Market Definition

The market encompasses the global production, distribution, and utilization of sodium sulfate across industries such as detergents, textiles, glass, and pulp and paper.

It includes both natural and synthetic sources, with market dynamics shaped by industrial demand, regulatory standards, and regional consumption trends driven by manufacturing growth and evolving end-use applications. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Sodium sulfate Market Overview

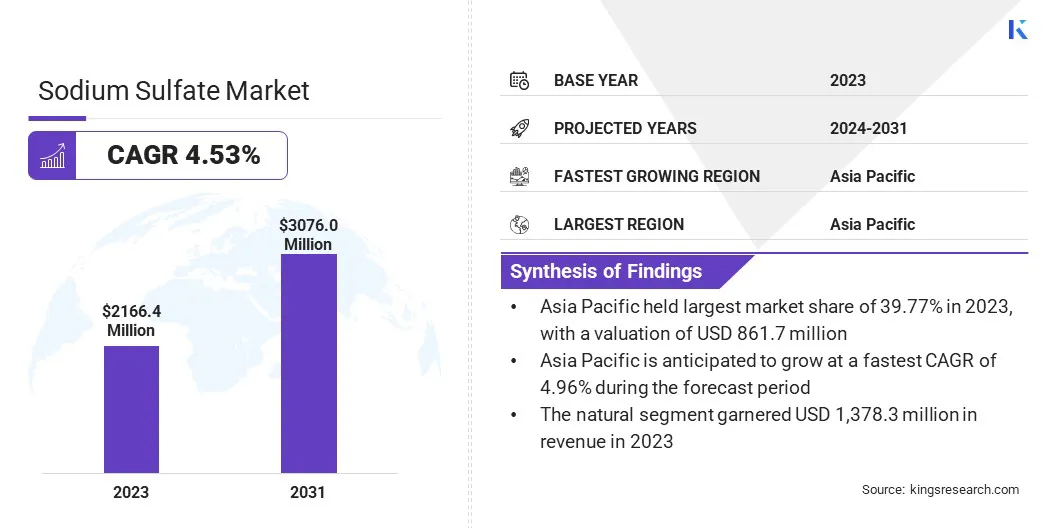

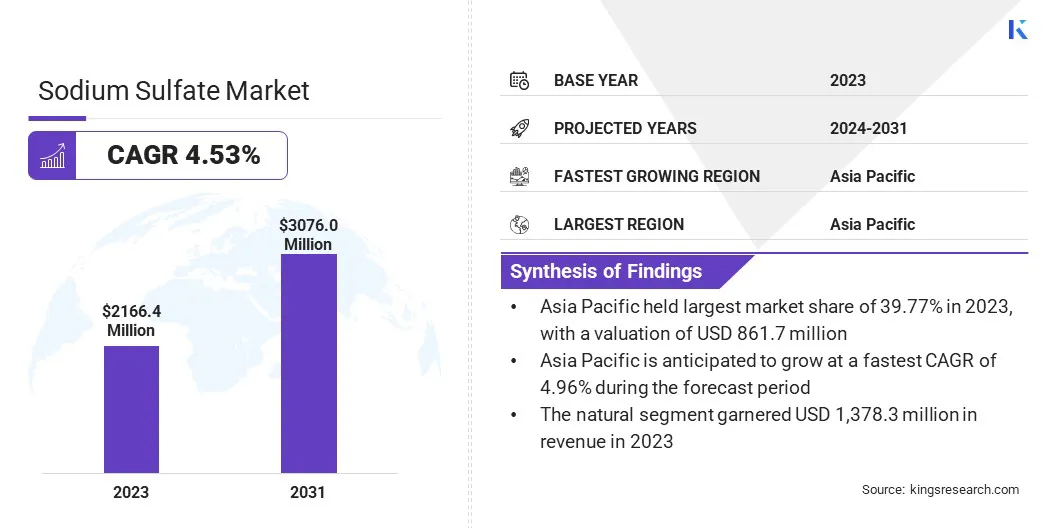

The global sodium sulfate market size was valued at USD 2,166.4 million in 2023 and is projected to grow from USD 2,256.4 million in 2024 to USD 3,076.0 million by 2031, exhibiting a CAGR of 4.53% during the forecast period.

The market is growing due to its essential role in key industries such as detergents and glass manufacturing. In the detergent industry, it is widely used as a filler in powdered laundry products, particularly in developing regions where powdered formulations are dominant.

The glass industry also relies on sodium sulfate to eliminate air bubbles during production for clear and high-quality glass output. Rising construction activities and automotive production are further increasing demand from the glass segment, reinforcing overall market growth.

Major companies operating in the sodium sulfate industry are YRC CHEMIST, Cooper Natural Resources, China Nafine Group International Co., Ltd, KUCHUKSULPHATE, Nippon Chemical Industrial CO., LTD., Lenzing AG, SHIKOKU CHEMICALS CORPORATION., Sun European Partners, LLP, Jiangsu Yinzhu Chemical Group Co., Ltd., CORDENKA GmbH & Co. KG, NIKUNJ CHEMICALS, Merck KGaA, SA MINERA CATALANO-ARAGONESA, Kora Holding, and Tokyo Chemical Industry Co., Ltd.

