Market Definition

The market involves the development and deployment of compact nuclear reactors. It includes reactor types like light water, heavy water, high-temperature, fast neutron, and others. These reactors offer flexible and low-carbon energy solutions for power generation, industrial use, and remote areas.

These solutions are driven by safety, scalability, and clean energy demand. The report outlines the primary drivers of market growth, with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Small Modular Reactor Market Overview

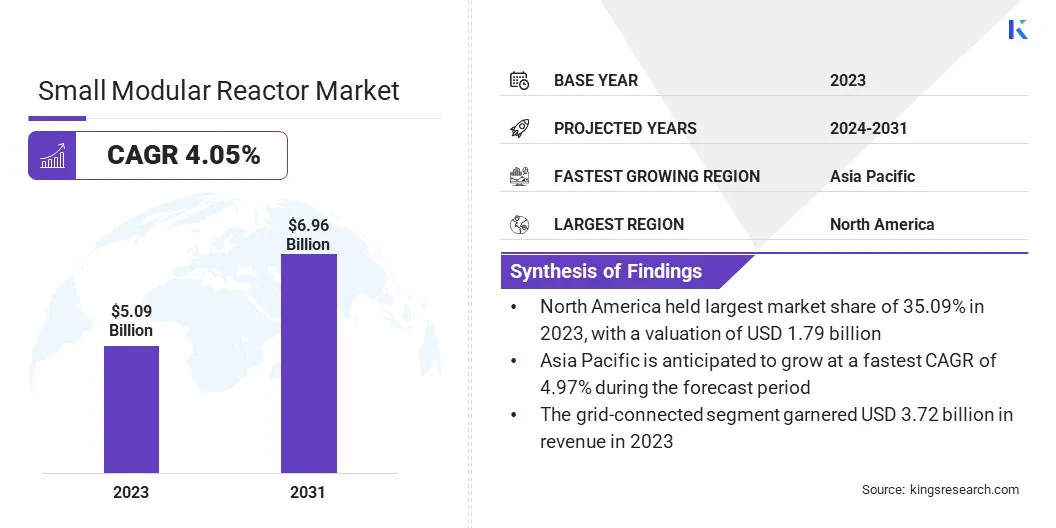

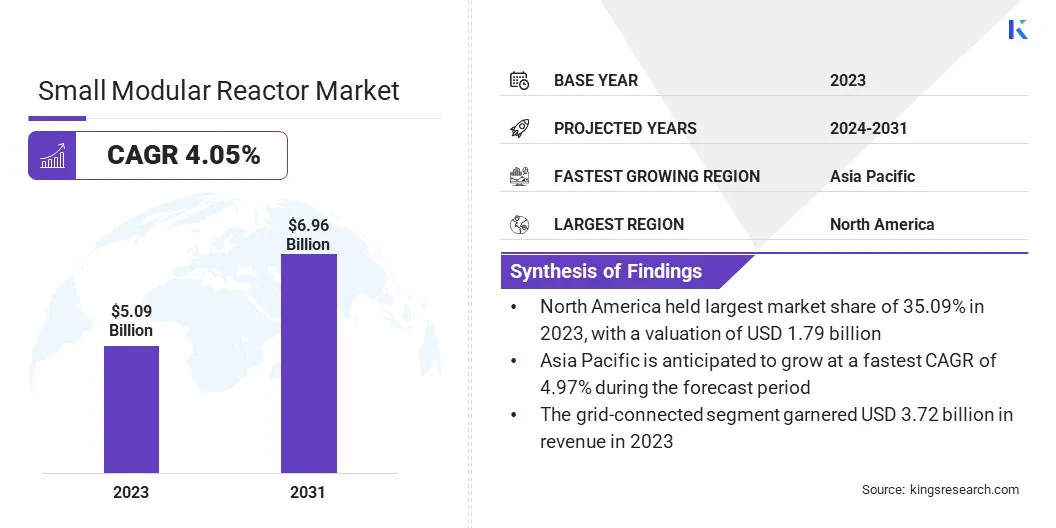

Global small modular reactor market size was valued at USD 5.09 billion in 2023, which is estimated to be valued at USD 5.27 billion in 2024 and reach USD 6.96 billion by 2031, growing at a CAGR of 4.05% from 2024 to 2031.

Compact and modular SMR designs enable factory fabrication by reducing on-site construction time and costs. This flexibility enables faster deployment in remote, urban, or challenging environments, accelerating global SMR market growth.

