Enquire Now

Solar Photovoltaic Glass Market Size, Share, Growth & Industry Analysis, By Type (AR-coated, Tempered, TCO-coated, Others), By Technology (Crystalline Silicon, Thin Film Module, Perovskite Module), By Application (Residential, Commercial, Industrial, Utility), and Regional Analysis, 2025-2032

Pages: 160 | Base Year: 2024 | Release: October 2025 | Author: Antriksh P.

Key strategic points

Solar photovoltaic glass is used in solar modules to convert sunlight into electricity. It features high solar transmittance, durability, and thermal resistance to enhance module efficiency and lifespan. Solar PV variants include anti-reflective, low-iron, and tempered glass, each tailored to improve light absorption and structural strength.

They are used in diverse solar applications, such as utility-scale farms, commercial rooftops, residential systems, Building-Integrated Photovoltaics (BIPV), and floating or agrivoltaic projects.

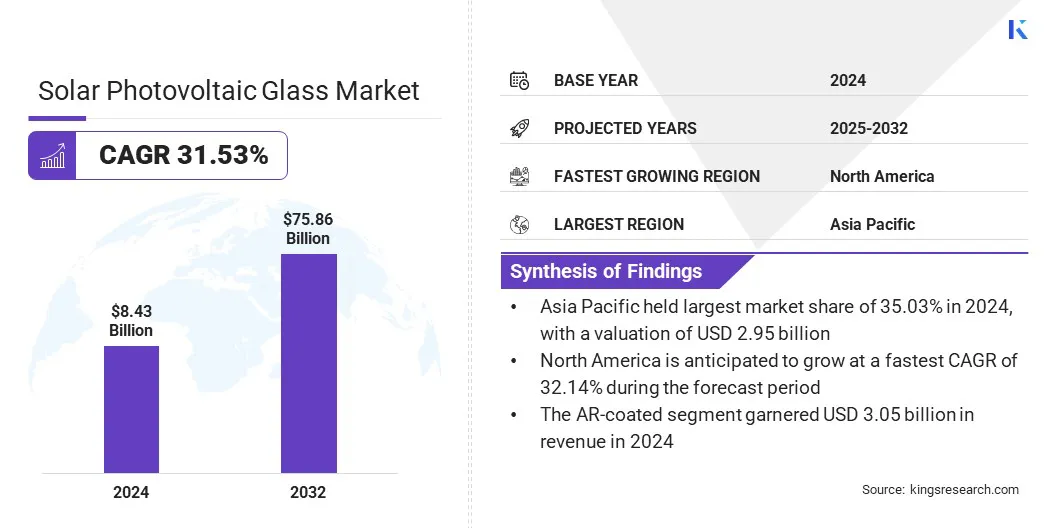

The global solar photovoltaic glass market size was valued at USD 8.43 billion in 2024 and is projected to grow from USD 11.06 billion in 2025 to USD 75.86 billion by 2032, exhibiting a CAGR of 31.53% over the forecast period. This growth is driven by large-scale deployment of solar farms supported by government incentives and declining power generation costs. Moreover, the utility projects strengthen energy security and accelerate renewable integration into national grids.

Major companies operating in the solar photovoltaic glass market are Xinyi Solar Holdings Limited, Flat Glass Group Co., Ltd, Saatvik Green Energy Ltd., AGC Inc., Waaree Group, Şişecam Group, Nippon Sheet Glass Co., Ltd, Saint-Gobain Group, Guardian Industries Holdings Site, Interfloat Corporation, Onyx Solar Group LLC, Qingdao Jinxin Glass Co., Ltd., and Hecker Glastechnik GmbH & Co. KG.

The increasing use of anti-reflective coated glass to enhance light transmission and module efficiency is driving the market. This coating reduces surface reflection losses, allowing higher solar energy absorption.

The rising demand for utility-scale solar projects also supports adoption, as efficiency gains directly improve project returns. Anti-reflective glass also supports durability for manufacturers aiming to meet performance standards in competitive solar energy installations worldwide.

Government Incentives for Renewable Energy Adoption

A key factor driving the progress of the solar photovoltaic glass market is the availability of government incentives supporting renewable energy deployment. Subsidies, feed-in tariffs, and tax benefits continue to reduce overall project costs for solar-based manufacturers. These measures make solar power generation more attractive to investors, leading to large-scale adoption of high-quality photovoltaic (PV) glass.

The incentives also encourage technological developments, ensuring glass manufacturers meet efficiency and safety requirements. In addition, growing global policy commitments toward net-zero targets sustain the long-term demand for photovoltaic glass.

Limited Supply of High-Quality Raw Materials

A major challenge to the solar photovoltaic glass market is the limited supply of high-quality raw materials. Shortages of low-iron silica sand and other critical inputs restrict production capacity, raise manufacturing costs, and hinder companies from meeting global demand. These limitations continue to impact scalability and operational efficiency across the industry.

To address this, companies have been securing long-term contracts with suppliers, investing in alternative sourcing strategies, and exploring material recycling processes to ensure consistent raw material availability while minimizing dependence on limited natural resources.

Growing Adoption of Bifacial Solar Modules

A notable trend influencing the solar photovoltaic glass market is the growing adoption of bifacial solar modules that capture sunlight from both sides. Manufacturers are producing more dual-glass configurations to support energy yield.

The increasing deployment of utility-scale projects is driving this trend, as bifacial modules provide high efficiency and improved cost-effectiveness. This continues to strengthen the demand for advanced photovoltaic glass designed for next-generation solar technologies.

|

Segmentation |

Details |

|

By Type |

AR-coated, Tempered, TCO-coated, Others |

|

By Technology |

Crystalline Silicon, Thin Film Module, Perovskite Module |

|

By Application |

Residential, Commercial, Industrial, Utility |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

The global market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The Asia Pacific solar photovoltaic glass market stood at 35.03% in 2024, valued at USD 2.95 billion, supported by strong manufacturing capabilities and rapid solar deployment. It has become a hub for PV glass production, due to its rising demand across utility and commercial installations. Increasing adoption of advanced technologies such as anti-reflective and tempered glass, along with supportive policy frameworks, continues to drive market growth.

North America solar photovoltaic glass industry is set to grow at a CAGR of 32.14% over the forecast period, reflecting expanding investments in renewable energy. Utility-scale projects, supported by favorable financing mechanisms are creating demand for specialized PV glass solutions.

Ongoing research into advanced solar coatings and lightweight modules is accelerating product innovation. The region’s focus on sustainable power generation and rising adoption of bifacial modules are further driving growth.

Key players in the solar photovoltaic glass industry are expanding production to strengthen manufacturing capabilities and meet surging global demand. Strategic collaborations and joint ventures help in securing access to advanced technologies and diversified supply chains. Companies are investing in research and development for anti-reflective coatings, lightweight materials, and high-efficiency glass products.

Manufacturers are adopting strategies such as economies of scale and vertical integration to streamline operations and reduce reliance on external suppliers. Market leaders are also expanding their global presence through acquisitions and new manufacturing facilities across high-growth regions.

Frequently Asked Questions