Market Definition

Specialty generics are lower-cost, therapeutically equivalent versions of complex specialty medicines, such as biologics, injectables, inhalables, transdermals, or other advanced formulations that require unique development, manufacturing, or handling expertise.

The market encompasses the development, manufacturing, and commercialization of these complex generic drugs across therapeutic areas such as oncology, autoimmune diseases, central nervous system disorders, cardiovascular diseases, and rare conditions.

Specialty Generics Market Overview

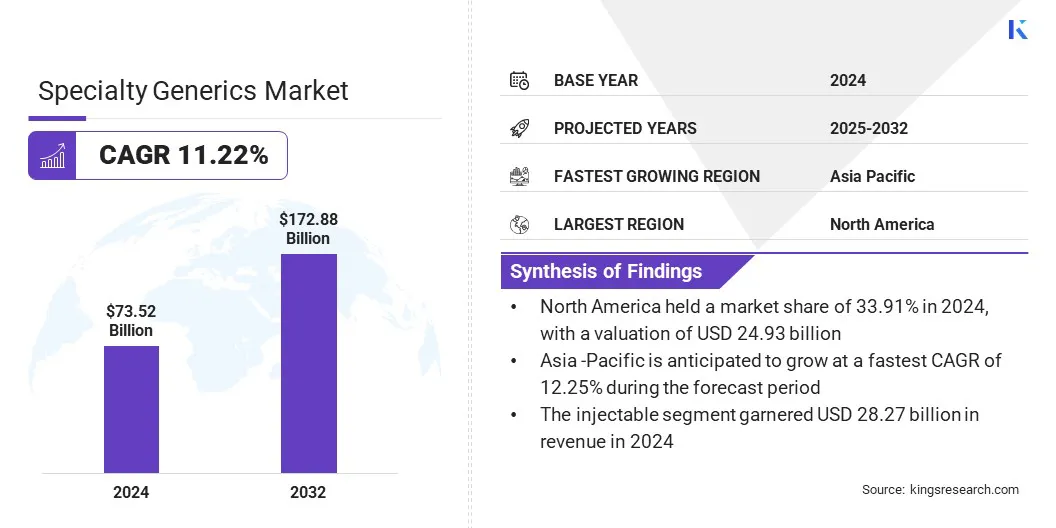

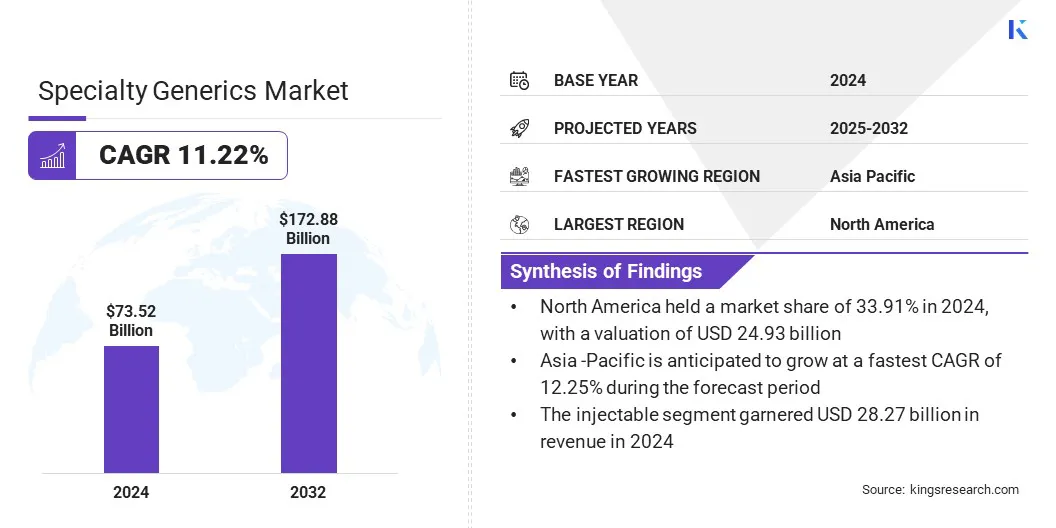

The global specialty generics market size was valued at USD 73.52 billion in 2024 and is projected to grow from USD 81.56 billion in 2025 to USD 172.88 billion by 2032, exhibiting a CAGR of 11.22% over the forecast period.

The market is driven by rising healthcare cost-containment measures implemented by governments, which are boosting the demand for affordable specialty alternatives and supporting broader access to specialty generics. Advancements in manufacturing technologies, such as complex formulation techniques and scalable production processes, are enabling efficient and reliable production of specialty generics.

Key Highlights:

- The specialty generics industry size was valued at USD 73.52 billion in 2024.

- The market is projected to grow at a CAGR of 11.22% from 2025 to 2032.

- North America held a share of 33.91% in 2024, valued at USD 24.93 billion.

- The injectable segment garnered USD 28.27 billion in revenue in 2024.

- The oncology segment is expected to reach USD 47.92 billion by 2032.

- The online segment is anticipated to witness the fastest CAGR of 11.88% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 12.25% over the forecast period.

