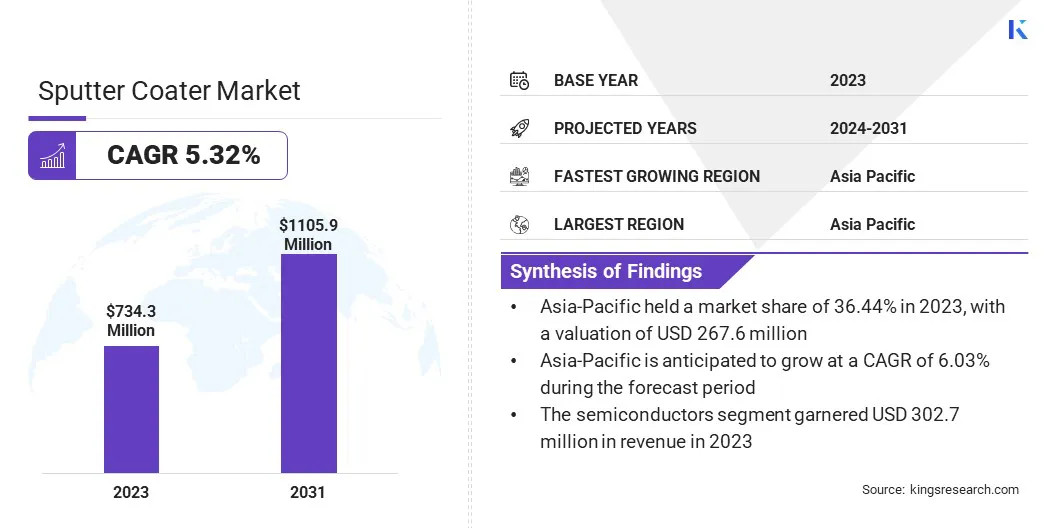

The global sputter coater market size was valued at USD 734.3 million in 2023 and is projected to grow from USD 769.4 million in 2024 to USD 1,105.9 million by 2031, exhibiting a CAGR of 5.32% during the forecast period.

This growth is driven by the increasing demand across various industries, particularly in electronics, semiconductors, renewable energy, and automotive sectors. Sputtering technology has become essential for depositing thin films with precise control over material properties such as thickness, uniformity, and adhesion.

Major companies operating in the global sputter coater inustry are ULVAC, Semicore Equipment Inc., Hitachi High-Tech Corporation., PVD Products, Inc., Quorum Technologies, Vac Coat Ltd., Cressington Scientific Instruments Ltd., Bühler, PLASSYS BESTEK, Angstrom Sciences, Inc., Oxford Instruments, Nanoscience Instruments., Denton Vacuum, Leica Microsystems, and JEOL USA, Inc.

The demand for high-performance sputter coating systems has grown significantly, pushing companies to invest in advanced technologies, such as magnetron sputtering, dual-target systems, and AI-driven process optimization. The market is poised for continued growth, spurred by technological innovation, expanding application areas, and the increasing need for high-quality, precise thin films in cutting-edge industries.

- In February 2025, Vac Coat Ltd. announced the launch of its DSCT-300, a new addition to its line of advanced sputter coating products. The DSCT-300 is designed to deliver high-precision thin-film coatings with enhanced uniformity and reliability.

Key Highlights:

- The global sputter coater market size was valued at USD 734.3 million in 2023.

- The market is projected to grow at a CAGR of 5.32% from 2024 to 2031.

- Asia Pacific held a market share of 36.44% in 2023, with a valuation of USD 267.6 million.

- The semiconductor segment garnered USD 302.7 million in revenue in 2023.

- The electronics and semiconductor segment is expected to reach USD 440.7 million by 2031.

- The market in Europe is anticipated to grow at a CAGR of 5.33% during the forecast period.

Market Driver

"Increasing Demand for Thin Film Coatings"

The increasing demand for thin film coatings is boosting the sputter coater market, as thin films are essential for various applications due to their ability to enhance the performance and durability of products across numerous industries. Thin film coatings offer significant advantages, including improved corrosion resistance, wear resistance, optical properties, and electrical conductivity.

Sputter coating offers several benefits, including the ability to apply uniform, high-quality coatings on complex substrates, making it an ideal solution for the production of thin films.

- In November 2024, Vac Coat Ltd. announced the redesign of its DST1-300 and DSCR-300 shutters, marking a significant upgrade to its sputter coating equipment lineup. The newly designed double shutters facilitates shutter movement inside the chamber by opening each piece in opposite directions, clockwise and counterclockwise.

Market Challenge

"Process Complexity and Technical Expertise"

Process complexity and technical expertise presents a significant challenge to the sputter coater market, as industries demand increasingly sophisticated thin films with precise properties. The process needs to be meticulously controlled to ensure that factors like film thickness, uniformity, adhesion, and material composition meet stringent specifications.

Technical expertise is crucial to successfully operate sputter coaters and optimize the process for different materials and applications. Engineers and technicians must possess a deep understanding of materials science, plasma physics, and vacuum systems to manage and fine-tune the sputtering process.

Investing in automated systems and advanced monitoring technologies can help reduce human error and improve process control. Automation tools, such as real-time sensors and AI-driven process optimization, can continuously monitor variables like deposition rate, pressure, and temperature, ensuring more consistent results with less hands-on intervention.

