Caustic Soda Market Size

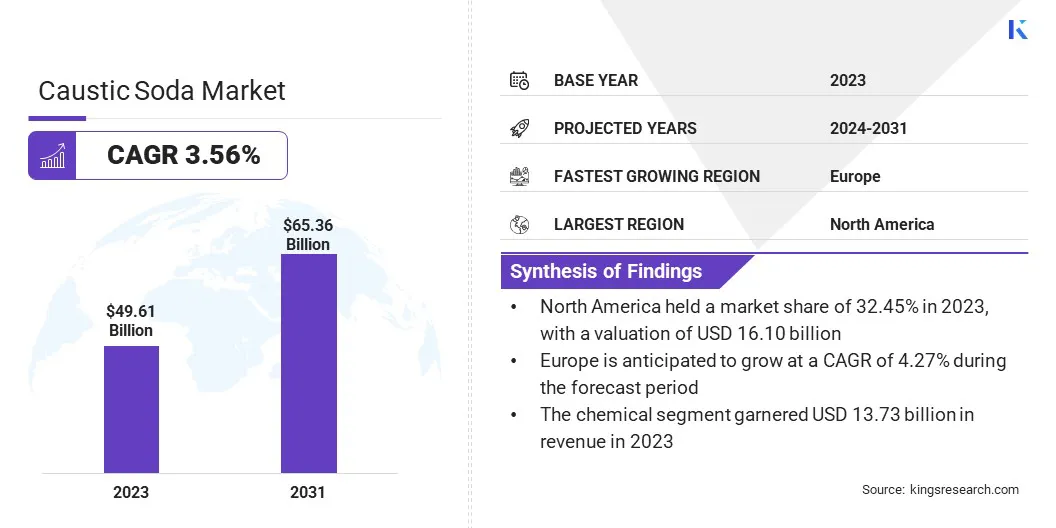

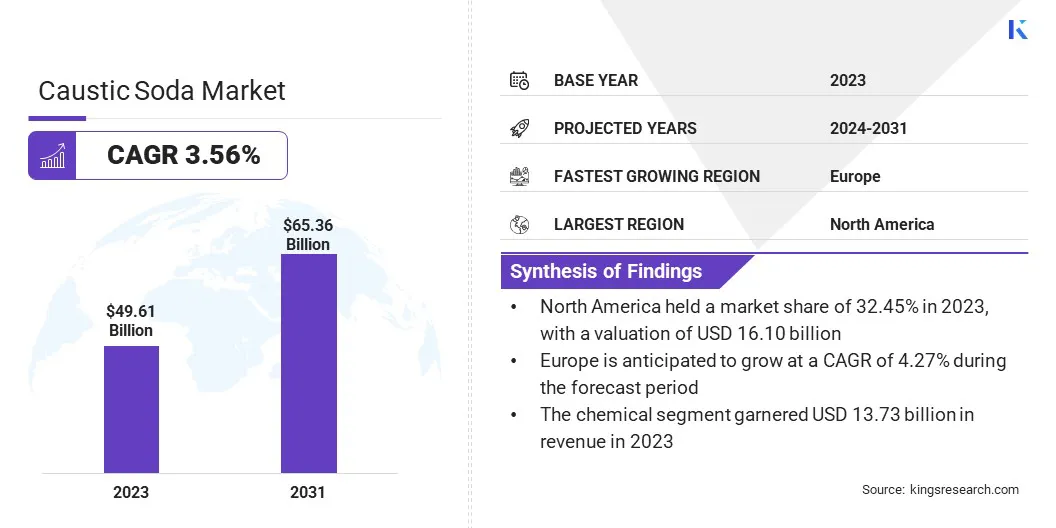

Global Caustic Soda Market size was recorded at USD 49.61 billion in 2023, which is estimated to be at USD 51.15 billion in 2024 and projected to reach USD 65.36 billion by 2031, growing at a CAGR of 3.56% from 2024 to 2031.

The market is witnessing a significant shift towards environmentally friendly production methods, driven by increasing awareness regarding sustainability and regulatory pressures. In the scope of work, the report includes solutions offered by companies such as Olin Corporation, Xinjiang Zhongtai Chemical Co., Ltd., PPG Industries, Tata Chemicals Ltd., Akzo Nobel N.V., Covestro AG, Hanwha Solutions Chemical Division, SABIC, Axiall Corporation, Dow, and others.

Manufacturers are increasingly adopting greener practices such as membrane cell technology, which reduces energy consumption and greenhouse gas emissions compared to traditional methods such as mercury cell technology.

Additionally, the notable shift towards renewable energy sources such as solar and wind power for caustic soda production is garnering significant attention, aligning with environmental objectives. This is further propelled by rising demand and corporate responsibility initiatives, as businesses seek to reduce their carbon footprint and enhance their reputation as environmentally conscious entities.

