Sodium Propionate Market Size

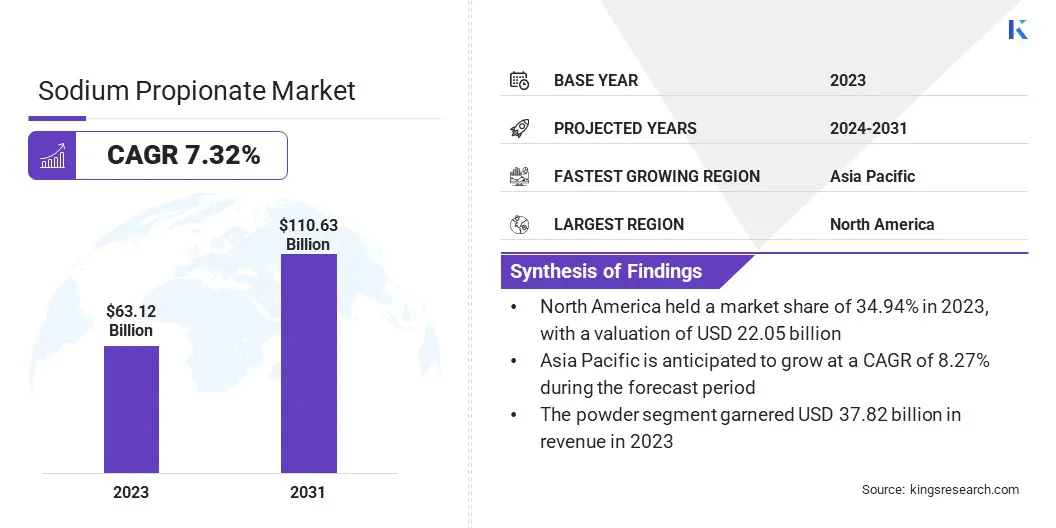

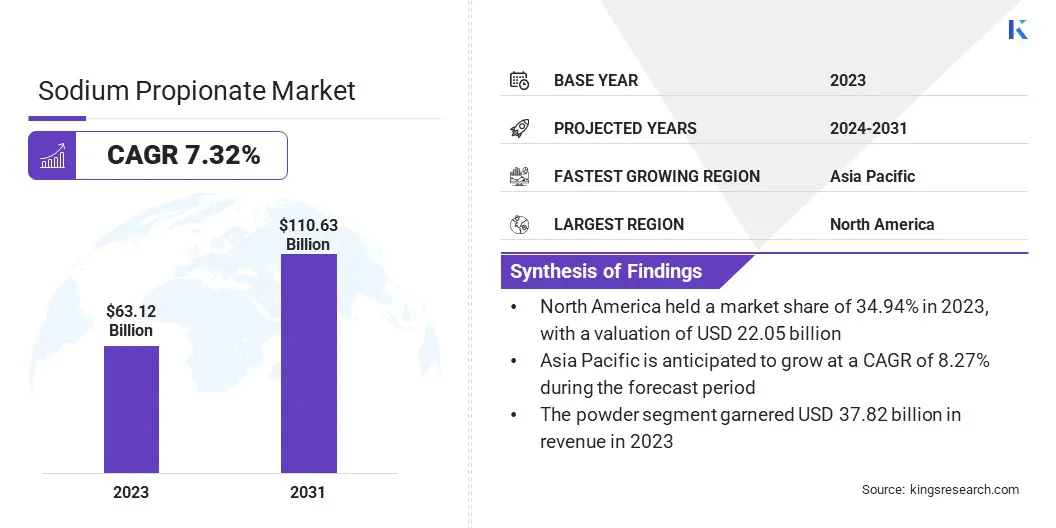

The global Sodium Propionate Market size was valued at USD 63.12 billion in 2023 and is projected to grow from USD 67.45 billion in 2024 to USD 110.63 billion by 2031, exhibiting a CAGR of 7.32% during the forecast period. Rising consumer preference for convenience foods, including baked goods, snacks, and processed meats, is increasing the demand for food preservatives and boosting the growth of the market.

Its ability to prevent mold and bacterial growth extends the shelf life of these products, making it crucial for the food industry. In the scope of work, the report includes products offered by companies such as American International Foods, Inc., Thermo Fisher Scientific Inc., Fengchen Group, Dr. Paul Lohmann GmbH & Co. KGaA, BioFuran Materials, Kraft Chemical Company, Plater Group, Merck Group, Alfa Chemistry, Kerry Group, and others.

