Market Definition

The small-scale liquefied natural gas (LNG) industry involves the production, transport, and regasification of LNG in volumes smaller than traditional large-scale facilities. It enables the distribution of natural gas to regions lacking extensive pipeline infrastructure or large storage terminals. This sector serves transportation, industrial feedstock, power generation, and commercial or municipal applications, offering flexible and efficient energy delivery solutions.

Small-scale LNG Market Overview

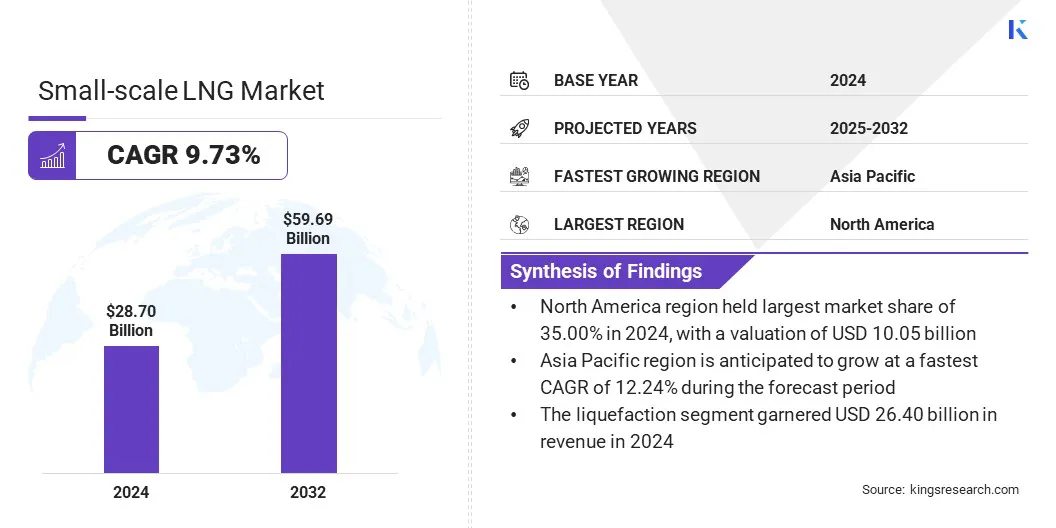

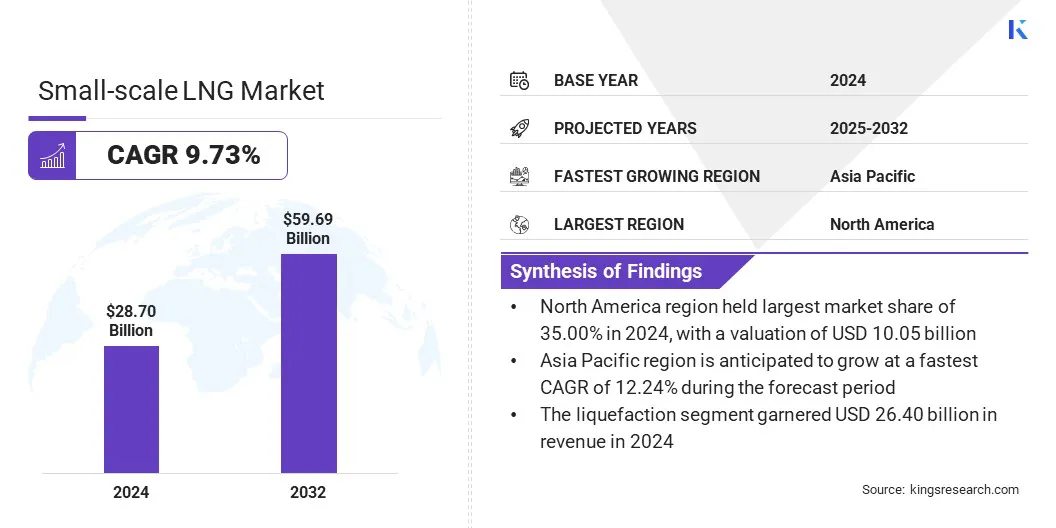

The global small-scale LNG market size was valued at USD 28.70 billion in 2024 and is projected to grow from USD 31.16 billion in 2025 to USD 59.69 billion by 2032, exhibiting a CAGR of 9.73% over the forecast period. The growth is due to rising adoption of LNG in industrial, transportation, and power-generation sectors to reduce emissions and improve energy efficiency.

