Market Definition

Anti-reflective (AR) coatings are thin layers of material applied to surfaces such as eyeglasses, camera lenses, screens, and solar panels to reduce glare and reflection. These coatings work by manipulating the way light waves reflect off surfaces, using the principle of destructive interference to cancel out reflected light. This results in improved visibility, clarity, and optical performance by allowing more light to pass through the surface rather than being reflected away.

The market encompasses the industry involved in the development and manufacturing of AR coatings used across various applications. The report identifies the principal factors contributing to the market expansion, along with an analysis of the competitive landscape influencing its growth trajectory.

Anti Reflective Coatings Market Overview

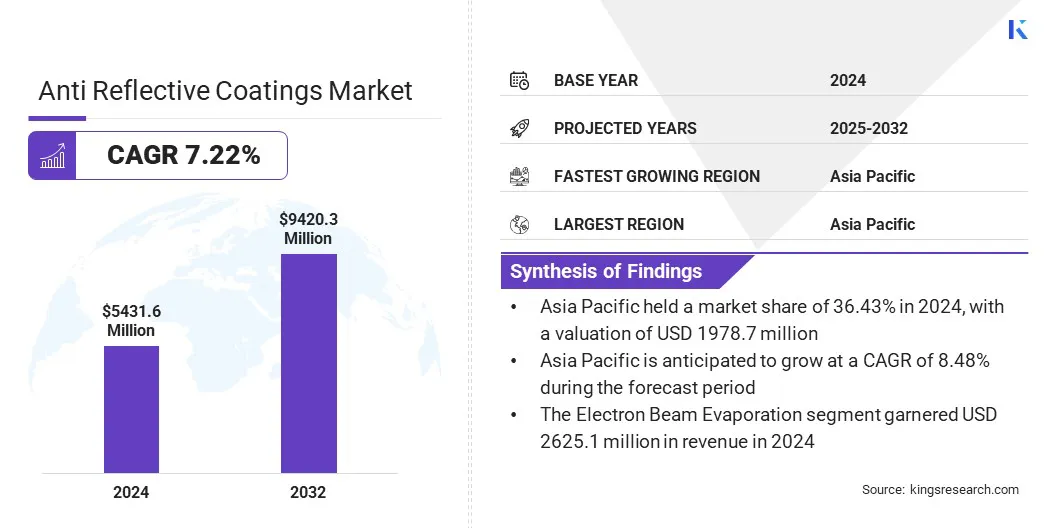

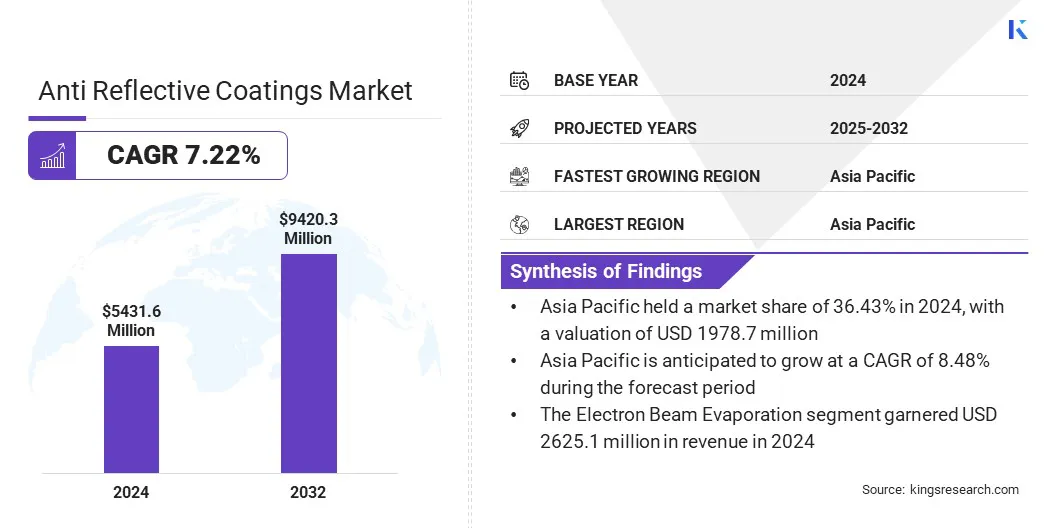

The global anti reflective coatings market size was valued at USD 5,431.6 million in 2024, which is estimated to be USD 5,782.7 million in 2025 and reach USD 9,420.3 million by 2032, growing at a CAGR of 7.22% from 2025 to 2032.

