Market Definition

Smart home appliances are internet-connected devices that use automation, AI, and remote control to enhance convenience, efficiency, and security. They can be operated through smartphones, voice assistants, or home automation systems.

Smart Home Appliances Market Overview

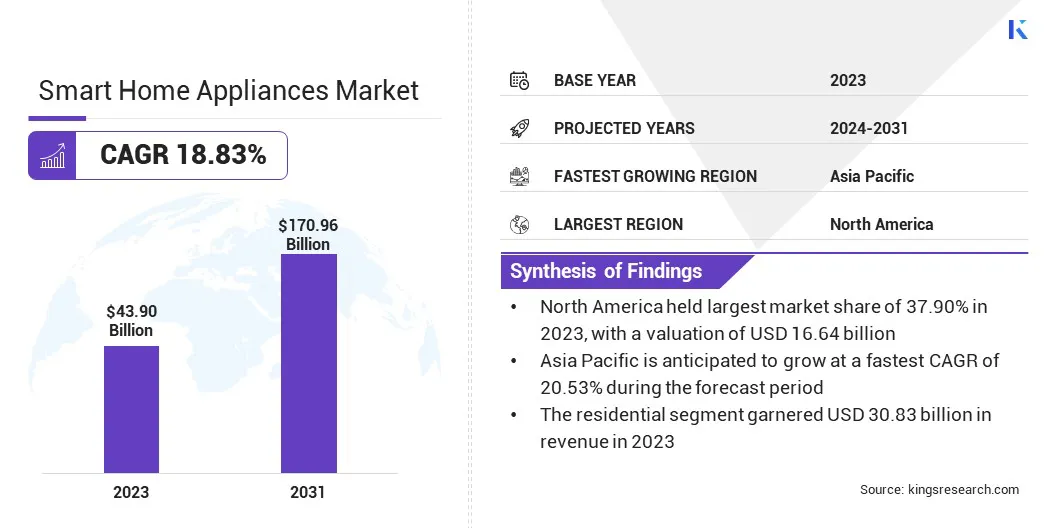

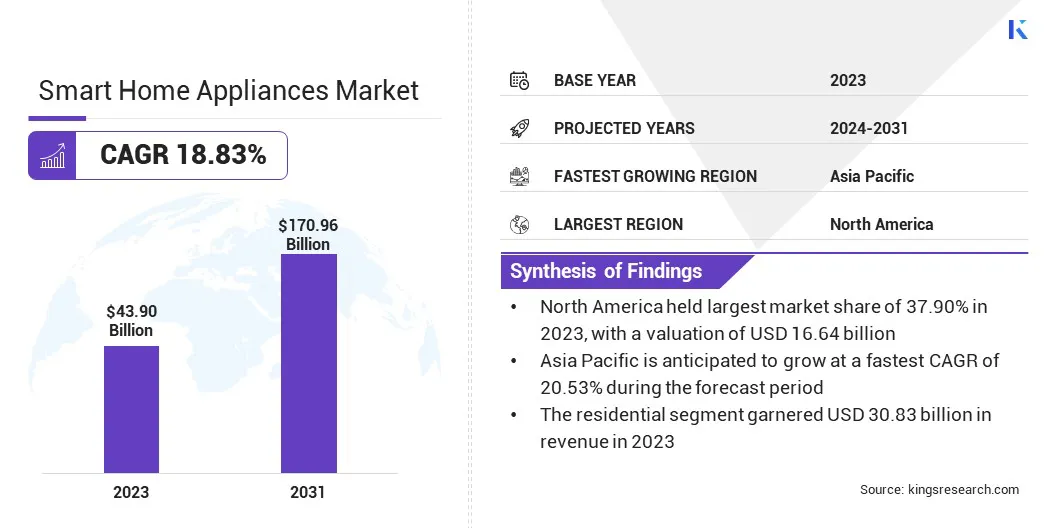

Global smart home appliances market size was valued at USD 43.90 billion in 2023 and is projected to grow from USD 51.10 billion in 2024 to USD 170.96 billion by 2031, exhibiting a CAGR of 18.83% during the forecast period.

