Market Definition

The market includes a broad range of technologies that use solid-state methods for thermal management across multiple industries. It includes systems that operate without traditional mechanical compressors or refrigerants. The market is segmented by technology, primarily thermoelectric cooling (TEC), magnetocaloric cooling, and other emerging solid-state approaches.

The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Solid State Cooling Market Overview

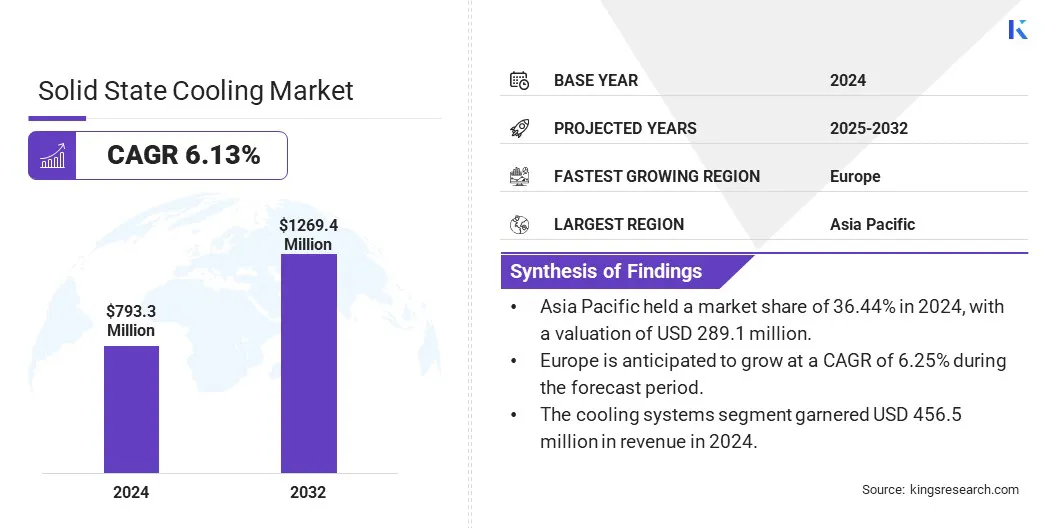

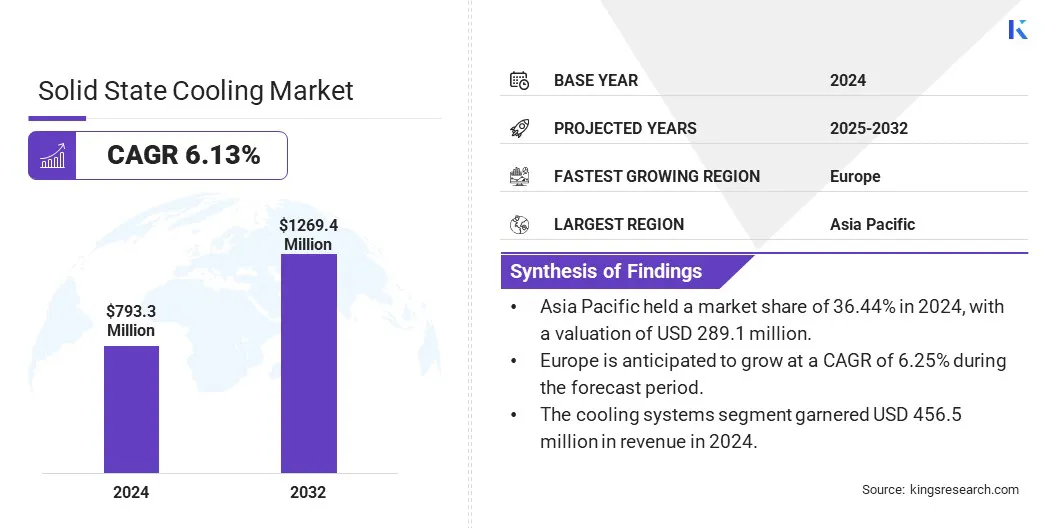

The global solid state cooling market size was valued at USD 793.3 million in 2024 and is projected to grow from USD 836.9 million in 2025 to USD 1,269.4 million by 2032, exhibiting a CAGR of 6.13% over the forecast period.

The growth is driven by increasing demand for energy-efficient, eco-friendly cooling solutions. With global regulations phasing out harmful refrigerants, industries are shifting toward non-compressor-based technologies such as thermoelectric and magnetocaloric systems. These systems feature silent operation, compact size, and low maintenance, which is ideal for electronics, medical devices, and aerospace applications.