As consumers become more environmentally aware, there is a growing preference for products manufactured using eco-friendly processes, prompting manufacturers to invest in sustainable production methods. This shift toward environmentally friendly production benefits the environment by reducing pollution and resource depletion and presents opportunities for businesses to differentiate themselves in the market and meet evolving consumer preferences.

Caustic soda, scientifically known as sodium hydroxide (NaOH), is a highly versatile chemical compound renowned for its alkaline properties and diverse applications across numerous industries. Typically found in the form of solid flakes, pellets, or concentrated liquid solutions, caustic soda is highly soluble in water and exhibits strong corrosive properties. Its versatility stems from its ability to serve as a powerful base, facilitating its use in various industrial processes.

In the pulp and paper industry, caustic soda is employed for pulping wood chips and bleaching paper products. In the textile industry, it aids in the processing of fabrics and fibers. Moreover, caustic soda plays a crucial role in the manufacturing of soaps, detergents, and other cleaning agents due to its excellent degreasing and emulsifying properties.

Additionally, it finds applications in water treatment processes for pH adjustment and effluent neutralization, as well as in the production of various chemicals and pharmaceuticals. Caustic soda's diverse forms and industrial applications underscore its significance as a fundamental chemical compound in modern manufacturing processes.

Analyst’s Review

The global caustic soda market is likely to witness robust growth through the projection period, driven by several key factors including increasing demand from end-use industries, expansion in emerging markets, and technological advancements in production processes.

Amidst this growth trajectory, key market players are strategically focusing on several imperatives to maintain and enhance their competitive positions. These strategies often include capacity expansion, geographical diversification, and investments in research and development to innovate and improve production efficiency.

Additionally, sustainability initiatives are becoming increasingly prominent, with companies investing heavily in greener production methods and adopting eco-friendly technologies to meet regulatory requirements and consumer preferences.

Caustic Soda Market Growth Factors

The growing consumption of caustic soda in alumina refining for aluminum production underscores its critical role in the metallurgical industry. Alumina, extracted from bauxite ore through the Bayer process, undergoes electrolysis to produce aluminum metal. In this process, caustic soda is utilized as a crucial ingredient for the extraction of alumina from bauxite, acting as a key component in the digestion stage.

With the increasing demand for aluminum across various sectors such as automotive, aerospace, and construction, the demand for caustic soda in alumina refining is on the rise. This is further fueled by the expansion of aluminum production capacities globally, particularly in emerging markets where demand is being spurred by industrialization and infrastructure development.

As aluminum continues to be a preferred choice for lightweight, durable, and recyclable materials, the consumption of caustic soda in alumina refining is expected to maintain its upward trajectory, presenting lucrative opportunities for market players in the caustic soda industry. Fluctuations in raw material prices pose a significant challenge for players in the caustic soda market, impacting their profit margins and operational stability.

The primary raw material for caustic soda production is sodium chloride (salt), which accounts for a substantial portion of production costs. Any volatility or disruption in the supply of salt can directly influence the overall cost of caustic soda production.

Additionally, fluctuations in energy prices, particularly electricity and natural gas, further intensify the cost pressures on manufacturers. These price fluctuations are often influenced by factors such as geopolitical tensions, weather conditions affecting salt production, and shifts in global energy markets.

To address these challenges, key players are implementing various risk management strategies, such as securing long-term supply contracts, diversifying raw material sources, and investing in energy-efficient technologies.

Caustic Soda Market Trends

The increasing demand for caustic soda in water treatment and recycling processes reflects a vital role in addressing environmental concerns and ensuring sustainable water management practices. Caustic soda is widely used in water treatment applications for pH adjustment, neutralization of acidic effluents, and removal of heavy metals and contaminants from wastewater.

Moreover, it plays a crucial role in the regeneration of ion exchange resins used in water softening and purification systems. With growing concerns over water pollution and scarcity, coupled with stringent regulations governing wastewater discharge standards, the demand for caustic soda in water treatment is expected to increase.

Additionally, the rise in industrial activities, rapid urbanization, and population growth augment the need for effective water treatment solutions. Furthermore, the growing emphasis on water recycling and reuse in various industries, including manufacturing, agriculture, and municipal sectors, presents significant opportunities for the utilization of caustic soda in water treatment processes.

As industries increasingly prioritize environmental sustainability and regulatory compliance, the demand for caustic soda in water treatment applications is poised to grow substantially.

Segmentation Analysis

The global caustic soda market is segmented based on form, process, application, and geography.

By Form

Based on form, the market is categorized into powder/flakes and liquid. The powder/flakes segment captured the largest market share of 54.67% in 2023. Powder and flakes forms of caustic soda are widely preferred in various industries due to their ease of handling, storage, and transportation compared to liquid forms. This makes them more convenient for industrial applications, contributing to their higher demand.

Additionally, powder and flakes exhibit excellent solubility in water, ensuring efficient and uniform dispersion during manufacturing processes such as pulp and paper production, textile processing, and soap and detergent manufacturing.

