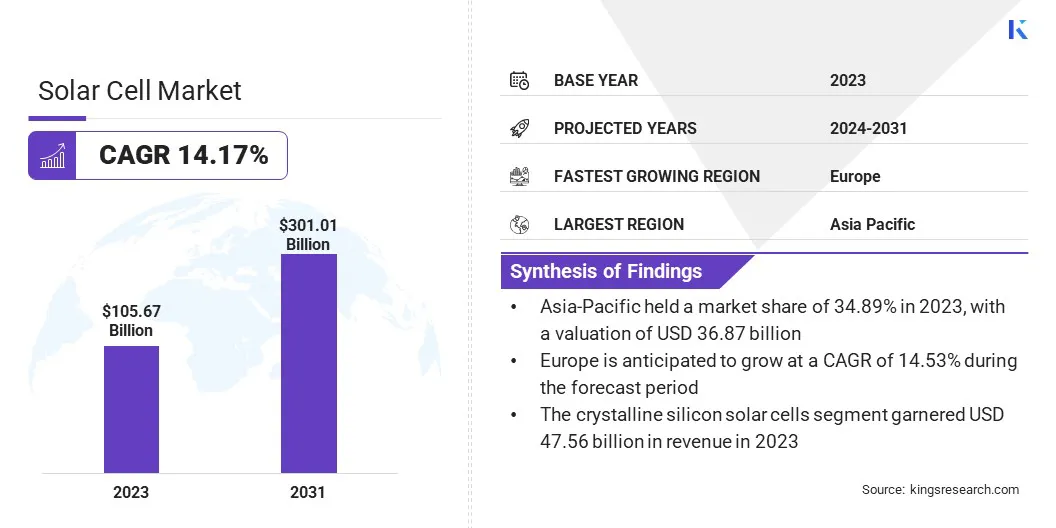

Solar Cell Market Size

The global Solar Cell Market size was valued at USD 105.67 billion in 2023 and is projected to grow from USD 119.01 billion in 2024 to USD 301.01 billion by 2031, exhibiting a CAGR of 14.17% during the forecast period. The expansion of the market is driven by increasing environmental awareness, government policies that promote renewable energy, ongoing technological advancements, and rising demand for sustainable energy solutions.

In the scope of work, the report includes solutions offered by companies such as Canadian Solar, First Solar., Hanwha Group, JA Solar Technology Co., Ltd., Jinko Solar, REC Solar Holdings AS, SunPower Corporation, Trinasolar, LG Electronics, LONGi, and others.

The growth of the solar cell market is driven by rising environmental concerns and government policies that promote the adoption of renewable energy. Technological advancements are reducing costs and improving efficiency, making solar energy more accessible. Additionally, rising electricity prices and the growing demand for sustainable energy sources propel market growth. Significant investments in solar infrastructure and favorable tax incentives further bolster the expansion of the market.

- For instance, in June 2023, LONGi launched its new Hi-MO 7 PV module to strengthen its position in the Canadian utility-scale solar market. Launched globally in May 2023, the Hi-MO 7 features high-efficiency mono HPDC technology, offering up to 580 watts power output and 22.5% conversion efficiency. The module's advanced design ensures reliability and performance in challenging weather, with less than 0.8% first-year power degradation and robust construction for cold climates.

The global shift toward carbon neutrality and efforts to mitigate climate change underscores the importance of solar energy. These elements collectively stimulate the growth of the market, thereby fostering innovation and adoption across various sectors, including residential, commercial, and industrial applications.

The solar cell market has experienced robust growth over recent years, fueled by both governmental support and continual technological advancements. As countries increasingly commit to reducing carbon emissions, the demand for renewable energy sources, including solar cells, continues to rise. The market encompasses a wide range of products, including photovoltaic panels and solar power systems, catering to diverse applications.

Asia-Pacific leads the market, spurred by strong production capabilities and substantial installations, followed by North America. The market is projected to expand further due to continuous innovation, thereby presenting ample opportunities for investors and stakeholders.

The market refers to the industry involved in the production and distribution of solar photovoltaic (PV) cells, which convert sunlight into electricity. These cells are a crucial component of solar panels and systems designed to capture and utilize solar energy. The market includes various types of solar cells, such as monocrystalline, polycrystalline, and thin-film, each with distinct efficiencies and applications.

Solar cells are utilized in residential, commercial, and utility-scale installations, providing a sustainable alternative to traditional energy sources. The market encompasses the entire value chain, ranging from raw material supply to the final deployment of solar power systems, thereby reflecting its expansive and dynamic nature.

