Market Definition

Sintered steel is a type of powdered metal product formed by compressing and heating steel powders below their melting point. This process creates a solid, dense, and durable material with desired porosity and mechanical properties.

It is used in automotive components (gears, bearings, bushings), industrial machinery, filtration systems, and construction tools, where precision, wear resistance, and cost-effective manufacturing are critical. The market encompasses the production, processing, and supply of steel powders, sintering equipment, and finished sintered steel components across automotive, industrial, and engineering sectors.

Sintered Steel Market Overview

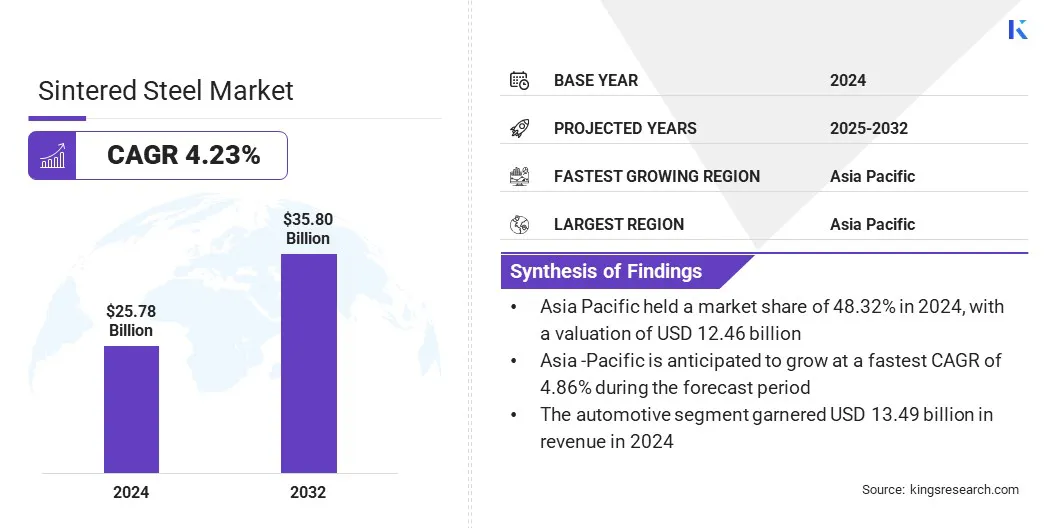

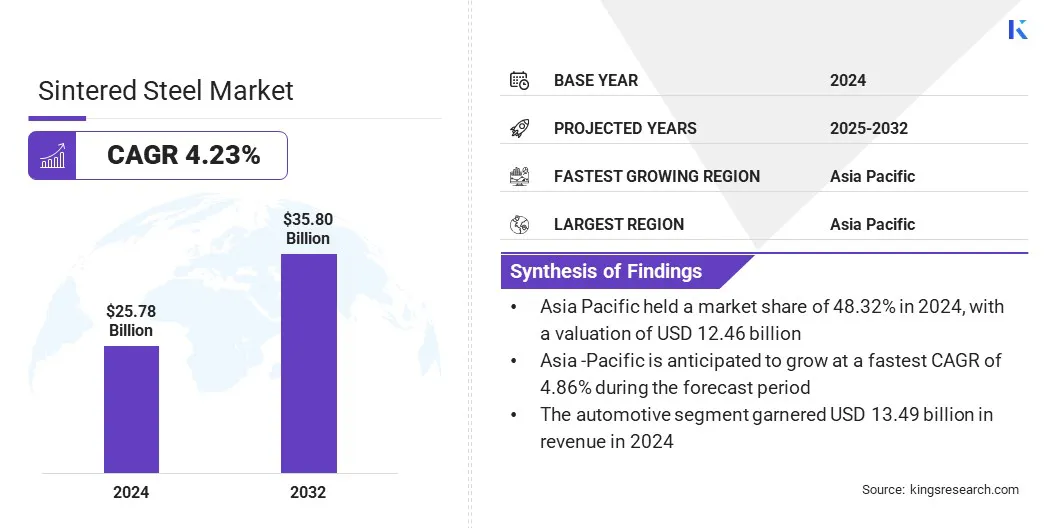

The global sintered steel market size was valued at USD 25.78 billion in 2024 and is projected to grow from USD 26.78 billion in 2025 to USD 35.80 billion by 2032, exhibiting a CAGR of 4.23% over the forecast period. This growth is attributed to the increasing use of sintered steel in precision engineering applications across automotive, industrial, and aerospace sectors.

Additionally, expansion of powder metallurgy technology and advancements in sintering techniques are enabling efficient production of complex, high-performance sintered steel parts.

Key Highlights:

- The sintered steel industry size was recorded at USD 25.78 billion in 2024.

