Smart Lighting Market Size

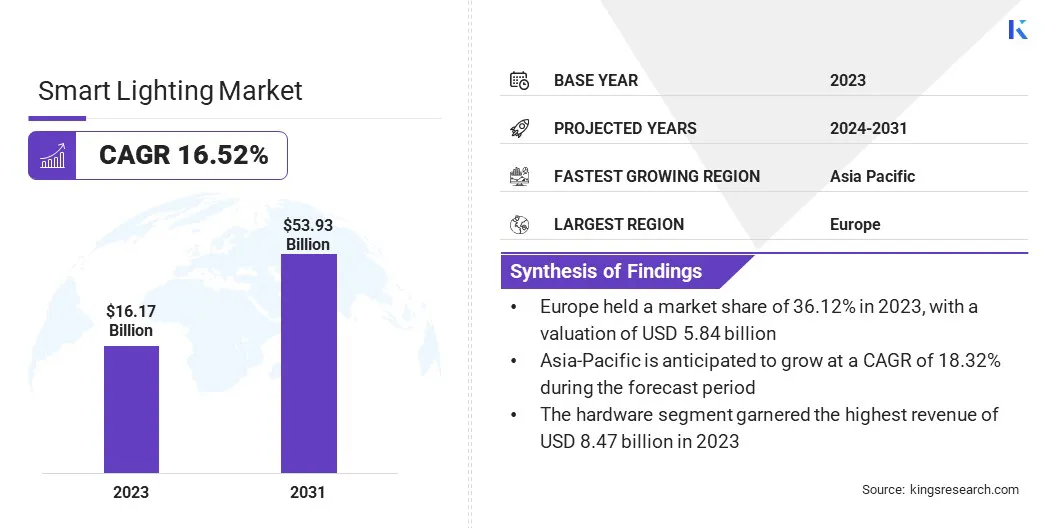

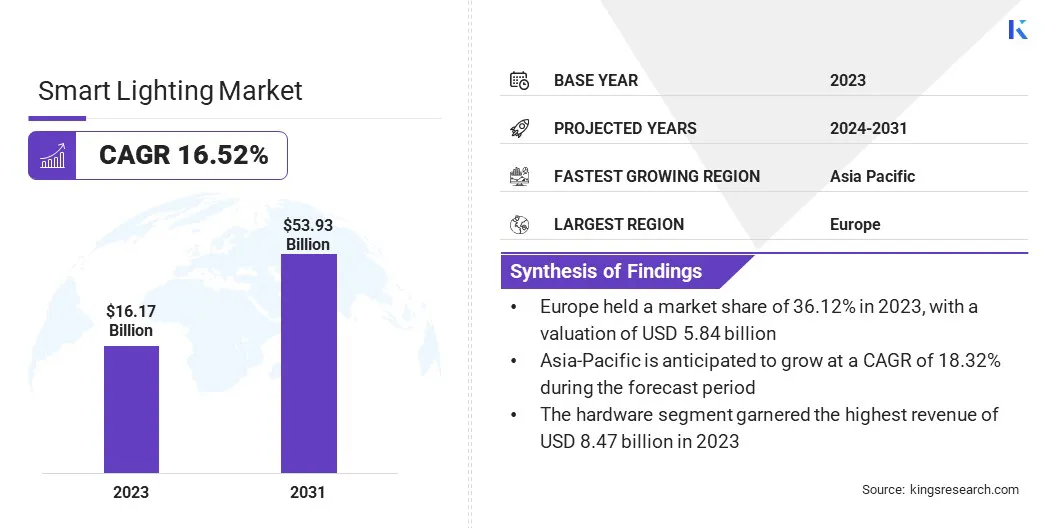

Global Smart Lighting Market size was recorded at USD 16.17 billion in 2023, which is estimated to be at USD 18.49 billion in 2024 and projected to reach USD 53.93 billion by 2031, growing at a CAGR of 16.52% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Acuity Brands Lighting, Inc., Signify Holding, Honeywell International Inc., Itron Inc., IDEAL INDUSTRIES, INC., Häfele America Co., Wipro Lighting, YEELIGHT., Sengled Optoelectronics Co., Ltd., Verizon, and others.

The growth of the market is driven by several factors such as increasing consumer demand for energy-efficient solutions, advancements in Internet of Things (IoT) technology, and the growing adoption of smart home ecosystems. Smart lighting systems offer numerous benefits, including energy savings, convenience, security, and enhanced ambience, making them increasingly popular across various sectors.

The expansion of the market is mainly fueled by the convergence of technological advancements, increasing consumer demand for energy-efficient solutions, and the proliferation of smart home ecosystems.

The advent of Internet of Things (IoT) technology has propelled the evolution of smart lighting systems from simple illumination devices to integral components of connected living environments. These systems offer unparalleled flexibility and control, allowing users to remotely adjust lighting settings, create customized schedules, and synchronize lighting with other smart devices.