The textile industry plays a crucial role in market growth, as sodium sulfate is used in dyeing processes to improve dye absorption and distribution. The pulp and paper industry also contributes to demand, utilizing sodium sulfate in the Kraft process to enhance pulp yield and quality.

Advancements in extraction and processing techniques are improving production efficiency and affordability, further driving market growth. The growing shift toward sustainability and eco-friendly manufacturing processes is also fueling the growth of the market.

Additionally, rising industrialization and urbanization in emerging economies are accelerating consumption, creating new growth opportunities for market participants.

- In September 2024, Evonik invested in scaling up electrodialysis technology to recover valuable raw materials like caustic soda and sulfuric acid from sodium sulfate. This initiative aims to improve process efficiency, reduce CO₂ emissions, and enhance sustainability in the chemical industry.

Key Highlights

- The sodium sulfate industry size was valued at USD 2,166.4 million in 2023.

- The market is projected to grow at a CAGR of 4.53% from 2024 to 2031.

- Asia Pacific held a market share of 39.77% in 2023, with a valuation of USD 861.7 million.

- The natural segment garnered USD 1,378.3 million in revenue in 2023.

- The paper & pulp segment is expected to reach USD 1,195.7 million by 2031.

- The market in North America is anticipated to grow at a CAGR of 4.72% during the forecast period.

Market Driver

"Rising Demand in Detergent, Glass, and Textile Industries"

The sodium sulfate market is driven by the growing demand from the detergent, glass, and textile industries. In the detergent industry, sodium sulfate is used as a filler in powdered detergents. Sodium sulfate plays a crucial role in maintaining the effectiveness of detergent formulations, ensuring an even distribution of active cleaning agents.

Growing urbanization, rising disposable incomes, and increased hygiene awareness in emerging economies are boosting the demand for household and industrial detergents, in turn driving the growth of the market.

Additionally, the shift toward sustainable detergent formulations using biodegradable surfactants has further fueled the use of sodium sulfate as an affordable and non-toxic ingredient. In the glass industry, sodium sulfate is essential for removing air bubbles from molten glass, ensuring high-quality final products.

The expanding construction and automotive sectors, which require glass for windows, panels, and displays, are driving the need for sodium sulfate. Similarly, in the textile industry, sodium sulfate aids in dyeing processes by promoting even dye absorption without damaging the fibers.

The rising demand for textiles, driven by fashion trends and population growth is further fueling sodium sulfate consumption in textile manufacturing, in turn driving the growth of the market.

Market Challenge

"Supply Chain Volatility"

Supply chain volatility presents a major challenge in the global sodium sulfate market. This instability results from several factors, including raw material dependence, shifting industrial trends, and geopolitical disruptions. The market's reliance on raw materials leads to fluctuations in availability and price.

Moreover, industries are shifting towards greener alternatives, affecting sodium sulfate production. Geopolitical disruptions, such as trade restrictions, export bans, and logistical issues, further complicate the situation.

Additionally, stringent environmental regulations restrict large-scale mining, and industries that produce sodium sulfate as a byproduct are moving toward more sustainable options.

Demand fluctuations in key sectors, including detergents, textiles, and glass production, contribute to further instability, making it difficult for manufacturers to secure a consistent supply.

To address this, companies are adopting diversified sourcing strategies and circular economy solutions to enhance supply chain stability. Emerging technologies like industrial wastewater recovery and lithium battery recycling are also providing new sources of sodium sulfate, reducing dependence on traditional extraction and byproduct generation.

Market Trend

"Sustainability and Technological Advancements"

The global sodium sulfate market is undergoing significant transformations driven by the increasing demand for sustainable and eco-friendly products. Industries are increasingly seeking sustainable raw materials with sodium sulfate being sourced from both natural deposits and recycled sources, rather than relying solely on chemical byproducts.

This shift aligns with strict environmental regulations and corporate sustainability goals, which makes sodium sulfate a preferred option in formulations with minimal environmental impact.

Additionally, advancements in recycling and recovery technologies are transforming market dynamics by enhancing the effectiveness of sodium sulfate extraction and reuse.

Innovations in electrochemical processes, membrane separation, and zero-liquid discharge technologies enable industries to recover sodium sulfate from industrial waste streams. This reduces reliance on virgin raw materials, lowers production costs, and enhances resource efficiency.

- In June 2024, Grasim Industries introduced Birla EcoSodium, a sustainable sodium sulfate alternative derived from recycled wastewater from viscose staple fiber manufacturing. This innovation reduces environmental impact by minimizing resource depletion and lowering Total Dissolved Solids (TDS) in treated wastewater. Birla EcoSodium enhances industrial applications in textiles, glass manufacturing, detergents, dyes, zinc smelting, and paper production, by promoting eco-friendly and efficient manufacturing processes.