Moreover, the global dairy industry, particularly in cheese and processed dairy segments, relies heavily on sodium propionate for its antifungal properties. Cheese and dairy products are highly susceptible to mold growth during storage and transportation.

Increasing global consumption of dairy products, especially in developing regions necessitates the use of preservatives to ensure product stability, contributing to the expansion of the sodium propionate market.

- According to the 2023 report by the Food and Agriculture Organization of the United Nations, global milk production reached 950 million tonnes in 2023, marking a 1.3% increase from the previous year, up from0.6% in 2022. This growth was primarily driven by increased production in Asia, particularly in India and China.

Sodium Propionate is an interdisciplinary field that merges biology and photonics to study the interactions between light and biological materials. Its applications cover various domains, including medical imaging such as optical coherence tomography for retinal imaging, spectroscopy, and microscopy.

Regulatory oversight, led by bodies such as the FDA, ensures the safety and efficacy of sodium propionate devices. These devices must meet stringent standards before entering the market.

Analyst’s Review

Global food safety regulations are becoming more stringent, requiring food manufacturers to adhere to higher standards. Sodium propionate is essential for controlling microbial growth and ensuring compliance with these regulations. As governments across regions enforce stricter regulations to prevent foodborne illnesses and maintain consumer safety, food producers are focusing on reliable preservatives, boosting the sodium propionate market growth.

Sodium propionate’s ability to ensure extended shelf life without compromising safety makes it a preferred choice in this regulatory environment. The evolving regulatory landscape is leading to increased adoption of sodium propionate across the food industry.

- A June 2024 report by RTI International highlights that contaminated food is responsible for more than 200 diseases globally, affecting over 600 million people annually, with 40% of cases occurring in children under the age of five. In response, the World Health Organization has acknowledged the critical importance of food safety and launched a Global Strategy for Food Safety 2022-2030. This initiative aims to ensure that people worldwide have access to safe and healthy food, thereby reducing the burden of foodborne illnesses.

Moreover, technological advancements in food preservation methods are contributing to the expansion of the market. Innovations in formulation techniques and packaging have enabled better integration of preservatives, ensuring that products maintain their quality for longer periods.

Food manufacturers are increasingly adopting cutting-edge preservation technologies to enhance product stability while maintaining taste or nutritional value, boosting market growth.

Sodium Propionate Market Growth Factors

The increasing global consumption of processed and packaged foods is stimulating the growth of the market. Modern lifestyles, characterized by busy schedules and rapid urbanization, have led consumers to seek convenient, ready-to-eat food options.

Sodium propionate is essential in maintaining the shelf life and quality of these products by preventing mold and bacterial growth. The expanding presence of supermarkets and convenience stores in both developed and developing markets is further fueling the demand for preserved food products.

Moreover, the agricultural sector is witnessing a growing demand for sodium propionate due to its efficacy in extending the shelf life of animal feed. Mold growth in feed can lead to spoilage, which reduces feed quality and impacts livestock health. Sodium propionate helps prevent this spoilage, ensuring that feed remains fresh and safe for consumption.

The increasing global demand for meat and dairy products, coupled with the need for high-quality animal nutrition, is increasing the adoption of preservatives in the feed industry, augmenting the growth of the market.

However, growing consumer preference for natural, organic, and chemical-free food products is restricting the use of synthetic preservatives, hindering sodium propionate market growth. While sodium propionate is recognized as safe by regulatory bodies, increasing consumer demand for cleaner labels and natural ingredients has created a perception that natural preservatives such as vinegar and rosemary extract are healthier alternatives.

To address this challenge, companies are adopting strategies such as developing sodium propionate blends with natural additives to align with the clean label trend. Additionally, manufacturers are investing in consumer education initiatives to raise awareness of the safety and efficacy of sodium propionate.

By emphasizing the minimal impact of synthetic preservatives on health and enhancing labeling transparency, companies are anticipated to sustain demand for sodium propionate while aligning with shifting consumer preferences.

Sodium Propionate Industry Trends

The bakery industry’s growth, particularly in emerging markets, significantly contributes to the expansion of the sodium propionate market. Baked goods, especially bread, are highly susceptible to spoilage due to mold, necessitating the use of preservatives critical for product stability.

With the expansion of bakery chains and artisanal bakeries expand, especially in Asia-Pacific and Latin America, demand for preservatives that extend the shelf life of bread and other products is increasing. This growth aligns with consumer preferences for fresh, long-lasting baked goods, prompting manufacturers to increasingly rely on sodium propionate to maintain product quality throughout distribution.