- The market is projected to grow at a CAGR of 4.23% from 2025 to 2032.

- Asia Pacific held a share of 48.32% in 2024, valued at USD 12.46 billion.

- The stainless steel segment garnered USD 10.92 billion in revenue in 2024.

- The conventional manufacturing segment is expected to reach USD 16.40 billion by 2032.

- The automotive segment is anticipated to witness the fastest CAGR of 4.69% over the forecast period.

- North America is anticipated to grow at a CAGR of 3.99% over the forecast period.

Major companies operating in the sintered steel market are GKN Powder Metallurgy, Inc., Miba AG, Höganäs AB, Sintercom Limited, AMES Group Sintering, SA, Atlantic Sintered, Atlas Pressed Metals, Sintex a/s, Porous Metal Filters Inc., Dalon Machinery Co., Ltd, Baoji Saga Porous Filter Co., Ltd, Sandvik AB, Keystone Powdered Metal Company, BEARING TECHNOLOGIES S.R.L., and Allied Sinterings, Inc.

The increasing demand for lightweight, high-strength, and precision-engineered automotive components driven by the adoption of electric vehicles is primarily driving this market. For instance, the International Energy Agency (IEA) reports that global electric car sales surpassed 17 million units in 2024, a 25% increase from 2023. Sintered steel offers superior material properties, dimensional accuracy, and durability in various applications.

Manufacturers are improving production techniques, and optimizing designs to efficiently produce high-performance sintered steel components for the automotive sector. These advancements enable the efficient manufacture of complex components, enhance vehicle performance, and support broader adoption of sintered steel across the automotive sector.

Growing Demand for Lightweight and High-Strength Automotive Components

A major driver in the sintered steel market is the growing demand for lightweight and high-strength automotive components for improving fuel efficiency and performance. For instance, the U.S. Department of Energy (DOE) reported that a 10% reduction in vehicle weight can result in a 6–8% improvement in fuel economy.

The demand for durable, precision-engineered parts, such as gears, and structural components, has fueled the need for sintered steel due to its superior strength-to-weight ratio. This is prompting advancements in material properties, production techniques, and component design of sintered steel automotive parts. It is also enabling automakers to meet fuel efficiency and emission targets.

High Initial Investment

The high initial investment required for establishing sintered steel production facilities poses significant challenges to the market for new entrants and smaller manufacturers. Specialized equipment, such as powder presses, high-temperature furnaces, and precision quality-control systems, demands substantial capital expenditure. The high upfront costs create entry barriers, slow the adoption of advanced technologies, and hinder market growth.

To address this challenge, market players are adopting partnership, merger, and acquisition strategies to share resources and expand production capabilities. Companies are also investing in modular and scalable production systems to increase efficiency, manage costs, and expand production capacity. Additionally, manufacturers are adopting advanced automation and process optimization to reduce operational expenses and improve efficiency.

Increased Focus on Sustainable and Energy-Efficient Sintering Processes

A key trend in the sintered steel market is the increased focus on sustainable and energy-efficient sintering processes. Manufacturers are adopting advanced furnace technologies, optimized thermal management, and environmentally friendly fuel alternatives to reduce energy consumption, and operational costs.

These improvements enhance process efficiency, material quality, and consistency, while supporting compliance and corporate sustainability goals. The integration of these technologies enables producers to manufacture high-performance sintered steel components more efficiently with a lower environmental footprint.

- In May 2025, SMS Group agreed to acquire parts of Metso Corporation’s portfolio related to sustainable metals production. The acquisition includes sintering, traveling grate pelletizing, and fluidized bed technologies. It also enhances service offerings, and support efficient and sustainable sintered steel production.

Sintered Steel Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Stainless Steel, Carbon Steel, Alloy Steel, Tool Steel

|

|

By Manufacturing Process

|

Metal Injection Molding, Additive Manufacturing, Conventional Manufacturing, Powder Forging Manufacturing

|

|

By Application

|

Automotive, Machinery & Equipment, Consumer Electronics, Medical Devices, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Stainless Steel, Carbon Steel, Alloy Steel, and Tool Steel): The stainless steel segment earned USD 10.92 billion in 2024 due to its superior corrosion resistance, durability, and widespread use in automotive and industrial components.

- By Manufacturing Process (Metal Injection Molding, Additive Manufacturing, Conventional Manufacturing, and Powder Forging Manufacturing): The conventional manufacturing segment held 47.89% of the market in 2024, due to its cost-effectiveness, established production infrastructure, and ability to produce sintered steel parts at scale.

- By Application (Automotive, Machinery & Equipment, Consumer Electronics, and Medical Devices): The automotive segment is projected to reach USD 19.41 billion by 2032, owing to the growing demand for lightweight, high-strength, and precision-engineered sintered steel components in vehicles.