The market is registering growth, due to the rising demand for high-performance eyewear. Consumers increasingly prioritize lenses that offer superior clarity, durability, and low-maintenance features, driving innovation and adoption of advanced coatings across global optical markets.

Major companies operating in the anti reflective coatings industry are NiPro Optics, ZEISS Group, Andover Corporation, ESSILOR Ltd, Honeywell International Inc., PPG Industries, Inc., DuPont, NSG GROUP, Beneq, Merck KGaA, HOYA, Applied Materials, Inc., PFG Optics, Accurate Optics, and iCoat Company, LLC.

The market is registering significant growth, driven by their increasing demand across various sectors such as solar energy, electronics, and optics. These coatings enhance light transmission by minimizing surface reflection and improving efficiency & visual clarity in devices. The rising adoption of AR coatings in solar panels, smartphones, and advanced display technologies is fueling the market.

Additionally, advancements in nanotechnology and material science are enabling effective and durable coatings, positioning anti-reflective technologies as essential components in modern energy and optical applications.

- In April 2025, researchers from Shiraz University of Technology and University of Mohaghegh Ardabili (Iran) proposed a perovskite solar cell (PSC) structure using dielectric nanoparticles as anti-reflection coatings. These coatings reduce light reflection via destructive interference, enhancing light absorption. Combined with Au nanopyramids, the structure improved perovskite layer absorption and solar cell efficiency significantly.

Key Highlights:

- The anti reflective coatings industry size was valued at USD 5,431.6 million in 2024.

- The market is projected to grow at a CAGR of 7.22% from 2025 to 2032.

- Asia Pacific held a market share of 36.43% in 2024, with a valuation of USD 1,978.7 million.

- The electron beam evaporation segment garnered USD 2,625.1 million in revenue in 2024.

- The eyewear segment is expected to reach USD 3,135.3 million by 2032.

- The market in Europe is anticipated to grow at a CAGR of 45% during the forecast period.

Market Driver

Rising Demand for High-performance Eyewear

Rising consumer expectations for high-performance eyewear is driving the anti reflective coatings market. Users seek lenses that provide superior visual clarity, reduce glare, and maintain their quality over time through enhanced scratch resistance and easier cleaning.

This demand for durability and low maintenance reflects a broader trend of investing in long-lasting, high-quality optical products. The adoption of advanced anti-reflective coatings continues to accelerate across global markets as people spend more time on digital devices and prioritize eye comfort.

- In September 2023, HOYA Vision Care, North America, introduced Super HiVision Meiryo EX4, a cutting-edge anti-reflective lens coating. It offers 2.5x better scratch resistance, 56% lower reflectance, and 10x longer cleanability than competitors. This innovation redefines lens durability, clarity, and ease of maintenance in everyday wear.

Market Challenge

Complex Fabrication Techniques

A major challenge in the anti reflective coatings market is the complex fabrication techniques required to produce uniform, high-quality coatings. These sophisticated processes often limit mass production efficiency, leading to higher costs and slower output.

Manufacturers are investing in advanced automated technologies and scalable coating methods that ensure consistency while increasing production speed. Innovations such as improved material formulations also help streamline manufacturing, making high-performance AR coatings more accessible and affordable for wider market adoption.

Market Trend

Integration of Anti-reflective Technology in Mobile Devices

A prominent trend in the anti reflective coatings market is the growing integration of anti-reflective technology in mobile devices. Manufacturers prioritize reducing screen glare to improve visibility in diverse lighting conditions, including bright sunlight and indoor environments. This focus enhances user experience by delivering clearer, more comfortable viewing and reducing eye strain.

The demand for advanced coatings that combine anti-reflective properties with durability is driving innovation, making such technologies standard features in the latest mobile devices.

- In January 2025, Samsung’s Galaxy S25 Ultra debuted with Corning Gorilla Armor 2, a scratch-resistant, anti-reflective glass ceramic cover. It offers over four times more scratch resistance than competitive lithium-aluminosilicate glasses, survives drops up to 2.2 meters, and reduces reflections to enhance display clarity, setting a new mobile display standard.