Alternatives to conventional fuels are increasingly prioritized for meeting decarbonization goals while ensuring stable energy supply. Integration of LNG into energy transition strategies and decentralized solutions is emerging as a key trend, enabling localized production and distribution to support flexible and resilient energy networks across industrial, transportation, and power-generation sectors.

Key Highlights:

- The small-scale LNG industry size was recorded at USD 28.70 billion in 2024.

- The market is projected to grow at a CAGR of 9.73% from 2025 to 2032.

- North America held a market share of 35.00% in 2024, with a valuation of USD 10.05 billion.

- The liquefaction segment garnered USD 26.40 billion in revenue in 2024.

- The truck segment is expected to reach USD 25.67 billion by 2032.

- The transportation segment is expected to reach USD 28.87 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 12.24% over the forecast period.

Major companies operating in the small-scale LNG market are Linde PLC, Wärtsilä, Honeywell International Inc., Chart Industries, Black & Veatch Corporation, Shell, TotalEnergies, Eni, Gazprom, NOVATEK, ENGIE Group, ANTHONY VEDER, Stolt-Nielsen, Excelerate Energy, Inc., Air Products and Chemicals, Inc.

Market growth is propelled by the expansion of modular and mobile LNG infrastructure, including floating and truck-based units, to improve accessibility and reduce delivery timelines. These solutions allow LNG to reach remote and off-grid locations efficiently, overcoming limitations of traditional pipeline networks.

Companies are increasingly deploying portable liquefaction, storage, and regasification units to meet regional demand quickly and cost-effectively. This enhances supply flexibility, supports timely energy delivery, and enables broader adoption of LNG across industrial, transportation, and power-generation sectors.

Market Driver

Growing Demand for Cost-Effective Production of Small-Scale LNG

The small-scale LNG market is primarily driven by the growing demand for cost-effective and lower-emission production of LNG. Companies and end users are seeking alternatives that reduce greenhouse gas emissions while providing reliable energy supply.

Small-scale LNG supports cleaner fuel adoption in industry, transportation, and power generation, helping meet environmental standards while controlling operational costs. This demand encourages the adoption of advanced liquefaction technologies and efficient distribution solutions to support sustainable energy strategies.

- In April 2024, NuBlu Energy and CNX Resources announced their collaboration to deploy CNG and micro-scale LNG technology solutions. The partnership focuses on introducing innovative production technologies, including ZeroHP CNG and Clean mLNG, to enable decentralized, cost-effective, and lower-emission natural gas production.

Market Challenge

High Infrastructure and Capital Requirements

A major challenge facing the small-scale LNG market is the high infrastructure and capital investment required for liquefaction, storage, and transport facilities. High costs create barriers for new entrants and smaller companies, limiting their ability to establish operations and compete effectively.

The financial burden slows market growth and limits the deployment of LNG in developing regions. To address this, companies are investing in modular and mobile LNG solutions and leveraging public-private funding initiatives to reduce upfront costs and expand market access.

Market Trend

Integration of LNG with Energy Transition and Decentralized Solutions

A key trend in the small-scale LNG market is the integration of LNG with energy transition and decentralized energy solutions. Companies are increasingly integrating LNG with renewable energy to provide reliable power in distributed systems. This enhances network resilience and flexibility in regions with limited grid access, while supporting the transition to lower-carbon energy models and enabling localized supply for industrial, transportation, and municipal use.

- In November 2024, INOX India Ltd (INOXCVA) was awarded a contract by Island Power Producers to set up a Mini LNG terminal in The Bahamas. The project includes the turnkey design, supply, and installation of 10 vacuum-insulated LNG storage tanks of 1500 m³ each and a regasification system for a 60 MW combined cycle power plant providing shore power to cruise ships at Nassau Cruise Port.

Small-scale LNG Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Liquefaction, Regasification

|

|

By Mode of Supply

|

Truck, Pipeline, Rail, Transshipment & Bunkering, ISO Containers, Others

|

|

By Application

|

Transportation, Industrial Feedstock, Power Generation, Commercial & Municipal, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Liquefaction and Regasification): The liquefaction segment earned USD 26.40 billion in 2024, due to rising demand for distributed natural gas and expansion of regional LNG facilities.