Analyst’s Review

Manufacturers in the solar cell market are making significant strides through continuous innovation and strategic investments. These efforts include developing more efficient and cost-effective solar cells, such as bifacial and perovskite cells. New products, such as integrated solar and storage solutions, are being introduced to the market, thereby addressing the demand for reliable and sustainable energy. Furthermore, companies are expanding their production capacities and forging partnerships to enhance their market presence.

- For instance, in August 2023, SunPower’s subsidiary, SunPower Financial entered into an agreement with ADT Solar in order to become the PPA and exclusive lease provider for ADT Solar customers. This partnership allowed ADT Solar to offer a lease option to its consumers, thereby enhancing the accessibility of solar energy. The two companies have further explored collaborations in the areas of solar and smart home services for homeowners.

To capitalize on these advancements, stakeholders are advised to focus on supporting research and development, leveraging government incentives, and promoting consumer awareness regarding the benefits of solar energy. Diversifying product portfolios and expanding into emerging markets are recommended strategies to sustain growth and maintain competitiveness in the evolving market.

Solar Cell Market Growth Factors

The market is experiencing significant growth due to rising environmental awareness and governmental policies that promote the adoption of renewable energy. Countries around the world are committing to reducing carbon emissions, resulting in increased investments in solar energy projects.

Technological advancements are continuously improving the efficiency and affordability of solar cells, making them more accessible to a broader range of consumers. The adoption of solar energy is expanding across residential, commercial, and industrial sectors. Additionally, incentives such as tax credits and subsidies are prompting more individuals and businesses to invest in solar energy, thereby bolstering market growth.

A major challenge hampering the development of the solar cell market is the high initial cost associated with installation. This financial barrier often deters individuals and businesses from adopting solar energy solutions. To overcome this challenge, several strategies are being implemented. Governments and financial institutions are offering various financing options, such as low-interest loans and leasing programs, to make solar energy more affordable.

Additionally, advancements in technology are reducing the cost of solar cells and related equipment. Increased competition among manufacturers is contributing to a reduction in prices. By making solar energy solutions more financially accessible, these measures are addressing the initial cost barrier and promoting wider adoption.

Solar Cell Market Trends

The increasing adoption of bifacial solar panels is a significant trend in the solar cell market. These panels are capable of capturing sunlight from both sides, thereby boosting energy production. As the efficiency of solar technology improves, bifacial panels are becoming increasingly popular due to their enhanced performance and cost-effectiveness.

They are particularly useful in areas with high albedo surfaces, such as snowy regions or reflective rooftops. Manufacturers are investing heavily in research and development to optimize these panels further. The dual-sided nature of bifacial panels aligns with the industry's growing focus on maximizing energy yield, establishing them as a key trend propelling market growth.

The integration of solar energy with energy storage systems is another emerging trend in the market. Combining solar panels with batteries allows for the storage of excess energy, thereby ensuring a reliable power supply even in the absence of sunlight. This trend is gaining immense traction due to advancements in battery technology, which are reducing costs and improving storage capacity.

Residential and commercial users are increasingly adopting solar-plus-storage solutions to achieve energy independence and resilience. Government incentives and declining battery prices are facilitating this integration, thereby promoting the adoption of sustainable energy solutions.

Segmentation Analysis

The global market is segmented based on type, application, and geography.

By Type

Based on type, the market is categorized into crystalline silicon solar cells, thin-film solar cells, and others. The crystalline silicon solar cells segment led the solar cell market in 2023, reaching a valuation of USD 47.56 billion. The crystalline silicon solar cells segment is further segmented into polycrystalline solar cells and monocrystalline solar cells.

The notable expansion of the segment is propelled by its high efficiency and reliability. Their superior performance and longevity compared to other types further contribute to this growth. Technological advancements are continuously enhancing their efficiency, making them more cost-effective.

Additionally, the extensive manufacturing infrastructure for crystalline silicon cells supports large-scale production, thereby reducing costs. Government incentives and policies that promote renewable energy further boost their adoption.

By Application

Based on application, the solar cell market is classified into residential solar cells, commercial solar cells, utility solar cells, portable solar chargers, and others. The residential solar cells segment is poised to witness significant growth at a robust CAGR of 17.62% through the forecast period (2024-2031), mainly due to increasing awareness of renewable energy and a growing preference for energy independence among homeowners.

Advances in solar technology are making residential installations more efficient and affordable. Government incentives, such as tax credits and rebates, are compelling homeowners to invest in solar energy. Additionally, rising electricity costs are prompting individuals to seek alternative energy solutions. The growing trend toward sustainable living and reducing carbon footprints further contributes to the growth of the segment.