Anti Reflective Coatings Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Electron Beam Evaporation, Sputtering, Ion-Assisted Deposition (IAD)

|

|

By Application

|

Eyewear, Electronics and Telecommunications, Solar Panels, Automotive, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology [Electron Beam Evaporation, Sputtering, and Ion-Assisted Deposition (IAD)]: The electron beam evaporation segment earned USD 2,625.1 million in 2024, due to its high precision, cost-effectiveness, and ability to produce uniform, durable anti-reflective coatings for various optical applications.

- By Application (Eyewear, Electronics and Telecommunications, Solar Panels, Automotive, and Others): The eyewear segment held 35.22% share of the market in 2024, due to the growing consumer demand for scratch-resistant, glare-reducing lenses that enhance visual clarity and eye comfort.

Anti Reflective Coatings Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific anti reflective coatings market share stood at around 36.43% in 2024, with a valuation of USD 1,978.7 million. This market dominance is attributed to the rapid technological advancements and strong manufacturing capabilities.

Growing demand for anti reflective coatings from key industries such as electronics, automotive, and renewable energy fuels the market. Additionally, rising investments in research and development, along with the increasing adoption of advanced optical devices, contribute to the region's leadership.

- For instance, researchers from the Beijing Institute of Aeronautical Materials and the National Center for Nanoscience and Technology developed an innovative AR coating using ultrathin conductive CuO films on copper substrates.

This design suppresses reflection, enhances light absorption, prevents copper oxidation, and improves the performance of transparent conductive electrodes for optoelectronic and solar energy applications. Favorable government policies and a large consumer base further accelerate the market growth, making Asia Pacific a critical hub for innovation and production in anti-reflective coating technologies.

The anti reflective coatings industry in Europe is poised for significant growth at a robust CAGR of 7.45% over the forecast period. This growth is attributed to the strong regional focus on innovation, sustainability, and high-quality manufacturing standards. The region’s emphasis on research and development, coupled with stringent environmental regulations, drives the adoption of advanced, eco-friendly coating technologies.

Additionally, the mature electronics, automotive, and renewable energy sectors in Europe contribute to consistent demand. Collaborative efforts between governments and industries further support technological advancements, making Europe a key player in advancing the market with sustainable and high-performance solutions.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) aims to protect human health and the environment and sets guidelines for emission control, which impact the materials used in AR coatings.

- The registration, evaluation, authorisation and restriction of chemicals (REACH) is the main EU law to protect human health and environment from the risks posed by chemicals.

Competitive Landscape

Companies in the anti reflective coatings industry are increasingly focusing on innovation and technology integration to enhance product performance, durability, and user experience. Significant investments are being directed toward research and development to engineer coatings that offer enhanced scratch resistance, superior optical clarity, and simplified maintenance.

Collaboration with key market players and adoption of advanced materials help firms meet the growing consumer demand for high-quality eyewear and electronic displays. Additionally, companies emphasize sustainable practices and customization options to strengthen market position and address diverse customer needs.

- In January 2025, ZEISS launched DuraVision Gold UV, a premium anti-reflective lens coating combining enhanced scratch resistance, superior clarity, and advanced ZEISS CleanGuard technology for faster cleaning. This golden-hued coating reduces lens yellowness, improves vision in low light, and offers a sophisticated esthetic, providing eye care professionals new upselling opportunities in both clear and tinted lenses.

List of Key Companies in Anti Reflective Coatings Market:

- NiPro Optics

- ZEISS Group

- Andover Corporation

- ESSILOR Ltd

- Honeywell International Inc.

- PPG Industries, Inc.

- DuPont

- NSG GROUP

- Beneq

- Merck KGaA

- HOYA

- Applied Materials, Inc.

- PFG Optics

- Accurate Optics

- iCoat Company, LLC

Recent Developments (M&A/Expansion)

- In July 2024, EssilorLuxottica signed an agreement to acquire Optical Investment Group, expanding its optical retail footprint in Romania. This strategic move aims to enhance access to high-quality vision care, including anti reflective coatings used in eyewear, while strengthening the company’s presence in the Central and Eastern European market.

- In May 2024, PPG announced a USD 300 million investment to build a new paint and coatings manufacturing facility in Tennessee, enhancing production for the automotive industry and expanding capabilities in North America over the next four years.