The market is experiencing rapid growth, driven by increasing consumer demand for convenience, energy efficiency, and home automation. Advancements in the Internet of Things (IoT), artificial intelligence, and voice-assisted technologies have fueled the adoption of smart devices such as refrigerators, washing machines, thermostats, lighting systems, and security cameras.

Major companies operating in the smart home appliances industry are SAMSUNG, LG Electronics, Haier Group, Robert Bosch GmbH, Whirlpool Corporation, Miele, ASSA ABLOY, tado GmbH, Govee, Honeywell International Inc., Panasonic Holdings Corporation, Dyson, Koninklijke Philips N.V., Alphabet Inc., Ring LLC, and others.

Rising internet penetration, expanding smart home ecosystems, and growing awareness of energy-saving solutions are further propelling market expansion. The market is expected to witness sustained growth, fueled by rapid urbanization, smart city initiatives, increasing investments in home automation technologies, and rising consumer preference for interconnected ecosystems.

- In January 2025, Hisense launched smart kitchen appliances at CES, featuring Dish Designer, an AI-powered recipe assistant, and ConnectLife, a platform connecting and controlling all smart domestic Hisense devices.

Key Highlights:

- The smart home appliances industry size was recorded at USD 43.90 billion in 2023.

- The market is projected to grow at a CAGR of 18.83% from 2024 to 2031.

- North America held a share of 37.90% in 2023, valued at USD 16.64 billion.

- The Wi-Fi segment garnered USD 25.37 billion in revenue in 2023.

- The residential segment is expected to reach USD 125.67 billion by 2031.

- The smart security systems segment is projected to generate a revenue of USD 58.79 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 20.53% over the forecast period.

Market Driver

"Rising Demand for Convenience and Automation"

Rising consumer demand for convenience is propelling the growth of the smart home appliances market. This has led to the increased adoption of devices that offer remote control and automation, streamlining daily tasks.

Advances in technologies such as artificial intelligence (AI) and machine learning have significantly improved the functionality of these appliances, enabling them to adapt to user preferences for a more personalized experience.

Additionally, the growing emphasis on sustainability is leading to the widespread adoption of energy-efficient smart appliances, as consumers seek to reduce their environmental impact and lower utility costs.

- For instance, in December 2024, Universal Electronics Inc. introduced its QuickSet homeSense technology at CES 2025. This technology enhances the smart home experience by adding on-device intelligence that adapts to user behavior and home environment changes, optimizing energy management and personalizing home automation. Key features include occupancy detection, personalized HVAC settings, and efficient automation.

Market Challenge

"High Costs and Rising Security Concerns"

High costs continue to hinder the growth of the smart home appliances market, limiting adoption among price-sensitive consumers. To tackle this challenge, manufacturers are developing more affordable models with key features to appeal to a wider audience.

Additionally, integration and interoperability issues between different brands and platforms present a major challenge, creating a fragmented user experience. To address this, industry players are adopting universal standards and enhancing cross-platform compatibility to facilitate seamless integration of smart devices.

- For instance, in September 2024, SmartThings introduced its Matter Bridge integration, enhancing connectivity between its platform and IKEA’s smart home devices. This feature enables users to easily connect IKEA devices to SmartThings, providing seamless control and automation across different ecosystems.

Data privacy and security concerns are major challenges, as smart appliances often collect personal information. In response to this, companies are improving encryption, strengthening cyber security measures, and adopting transparent privacy policies to build consumer trust.

Market Trend

"Rising Adoption for Voice-Controlled Devices and AI Integration"

The demand for voice-controlled devices is growing as consumers seek greater convenience and control. Voice assistants such as Amazon Alexa, Google Assistant, and Apple Siri are becoming integral to smart home ecosystems.