- By Mode of Supply (Truck, Pipeline, Rail, Transshipment & Bunkering, ISO Containers, and Others): The truck segment held 35.00% of the market in 2024, due to its flexibility in delivering LNG to remote and off-grid locations.

- By Application (Transportation, Industrial Feedstock, Power Generation, Commercial & Municipal, and Others): The transportation segment is projected to reach USD 28.87 billion by 2032, owing to increasing adoption of LNG as a cleaner fuel for heavy-duty and maritime transport.

Small-scale LNG Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America small-scale LNG market share stood at 35.00% in 2024, with a valuation of USD 10.05 billion. The dominance is due to its established LNG infrastructure and extensive natural gas production, which enable efficient liquefaction, transport, and distribution across industrial, commercial, and transportation sectors. Advanced logistics networks, regulatory frameworks, and the presence of major LNG operators further support its dominant position.

Asia Pacific is poised to grow at a significant CAGR of 12.24% over the forecast period. The growth is primarily driven by the launch of new small-scale LNG units by regional market players, which expand production capacity and enable wider distribution. Supportive government initiatives further encourage the adoption of cleaner energy solutions and facilitate policy frameworks that guide infrastructure development.

Investments by energy companies and governments in storage, transportation, and regasification infrastructure promote LNG use across transportation, power generation, and industrial applications. These factors support the rapid expansion of small-scale LNG and enhance energy accessibility, thereby driving market growth in the Asia Pacific.

- In March 2024, the Indian Ministry of Petroleum & Natural Gas inaugurated 201 CNG stations and India’s first Small-Scale LNG unit of GAIL. The initiative focused on expanding the City Gas Distribution network across 52 Geographical Areas in 17 states and deploying small-scale LNG technology at GAIL’s Vijaipur LPG plant. The project aims to improve access to cleaner and sustainable fuels and connect isolated gas sources with consumers.

Regulatory Frameworks

- In the U.S, the small-scale LNG sector operates under regulations set by the Federal Energy Regulatory Commission (FERC) and the Department of Transportation, which oversee LNG facility safety, pipeline operations, and transportation standards.

- In Europe, the regulatory framework includes the Gas Directive and the TEN-E Regulation, which govern LNG infrastructure development, cross-border supply, and safety compliance.

- In Japan, the Ministry of Economy, Trade and Industry (METI) and the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) regulate LNG terminals, storage, and transport to ensure safety and energy security.

- In India, the Petroleum and Natural Gas Regulatory Board (PNGRB) monitors LNG import, distribution, and pricing to promote transparent operations and safe infrastructure development.

Competitive Landscape

Key players in the small-scale LNG industry are focusing on geographic expansion and the establishment of new plants to strengthen their competitive positions and increase market share. Companies are investing in regional facilities to enhance production capacity, improve operational efficiency, and reduce delivery times to end users.

Several players are strategically setting up liquefaction and regasification units in high-demand regions to capture emerging opportunities, optimize supply chains, and better serve local markets. These strategies enable companies to expand their market reach, strengthen regional presence, and maintain a competitive edge in key growth areas worldwide.

- In January 2025, NNPC Ltd and its partners launched five mini-LNG plants in Ajaokuta, Kogi State, Nigeria. The partnership focused on developing NNPC Prime LNG, NGML/Gasnexus LNG, BUA LNG, Highland LNG, and LNG Arete, with a combined capacity of 97 mmscf/d. The initiative aims to increase domestic gas utilization, support off-grid industrial energy needs, reduce carbon emissions, and promote economic growth.

Key Companies in Small-scale LNG Market:

- Linde PLC

- Wärtsilä

- Honeywell International Inc.

- Chart Industries

- Black & Veatch Corporation

- Shell

- TotalEnergies

- Eni

- Gazprom

- NOVATEK

- ENGIE Group

- ANTHONY VEDER

- Stolt-Nielsen

- Excelerate Energy, Inc.

- Air Products and Chemicals, Inc.

Recent Developments

- In June 2025, OLT Offshore LNG Toscana announced the successful commissioning of its new Small Scale LNG service through the FSRU Toscana terminal. The service focuses on enabling small LNG carriers to load and discharge LNG for maritime bunkering, coastal storage, and regasification into the grid. This initiative supports decarbonization of maritime and land transport, aligning with the Mediterranean SECA regulations and promoting the use of LNG as a cleaner alternative fuel.

, and support India’s vision of a gas-based economy.