Specialty Coatings Market Size

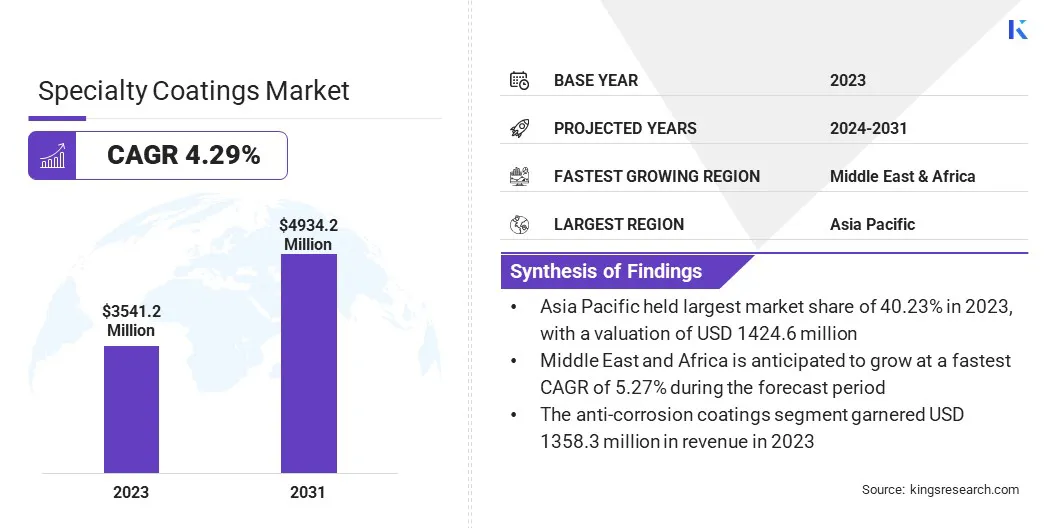

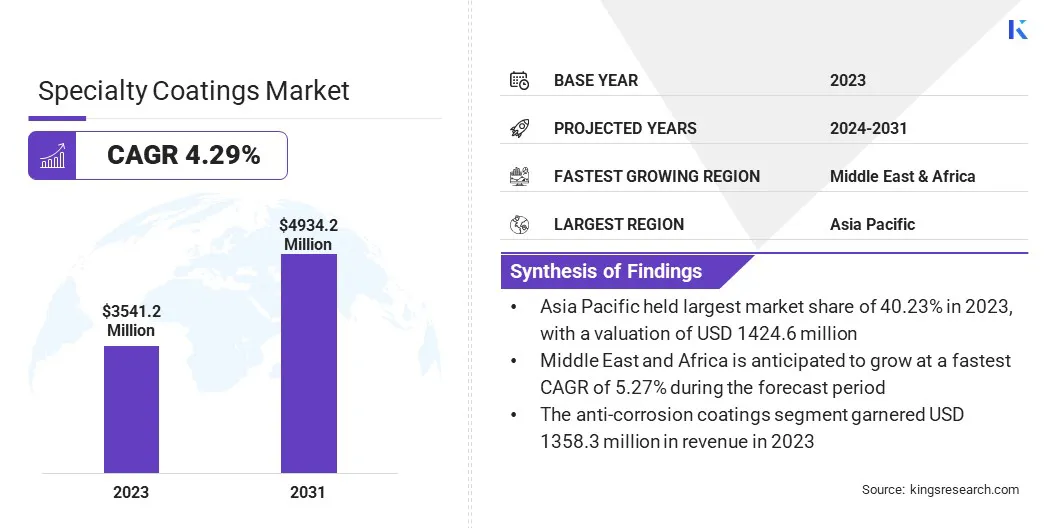

The global Specialty Coatings Market size was valued at USD 3,541.2 million in 2023 and is projected to grow from USD 3,678.3 million in 2024 to USD 4,934.2 million by 2031, exhibiting a CAGR of 4.29% during the forecast period.

The oil & gas, marine, and construction industries rely on durable coatings to protect equipment and structures gainst corrosion in harsh environments. Rising investments in infrastructure development and the need to extend the lifecycle of assets are boosting the growth of the specialty coatings market.

In the scope of work, the report includes products offered by companies such as PPG Industries, Inc., BASF SE, Axalta Coating Systems, The Sherwin-Williams Company, Nippon Paint Holdings Co., Ltd., RPM International Inc., Asian Paints Limited, Hempel A/S, Valspar, Jotun, and others.

- In August 2024, PPG Industries Inc. introduced PPG PITT-THERM 909, a silicone-based spray-on insulation (SOI) coating for high-temperature applications. Engineered for use in sectors such as oil and gas, chemical, petrochemical, and other critical infrastructure industries, it enhances safety, asset protection, and operational efficiency, outperforming traditional thermal insulating materials.