Additionally, interoperability is becoming increasingly important, with smart appliances designed for seamless integration across different platforms, ensuring a more connected and integrated home environment. Additionally, AI-powered refrigerators are gaining popularity, offering personalized meal planning, reducing food waste, and simplifying meal preparation.

- For instance, in April 2024, Samsung Electronics America, Inc. expanded its Bespoke kitchen appliance line-up with the introduction of new 4-Door Flex refrigerators and a redesigned Bespoke Slide-in Induction Range. The AI-powered refrigerators feature AI Vision Inside to track food, suggest recipes, and create shopping lists, while the Slide-in Induction Range integrates with SmartThings for recipe guidance and cooking control via a touchscreen, simplifying meal planning and preperation.

Smart Home Appliances Market Report Snapshot

| Segmentation |

Details |

| By Connectivity |

Wi-Fi, Bluetooth, Zigbee, Others |

| By Application |

Residential, Commercial |

| By Offering |

Smart Kitchen Appliances (Smart Refrigerators, Smart Ovens & Microwaves, Smart Dishwashers, Smart Coffee Makers, Smart Cooktops & Hobs, Smart Blenders & Food Processors, Smart Air Fryers & Toasters, Smart Water Purifiers, Smart Kitchen Hoods, Smart Kettles & Beverage Dispensers), Smart Laundry Appliances (Smart Washing Machines, Smart Dryers, Smart Washer-Dryer Combos, Smart Ironing Systems), Smart HVAC Systems (Smart Air Conditioners, Smart Thermostats, Smart Air Purifiers, Smart Ventilation Systems, Smart Dehumidifiers & Humidifiers, Smart Water Heaters), Smart Lighting Systems (Smart Bulbs, Smart LED Strips, Smart Lamps & Fixtures, Smart Light Switches & Dimmers, Smart Outdoor Lighting, Smart Ceiling Fans with Lighting), Smart Security Systems (Smart Door Locks, Smart Doorbells (Video Doorbells), Smart Security Cameras, Smart Motion Sensors, Smart Alarm Systems, Smart Garage Door Openers, Smart Smoke & Carbon Monoxide Detectors), Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Connectivity (Wi-Fi, Bluetooth, Zigbee, and Others): The Wi-Fi segment earned USD 25.37 billion in 2023 due to its widespread adoption and ability to provide reliable and high-speed internet connections.

- By Application (Residential and Commercial): The residential held a share of 70.23% of the market in 2023, fueled by the growing consumer demand for smart home solutions that enhance convenience, energy efficiency, and security.

- By Offering (Smart Kitchen Appliances, Smart Laundry Appliances, Smart HVAC Systems, Smart Lighting Systems, Smart Security Systems, and Others): The smart security systems segment is projected to reach USD 58.79 billion by 2031, attributed to the increasing focus on home safety and the growing adoption of surveillance cameras, smart locks, and motion detectors.