Solar Cell Market Regional Analysis

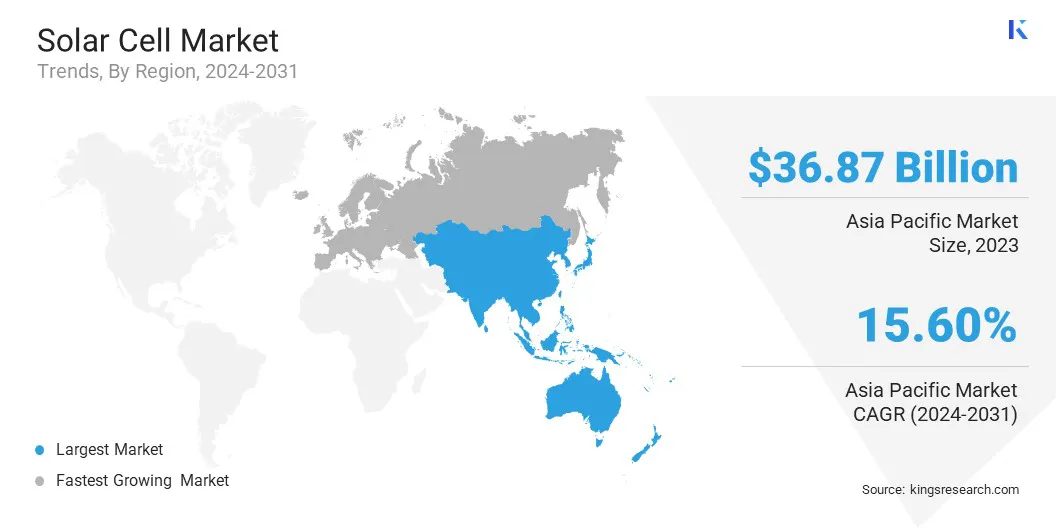

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

Asia-Pacific solar cell market captured a substantial share of around 34.89% in 2023, with a valuation of USD 36.87 billion. The region's large population and rapid urbanization are leading to increased demand for energy. Governments in countries such as China, India, and Japan are actively promoting renewable energy through favorable policies and subsidies.

China, in particular, leads in both the production and installation of solar cells, benefiting from economies of scale. Technological advancements and significant investments in solar infrastructure further bolster the expansion of the regional market. The availability of low-cost labor and raw materials further solidifies the region's leading market position.

Europe is poised to experience significant growth at a staggering CAGR of 14.53% over the forecast period. This considerable expansion is largely attributed to its strong commitment to renewable energy and carbon neutrality goals. The European Union's Green Deal and various national policies are catalyzing substantial investments in solar energy infrastructure.

Technological advancements and declining costs of solar installations are making solar energy more accessible. Additionally, high electricity prices and increasing environmental awareness are promoting the adoption of solar solutions. The region's growing focus on sustainability and energy security further supports regional market expansion.

Competitive Landscape

The global solar cell market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Solar Cell Market

- Canadian Solar

- First Solar.

- Hanwha Group

- JA Solar Technology Co., Ltd.

- Jinko Solar

- REC Solar Holdings AS

- SunPower Corporation

- Trinasolar

- LG Electronics

- LONGi

Key Industry Developments

- May 2024 (Launch): REC Group launched REC Alpha Pro M Series solar panel, which features advanced heterojunction cell technology with a power output of 610 to 640 watt-peak. Designed for commercial and industrial installations in the US, this new panel offers 22.5% efficiency and a 25-year performance warranty.

- December 2023 (Partnership): LONGi announced a three-year partnership with UNHCR to enhance climate action and energy equity. The initiative is anticipated to commencing with solarizing emergency facilities in Uzbekistan and providing solar solutions in Pakistan starting in 2024. The partnership further includes solar energy skills training and support for afforestation activities, with the aim of improving livelihoods and contributing to the achievement of Sustainable Development Goal No. 7. This collaboration, unveiled at COP28, is set to benefit numerous countries involved in UNHCR's climate-focused initiatives.

The global solar cell market is segmented as:

By Type

- Crystalline Silicon Solar Cells

- Polycrystalline Solar Cells

- Monocrystalline Solar Cells

- Thin-Film Solar Cells

- Amorphous Silicon (a-Si)

- Cadmium Telluride (CdTe)

- Copper Indium Gallium Selenide or Diselenide (CIGS)

- Others

By Application

- Residential Solar Cells

- Commercial Solar Cells

- Utility Solar Cells

- Portable Solar Chargers

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America