The defense industry extensively utilizes specialty coatings for equipment, vehicles, and infrastructure to ensure optimal performance in extreme environments. Protective coatings enhance resistance to wear, corrosion, and chemical exposure, making them essential for military applications.

Rising defense budgets and modernization efforts across nations are creating a strong demand for advanced coatings tailored to specific requirements.

Specialty coatings are high-performance, customized coatings designed to provide specific functions such as corrosion resistance, thermal protection, wear resistance, and aesthetic enhancement.

These coatings are applied to various substrates, including metals, concrete, plastics, and ceramics, in industries such as automotive, aerospace, construction, and electronics. They are engineered to ensurer durability, environmental protection, and operational efficiency, often incorporating advanced technologies such as nanotechnology, self-healing materials, or smart coatings.

Specialty coatings play a critical role in enhancing the longevity and performance of products and infrastructure, particularly in harsh or demanding environments.

Analyst’s Review

Technological innovations have transformed the specialty coatings industry, enabling the development of advanced products with superior properties and functionalities. Key innovations such as nanotechnology, self-healing coatings, and smart materials have broadened the scope of applications across multiple sectors, including automotive, aerospace, construction, and electronics.

These advancements address critical challenges in wear resistance, thermal management, and chemical exposure, providing solutions previously deemed unattainable.

- In January 2023, Coval Technologies launched innovative, long-lasting coatings that are easy to apply and offer effective protection against chemicals and corrosion. These UV-stable, single-component, thin-film coatings bond covalently with various substrates, including concrete, stone, vinyl, metals, and painted surfaces. Due to its nanotechnology bonding, the coating delivers exceptional adhesion and superior abrasion resistance.

This is prompting companies to invest heavily in research and development to meet evolving industry demands and capitalize on emerging opportunities. The continuous evolution of coating technologies enhances product performance and fosters broader adoption, thereby stimulating the growth of the market.

Specialty Coatings Market Growth Factors

Specialty coatings are commonly used in critical infrastructure projects, including pipelines, bridges, and offshore platforms, for their exceptional resistance to degradation. Increased investments in industrial infrastructure and stringent maintenance requirements further propel the growth of the specialty coatings market.

Moreover, specialty coatings are essential in addressing industry-specific challenges in automotive and aerospace manufacturing. The growth of electric vehicle production and lightweight aircraft manufacturing has increased the demand for high-performance coatings.

- According to the IEA report, electric car sales in 2023 surged by 3.5 million, a remarkable 35% growth from 2022. This figure is more than six times higher than the sales recorded in 2018. In 2023, weekly new registrations exceeded 250,000, surpassing the total annual registrations of 2013.

Companies in these sectors are integrating specialty coatings to optimize fuel efficiency, minimize maintenance costs, and improve aesthetics. Increasing global transportation demands and technological advancements are increasing the adoption of specialty coatings in these industries.

However, the high cost of advanced coatings, particularly in price-sensitive industries, is limiting their adoption and hindering the growth of the specialty coatings market. The complexity of manufacturing these coatings results in longer production timelines and increased costs.

To overcome these challenges, companies are focusing on developing cost-effective, eco-friendly coatings with lower VOC emissions. Furthermore, investing in automation and improving manufacturing processes can reduce costs and production time, making specialty coatings more accessible across industries.

Specialty Coatings Market Trends

Renewable energy projects are increasingly utilizing specialty coatings to safeguard critical assets against harsh environmental conditions, reshaping the landscape of the specialty coatings market. Wind turbines, solar panels, and hydroelectric equipment require coatings that offer resistance to UV rays, corrosion, and extreme temperatures.

The global transition toward clean energy sources has spurred significant investments in renewable infrastructure, increasing the demand for protective solutions to enhance operational efficiency.

- The 2024 report by the Global Wind Energy Council highlights that the global wind industry set a record in 2023, installing 117 GW of new capacity. To meet COP28 targets, annual installations are expected to triple, reaching at least 320 GW by 2030.

Moreover, the growing consumer preference for both aesthetically appealing and functional coatings in residential and commercial buildings has fueled the demand for specialty coatings in the architectural sector. These coatings provide superior finishes, weather resistance, and energy efficiency, addressing the requirements of modern construction.

Enhanced durability and customization options make specialty coatings a preferred choice for high-end projects. The focus on green buildings and sustainable construction practices further boosts the adoption of eco-friendly specialty coatings, thus supporting market growth.

Segmentation Analysis

The global market has been segmented based on coating type, technology, end use industry, and geography.

By Coatings Type

Based on coatings type, the market has been segmented into anti-corrosion coatings, fire-resistant coatings, waterproof coatings, heat resistant coatings, anti-graffiti coatings, and others. The anti-corrosion coatings segment led the specialty coatings market in 2023, reaching a valuation of USD 1,388.9 million, propelled by the critical need for protection against corrosion across industries.