Smart Home Appliances Market Regional Analysis

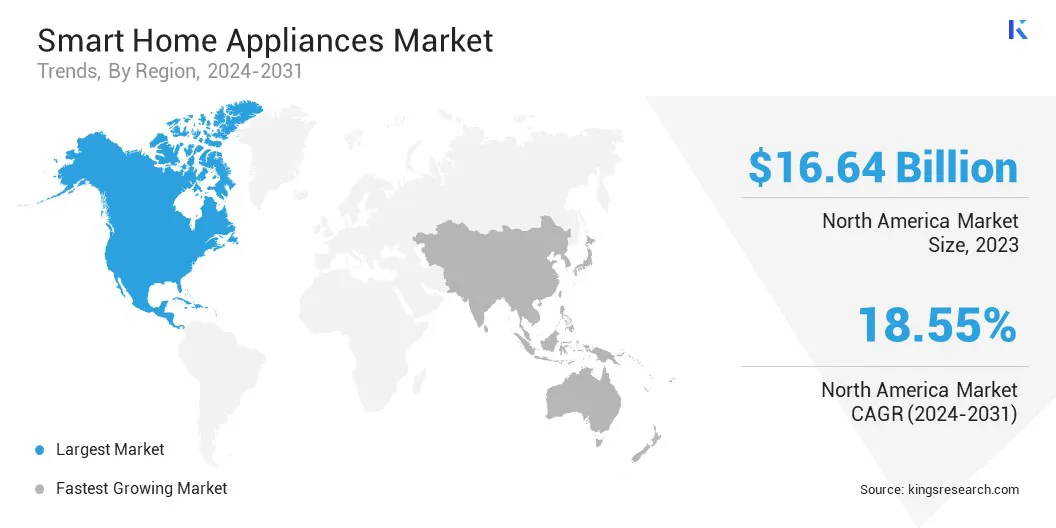

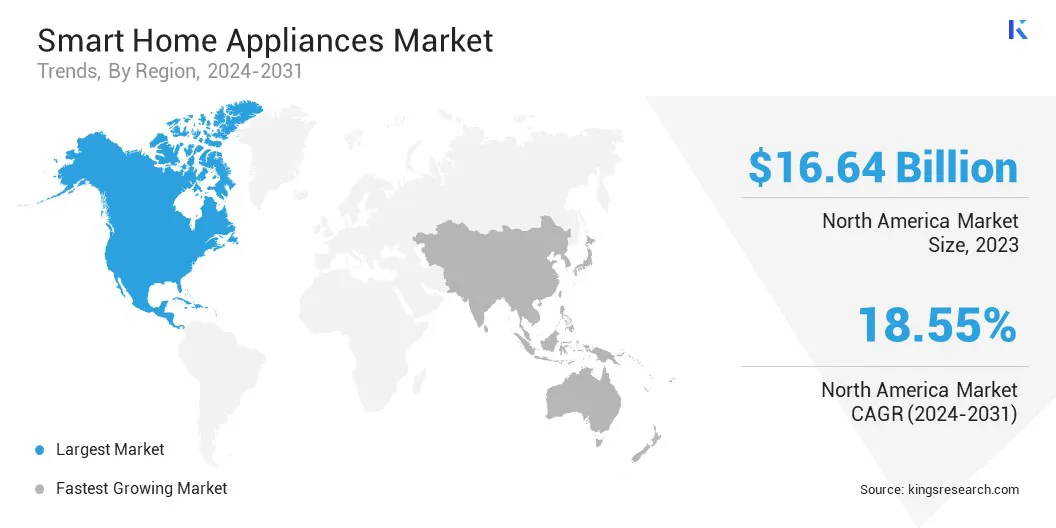

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America smart home appliances market accounted for a share of around 37.90% in 2023, valued at USD 16.64 billion. This dominance is primarily propelled by high consumer demand for advanced technology, the widespread adoption of smart home solutions, and significant investments in IoT infrastructure.

The regional market benefits from a strong presence of leading manufacturers, extensive internet penetration, and an increasing preference for energy-efficient and convenient appliances, which has contributed to its steady growth.

Asia Pacific smart home appliances industry is poised to witness significant growth, registering a robust CAGR of 20.53% over the forecast period. Rapid urbanization, increasing disposable incomes, and a growing middle-class population in countries such as China, India, and Japan are boosting the demand for smart home appliances.

Moreover, advancements in smart technology and the expansion of e-commerce platforms are enhancing consumer access. With the rising adoption of connected devices and a strong shift toward energy-efficient solutions, the region is witnessing a transformation in consumer behavior, where there is an increasing preference for convenience, automation, and sustainability in home appliances.