Sintered Steel Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific sintered steel market share stood at 48.32% in 2024, valued at USD 12.46 billion in the global market. This growth is due to the rapid expansion of the automotive manufacturing sector across the region. The growing demand for affordable yet high-performance industrial equipment in emerging economies, such as India and Indonesia, is boosting the use of sintered steel components in fluid control and electrical systems.

Increasing aftermarket demand and replacement of industrial machinery and automotive parts are fueling continuous consumption of sintered steel products. Continuous investments in local production facilities and technical expertise by regional players are enhancing manufacturing capacity and supply chain efficiency across Asia Pacific.

- In May 2025, American Axle & Manufacturing acquired Dowlais Group plc, strengthening its capabilities in producing sintered steel and powder metallurgy automotive components.

North America sintered steel industry is set to grow at a robust CAGR of 3.99% over the forecast period. This growth is driven by increasing demand for lightweight and high-strength automotive components across the region. The rapid adoption of electric vehicles is further propelling the need for precision-engineered, durable parts for high-performance automotive systems.

Advancements in additive manufacturing and powder metallurgy technologies are enabling the production of complex components with superior material properties. Additionally, strategic acquisitions and capacity expansions by regional players are enhancing technical expertise and production capabilities, supporting market growth in the region.

- In June 2024, Continuim Equity Partners acquired Innovative Sintered Metals, Inc. (ISM). The acquisition has created a mid-sized powder metal platform with enhanced manufacturing capacity, technical expertise, and customer reach across automotive, industrial, fluid control, and electrical sectors.

Regulatory Frameworks

- In the U.S., the Occupational Safety and Health Administration (OSHA) oversees workplace safety in sintered steel manufacturing. It regulates equipment operation, handling of powdered metals, exposure to hazardous materials, ventilation, protective gear, and employee training to ensure safe and compliant operations.

- In the UK, the Health and Safety Executive (HSE) oversees occupational safety and equipment operation in sintered steel manufacturing. It also regulates material handling, fire hazards, and environmental compliance to promote safe and efficient production practices.

- In China, the Ministry of Industry and Information Technology (MIIT) regulates industrial production practices and quality standards for sintered steel. It also monitors energy consumption, environmental compliance, and adoption of advanced technologies to promote efficient and sustainable manufacturing.

- In India, the Bureau of Indian Standards (BIS) sets and enforces quality, safety, and dimensional standards for sintered steel components. It monitors environmental compliance and ensures material reliability to support sustainable and high-quality powder metallurgy production.

Competitive Landscape

Key players in the sintered steel industry are actively expanding and upgrading production capabilities to meet growing regional demand for high-performance components. They are developing advanced steel powders and alloys with improved hardness to support additive manufacturing and the production of complex parts.

They are also integrating advanced manufacturing technologies, such as precision powder metallurgy and optimized sintering processes, to improve efficiency and reduce material waste. Additionally, players are introducing versatile materials that combine mechanical performance with process adaptability, catering to automotive and consumer electronics applications.

- In September 2025, Sandvik AB launched Osprey MAR 55, a versatile tool steel powder designed for Laser Beam Powder Bed Fusion (PBF-LB) additive manufacturing. The alloy offers weldability, high hardness, and toughness, enabling efficient production of high-performance sintered steel components.

Top Key Companies in Sintered Steel Market:

- GKN Powder Metallurgy, Inc

- Miba AG

- Höganäs AB

- Sintercom Limited

- AMES Group Sintering, SA

- Atlantic Sintered

- Atlas Pressed Metals

- Sintex a/s

- Porous Metal Filters Inc

- Dalon Machinery Co., Ltd

- Baoji Saga porous filter Co., Ltd

- Sandvik AB

- Keystone Powdered Metal Company

- BEARING TECHNOLOGIES S.R.L.

- Allied Sinterings, Inc.

Recent Developments

- In February 2024, Phoenix Sintered Metals acquired the assets of Catalus Corporation and established Phoenix Sintered Metals Galeton, LLC. The acquisition strengthens Phoenix’s powder metallurgy platform in Pennsylvania and enhances its manufacturing capacity.

- In June 2024, Desktop Metal launched its PureSinter furnace for debinding and sintering metal parts produced via Binder Jetting, MIM, and Press-and-Sinter PM methods. The furnace prevents contamination and enhances part purity, enabling more efficient production of high-quality sintered steel and metal components.

- In June 2024, AMETEK Specialty Metal Products launched High Green Strength Stainless Steel Powders. The powders provide improved green strength, minimize part damage during die ejection and transfer, and maintain sintered density and dimensional stability.