Furthermore, the powder/flakes form of caustic soda often presents cost advantages over liquid counterpart, making it a preferred choice for large-scale industrial applications where cost-effectiveness is paramount. The widespread applicability, convenience, and cost-effectiveness of powder and flakes forms of caustic soda has contributed to its leading position in the market.

By Process

Based on process, the market is divided into membrane cell and diaphragm cell. The membrane cell segment is anticipated to witness the highest growth, registering a CAGR of 4.11% between 2024 and 2031.

Membrane cell technology offers significant advantages over traditional mercury cell and diaphragm cell technologies, including higher energy efficiency, reduced environmental impact, and improved product purity. As environmental regulations become increasingly stringent globally, there is a growing preference for membrane cell technology due to its lower energy consumption and elimination of mercury usage, aligning with sustainability goals.

Moreover, advancements in membrane materials and manufacturing processes are enhancing the performance and cost-effectiveness of membrane cell systems, leading to their widespread adoption in caustic soda production. Additionally, as industries strive for operational efficiency and cost optimization, the superior efficiency and lower operational costs associated with membrane cell technology are expected to foster its growth trajectory.

By Application

Based on application, the market is divided into pulp & paper, chemical, food, alumina, soap & detergent, water treatment, and others. The chemical segment garnered the highest revenue of USD 13.73 billion in 2023.

Caustic soda is a fundamental chemical compound with a wide range of industrial applications across sectors such as pulp and paper, textiles, chemicals, and metallurgy. Its indispensable role in various manufacturing processes, including alumina refining for aluminum production, soap and detergent manufacturing, and water treatment, facilitates consistent demand and revenue generation.

Additionally, the increasing adoption of caustic soda in emerging applications such as pharmaceuticals, food processing, and healthcare expands its market opportunities. Moreover, favorable market conditions, including economic growth, industrial expansion, and rapid urbanization in key regions, contribute to the sustained demand for caustic soda. Furthermore, strategic initiatives by key players such as capacity expansions, product innovations, and geographical expansions play a significant role in boosting the progress of the segment.

Caustic Soda Market Regional Analysis

Based on region, the global caustic soda market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific Caustic Soda Market share stood around 32.45% in 2023 in the global market, with a valuation of USD 16.10 billion, primarily fueled by rapid industrialization and urbanization in countries such as China, India, and Southeast Asian nations. This has led to an increased demand for caustic soda across various sectors such as chemicals, textiles, and pulp and paper. These countries are major manufacturing hubs, resulting in substantial adoption of caustic soda in industrial processes.

Additionally, the burgeoning construction and infrastructure development activities in the region require significant quantities of caustic soda for manufacturing construction materials such as cement, glass, and ceramics.

Moreover, favorable government policies, growing investments in industrial infrastructure, and increasing foreign direct investments contribute to the robust Asia-Pacific caustic soda market growth. Furthermore, the region's large population base and rising disposable incomes are boosting the demand for consumer goods, including soaps, detergents, and textiles, thereby augmenting the consumption of caustic soda.

Europe is poised to experience significant growth, registering a 4.27% CAGR in the foreseeable future, largely attributed to stringent environmental regulations and sustainability initiatives in Europe, prompting industries to adopt eco-friendly production methods, including the use of membrane cell technology for caustic soda production. This rising shift toward green manufacturing practices is expected to bolster the demand for caustic soda in the region.

Additionally, the growing emphasis on water treatment and recycling to address environmental concerns and ensure sustainable water management practices is stimulating the demand for caustic soda in Europe.

Moreover, the region's well-established chemical, pulp and paper, and metallurgical industries are expected to continue to increase the consumption of caustic soda for various manufacturing processes. Furthermore, technological advancements and innovations in caustic soda production processes are estimated to enhance efficiency and reduce environmental impact, thereby supporting regional market growth.

Competitive Landscape

The global caustic soda market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Caustic Soda Market

- Olin Corporation

- Xinjiang Zhongtai Chemical Co., Ltd.

- PPG Industries

- Tata Chemicals Ltd.

- Akzo Nobel N.V.

- Covestro AG

- Hanwha Solutions Chemical Division

- SABIC

- Axiall Corporation

- Dow

Key Industry Developments

- November 2023 (Investment): Akzo Nobel advanced its innovative technology for caustic soda evaporation by investing in a new plant dedicated to concentrating caustic soda. This strategic decision has led to significant reductions in both installation and maintenance expenses.

- February 2023 (Expansion): Covestro successfully commissioned a new world-scale facility for chlorine production in Tarragona, Spain. This state-of-the-art plant guarantees an efficient, sustainable, and self-sufficient supply of chlorine and caustic soda, thereby enhancing the European production network for MDI.

The Global Caustic Soda Market is Segmented as:

By Form

By Process

- Membrane Cell

- Diaphragm Cell

By Application

- Pulp & Paper

- Chemical

- Food

- Alumina

- Soap & Detergent

- Water Treatment

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America