Developing modular, user-friendly sputter coating systems with built-in process controls and easy-to-understand interfaces can lower the barrier to entry for less-experienced operators while still ensuring high-quality results.

Market Trend

"Rise in Nanotechnology and Advanced Materials"

Nanotechnology enables the creation of materials with enhanced mechanical, electrical, optical, and chemical properties, which are essential for emerging industries such as electronics, healthcare, energy storage, and materials science. In the electronics industry, sputtered thin films are used to create semiconductors, sensors, and memory devices, where the ability to control film thickness and material composition at the nanoscale is crucial for improving device performance and efficiency.

In medical devices and biotechnology, sputtering enables the creation of biocompatible coatings for implants, drug delivery systems, and biosensors. These coatings can be engineered to interact with biological tissues at the molecular level, offering new solutions for medical applications.

Sputter Coater Market Report Snapshot

|

Segmentation

|

Details

|

|

By Substrate

|

Metal, Glass, Semiconductor, Others (Ceramics and Plastics)

|

|

By End-Use Industry

|

Electronics and Semiconductor, Automotive, Medical, Others (Hardware, FMCG, Construction)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Substrate (Metal, Glass, Semiconductor, Others (Ceramics and Plastics)): The semiconductor segment earned USD 302.7 million in 2023, due to the growing demand for high-precision coatings in semiconductor fabrication and electronics manufacturing.

- By End-use Industry (Electronics and Semiconductor, Automotive, Medical, Others (Hardware, FMCG, Construction)): The electronics and semiconductor segment held 40.80% share of the market in 2023, due to the increasing demand for advanced electronic devices, semiconductor components, and high-performance coatings in the rapidly growing technology sector.

Sputter Coater Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a sputter coater market share of around 36.44% in 2023, with a valuation of USD 267.6 million. The substantial market share can be attributed to the rapid industrialization, significant investments in electronics and semiconductor manufacturing, and the growing adoption of advanced technologies across the region.

The sputter coater in Asia Pacific is further bolstered by the increasing demand for consumer electronics, renewable energy applications, and automotive technologies that require high-performance coatings.

The sputter coater industry in Europe is poised for significant growth at a robust CAGR of 5.33% over the forecast period, driven by the increasing demand for high-quality thin-film coatings in industries such as electronics, automotive, and renewable energy. Technological innovations coupled with the rising adoption of advanced materials and sustainable manufacturing processes are further boosting the demand for sputter coater.

Europe’s emphasis on green energy initiatives, such as the expansion of solar power infrastructure, and its efforts to support high-tech manufacturing in countries like Germany, France, and the UK, are also contributing to the market's expansion.

- In March 2023, Science Services GmbH announced a strategic partnership with Meiwafosis Co., Ltd., Japan to distribute its new Osmium PE-CVD coating system "Tennant20" in Germany, Austria and other European countries.

Regulatory Frameworks:

- The International Organization for Standardization (ISO) regulates ISO 45001:2018, which specifies the requirements for an occupational health and safety (OH&S) management system, aiming to provide a safe and healthy workplace by preventing work-related injuries and illnesses.

- The American Society for Testing and Materials (ASTM) International regulates ASTM F1844-97 (2018), which outlines the requirements for metallic coatings, ensuring uniformity, adhesion, and durability for various industrial applications.

- The European Union (EU) regulates the Pressure Equipment Directive (PED) 2014/68/EU, which sets out safety requirements for the design, manufacturing, and conformity assessment of pressure equipment.

- The European Union (EU) regulates Directive 2011/65/EU (RoHS Directive), which restricts the use of hazardous substances in electrical and electronic equipment to reduce environmental and health risks associated with substances like lead, mercury, and cadmium.

Competitive Landscape

The global sputter coater market is characterized by the presence of several key players that offer a range of sputtering equipment and solutions catering to diverse industry needs.

A major competitive factor in the market is the ability to deliver advanced sputtering systems that offer high precision, flexibility, and scalability, allowing manufacturers to cater to sectors like electronics, semiconductor fabrication, automotive, and renewable energy.

Companies are increasingly investing in research and development (R&D) to develop next-generation sputtering technologies, such as high-rate deposition systems, multi-target sputtering, and AI-powered process control, which help improve efficiency, reduce costs, and provide superior coatings.

List of Key Companies in Sputter Coater Market:

- ULVAC

- Semicore Equipment Inc.

- Hitachi High-Tech Corporation.

- PVD Products, Inc.

- Quorum Technologies

- Vac Coat Ltd.

- Cressington Scientific Instruments Ltd.

- Bühler

- PLASSYS BESTEK

- Angstrom Sciences, Inc.

- Oxford Instruments

- Nanoscience Instruments.

- Denton Vacuum

- Leica Microsystems

- JEOL USA, Inc.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In January 2025, Vac Coat Ltd. announced a strategic collaboration with ATG Instrumentación S.A. de C.V., a recognized leader in precision measurement and instrumentation. This partnership aims to enhance the capabilities of both companies by combining VACCOAT's expertise in sputter coating technology with ATG Instrumentación's advanced measurement systems.