Major companies operating in the solid state cooling industry are Adcol Electronic Guangzhou Company Ltd., Phononic.com, Wakefield Thermal, Inc., Hi-Z TECHNOLOGY, Tark Thermal Solutions, Thermonamic Electronics(Jiangxi) Corp., Ltd., MERIT TECHNOLOGY GROUP, Ferrotec Corporation, TEC Microsystems GmbH, Kryotherm, Crystal Ltd., Coherent Corp., RMT Ltd., Gentherm, TE Technology, Inc.

Another growth factor is the rise of AI-driven data centers, which require advanced cooling to maintain high performance. Solid state cooling is used in liquid-cooled enterprise SSDs in these deployments for reliable and efficient thermal management. Continuous innovation in material sciences and miniaturization is expanding the range of applications and accelerating the market growth.

- In January 2025, Coherent Corp. launched its CT-Series thermoelectric coolers to expand its thermal management offerings. The new line is designed to deliver high thermal performance, cost-efficiency, and reliability for life sciences, medical, and industrial applications.

Key Highlights:

- The solid state cooling market size was recorded at USD 793.3 million in 2024.

- The market is projected to grow at a CAGR of 6.13% from 2025 to 2032.

- Asia Pacific held a market share of 36.44% in 2024, with a valuation of USD 289.1 million.

- The cooling systems segment garnered USD 456.5 million in revenue in 2024.

- The thermoelectric cooling (TEC) segment is expected to reach USD 589.6 million by 2032.

- The healthcare segment is expected to reach USD 417.4 million by 2032.

- Europe is anticipated to grow at a CAGR of 6.25% during the forecast period.

Market Driver

Rising Demand for Energy-efficient Cooling Solutions

The market is driven by the rising demand for energy-efficient cooling solutions across sectors. Electronics, automotive, and healthcare industries need thermal management systems that consume less power and reduce environmental impact.

Solid state cooling, including thermoelectric and magnetocaloric methods, offer low energy consumption and silent operation without any harmful refrigerants. As a result, end-users are adopting solid state cooling to meet their energy goals while maintaining a reliable temperature.

- In June 2024, Laird Thermal Systems launched the SuperCool X Series, a high-performance thermoelectric cooler assembly featuring next-generation thermoelectric coolers with advanced semiconductor materials. The series offers up to 10% improved cooling performance and is designed for analytical instrumentation and medical diagnostic chambers.

Market Challenge

High Cost of Technology and Materials

A key challenge in the solid state cooling market is the high cost of this technology and materials. Thermoelectric and magnetocaloric systems use advanced materials that are expensive and require precise manufacturing processes. This increases the upfront costs compared to conventional cooling systems, limiting adoption in price-sensitive applications.

To overcome this, companies are focusing on improving material efficiency and scaling up production to reduce unit costs. Advances in low-cost thermoelectric materials and improved manufacturing techniques are expected to make solid state cooling more cost-competitive over time.

Market Trend

Integration of Solid State Cooling in Liquid-Cooled Enterprise SSDS for AI Deployments

In the market, one key trend is its increasing use in liquid-cooled enterprise SSDs for AI deployments. As data centers face rising thermal loads from AI-driven applications, there is a growing need for compact, reliable, and efficient cooling systems.

Solid state cooling technologies, particularly thermoelectric modules integrated with liquid-cooled SSDs can maintain optimal operating temperatures and prevent performance degradation. These systems offer consistent data throughput, consume less power, and extend the lifespan of high-performance storage devices for next-generation AI infrastructure.

- In March 2025, Solidigm unveiled one of the world’s first liquid-cooled enterprise solid state drives (eSSDs) at the GTC AI Conference. The innovation combines the Solidigm D7-PS1010 E1. S 9.5mm SSD with cold-plate technology to support fully fanless GPU servers. This solution addresses previous limitations of single-side cooling and lack of hot-swappability in SSD DLC designs.

Solid State Cooling Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Cooling Systems (Air Conditioners, Chillers, Coolers, Heat Pumps, Others), Refrigeration Systems (Refrigerators, Freezers, Specialized Refrigeration Units)

|

|

By Technology

|

Thermoelectric Cooling (TEC), Magnetocaloric Cooling, Others

|

|

By End-use Industry

|

Electronics & Semiconductors, Healthcare, Automotive, Aerospace & Defense, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Cooling Systems, Refrigeration Systems): The Cooling Systems segment earned USD 456.5 million in 2024 due to rising demand for compact and energy-efficient thermal management solutions across consumer electronics and industrial equipment.

