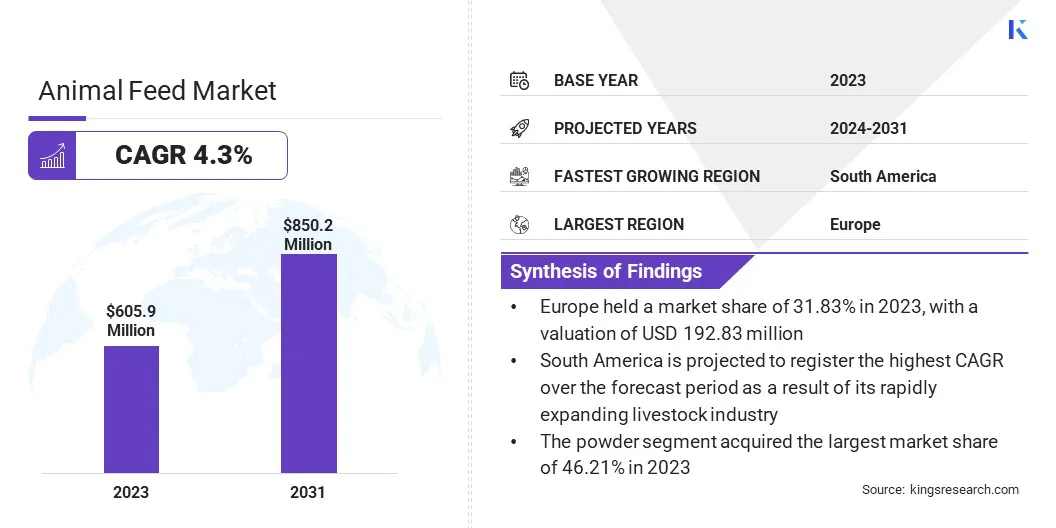

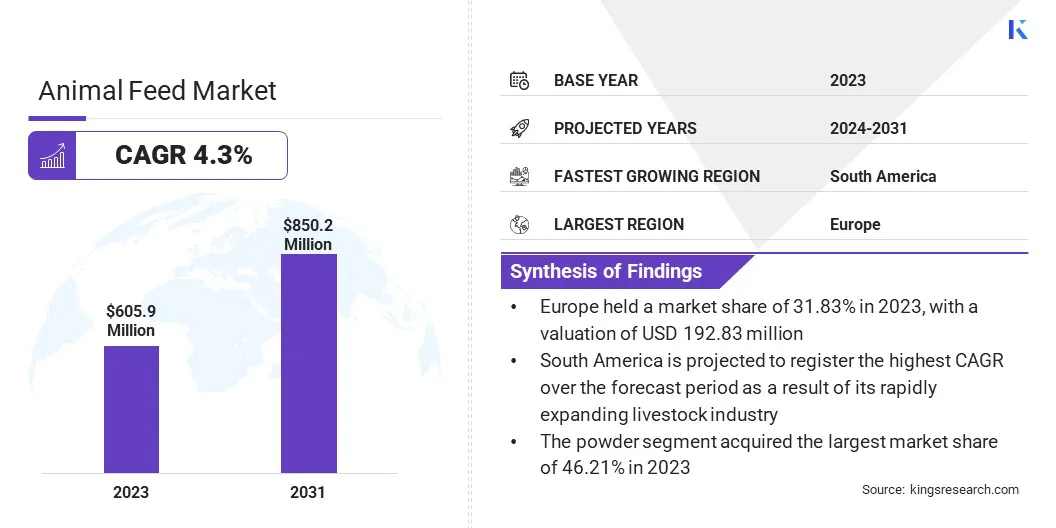

Animal Feed Market Size

The global Animal Feed Market size was valued at USD 605.9 million in 2023 and is projected to reach USD 850.2 million by 2031, growing at a CAGR of 4.3% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as ADM, BASF SE, Land O Lakes Purina, Nutreco N.V. (Trouw nutrition), Cargill Inc., Kemin Industries, Inc., ANOVA Group, ADM, Hansen Holding, Alltech, Inc. and Others.

The animal feed market is constantly evolving in response to changing consumer preferences and regulations. As more people become aware of the importance of sustainable and ethical practices in agriculture, there is a growing demand for feed that is sourced from responsible and environmentally-friendly sources.

Additionally, advancements in technology have allowed for the development of more nutritious and efficient feed options that help improve the health and productivity of livestock. These factors have contributed to a shift toward more specialized and tailored feed products that cater to specific animal needs and requirements. This trend is expected to continue as the agricultural industry seeks to meet the evolving needs of both consumers and the environment.

By investing in research and innovation, companies are able to create feed products that support animal welfare, while also promoting sustainability and eco-friendliness. The trajectory of the agricultural sector hinges on innovating feed solutions that are not only performance-oriented and cost-effective but also resonate with the ethical and environmental considerations of the modern, informed consumer base.

Analyst’s Review

The animal feed market has experienced substantial growth in recent years, primarily fueled by the rising demand for superior-quality feed products. Additionally, advancements in technology and research have facilitated the emergence of innovative feed solutions that enhance animal health and performance. These factors, coupled with a shift in consumer preferences toward organic and natural products, are projected to stimulate further expansion of the market.

As consumers become increasingly conscious of the significance of sustainable and nutritious food choices, the demand for high-quality animal feed products is poised to surge. The growing demand for organic and natural ingredients in animal feed is likely to spur industry innovation, as companies strive to meet these evolving consumer preferences. With ongoing advancements in technology and research, the future of the animal feed market appears promising and conducive to sustained growth.

Market Definition

Animal feed refers to the provision of pellets, grains, or supplements to domestic animals to ensure they receive the necessary nutrients for their growth, maintenance, and overall well-being. This feed is carefully formulated to meet the specific nutritional requirements of various species, including livestock, poultry, and pets.