- For instance, in September 2024, ABB India launched ABB-free@home, a wireless home automation system that integrates with platforms such as Samsung SmartThings, Philips Hue, Miele, and Sonos. The system allows users to control lighting, HVAC, security systems, and appliances from a single interface, optimizing energy consumption and reducing carbon footprints.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S. the Federal Communications Commission (FCC) regulates the radio frequency emissions from electronic devices, while the Consumer Product Safety Commission addresses safety concerns and the Department of Energy sets energy efficiency standards.

- In Europe, the European Commission regulates smart home appliances, promoting interoperability through the Smart Appliances REFerence (SAREF) ontology. Data privacy is governed by the General Data Protection Regulation (GDPR).

- In China, the Ministry of Industry and Information Technology (MIIT) regulates smart home appliances by setting policies and standards, while the State Administration for Market Regulation (SAMR) oversees overall market regulation.

- In Japan, the Ministry of Economy, Trade and Industry (METI) set standards and policies for smart home appliances, and the Japan Electrical Manufacturers' Association (JEMA) ensures safety and quality compliance.

- In India, the Bureau of Indian Standards (BIS), under the Ministry of Electronics and Information Technology (MeitY), sets standards to ensure safety and quality of smart home appliances.

Competitive Landscape

The smart home appliances industry is characterized by a number of participants, including both established corporations and emerging organizations. These companies are implementing numerous strategies, such as product innovation, IoT adoption, and addressing the rising demand for energy-efficient, sustainable appliances, which further intensified market competition.

Moreover, companies are investing heavily in research and development to create innovative solutions that cater to diverse consumer needs, while ensuring user-friendly interfaces and compatibility across multiple smart home platforms.

Additionally, key players focus on strategic partnerships, acquisitions, and geographic expansion to enhance offerings with advanced features such as AI integration, voice control, and energy efficiency to meet the growing consumer demand for smarter, more connected living solutions.

- In October 2024, Haier Smart Home acquired Carrier Commercial Refrigeration, including brands such as Profroid, Celsior, and Green & Cool. The acquisition expands Haier’s product portfolio and strengthens its position in the commercial refrigeration market, particularly in the industrial, food retail, and cold storage sectors.

List of Key Companies in Smart Home Appliances Market:

- SAMSUNG

- LG Electronics

- Haier Group

- Robert Bosch GmbH

- Whirlpool Corporation

- Miele

- ASSA ABLOY

- tado GmbH

- Govee

- Honeywell International Inc.

- Panasonic Holdings Corporation

- Dyson

- Koninklijke Philips N.V.

- Alphabet Inc.

- Ring LLC

Recent Developments (Agreements/New Product Launch)

- In December 2024, Samsung Electronics Co., Ltd. expanded its AI Home technology with a new 9” AI Home screen for Bespoke refrigerators and a 7” AI Home screen for the Bespoke AI Washer and Dryer set. This development supports Samsung’s “Screens Everywhere” vision, integrating compact, functional screens into a wider range of home appliances.

- In November 2024, Nuki introduced the Smart Lock Ultra, featuring a new brushless motor for enhanced performance, a smaller design, three locking modes, quick charging with a lithium polymer battery, and simplified installation via a new Universal Cylinder.

- In November 2024, LG Electronics and Tenstorrent expanded their collaboration to develop System-on-Chips and AI-driven systems. The partnership aims to enhance LG's AI chip development for home appliances, smart home solutions, and future mobility, while boosting AI competitiveness through Tenstorrent's high-performance computing semiconductors.

- In June 2024, Bosch launched new compact washers and dryers across its 500 and 800 Series, incorporating advanced technologies such as Home Connect, Smart Dry, and i-DOS, enabling remote monitoring, automatic detergent dispensing, and wrinkle-reducing steam drying in small spaces.

- In June 2024, LG Electronics USA showcased its energy-efficient solutions at the Pacific Coast Builders Conference through the LG Pro Builder division. The company highlighted its portfolio of appliances, HVAC systems, and smart home products to support the West Coast homebuilders adopting electrification and energy-efficient technologies.