- By Technology (Thermoelectric Cooling (TEC), Magnetocaloric Cooling, Others): The thermoelectric cooling (TEC) segment held 47.44% of the market in 2024, due to its scalability, silent operation, and integration into electronics and medical devices.

- By End-use Industry (Electronics & Semiconductors, Healthcare, Automotive, and Aerospace & Defense): The healthcare segment is projected to reach USD 417.4 million by 2032, owing to increasing adoption of precise temperature control systems in medical storage and diagnostic equipment.

Solid State Cooling Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific solid state cooling market share stood at 36.44% in 2024 in the global market, with a valuation of USD 289.1 million. This dominance is driven by high demand from the electronics and semiconductor industries in China, Japan, South Korea, and Taiwan.

Rapid industrialization, robust manufacturing output, and high adoption of energy-efficient cooling technologies across consumer electronics and automotive segments are key contributors to market growth. Government initiatives promoting sustainable technologies and significant investments in healthcare infrastructure have also supported market growth in the region.

- In January 2024, the Ministry of Science & Technology, Government of India, announced a new alloy that can serve as an effective magnetic refrigerant. This innovation establishes magnetic refrigeration technology as a sustainable alternative to vapor-cycle systems, to reduce greenhouse gas emissions and improve energy efficiency in cooling applications.

Europe is expected to witness a CAGR of 6.25% over the forecast period. The growth is due to the regulatory focus on energy efficiency and sustainability across key sectors. The region has seen consistent demand from the automotive, aerospace, and healthcare industries, where solid state technologies align with performance and environmental goals.

Countries such as Germany, France, and the UK are leading in R&D investments and integration of advanced thermal management systems. The push toward electrification and precision cooling in industrial applications also continues to drive market adoption.

Regulatory Frameworks

- In the U.S, solid state cooling technologies are regulated by the U.S. Department of Energy (DOE) that promote energy efficiency under the Energy Policy and Conservation Act (EPCA). These regulations encourage the development of non-compressor-based systems that reduce greenhouse gas emissions.

- In Japan, the Top Runner Program under the Energy Conservation Law sets performance benchmarks that support the adoption of solid state cooling technologies by encouraging manufacturers to improve energy efficiency in appliances and industrial systems.

Competitive Landscape

The key players in the solid state cooling market are prioritizing technology development, particularly in thermoelectric and magnetocaloric systems, to improve efficiency and scalability. Many companies are investing in patent portfolios to strengthen their intellectual property and secure long-term profitability.

Partnerships with electronics and medical device manufacturers have become a core strategy to accelerate integration of solid state systems into commercial products. Several firms are entering into joint development agreements with research institutions to advance material science and system miniaturization.

Additionally, expansion into high-growth regions through manufacturing setups and distribution agreements is a common approach to improve market presence.

- In February 2025, Vertiv announced the launch of its Liquid Cooling Services portfolio. The offering supports the entire lifecycle of liquid-cooled systems, including installation, fluid management, maintenance, and digital services. It aims to enhance system availability and efficiency for AI and high-density compute applications.

List of Key Companies in Solid State Cooling Market:

- Adcol Electronic Guangzhou Company Ltd.

- Phononic.com

- Wakefield Thermal, Inc.

- Hi-Z TECHNOLOGY

- Tark Thermal Solutions

- Thermonamic Electronics(Jiangxi) Corp., Ltd.

- MERIT TECHNOLOGY GROUP

- Ferrotec Corporation

- TEC Microsystems GmbH

- Kryotherm

- Crystal Ltd.

- Coherent Corp.

- RMT Ltd.

- Gentherm

- TE Technology, Inc.

Recent Developments (Product Launch)

- In May 2025, Frore Systems unveiled the AirJet Mini G2 at COMPUTEX 2025. The new solid-state active cooling chip increases heat removal by 50% while maintaining the original compact size. Designed to support growing AI processing demands, the AirJet Mini G2 delivers silent, powerful cooling with 7.5 Watts heat removal and 1750 Pascals back pressure. CREVIS, a machine vision camera manufacturer, adopted the technology to improve image quality and device performance.