Moreover, the growing emphasis on energy efficiency and sustainability is facilitating the widespread adoption of smart lighting solutions, as both consumers and businesses increasingly seek to reduce their carbon footprint and lower energy costs. Additionally, smart lighting is revolutionizing urban infrastructure through smart city initiatives, with municipalities investing heavily in intelligent street lighting systems to enhance safety, efficiency, and sustainability.

- As the smart lighting market continues to expand, fueled by innovation and increasing consumer awareness, it presents lucrative opportunities for stakeholders across industries to capitalize on the growing demand for advanced lighting solutions.

Smart lighting refers to lighting systems equipped with advanced technologies, such as sensors, wireless connectivity, and programmable controls. These features facilitate automation, customization, and remote management of lighting settings. These systems are integrated into smart home ecosystems and connected to other devices, enabling users to control their lighting remotely through smartphone apps, voice commands, or automated schedules.

Smart lighting offers a wide range of features and benefits, including energy efficiency, convenience, security, and enhanced ambience. It possess the capability to adjust brightness levels, color temperatures, and even color schemes to suit different activities, moods, or preferences. This market encompasses a wide range of products, including smart bulbs, fixtures, switches, sensors, and lighting management systems.

Analyst’s Review

The smart lighting market is poised to witness substantial growth due to ongoing technological advancements and increasing consumer adoption. Key players in the market are strategically positioning themselves by innovating and developing adavnce lighting solutions embedded with intelligent sensors and controls.

Moreover, strategic collaborations with technology firms enable the integration of smart lighting systems with other IoT devices, fostering enhanced connectivity and user convenience. In addition, aggressive marketing initiatives aimed at educating consumers and businesses about the advantages of smart lighting solutions contribute to market expansion.

Furthermore, these players prioritize customer-centric services, including installation support and ongoing maintenance, to ensure seamless adoption and optimal performance of their products. Additionally, there is a notable focus on sustainability and energy efficiency, with efforts directed toward developing eco-friendly lighting solutions that minimize environmental impact.

Smart Lighting Market Growth Factors

The smart lighting market is experiencing robust growth, majorly attributed to the increasing consumer demand for energy-efficient lighting solutions. As awareness of environmental sustainability and energy conservation rises, both consumers and businesses are actively seeking alternatives that reduce energy consumption and lower electricity bills.

Smart lights, when programmed and controlled remotely, offer substantial energy savings compared to traditional lighting solutions. These advanced lighting systems allow users to customize lighting schedules, adjust light intensity to mitigate unnecessary full brightness, and remotely control the activation or deactivation of lights leading to lower energy usage.

Moreover, smart lighting systems often integrate with other smart home devices, thereby enhancing overall energy efficiency within households and commercial spaces. This convergence of energy efficiency and technological convenience is making smart lighting an attractive choice for environmentally conscious consumers and cost-sensitive businesses, thereby supporting market growth.

A significant challenge impeding smart lighting market development is interoperability and compatibility issues among different smart lighting systems and platforms. As the market continues to expand, consumers and businesses are confronted with numerous options from various manufacturers, each offering their own proprietary technologies and protocols. This lack of standardization often leads to compatibility issues, making it difficult for users to seamlessly integrate different smart lighting products with their existing smart home ecosystems or automation systems.

This fragmentation hampers user experience and limits the potential benefits of interconnected smart lighting solutions, such as energy savings, convenience, and automation. Moreover, interoperability challenges hinder market growth by creating confusion among consumers and inhibiting the widespread adoption of smart lighting technology.

Addressing this challenge requires collaboration among industry stakeholders to develop and adopt common standards and protocols for interoperability, ensuring seamless integration and compatibility across different smart lighting systems and platforms. By overcoming interoperability challenges, key market players are aiming to provide users with a more cohesive and integrated lighting experience

Smart Lighting Market Trends

The growing adoption of voice-activated controls is expected to propel market growth. With the proliferation of smart assistants such as Amazon Alexa, Google Assistant, and Apple's Siri, consumers are increasingly using voice commands to control their smart lighting systems. This trend is fueled by an increasing preference for hands-free operation, coupled with the convenience of integrating lighting control into daily routines.

Voice-activated smart lighting allows users to effortlessly adjust lighting settings, turn lights on or off, and change colors or adjust brightness levels without needing to physically interact with switches or smartphones. This integration enhances user experience by making lighting control more accessible and intuitive, thus aligning with the broader trend of smart home automation.

As consumers increasingly integrate voice assistants into their daily operations for various tasks, the demand for compatible smart lighting systems continues to grow, thereby reinforcing the importance of voice control as a key feature in the market.

Another significant trend in the smart lighting sector is the rise of smart city initiatives. Municipalities worldwide are investing heavily in smart street lighting as part of broader efforts to enhance urban infrastructure and promote sustainability.

Smart street lights, equipped with advanced sensors, are capable of adjusting brightness based on the time of day and prevailing weather conditions, thereby optimizing energy use and reducing costs. These lights further monitor traffic flow and air quality, providing valuable data to city planners for improving urban mobility and environmental health.