Major companies operating in the specialty generics market are Teva Pharmaceuticals USA, Inc, Viatris Inc, Sun Pharmaceutical Industries Ltd, Dr. Reddy’s Laboratories Ltd, Sandoz AG, Cipla Limited, STADA Arzneimittel AG, Lupin Limited, Zydus Group, Mallinckrodt Pharmaceuticals Limited, Amneal Pharmaceuticals LLC, Glenmark Pharmaceuticals Ltd, Endo, Inc, Biocon Ltd, and Alkem Laboratories Ltd.

The rising incidence of cancer is increasing the demand for cost-effective oncology generics as alternatives to high-priced branded therapies. The growing disease burden is driving the adoption of specialty generics in complex formulations and injectables to improve access and reduce treatment costs for patients and healthcare systems.

- In February 2024, the World Health Organization (WHO) projected that global cancer cases is expected to rise from 20 million in 2022 to over 35 million by 2050, representing a 77% increase. This surge in cancer prevalence is driving demand for cost-effective oncology treatments and boosting the adoption of specialty generics.

Government Policies and Initiatives

A key driver propelling the growth of the specialty generics market is government policies and initiatives promoting the adoption of affordable alternatives to branded therapies.

Governments are supporting the development of generics and biosimilars by easing regulatory approvals and expanding access to lower-cost medicines, thereby increasing the adoption of specialty generics. This focus on improving accessibility and reducing healthcare costs drives the adoption of specialty generics, thereby accelerating market growth.

- In April 2025, the U.S. government implemented executive actions to lower drug prices by promoting generic and biosimilar alternatives to branded prescription drugs.

Complex Manufacturing Processes of Specialty Generics

A key challenge impeding the growth of the specialty generics market is the complexity of their manufacturing processes. Producing specialty generics involves advanced formulations such as injectables, inhalables, ophthalmics, and transdermals, which require specialized facilities, sophisticated equipment, and strict adherence to regulatory standards.

This complexity increases production costs and timelines, and creates a barrier for new entrants, restricting large-scale adoption of specialty generics. To address this challenge, market players are investing in advanced production technologies that ensure precision, sterility, and regulatory compliance.

Companies are forming partnerships with contract development and manufacturing organizations to leverage specialized expertise and expand the capacity of specialty generic drugs efficiently.

Additionally, they are adopting innovative drug delivery systems, such as prefilled syringes and auto-injectors, along with automation to streamline production, minimize errors, and enhance the efficiency of complex specialty generics manufacturing.

Growing Adoption of Advanced Drug Delivery Technologies

A key trend influencing the specialty generics market is the growing adoption of advanced drug delivery technologies. Manufacturers are increasingly developing formulations such as long-acting injectables and microsphere-based systems to enhance patient convenience and therapeutic outcomes.

These technologies enable sustained or targeted drug release, reduce dosing frequency, and improve clinical effectiveness in complex therapies such as oncology and cardiometabolic treatments. The widespread adoption of these advanced drug delivery solutions is enhancing product differentiation and expanding product offerings in the market.

- In September 2025, Amneal Pharmaceuticals received U.S. FDA approval for Risperidone Extended-Release Injectable Suspension, utilizing microsphere-based long-acting technology. The launch expands Amneal’s complex injectables portfolio and strengthens its presence in advanced drug delivery.

Specialty Generics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Route of Administration

|

Injectable, Oral, Others

|

|

By Application

|

Oncology, Inflammatory conditions, Multiple sclerosis, Hepatitis C, Others

|

|

By End Use

|

Specialty pharmacy, Retail pharmacy, Hospital pharmacy, Online

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Route of Administration (Injectable, Oral, and Others): The injectable segment earned USD 28.27 billion in 2024, due to the high demand for complex specialty therapies requiring precise and rapid delivery.

- By Application (Oncology, Inflammatory conditions, Multiple sclerosis, Hepatitis C, and Others): The oncology segment held 27.69% of the market in 2024, driven by the rising prevalence of cancer and increased adoption of specialty generics in treatment protocols.

- By End Use (Specialty pharmacy, Retail pharmacy, Hospital pharmacy, and Online): The hospital pharmacy segment is projected to reach USD 62.74 billion by 2032, owing to growing hospital-administered specialty treatments and expanded inpatient care services.

Specialty Generics Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America specialty generics market share stood at 33.91% in 2024 in the global market, valued at USD 24.93 billion. This dominance is driven by rising healthcare costs and insurance cost management measures, such as formulary management and step therapy. These measures encourage the adoption of specialty generics by enhancing accessibility and offering a more cost-effective alternative to branded therapies.

Advancements in complex drug formulations and manufacturing processes are enabling efficient production of injectables, ophthalmics, and inhalables. Strategic expansions and acquisitions by regional market players are enhancing production capacity, broadening specialty generics portfolios, and strengthening distribution networks across hospitals, pharmacies, and contract development and manufacturing organizations.

- In April 2024, Bora Pharmaceuticals completed the acquisition of Upsher-Smith Laboratories, a U.S.-based generics manufacturer. The acquisition expands Bora’s specialty generics portfolio, enhances its CDMO capabilities, and strengthens its market reach through Upsher-Smith’s established product base and distribution network in the U.S.