In the United States, the Food and Drug Administration (FDA) governs the production and labeling of animal feed to guarantee its safety and quality. Instances of feed contamination have resulted in outbreaks of diseases among livestock, underscoring the significance of stringent regulatory oversight in the industry.

Additionally, advancements in feed technology have facilitated the creation of specialized feeds tailored to address the distinct needs of animals at different life stages or production phases. These specialized feeds often contain a balanced combination of nutrients, vitamins, and minerals to support optimal growth, reproduction, and overall health in animals.

For instance, there are feeds specifically formulated for pregnant or lactating animals, as well as for young animals that require increased levels of certain nutrients to facilitate optimal growth and development. By providing animals with appropriate feed that aligns with their specific requirements, producers are ensuring the health and productivity of their livestock, poultry, and pets.

Overall, the regulatory frameworks and advancements in animal feed technology play a crucial role in supporting animal well-being and fostering the growth of the animal agriculture industry.

Animal Feed Market Dynamics

Advancements in animal nutrition and feed technology are poised to propel market growth by enhancing overall animal health and performance. These advancements involve providing animals with tailored, balanced diets that optimize growth rates, reproductive efficiency, and disease resistance. Furthermore, innovations in feed technology have resulted in more efficient and cost-effective feeding methods, leading to increased productivity and profitability for farmers.

These advancements are essential in meeting the rising demand for sustainable, high-quality animal products, making them a major factor in stimulating market expansion. Advancements in animal nutrition have transformed farming practices by offering a wide range of specialized feeds and supplements to address specific health and performance issues in livestock.

As a result, animals experience improved health, increased productivity, and enhanced resilience against diseases. This benefits farmers by enhancing profitability and ensures a consistent supply of high-quality animal products to meet global consumer demand. The continuous development of feed technology is playing a critical role in shaping the landscape of agriculture and promoting the sustainability of food production.

However, fluctuations in the prices of essential components such as steel, aluminum, and petroleum are leading to an increase in manufacturing costs for producers. This results in higher prices for consumers, which reduces demand for products. Furthermore, price fluctuations in raw materials disrupt supply chains, causing production and delivery delays. These challenges introduce uncertainty for businesses and hinder their ability to forecast future growth and profitability of the market.

Nonetheless, to mitigate these risks, companies are diligently monitoring and managing their raw material supply chains, anticipating and adapting to price and availability fluctuations. This step enhances resilience in the face of volatile raw material markets, ensuring long-term success and viability.

Segmentation Analysis

The global animal feed market is segmented based on feed form, livestock type, and geography.

By Feed Form

Based on feed form, the market is bifurcated into powder, pellet, and liquid. The powder segment acquired the largest market share of 46.21% in 2023, primarily due to its ease of use and versatility. Powdered feed can be easily mixed into existing feed blends, making it a convenient option for farmers looking to enhance the nutritional value of their livestock's diet.

Additionally, powdered supplements have a longer shelf life compared to liquid or solid forms, which reduces the risk of spoilage and ensures consistent quality. Furthermore, the powder form allows for precise dosing, thereby ensuring that animals receive the correct amount of nutrients necessary for their optimal growth and health. The convenience, stability, and accuracy of powdered feed products have contributed to their widespread adoption in the animal feed industry.

By Livestock Type

Based on livestock type, the market is bifurcated into swine, ruminants, poultry, aquaculture, and companion animals. The poultry segment dominated the animal feed market with a significant share of 46.77% in 2023, mainly driven by its high demand for feed products compared to other livestock.

Additionally, poultry farming has become increasingly popular in recent years, leading to an increased need for specialized feed formulations tailored to the specific nutritional requirements of different poultry species. This has resulted in a surge in research and development efforts focused on creating innovative feed solutions that improve poultry health, growth rates, and overall productivity.

As a result, the poultry segment has gained significant traction in the animal feed industry, attracting considerable investments from feed manufacturers and suppliers looking to capitalize on this lucrative market opportunity.

Animal Feed Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Europe Animal Feed Market share stood around 31.83% in 2023 in the global market, with a valuation of USD 192.83 million, due to its advanced agricultural infrastructure and technological innovation. European countries have invested heavily in research and development, leading to the production of high-quality animal feed products.

Additionally, stringent regulations and quality control measures ensure that European animal feed is safe and effective for livestock consumption. This commitment to excellence has helped European companies gain a competitive edge in the global market landscape, thereby attracting customers from diverse regions. Europe's leading position in the animal feed industry is a result of its unwavering dedication to quality, safety, and innovation.

Latin America is projected to register the highest CAGR over the forecast period as a result of its rapidly expanding livestock industry. With increasing demand for meat products and dairy, the need for high-quality animal feed has surged in the region.

Furthermore, advancements in technology and agricultural practices have allowed Latin American farmers to maximize productivity and efficiency in their operations, resulting in significant regional market growth. Additionally, favorable government policies and investments in research and development have supported the growth of the industry in Latin America.

Competitive Landscape

The animal feed market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Animal Feed Market

- ADM

- BASF SE

- Land O Lakes Purina

- Nutreco N.V. (Trouw nutrition)

- Cargill Inc.

- Kemin Industries, Inc.

- ANOVA Group

- ADM

- Hansen Holding

- Alltech, Inc.

Key Industry Development

- April 2023(Sell): ForFarmers N.V. sold its Belgian compound feed business to Arvesta, a Belgium-based company, for EUR25 million (US$27.4 million).

The global Animal Feed Market is segmented as:

By Feed Form

By Livestock Type

- Swine

- Ruminants

- Poultry

- Aquaculture

- Companion Animals

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America