Market Definition

The market involves the production, transportation, and consumption of natural gas as a commodity. It includes producers, transporters (via pipelines or LNG), and consumers such as industries and power plants.

Prices are influenced by supply-demand dynamics, geopolitical factors, and seasonal fluctuations, with both regional and global markets playing key roles in pricing and trade.

Natural Gas Market Overview

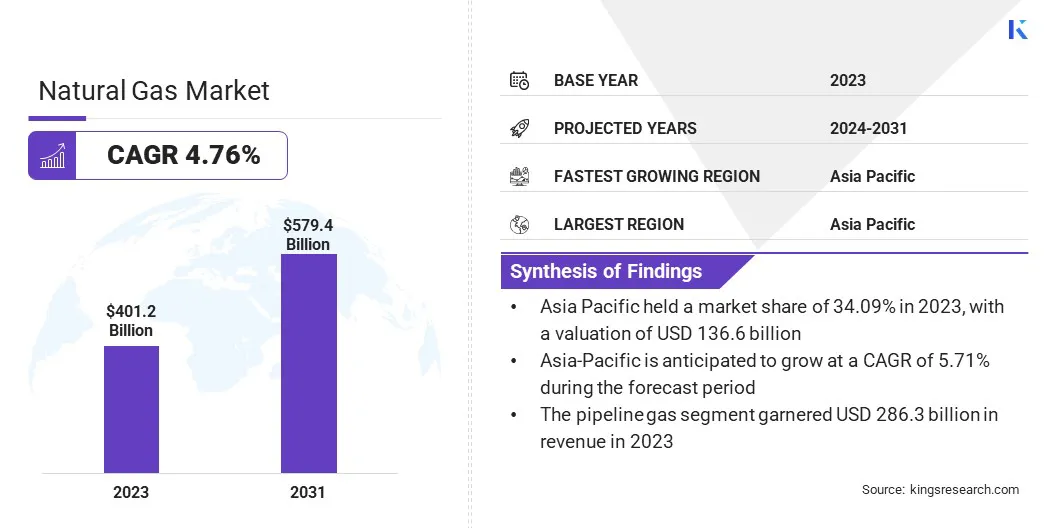

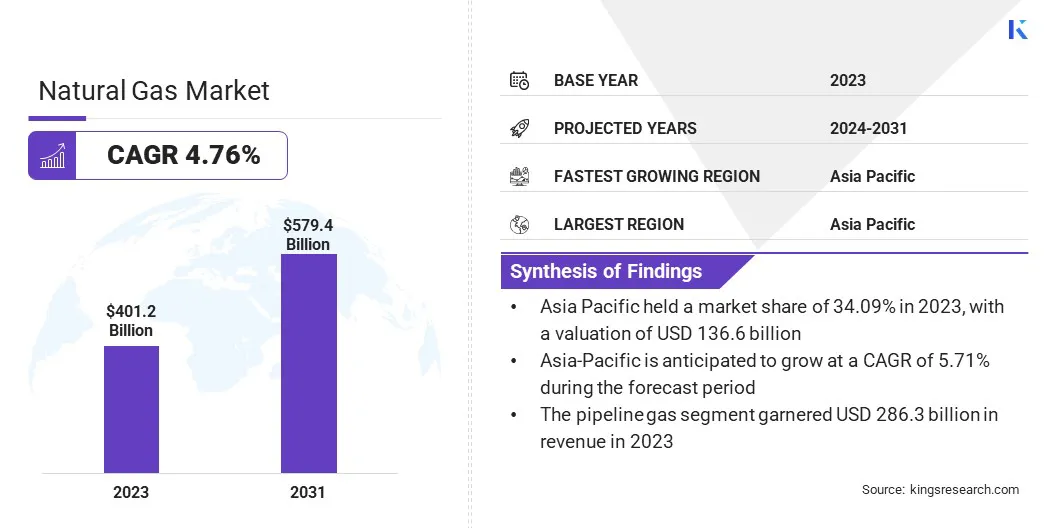

The global natural gas market size was valued at USD 401.2 billion in 2023, which is estimated to be USD 418.3 billion in 2024 and reach USD 579.4 billion by 2031, growing at a CAGR of 4.76% from 2024 to 2031.

Environmental concerns have driven the market, as it is considered a cleaner alternative to coal and oil. Its lower carbon emissions make it an attractive option for countries aiming to reduce environmental impact and transition to sustainable energy.