Major companies operating in the small modular reactor industry are Westinghouse Electric Company LLC., GE Hitachi Nuclear Energy, AtkinsRéalis, NuScale Power, LLC, Terrestrial Energy Inc., X Energy, LLC, Holtec International, General Atomics, KAIROS POWER LLC., KEPCO, Fluor Corporation, Rolls-Royce plc, The State Atomic Energy Corporation ROSATOM, Ansaldo Energia, and Tractebel Group.

The market is evolving rapidly, driven by the global shift toward clean, reliable, and adaptable energy solutions. SMRs offer flexible deployment options, which makes them ideal for power generation, industrial heat supply, and offshore energy production.

Their compact design, enhanced safety, and scalability enable integration with existing energy systems, supporting carbon neutrality goals, and providing a sustainable alternative to fossil fuels in diverse sectors and geographical regions.

- In September 2024, at the IAEA General Conference in Vienna, KEPCO E&C showcased its BANDI small modular reactor.This event attracted global interest for its innovative design and potential contribution to carbon neutrality and marine applications.

Key Highlights:

- The global small modular reactor market size was valued at USD 5.09 billion in 2023.

- The market is projected to grow at a CAGR of 4.05% from 2024 to 2031 .

- North America held a market share of 35.09% in 2023, with a valuation of USD 1.79 billion.

- The Light Water Reactor (LWR) segment garnered USD 2.85 billion in revenue in 2023.

- The grid-connected segment is expected to reach USD 4.88 billion by 2031.

- The single module segment will have a market share of 64.09% in 2023.

- The marine sector segment is expected to have a CAGR of 5.97% during the forecast period.

- The power generation segment is anticipated to have a market share of 62.13% in 2031.

- Asia Pacific is anticipated to grow at a CAGR of 4.97% during the forecast period.

Market Driver

Compact and Modular Design

One of the most significant growth drivers for the market is their compact design. Unlike traditional nuclear plants, SMRs are manufactured in controlled settings and transported to the installation site. This minimizes construction timelines and reduces capital expenditure (CAPEX), while lowering logistical and labor challenges.

Their modularity also allows phased deployment to match demand, which makes SMRs suitable for developed and remote regions. This efficiency and adaptability are key factors propelling their market adoption globally.

- In May 2023, Westinghouse Electric Company launched the AP300 small modular reactor, a 300-MWe pressurized water reactor. Based on the proven AP1000 technology, it offers a compact design, lower costs, enhanced safety, and integration with renewable resources.

Market Challenge

High Initial Costs

High initial costs remain a significant challenge for the small modular reactor market, as the development and construction of even smaller reactors require substantial capital investment. This financial burden can hamper adoption, especially in developing areas.

Key solutions include government subsidies and incentives, public-private partnerships, and innovative financing models like power purchase agreements. Additionally, improving economies of scale through modular construction, optimizing design efficiency, and leveraging existing nuclear infrastructure could help lower costs.

Market Trend

Increased Corporate Investments

A key trend in the market is the growing interest from large corporations investing in SMR projects to diversify their energy portfolios and achieve sustainability targets. These companies recognize the potential of SMRs to provide reliable and low-carbon energy while addressing electricity demands.

As industries seek alternative energy sources, SMRs offer an attractive solution for meeting long-term sustainability goals. This trend is expected to drive innovation, accelerate SMR deployment, and foster the adoption of nuclear technology as a carbon-free energy solution.

- In October 2024, Amazon announced new agreements with Energy Northwest and Dominion Energy to support innovative nuclear energy projects, including SMRs. This is part of Amazon's broader strategy to meet the growing energy demands and shift to carbon-free energy, advancing toward its 2040 net-zero carbon goal.

Small Modular Reactor Market Report Snapshot

|

Segmentation

|

Details

|

|

By Reactor Type

|

Light Water Reactor (LWR), Heavy Water Reactor (HWR), High-Temperature Reactor, Fast Neutron Reactor, Others

|

|

By Connectivity

|

Grid-Connected, Off-Grid

|

|

By Deployment Type

|

Single Module, Multi-Module

|

|

By End-User

|

Utilities, Industrial Users, Government/Military, Marine Sector

|

|

By Application

|

Power Generation, Desalination, Process Heat, District Heating, Marine Propulsion

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Reactor Type [Light Water Reactor (LWR), Heavy Water Reactor (HWR), High-Temperature Reactor, Fast Neutron Reactor, Others]: The Light Water Reactor (LWR) segment earned USD 2.85 billion in 2023 due to the increasing demand for reliable, scalable, and carbon-free energy solutions across industries.

- By Connectivity (Grid-Connected, Off-Grid): The grid-connected segment held a staggering 73.09% of the market in 2023, due to growing investments in nuclear energy infrastructure to meet rising energy needs.

