Market Definition

The market refers to the industry that involves the production, of SOFCs. SOFCs are a type of electrochemical device that converts chemical energy into electrical energy through a reaction between a fuel (typically hydrogen or natural gas) and oxygen.

They operate at high temperatures (typically between 600°C and 1000°C) and are highly efficient for electricity generation and Combined Heat and Power (CHP) applications. The report identifies the principal factors contributing to market expansion, along with an analysis of the competitive landscape influencing its growth trajectory.

Solid Oxide Fuel Cell Market Overview

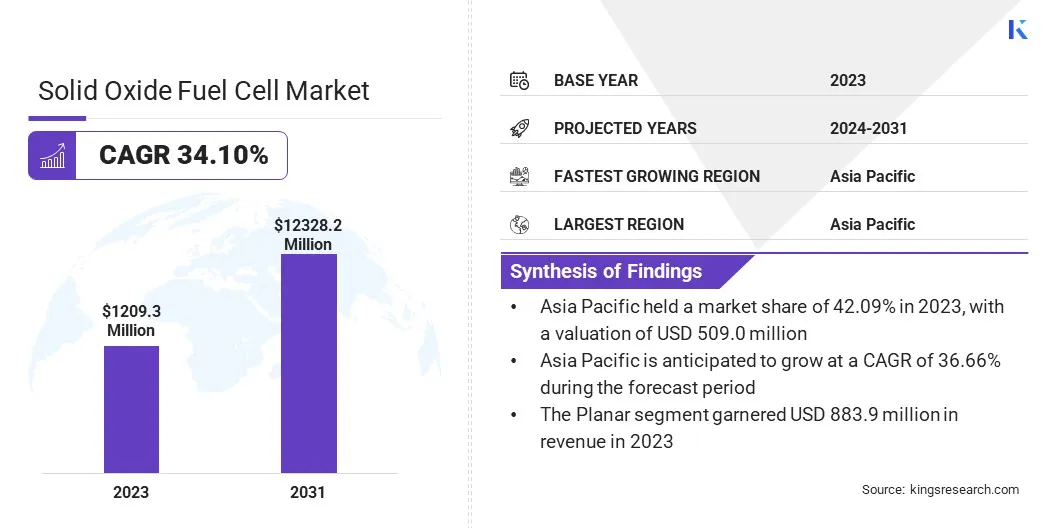

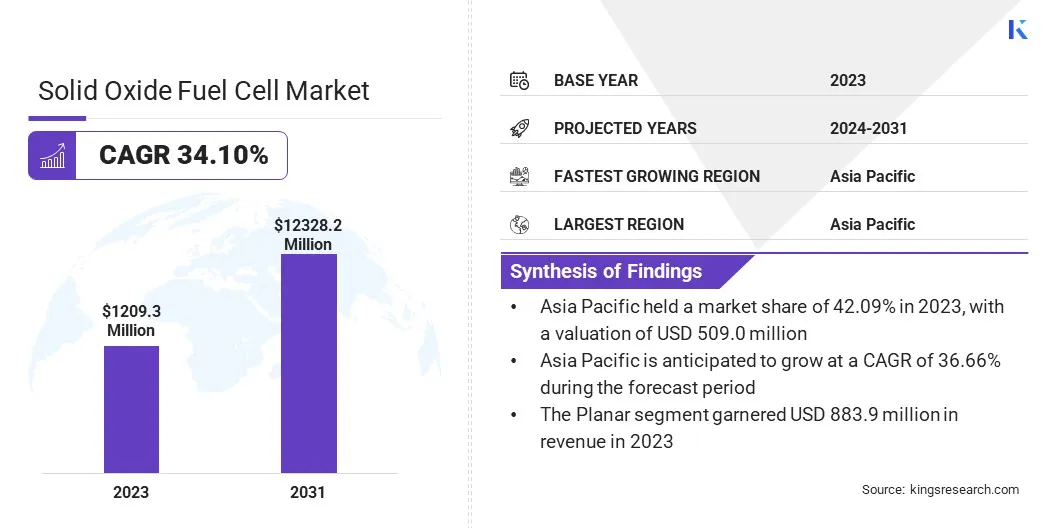

The global solid oxide fuel cell market size was valued at USD 1,209.3 million in 2023, which is estimated to be USD 1,580.6 million in 2024 and reach USD 12,328.2 million by 2031, growing at a CAGR of 34.10% from 2024 to 2031. The global push for carbon neutrality is significantly increasing the demand for clean energy technologies.

Countries are focusing on reducing emissions, thus efficient power generation solutions like SOFCs are gaining traction for their low-emission, high-efficiency capabilities, driving the market.