Major companies operating in the natural gas industry are Saudi Arabian Oil Co., Exxon Mobil Corporation, Chevron Corporation, Reliance Industries Limited, PetroChina Company Limited, Shell International B.V., TotalEnergies, ConocoPhillips, CNOOC, Oil and Natural Gas Corporation Limited, Indian Oil Corporation Ltd, Vedanta Limited, Devon Energy Corporation., Cairn Oil & Gas, and Expand Energy Corporation.

Natural gas is a crucial component of the global energy mix, balancing energy demand with sustainability goals. Its significant role in providing a cleaner alternative to more polluting fuels, such as coal and oil, positions natural gas as a preferred choice for many regions.

The market is characterized by evolving demand patterns, with increasing investments in infrastructure and transportation, particularly LNG. This presents growth opportunities, especially as countries continue to prioritize clean energy solutions for both domestic use and international trade.

- In October 2024, Enterprise Products Partners L.P. completed its acquisition of Piñon Midstream for USD 950 million in cash. The deal expands Enterprise’s presence in the Delaware Basin, enhancing its natural gas gathering and treating services in Texas and New Mexico.

Key Highlights:

- The natural gas industry size was valued at USD 401.2 billion in 2023.

- The market is projected to grow at a CAGR of 4.76% from 2024 to 2031.

- Asia Pacific held a market share of 34.09% in 2023, with a valuation of USD 136.8 billion.

- The conventional natural gas segment garnered USD 281.3 billion in revenue in 2023.

- The power segment is expected to reach USD 234.3 billion by 2031.

- The Liquefied Natural Gas (LNG) segment is anticipated to register the fastest CAGR of 5.48% during the forecast period.

- The market in Europe is anticipated to grow at a CAGR of 5.23% during the forecast period.

Market Driver

"Increasing Global Energy Demand"

Increasing global energy demand, particularly in developing economies, is a significant driver of the natural gas market.

- According to the IEA's February 2025 article, electricity consumption is projected to grow by 4% annually through 2027. This increase is driven by rising demand in industry, air conditioning, electrification, and data centers, reflecting broader global energy needs.

The need for reliable, affordable energy sources grows as these nations industrialize and urbanize. Natural gas, with its efficiency and lower carbon emissions compared to coal and oil, is increasingly favored for electricity generation, heating, and industrial use.

This rising demand not only boosts consumption but also encourages investments in infrastructure, technology and transportation to meet energy needs sustainably across emerging markets.

- In August 2024, Trace Midstream Partners II, LLC, a portfolio company of Quantum Capital Group, announced its acquisition of natural gas gathering and transportation assets in the Northern Delaware Basin from LM Energy. The assets include pipelines, compressor stations, and a high-pressure transportation pipeline, expanding Trace’s footprint in the region.

Market Challenge

"Price Volatility"

A significant challenge in the natural gas market is the volatility of prices, often influenced by geopolitical tensions, supply disruptions, and seasonal demand fluctuations. This unpredictability can lead to financial instability for producers and consumers. A potential solution lies in enhancing infrastructure for natural gas storage and diversifying supply sources.

Increasing storage capacity and investing in long-term contracts with multiple suppliers can aid in managing price fluctuations, ensuring more stable supply and pricing for both producers and consumers.

Market Trend

"Technological advancements"

Technological advancements in fracking, drilling, and transportation systems have significantly transformed the natural gas market. Innovations such as horizontal drilling and hydraulic fracturing (fracking) have unlocked previously inaccessible reserves, boosting production efficiency.

Additionally, improvements in pipeline technologies and liquefaction processes for LNG have enhanced transportation, reducing costs and expanding market access. These advancements have not only increased production but also made natural gas more competitive, enabling it to meet the growing global demand while maintaining cost-effectiveness and operational efficiency.

- In September 2024, Honeywell completed its USD 1.81 billion acquisition of Air Products' LNG process technology and equipment business. This acquisition enhances Honeywell's energy transition portfolio, offering a comprehensive suite of solutions for managing LNG assets efficiently and reliably.