- By Deployment Type (Single Module, Multi-Module): The single module segment is projected to reach USD 4.36 billion by 2031, owing to their faster construction times, lower costs, and smaller physical footprints compared to traditional reactors.

- By End-User (Utilities, Industrial Users, Government/Military, Marine Sector): The marine sector is anticipated to grow at a CAGR of 5.97% over the forecast period, due to growing interest in portable and off-grid nuclear power solutions for ships and remote locations.

- By Application (Power Generation, Desalination, Process Heat, District Heating, Marine Propulsion): The power generation segment is anticipated to have a market share of 62.13% in 2031, due to increasing global demand for reliable power and sustainability commitments.

Small Modular Reactor Market Regional Analysis

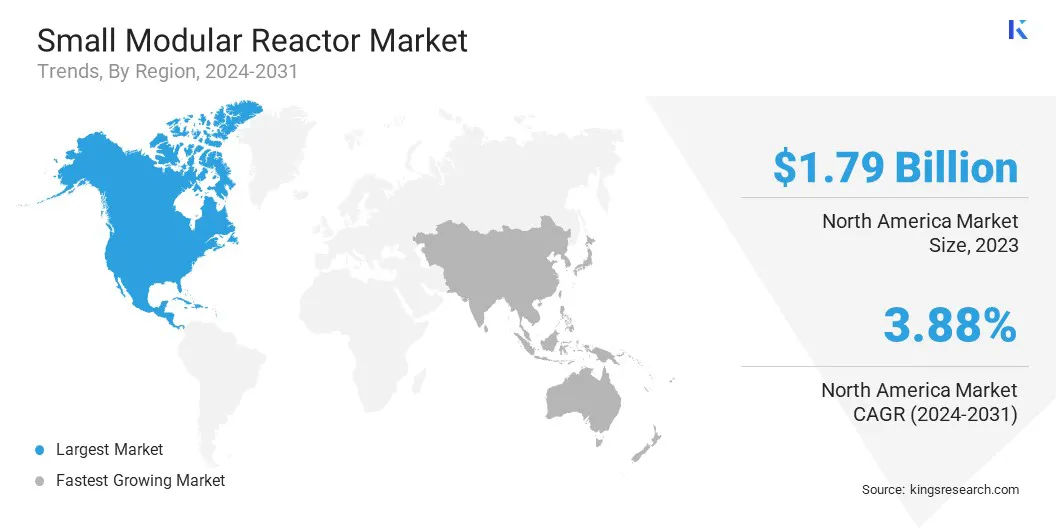

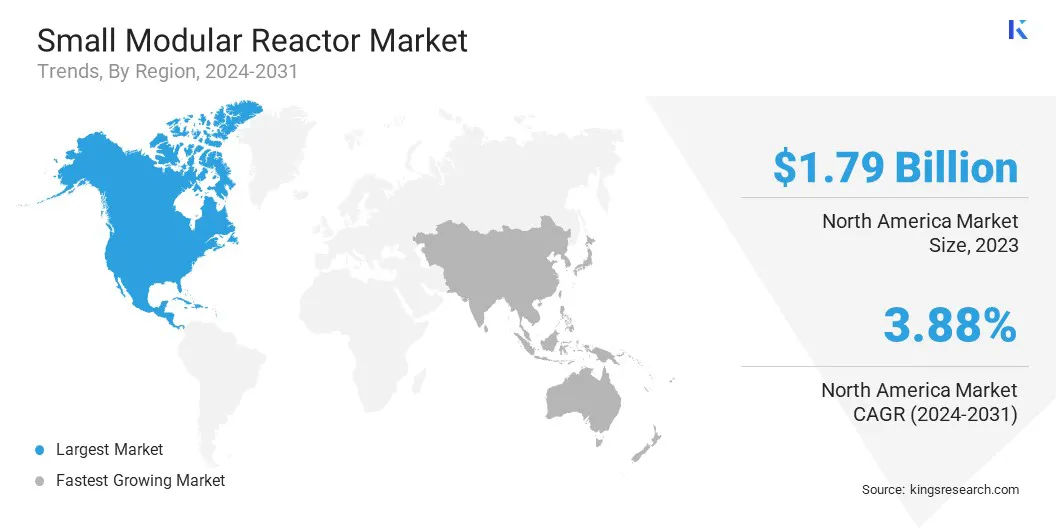

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

The North America small modular reactor market share stood at around 35.09% in 2023 in the global market, with a valuation of USD 1.79 billion. North America dominates the market due to substantial investments in nuclear energy and a strong push for cleaner and more reliable power.