- In 2023, the Government of Canada reported that retail sales of baked goods in the United States reached USD 82.9 billion by the end of 2022. The market is projected to expand at a compound annual growth rate (CAGR) of 3.1% from 2023 to 2027, with sales anticipated to hit USD 97.7 billion by 2026.

The agricultural sector is witnessing a growing demand for sodium propionate due to its efficacy in extending the shelf life of animal feed. Mold growth in feed can lead to spoilage, which reduces feed quality and impacts livestock health. Sodium propionate helps prevent this spoilage, ensuring that feed remains fresh and safe for consumption.

The increasing global demand for meat and dairy products, coupled with the need for high-quality animal nutrition, is boosting the adoption of preservatives in the feed industry. Sodium propionate plays a crucial role in improving feed storage and quality.

Segmentation Analysis

The global market has been segmented based on form, application, end-user, and geography.

By Form

Based on form, the market has been segmented into powder, liquid and granules. The powder segment led the sodium propionate market in 2023, reaching a valuation of USD 37.82 billion. This growth is mainly propelled by its superior handling, stability, and versatility in various industrial applications.

Sodium propionate in powder form offers better solubility, making it easier to blend uniformly into products such as baked goods, animal feed, and pharmaceuticals. Its ease of storage and transportation enhances its commercial appeal, especially for large-scale manufacturers seeking efficiency in production and logistics. Additionally, the powder form provides extended shelf life, reducing spoilage risks and ensuring product consistency.

By Application

Based on application, the market has been classified into preservative, antifungal treatment, additive, and others. The preservative segment secured the largest revenue share of 64.33% in 2023. Sodium propionate is widely used as a preservative in baked goods, dairy products, and processed meats, where it effectively inhibits mold and bacterial growth.

This application is particularly important due to the increasing demand for processed and packaged foods worldwide. The need for longer shelf life and improved food safety fosters the adoption of sodium propionate as a reliable preservative. Its proven efficacy and regulatory approval further solidify its dominance, ensuring it remains a preferred choice for food preservation.

By End-User

Based on end-user, the market has been divided into food & beverage manufacturers, pharmaceutical companies, animal feed producers, cosmetic manufacturers, and industrial users. The animal feed producers segment is set to witness significant growth at a robust CAGR of 8.23% through the forecast period. This expansion is attributed to the rising global demand for meat and dairy, which necessitates high-quality, long-lasting feed.

As livestock farming expands, particularly in emerging markets, feed manufacturers are increasingly utilizing sodium propionate to enhance feed stability and shelf life. Additionally, stricter food safety regulations and the need to minimize feed waste are prompting feed producers to adopt preservatives, thereby boosting demand for sodium propionate.