Major companies operating in the solid oxide fuel cell industry are Bloom Energy, MITSUBISHI HEAVY INDUSTRIES, LTD, MIURA CO., LTD. , KYOCERA Corporation, Elcogen AS, SolydEra SpA , WATT Fuel Cell, H2E Power , Upstart Power, FuelCell Energy, Inc, WEICHAI POWER CO.,LTD., Special Power Sources, ADELAN, Edge Autonomy Operations, LLC, and Ceres.

The market presents significant opportunities to drive cost reductions in clean energy solutions. The market can offer affordable renewable energy options to a broader range of customers by improving the efficiency and scalability of SOFC and its technologies.

This is particularly valuable in emerging markets or regions with limited access to traditional energy infrastructure, enabling them to adopt sustainable energy solutions while meeting global net-zero emissions targets.

- In October 2023, Elcogen and Bumhan Fuel Cell Co. signed a Memorandum of Understanding (MOU) to collaborate on the commercialization of SOFC and Solid Oxide Electrolyser Cells (SOEC), aiming to accelerate the global transition to clean energy and support decarbonization efforts.

Key Highlights:

- The solid oxide fuel cell industry size was valued at USD 1,209.3 million in 2023.

- The market is projected to grow at a CAGR of 34.10% from 2024 to 2031.

- Asia Pacific held a market share of 42.09% in 2023, with a valuation of USD 509.0 million.

- The hydrogen segment garnered USD 569.5 million in revenue in 2023.

- The planar segment is expected to reach USD 8,380.0 million by 2031.

- The stationary held a market of 65.09% in 2023.

- The military & defense segment is anticipated to grow at a CAGR of 46.60% during the forecast period.

- The market in Europe is anticipated to grow at a CAGR of 33.36% during the forecast period.

Market Driver

Increased Demand for Clean Energy

The global transition toward carbon neutrality is driving the market. Nations and industries seek to reduce their carbon footprints, boosting the demand for clean, efficient energy solutions.

SOFCs stand out, due to their high efficiency and ability to generate low-emission power, making them ideal for both stationary and mobile applications. Governments and businesses push for sustainable practices globally, positioning SOFCs as a critical technology to help meet net-zero targets and contribute to cleaner energy systems.

- In March 2024, Nissan announced the trial of a stationary bio-ethanol-fueled SOFC system at its Tochigi Plant in Japan. The system, aimed at improving power generation efficiency, is set for full-scale operations by 2030, supporting carbon-neutral goals and advanced energy solutions.

Market Challenge

High Operating Temperatures

High operating temperatures (600-1000°C) in SOFCs pose a significant challenge in the solid oxide fuel cell market, as they can lead to material degradation, wear and tear, and reduced long-term reliability. This can result in higher maintenance costs and limited operational lifespan.

Ongoing research focuses on developing advanced materials, such as metal-supported cells, that can withstand these extreme conditions while maintaining performance. Additionally, improvements in cell designs and coatings are being explored to enhance durability, reduce degradation, and ensure more efficient and sustainable SOFC operations in the long term.

- In March 2024, research carried out by Southwest Petroleum University in China focused on the low-temperature (300–600°C) operation of SOFCs. The study developed a high-performance composite cathode, improving oxygen reduction reaction and enhancing electrochemical performance, achieving peak power densities of 1049 mW cm–2 at 550°C and 158 mW cm–2 at 400°C.

Market Trend

Integration with Renewable Energy

The integration of SOFC technology with renewable energy systems is a growing trend in the market, driven by the need for reliable, low-emission power generation. SOFCs provide efficient, sustainable energy solutions by using renewable sources such as solar or wind.

This integration helps reduce the reliance on traditional energy sources, supports decarbonization goals, and enhances energy security, making SOFCs an increasingly attractive option for industries and organizations committed to achieving sustainable and carbon-neutral energy systems.

- In June 2024, FuelCell Energy and the University of Connecticut (UConn) announced a partnership to power UConn’s Innovation Partnership Building with SOFC technology. The collaboration aims to provide sustainable, low-emission energy, supporting UConn’s carbon neutrality goals and fostering educational opportunities for students.

Solid Oxide Fuel Cell Market Report Snapshot

|

Segmentation

|

Details

|

|

By Fuel Type

|

Hydrogen, Natural Gas, Biogas & Others

|

|

By Type

|

Planar, Tubular

|

|

By Application

|

Stationary, Portable, Transport

|

|

By End Use

|

Commercial & Industrial, Residential, Military & Defense, Data Centers & Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Fuel Type (Hydrogen, Natural Gas, Biogas & Others): The hydrogen segment earned USD 569.5 million in 2023, due to increasing investments in clean energy technologies and the rising demand for hydrogen-powered fuel cells in industrial applications.