The region's growing energy demand with a focus on reducing carbon emissions, has spurred interest in SMRs as a scalable and sustainable solution. Additionally, favorable government policies, technological advancements, and the region’s established nuclear infrastructure is supporting the development and deployment of SMRs in North America, positioning it at the forefront of the global energy transition.

- In January 2023, the United States Nuclear Regulatory Commission (NRC) certified NuScale Power’s SMR design, making it the first certification of this sort in the U.S. This approval, as part of the Carbon Free Power Project with Utah Associated Municipal Power Systems (UAMPS), helps the deployment of NuScale’s scalable and emission-free energy solution to support the nation’s sustainable energy goals.

The Asia-Pacific market is poised for significant growth over the forecast period at a CAGR of 4.97%. The Asia-Pacific region is emerging as the fastest-growing market for small modular reactors (SMRs) due to rising energy demand, rapid industrialization, and a strong push for clean energy solutions.

Countries like China, Uzbekistan, Japan, and India are investing in nuclear energy to diversify their power sources and reduce carbon emissions. SMRs offer scalable and cost-effective solutions, which make them attractive for populated nations. This positions the Asia-Pacific region as a key player in the global small modular reactors market.

- In June 2024, Rosatom signed a contract to build the world’s first export small modular reactor nuclear power plant in Uzbekistan. This marked Rosatom’s leadership in global nuclear energy, which involved the construction of a 330 MW SMR plant in the Jizzakh Region, with the first unit scheduled to be operational by late 2029. The reactors, RITM-200, will provide a reliable energy source as Uzbekistan's demand for power is expected to nearly double by 2050.

Regulatory Frameworks

- In Canada, the Small Modular Reactor (SMR) Action Plan outlines the development, demonstration, and deployment of SMRs. This collaborative effort aims to harness the economic, geopolitical, social, and environmental benefits of SMRs.

- In India, the Atomic Energy Act of 1962 governs the development, control, and use of atomic energy for peaceful purposes, including the development and deployment of Small Modular Reactors (SMRs).

- In the U.S., the Department of Energy established the SMR Licensing Technical Support (LTS) program in 2012, fostering public and private partnerships to accelerate SMR deployment, focusing on research and development to overcome regulatory and economic barriers.

Competitive Landscape:

Companies in the small modular reactor market are focusing on the development of advanced and scalable nuclear technologies for cleaner and more reliable energy solutions. They are working on designing compact reactors with enhanced safety, operational efficiency, and lower construction costs.

By using innovative materials, modular construction, and high-temperature steam capabilities, they aim to address global energy needs, reduce carbon emissions, and contribute to a sustainable energy future.

- In July 2023, Energy Northwest and X-energy signed a joint development agreement for the Xe-100 advanced small modular reactor project in central Washington. The project aims to deploy up to 12 Xe-100 modules, generating a total of 960 MW of carbon-free power. The first module is expected to be operational by 2030.

List of Key Companies in Small Modular Reactor Market:

- Westinghouse Electric Company LLC.

- GE Hitachi Nuclear Energy

- AtkinsRéalis

- NuScale Power, LLC

- Terrestrial Energy Inc.

- X Energy, LLC

- Holtec International

- General Atomics

- KAIROS POWER LLC.

- KEPCO

- Fluor Corporation.

- Rolls-Royce plc

- The State Atomic Energy Corporation ROSATOM

- Ansaldo Energia

- Tractebel Group

Recent Developments(Partnerships)

- In October 2024, Google signed the world’s first corporate agreement to purchase nuclear energy from Kairos Power’s SMRs. This agreement aimed at providing up to 500 MW of 24/7 carbon-free power to U.S. grids by 2035. It supports clean energy transition while helping Google meet its ambitious net-zero goals and power its global data centers.

- In July 2024, Fluor Corporation was awarded a contract for the next phase of engineering and design work at Romania’s first SMR facility in Doicesti. The project will generate up to 462 megawatts of carbon-free power by utilizing NuScale Power’s SMR technology.

- In June 2024, AtkinsRéalis collaborated with Orlen-Synthos Green Energy and GE Hitachi Nuclear Energy, and signed agreements to support the deployment of BWRX-300 SMRs in Poland. This initiative supports Poland's efforts to modernize its energy grid, with AtkinsRéalis offering engineering expertise and consultation for SMR deployment.

- In January 2023, SNC-Lavalin's Candu Energy Inc. signed an agreement with Ontario Power Generation (OPG) to develop Canada's first SMR project at Darlington. The project, featuring the GEH BWRX-300 SMR, is expected to be the first grid-scale SMR deployed in Canada, contributing to the country's clean energy goals. The six-year alliance agreement with Aecon and GE-Hitachi focuses on engineering, procurement, and construction for the project.