Sodium Propionate Market Regional Analysis

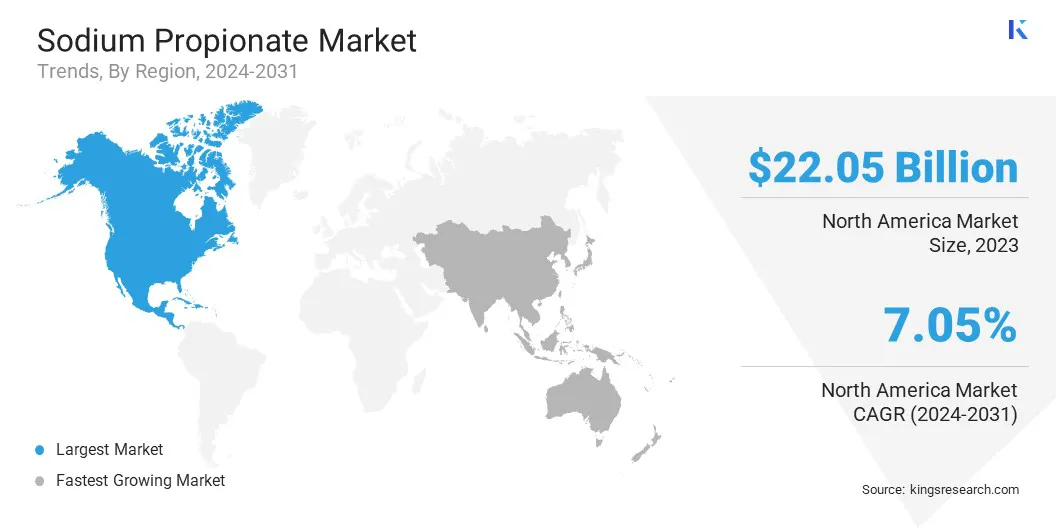

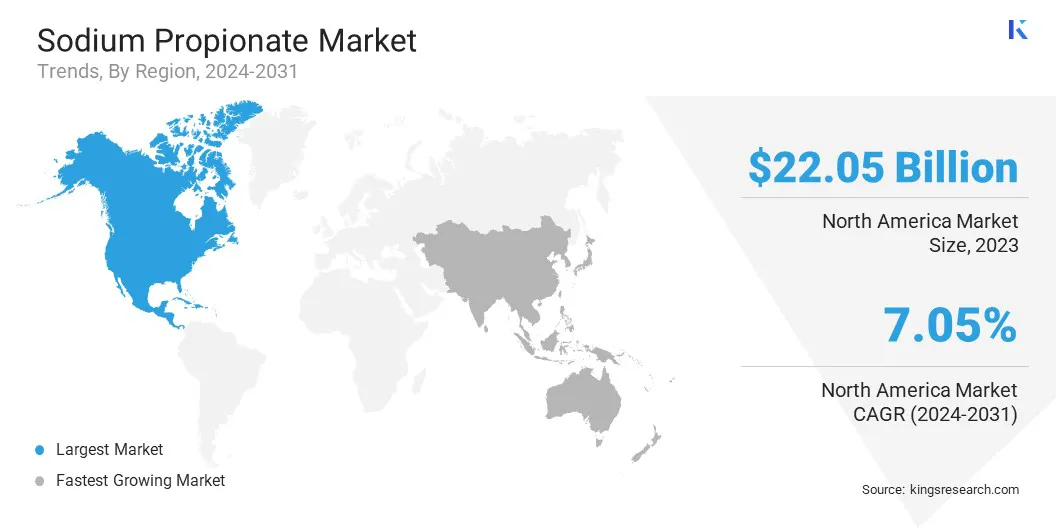

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America sodium propionate market captured a substantial share of around 34.94% in 2023, with a valuation of USD 22.05 billion. The North American agricultural sector is witnessing a rising demand for sodium propionate due to its effectiveness in prolonging the shelf life of animal feed.

Sodium propionate acts as a preservative, preventing spoilage and maintaining the freshness and nutritional value of animal feed. The increasing global demand for meat and dairy products, coupled with the need for high-quality animal nutrition, is fostering the expansion of the feed industry. This growing focus on improving feed safety and storage is supporting the progress of the North America market.

- A 2023 report from the American Feed Industry Association states that the U.S. has approximately 5,800 animal food manufacturing facilities that produce over 284 million tons of finished feed and pet food annually.

Asia Pacific is set to experience significant growth at a robust CAGR of 8.27% over the forecast period. The rapid growth of pharmaceutical production in the Asia-Pacific region is contributing significantly to the robust expansion of the market.

Increasing healthcare demands, fueled by population growth, rising incomes, and improved access to medical care, have led to significant investments in pharmaceutical manufacturing across countries such as China, India, and Southeast Asia.

Additionally, the region is emerging as a global hub for pharmaceutical exports, increasing the need for effective preservatives to ensure the stability and shelf life of medicines.

- According to a 2024 report by the India Brand Equity Foundation, The Indian pharmaceutical industry, ranked third globally in terms of production volume in 2023, has been expanding at a compound annual growth rate (CAGR) of 9.43% over the past nine years. By 2030, the industry's total market size is projected to reach USD 130 billion, with anticipations of further growth to USD 450 billion by 2047.

Competitive Landscape

The global market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Sodium Propionate Market

- American International Foods, Inc.

- Thermo Fisher Scientific Inc.

- Fengchen Group

- Paul Lohmann GmbH & Co. KGaA

- BioFuran Materials

- Kraft Chemical Company

- Plater Group

- Merck Group

- Alfa Chemistry

- Kerry Group

Key Industry Development

- May 2024 (Partnership): Plater Group showcased its products at the UK’s largest chemical industry supply chain exhibition, CHEMUK 2024. This initiative aims to enhance visibility in the sodium propionate industry, engage with existing and potential customers, and demonstrate its product line.

The global sodium propionate market has been segmented as:

By Form

By Application

- Preservative

- Antifungal treatment

- Additive

- Others

By End-User

- Food & Beverage Manufacturers

- Pharmaceutical Companies

- Animal Feed Producers

- Cosmetic Manufacturers

- Industrial Users

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America