- By Type (Planar, Tubular): The planar segment held 73.09% share of the market in 2023, due to its high efficiency, easier manufacturing processes, and better adaptability for large-scale power generation systems in commercial and industrial applications.

- By Application (Stationary, Portable, Transport): The stationary segment is projected to reach USD 7,740.0 million by 2031, owing to the increasing adoption of SOFCs in power generation for industrial and residential applications, driven by sustainability and cost-efficiency needs.

- By End Use (Commercial & Industrial, Residential, Military & Defense, Data Centers & Others): The military & defense segment is anticipated to register a CAGR of 46.60% during the forecast period, as SOFCs provide reliable, off-grid power solutions essential for defense operations and mobile military units.

Solid Oxide Fuel Cell Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a market share of around 42.09% in 2023, with a valuation of USD 509.0 million. Asia Pacific is emerging as the dominant region in the solid oxide fuel cell market, driven by rapid industrialization, increasing energy demands, and strong government support for clean energy technologies.

The region's focus on reducing carbon emissions and transitioning to sustainable energy sources has fueled the adoption of advanced technologies like SOFCs. Additionally, the region benefits from a growing emphasis on energy security and decentralized power generation, making SOFCs a key solution for achieving energy efficiency and sustainability goals across various sectors.

- In February 2023, Weichai launched the world's first high-power metal-supported commercial SOFC, achieving a cogeneration efficiency of 92.55%. This innovative product sets a new record for high-power SOFC systems, offering advantages like low operating temperature, strong thermal shock resistance, and rapid start-up times.

The solid oxide fuel cell industry in Europe is poised for significant growth at a robust CAGR of 33.36% over the forecast period. This is attributed to its strong commitment to sustainability and carbon neutrality. The region’s push for cleaner energy solutions, coupled with supportive government policies and incentives, is driving the adoption of SOFCs.

Industries, commercial sectors, and residential users are increasingly adopting SOFC technology for efficient, low-emission power generation. Additionally, Europe’s focus on renewable energy integration and decarbonization efforts positions it as a key driver of the market.

Regulatory Frameworks

- In the U.S., the Department of Energy's SOFC program, launched in 2000, focuses on developing cost-effective, high-efficiency, environmentally friendly SOFC technology for both small and large-scale power generation.

- In India, the Perform, Achieve, and Trade (PAT) Scheme under the Bureau of Energy Efficiency encourages industries to adopt energy-efficient technologies, including SOFCs, by certifying excess energy savings for trade, reducing specific energy consumption.

- In the EU, the Clean Hydrogen Joint Undertaking (JU) focuses on advancing hydrogen technologies, including SOFCs. It emphasizes renewable hydrogen production, storage, distribution, and clean power generation, aiming to boost efficiency, safety, and cost-effectiveness through collaborative innovation.

Competitive Landscape:

Companies in the solid oxide fuel cell market are focusing on advancing SOFC technology by enhancing efficiency, reducing costs, and expanding fuel flexibility. Many are investing in research and development to improve the scalability of SOFC systems for large-scale power generation and industrial applications.

Furthermore, companies are exploring new partnerships and collaborations to integrate SOFCs with renewable energy sources, such as solar and wind, to create sustainable, low-emission energy solutions. These efforts aim to meet the growing demand for clean energy technologies and contribute to global decarbonization goals.

- In June 2023, Bloom Energy partnered with Perenco to deploy 2.5 MW of SOFCs at Wytch Farm, the largest onshore oil field in Western Europe. This initiative marks Bloom’s first fuel cell installation in the UK, supporting energy resilience and sustainability goals.

List of Key Companies in Solid Oxide Fuel Cell Market:

- Bloom Energy

- MITSUBISHI HEAVY INDUSTRIES, LTD

- MIURA CO., LTD.

- KYOCERA Corporation

- Elcogen AS

- SolydEra SpA

- WATT Fuel Cell

- H2E Power

- Upstart Power

- FuelCell Energy, Inc

- WEICHAI POWER CO.,LTD.

- Special Power Sources

- ADELAN

- Edge Autonomy Operations, LLC

- Ceres

Recent Developments (Partnerships/Agreements)

- In February 2023, Weichai Power, a strategic partner of Ceres, launched a stationary power SOFC system, achieving CE certification with TÜV SÜD. The system demonstrates high power generation efficiency and fast start-up capabilities, positioning SOFC as a key component in Weichai’s diversified energy strategy.

- In January 2023, Elcogen signed an MOU with Korea Shipbuilding and Offshore Engineering (KSOE) and Fraunhofer IKTS for R&D in green hydrogen and emission-free power systems. Elcogen will provide SOFC and SOEC technology, offering efficient solutions for affordable, sustainable energy production to support net-zero goals.