Asia Pacific specialty generics industry is set to grow at a robust CAGR of 12.25% over the forecast period. This growth is propelled by rapid population growth in the region and the rising prevalence of chronic and complex diseases, such as diabetes, cardiovascular disorders, and cancer, which are increasing the demand for specialty treatments.

Growing healthcare expenditure and government initiatives, such as reimbursement programs, pricing regulations, and promotion of generics adoption, are supporting the adoption of specialty generics. Additionally, market players in the region are actively expanding operations and product portfolios, thereby improving distribution networks and accelerating specialty generics adoption across hospitals and pharmacies in the region.

- In June 2024, Lotus Pharmaceuticals acquired Teva Pharma Thailand to expand its footprint in Southeast Asia. The acquisition strengthens Lotus’ portfolio in oncology, women’s health, ophthalmic, and respiratory products and broadens its presence across hospital and pharmacy channels in Thailand.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates specialty generics by overseeing their approval, manufacturing, labeling, and marketing. It ensures bioequivalence, enforces Good Manufacturing Practices (GMP), monitors post-market safety, and evaluates complex formulations such as injectables, ophthalmics, and inhalables to maintain quality, efficacy, and patient safety.

- In the UK, the Medicines and Healthcare Products Regulatory Agency (MHRA) regulates specialty generics by reviewing marketing authorizations, bioequivalence, and quality data. It monitors manufacturing facilities, enforces GMP, oversees labeling and packaging, and ensures safety and efficacy of complex formulations, including ophthalmic, inhalable, and injectable products.

- In China, the National Medical Products Administration (NMPA) regulates specialty generics by approving new and generic drug applications and reviewing quality and bioequivalence data. It inspects manufacturing facilities, enforces GMP compliance, monitors post-market safety, and regulates advanced formulations, including biologics, injectables, and ophthalmic products, to ensure safe and effective patient access.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates specialty generics by approving clinical trials, generic drug registrations, and bioequivalence studies. It oversees manufacturing standards, quality control, labeling, and pharmacovigilance, particularly for complex formulations such as injectables, ophthalmics, inhalables, and transdermals, ensuring therapeutic efficacy and patient safety.

Competitive Landscape

Major players operating in the specialty generics industry are actively expanding their product portfolios by introducing bioequivalent versions of established branded therapies to enhance market presence and strengthen their therapeutic offerings.

Market players are entering new geographic regions to broaden distribution networks across hospitals and pharmacies, improving the reach and availability of specialty generics. Additionally, they are leveraging advanced manufacturing capabilities, such as precision formulation technologies, to maintain consistent product quality in complex specialty generics.

- In July 2025, Lupin launched generic Loteprednol Etabonate Ophthalmic Suspension in the U.S. The product is bioequivalent to Bausch & Lomb’s Lotemax 0.5% and expands Lupin’s ophthalmic specialty generics portfolio and provides a more accessible treatment option for steroid-responsive ocular inflammatory conditions.

Key Companies in Specialty Generics Market:

- Teva Pharmaceuticals USA, Inc

- Viatris Inc

- Sun Pharmaceutical Industries Ltd

- Reddy’s Laboratories Ltd

- Sandoz AG

- Cipla Limited

- STADA Arzneimittel AG

- Lupin Limited

- Zydus Group

- Mallinckrodt Pharmaceuticals Limited

- Amneal Pharmaceuticals LLC

- GLENMARK PHARMACEUTICALS LTD

- Endo, Inc

- Biocon Ltd

- Alkem Laboratories Ltd.

Recent Developments (M&A/Agreements/Product Launch)

- In August 2025, Senores Pharmaceuticals acquired two USFDA-approved Abbreviated New Drug Applications (ANDAs) from Teva Pharmaceuticals, Inc. The acquisition expands Senores’ U.S. specialty generics portfolio. It also strengthens the company’s presence in the U.S. and enhances access to specialty therapies.

- In September 2025, CapVest signed a definitive agreement to acquire a majority stake in STADA from Bain Capital and Cinven. The acquisition aims to strengthen STADA’s presence in generics and specialty pharmaceuticals by leveraging CapVest’s healthcare expertise, capital investment.

- In March 2025, Mallinckrodt and Endo entered a definitive agreement to merge, combining their generics businesses along with Endo’s sterile injectables division. The is aimed at creating a scaled and diversified pharmaceutical leader, enhancing capabilities in specialty generics. The merged entity plans to leverage operational synergies, expand product offerings, and strengthen distribution networks.

- In March 2025, Glenmark Pharmaceuticals launched generic Empagliflozin in India, including fixed-dose combinations with Linagliptin and Metformin. This will expand its cardiometabolic specialty generics portfolio and provide an affordable treatment option for patients with type 2 diabetes and cardiovascular risk.

- In March 2024, Avenacy launched Fosaprepitant for Injection and Fulvestrant Injection in the U.S., strengthening its specialty injectable generics portfolio in oncology and supportive care.