Natural Gas Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Conventional Natural Gas, Unconventional Natural Gas

|

|

By Application

|

Industrial Use, Power Generation, Residential & Commercial, Transportation, Petrochemical Industry

|

|

By Mode of Transport

|

Pipeline Gas, Liquefied Natural Gas (LNG), Compressed Natural Gas (CNG)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Conventional Natural Gas, Unconventional Natural Gas): The conventional natural gas segment earned USD 281.3 billion in 2023, due to high demand for reliable, cost-effective energy sources globally.

- By Application (Industrial Use, Power Generation, Residential & Commercial, Transportation, Petrochemical Industry): The power generation segment held 42.56% share of the market in 2023, due to the growing need for cleaner energy solutions.

- By Mode of Transport [Pipeline Gas, Liquefied Natural Gas (LNG), Compressed Natural Gas (CNG)]: The pipeline gas segment is projected to reach USD 405.7 billion by 2031, owing to increasing infrastructure investments and demand.

Natural Gas Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a natural gas market share of around 34.09% in 2023, with a valuation of USD 136.8 billion. The region’s rapid industrialization, growing urbanization, and rising energy demand contribute to its leadership. Countries like China and India are major consumers of natural gas, driving investments in infrastructure like pipelines and LNG terminals.

Additionally, Asia Pacific’s focus on cleaner energy sources and reducing carbon emissions is pushing the shift towards natural gas, further solidifying its market dominance.

- In April 2024, Sumitomo Corporation announced a primary investment in AG&P LNG Marketing Pte. Ltd. to enter India’s city gas business. This investment will support the development of city gas distribution networks, promoting natural gas usage and aiding India's carbon neutrality goals by 2070.

The market in Europe is poised for significant growth at a robust CAGR of 5.23% over the forecast period. The European Union's (EU) commitment to reducing coal dependency and transitioning to greener energy sources has led to a surge in the demand for natural gas.

With an increasing emphasis on energy security and diversification, the EU is investing in LNG terminals, infrastructure development, and natural gas imports. Moreover, Europe’s push toward sustainability, coupled with geopolitical factors, is accelerating the adoption of natural gas as a transition fuel in the region.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) protects people and the environment from significant health risks, sponsors and conducts research, and develops and enforces environmental regulations.

- The Federal Energy Regulatory Commission (FERC) is an independent agency that regulates the interstate transmission of natural gas, oil, and electricity in the U.S. The FERC also regulates natural gas and hydropower projects.

- The Agency for the Cooperation of Energy Regulators (ACER) aids in the integration of the energy market across Europe to bring the benefits of affordable, secure, and decarbonised energy to European businesses and citizens.

Competitive Landscape:

Companies in the natural gas market are focusing on expanding their portfolios and enhancing regional energy security. They invest in developing gas assets, forming joint ventures, and creating new platforms to meet the rising global demand.

These efforts aim to support energy transitions, improve infrastructure, and ensure a reliable, lower-carbon energy supply while contributing to economic growth and sustainable development.

- In December 2024, bp and XRG announced the formation of Arcius Energy, a joint venture focused on natural gas development. This partnership aims to meet regional demand, support energy security, and contribute to Egypt's economic growth, leveraging both companies' expertise in gas asset management and operations.

List of Key Companies in Natural Gas Market:

- Saudi Arabian Oil Co.

- Exxon Mobil Corporation

- Chevron Corporation

- Reliance Industries Limited

- PetroChina Company Limited

- Shell International B.V.

- TotalEnergies

- ConocoPhillips

- CNOOC

- Oil and Natural Gas Corporation Limited

- Indian Oil Corporation Ltd

- Vedanta Limited

- Devon Energy Corporation.

- Cairn Oil & Gas

- Expand Energy Corporation

Recent Developments (Agreement/Partnership/Expansion)

- In February 2025, Centrica signed a long-term LNG supply agreement with Petrobras, securing 0.8 million tons per annum for 15 years starting in 2027. This deal enhances Centrica’s LNG portfolio, supporting Brazil's energy security while advancing Centrica's commitment to sustainable energy solutions in the global transition.

- In January 2025, Engine No. 1, Chevron U.S.A., and GE Vernova formed a partnership to develop scalable, reliable power solutions for U.S. data centers using domestic natural gas. Their projects aim to deliver up to four gigawatts of power by 2027, supporting energy security.

- In October 2024, Evergy announced plans to invest in two new 705 MW combined-cycle natural gas plants in Kansas. Set to begin operations in 2029 and 2030, the plants will support economic growth, job creation, and the state’s energy infrastructure.