Sodium Sulfate Market Report Snapshot

|

Segmentation

|

Details

|

|

By Nature

|

Natural, Synthetic

|

|

By End Use Industry

|

Paper & Pulp, Detergents, Glass, Food & Beverage, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Nature (Natural, Synthetic): The natural segment earned USD 1,378.3 million in 2023 due to its abundant availability, lower production costs, and prevalent use in detergents and paper manufacturing.

- By End Use Industry (Paper & Pulp, Detergents, Glass, Food & Beverage, Others): The paper & pulp segment held 38.43% of the market in 2023, due to the increasing demand for sodium sulfate in kraft pulping and bleaching processes, which enhance paper quality and production efficiency.

Sodium Sulfate Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific sodium sulfate market accounted for a market share of 39.77% in 2023 in the global market, with a valuation of USD 861.7 million. The dominance of this region is driven by the large-scale production of sodium sulfate in countries like China and India, where natural reserves are abundant and manufacturing costs are relatively low.

The robust paper & pulp, detergent, and textile industries in the region significantly contribute to the demand for sodium sulfate, as it is widely used in these sectors. Additionally, the region's rapidly expanding population and industrialization have resulted in the increased consumption of detergents and glass products, further driving the growth of the market.

The sodium sulfate industry in North America is expected to register the fastest growth, with a projected CAGR of 4.72% over the forecast period. This growth is due to the rising adoption of sodium sulfate in the detergent industry, driven by increasing consumer preference for eco-friendly and sulfate-based cleaning products.

Moreover, the strong presence of major players in the paper & pulp and glass industries has further increased the demand for sodium sulfate in this region. Advancements in recycling and waste management have led to the increased use of sodium sulfate in multiple industrial applications.

The increasing focus on sustainability and circular economy practices in the U.S. and Canada is also promoting the use of sodium sulfate in eco-friendly manufacturing processes.

Moreover, advancements and research initiatives to enhance the efficiency of sodium sulfate extraction and utilization have further strengthened North America's position as a high-growth market.

Regulatory Frameworks

- In the US, the primary regulatory authority for sodium sulfate depends on its intended use. The Food and Drug Administration (FDA) regulates it as a food additive, while the Environmental Protection Agency (EPA) oversees its use in pesticides and other environmental contexts.

- In Europe, the regulatory authority for sodium sulfate is the European Chemical Agency (ECHA), which oversees its registration, classification, labeling, and uses under the REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) Regulation.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) and the Ministry of Health, Labour and Welfare (MHLW) are the key regulatory authorities responsible for ensuring the safety, efficacy, and quality of pharmaceuticals, medical devices, and regenerative medical products, which includes substances like sodium sulfate.

Competitive Landscape

The sodium sulfate industry is characterized by key players focusing on strategic initiatives to strengthen their market presence, enhance production capabilities, and expand their geographic reach.

Companies are actively investing in capacity expansion, particularly in regions with high raw material availability, to ensure a stable supply chain and meet the increasing demand. Key players are adopting advanced extraction and processing technologies to improve efficiency, reduce production costs, and maintain product quality.

Another key strategy is the development of high-purity sodium sulfate variants tailored to specialized applications, including pharmaceuticals, food additives, and high-performance glass manufacturing.

Mergers and acquisitions are also being pursued to strengthen market positions, expand product portfolios, and access new customer bases. Additionally, companies are improving their distribution channels, enhancing logistical capabilities, and utilizing digital platforms to boost market penetration and customer engagement.

- In September 2024, Cinis Fertilizer and Ragn-Sells collaborated to upcycle sodium sulfate into potassium sulfate fertilizer. This supports sustainable resource utilization by transforming industrial waste into valuable input materials, enhancing Cinis Fertilizer’s circular business model.

List of Key Companies in Sodium Sulfate Market:

- YRC CHEMIST

- Cooper Natural Resources

- China Nafine Group International Co., Ltd

- KUCHUKSULPHATE

- Nippon Chemical Industrial CO., LTD.

- Lenzing AG

- SHIKOKU CHEMICALS CORPORATION.

- Sun European Partners, LLP

- Jiangsu Yinzhu Chemical Group Co., Ltd.

- CORDENKA GmbH & Co. KG

- NIKUNJ CHEMICALS

- Merck KGaA

- SA MINERA CATALANO-ARAGONESA

- Kora Holding

- Tokyo Chemical Industry Co., Ltd.

Recent Developments (Investment)

- In June 2024, Aepnus Technology, an electrochemical platform developer based in Emeryville, California, secured USD 8 million in seed funding for advancing its sodium sulfate recycling technology for the battery supply chain. The funding supported pilot deployments with battery manufacturers, recyclers, and mineral refineries. Aepnus' electrolysis platform converts sodium sulfate into sodium hydroxide and sulfuric acid, which offers an economical and sustainable alternative to traditional processes.