These coatings are essential for safeguarding infrastructure, machinery, and equipment in harsh environments such as marine, oil and gas, and chemical industries. The growing focus on asset longevity, coupled with stringent regulatory standards for environmental protection, leads to the increased demand for anti-corrosion solutions.

Additionally, advancements in coating technologies, including more durable and cost-effective formulations, have expanded their applicability and aided segmental growth.

By Technology

Based on technology, the market has been classified into solvent-based coatings, water-based coatings, powder coatings, high-solid coatings, nano coatings, and others. The solvent-based coatings segment secured the largest revenue share of 36.78% in 2023.

These coatings offer excellent adhesion, durability, and resistance to harsh environmental conditions, making them ideal for demanding applications in industries such as automotive, construction, and industrial coatings. The ability of solvent-based coatings to deliver smooth finishes with high gloss and color retention further boosts their demand.

Additionally, their relatively easy application process and faster drying times enhance operational efficiency, making them a preferred choice for large-scale projects.

By End Use Industry

Based on end use industry, the market has been divided into automotive, industrial, marine, construction, electronics, and others. The construction segment is poised to witness significant growth, resitering a robust CAGR of 7.91% through the forecast period.

With rapid urbanization and large-scale infrastructure projects globally, the demand for coatings that protect against moisture, UV radiation, and corrosion is steadily increasing. Specialty coatings in construction provide essential benefits such as weather resistance, fire protection, and improved structural integrity, making them integral to modern construction practices.

Furthermore, rising sustainability trends and green building certifications have increased the demand for eco-friendly, high-performance coatings, thereby supporting segmental expansion.

Specialty Coatings Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia Pacific specialty coatings market accounted for a major share of 40.23% in 2023, valued at USD 1,424.6 million. This growth is largely attributed to a surge in industrialization and urbanization, particularly in emerging economies auch as China, India, and Southeast Asia.

The expanding manufacturing, automotive, and construction sectors are driving demand for specialty coatings to protect machinery, infrastructure, and vehicles from environmental degradation.

Additionally, rapid urbanization is fueling large-scale infrastructure projects, including roads, bridges, and smart cities, thereby increasing the demand for advanced coating solutions to ensure longevity and performance.

- The United Nations Human Settlements Programme reports that Asia houses over 54% of the global urban population, or more than 2.2 billion people. By 2050, this population is projected to grow by 1.2 billion, a 50% increase.

Moreover, the rise in electric vehicle production, especially in China and Japan, has increased the demand for high-performance coatings that enhance battery efficiency and safety. This growing automotive manufacturing base significantly supports the expansion of the regional market.

Middle East & Africa is set to experience significant growth, registering a CAGR of 5.27% over the forecast period. The Middle East, a global leader in oil and gas production, propels the demand for specialty coatings to protect equipment and pipelines from corrosion, extreme temperatures, and harsh chemicals.

These coatings are essential for ensuring the operational efficiency and longevity of critical infrastructure. As countries invest in modernizing refineries and expanding pipeline networks, the demand for high-performance coatings grows.

Additionally, the Middle East and Africa are investing in renewable energy sources, including solar and wind power, to diversify energy portfolios and reduce dependency on fossil fuels. Projects such as the Mohammed bin Rashid Al Maktoum Solar Park in Dubai play a key role in boosting this demand.

Competitive Landscape

The global specialty coatings market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Specialty Coatings Market

- PPG Industries, Inc.

- BASF SE

- Axalta Coating Systems

- The Sherwin-Williams Company

- Nippon Paint Holdings Co., Ltd.

- RPM International Inc.

- Asian Paints Limited

- Hempel A/S

- Valspar

- Jotun

Key Industry Developments

- November 2024 (Partnership): PPG Industries partnered with SARO/Siccardi, Italy’s largest distributor of powder coatings. This collaboration aims to enhance PPG’s distribution network in Italy, offering customers improved access to a broader range of high-quality powder coating products and services.

- October 2024 (Acquisition): Nippon Paint Holdings announced its acquisition of AOC, a leading manufacturer of specialty chemical formulations in unsaturated polyester and vinyl ester sectors, from Lone Star Funds. The deal, pending closing adjustments and regulatory approvals, is anticipated to finalize in the first half of 2025.

The global specialty coatings market has been segmented as:

By Coating Type

- Anti-Corrosion Coatings

- Fire-resistant Coatings

- Waterproof Coatings

- Heat resistant Coatings

- Anti-Graffiti Coatings

- Others

By Technology

- Solvent-Based Coatings

- Water-Based Coatings

- Powder Coatings

- High-Solid Coatings

- Nano Coatings

- Others

By End Use Industry

- Automotive

- Industrial

- Marine

- Construction

- Electronics

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America