Furthermore, smart street lighting systems enhance public safety by integrating with surveillance systems, enabling real-time monitoring and quicker response to incidents. By adopting these smart city applications, municipalities are expanding the scope and impact of smart lighting technology, making cities more efficient, sustainable, and safer for residents. This trend is leading to the growth of the smart lighting market as cities around the globe seek to modernize their infrastructure and leverage the benefits of connected technology.

Segmentation Analysis

The global market is segmented based on offering, application, distribution channel, connectivity, and geography.

By Offering

Based on offering, the market is categorized into hardware and software. The hardware segment garnered the highest revenue of USD 8.47 billion in 2023. This segment encompasses a diverse array of components designed to facilitate connected, energy-efficient lighting solutions.

Smart bulbs are among the most widely adopted hardware offerings, equipped with built-in connectivity features such as Wi-Fi or Bluetooth, enabling users to control them remotely via smartphone apps or voice commands. Complementing these bulbs are smart switches and dimmers, which replace traditional switches, allowing users to remotely control and automate their lighting systems.

Controllers had hubs are central to the operation of smart lighting systems enabling the management of multiple smart lighting devices and the creation of custom scenes and schedules. The diversity and functionality of the hardware segment address various applications, fostering innovation and propelling growth within the smart lighting market.

By Application

Based on application, the market is divided into indoor and outdoor. The indoor segment captured the largest market share of 61.05% in 2023.

The indoor smart lighting market offers a diverse array of solutions tailored to meet the unique requirements of residential, commercial, and institutional environments. Smart lighting systems are transforming indoor spaces worldwide, offering a range of customized lighting options for homeowners, productivity-enhancing features for businesses, and safety-focused solutions for institutions.

As the adoption of connected and intelligent lighting solutions continues to rise, fueled by advancements in technology and shifting consumer preferences, the segment is projected to experience significant growth and innovation in the coming years, leading to enhanced comfort, convenience, and efficiency across various indoor environments.

By Connectivity

Based on connectivity, the market is bifurcated into wired and wireless. The wireless segment is anticipated to generate the largest market share of 51.33% by 2031. Wireless smart lighting systems play a crucial role in providing flexible and interconnected lighting solutions across various settings. Through various technologies such as Wi-Fi, Bluetooth mesh networking, Zigbee, Z-Wave, Thread, and emerging 5G connectivity, wireless smart lighting systems offer users convenient control, scalability, and reliability.

Wi-Fi connectivity enables high-speed data transmission and wide coverage, making it suitable for residential and small to medium-sized commercial installations. As technology continues to advance and wireless connectivity becomes more pervasive, the wireless segment is expected to observe substantial growth in the forthcoming years.

Smart Lighting Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Europe Smart Lighting Market share stood around 36.12% in 2023 in the global market, with a valuation of USD 5.84 billion. Europe boasts a strong infrastructure and technological landscape, providing an ideal environment for the development and deployment of smart lighting solutions. With advanced telecommunications networks and widespread internet connectivity, European countries are well-positioned to support the implementation of wireless smart lighting systems and IoT connectivity.

Additionally, the region places a significant emphasis on sustainability and energy efficiency, resulting in the widespread adoption of smart lighting technologies that offer substantial energy savings and environmental benefits. Governments and regulatory bodies across the region have implemented stringent energy efficiency standards and incentives to encourage the adoption of smart lighting solutions, further propelling regional market growth.

Asia- Pacific is anticipated to witness a significant growth, recording a robust CAGR of 18.32% over the forecast period. Asia Pacific countries are increasingly investing in smart city initiatives, which is leading to an increase in the adoption of connected lighting systems. Governments across the region are implementing strategies to transform urban environments, enhance energy efficiency, and improve quality of life through the deployment of smart lighting solutions.

Additionally, the presence of innovative startups and established companies that are driving advancements in smart lighting technologies is supporting regional market progress. With a strong focus on research and development, the region creates an environment conducive to innovation and entrepreneurship, thereby facilitating the rapid development of advanced solutions.

Competitive Landscape

The global smart lighting market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Smart Lighting Market

- Acuity Brands Lighting, Inc.

- Signify Holding

- Honeywell International Inc.

- Itron Inc.

- IDEAL INDUSTRIES, INC.

- Häfele America Co.

- Wipro Lighting

- YEELIGHT.

- Sengled Optoelectronics Co., Ltd.

- Verizon

Key Industry Developments

- July 2023 (Product Launch): Yeelight introduced its new product adhering to the Matter standard, specifically designed to integrate seamlessly with Apple’s HomeKit: The Yeelight Cube Smart Lamp. This lamp, as an integral component of the Yeelight Fun portfolio, became the first Matter-supported product from Yeelight.

The Global Smart Lighting Market is Segmented as:

By Offering

By Application

By Distribution Channel

By Connectivity

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America