Market Definition

Powder metallurgy (PM) is a manufacturing process that involves the production of metal powders and consolidates them into finished or near-net-shape components through compaction and sintering. This technique allows for the creation of complex geometries with high precision, making it a cost-effective alternative to traditional machining methods.

Materials used in powder metallurgy include iron, steel, aluminum, titanium, and nickel-based superalloys, selected for properties such as strength, durability, and thermal resistance. Powder metallurgy finds applications across various industries, including automotive, aerospace, medical, and electronics.

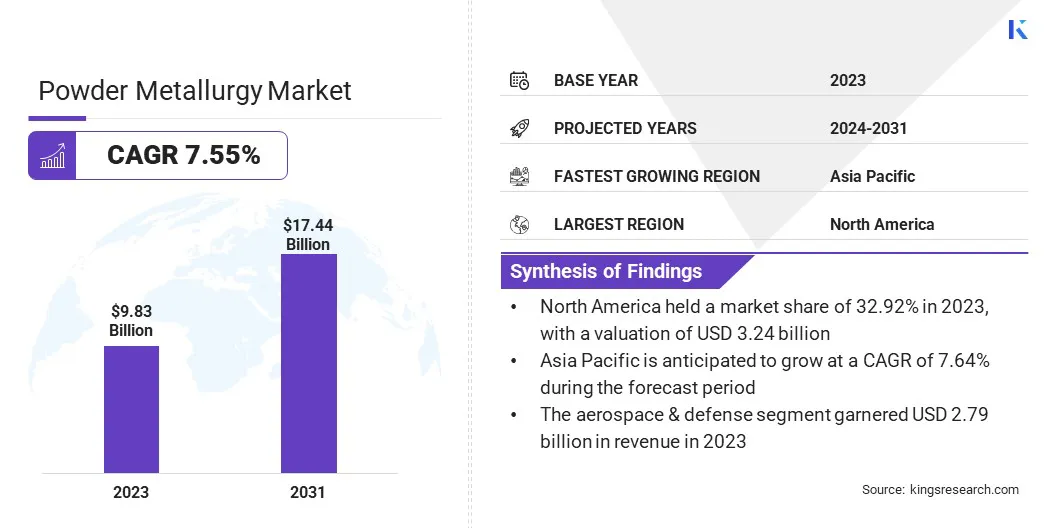

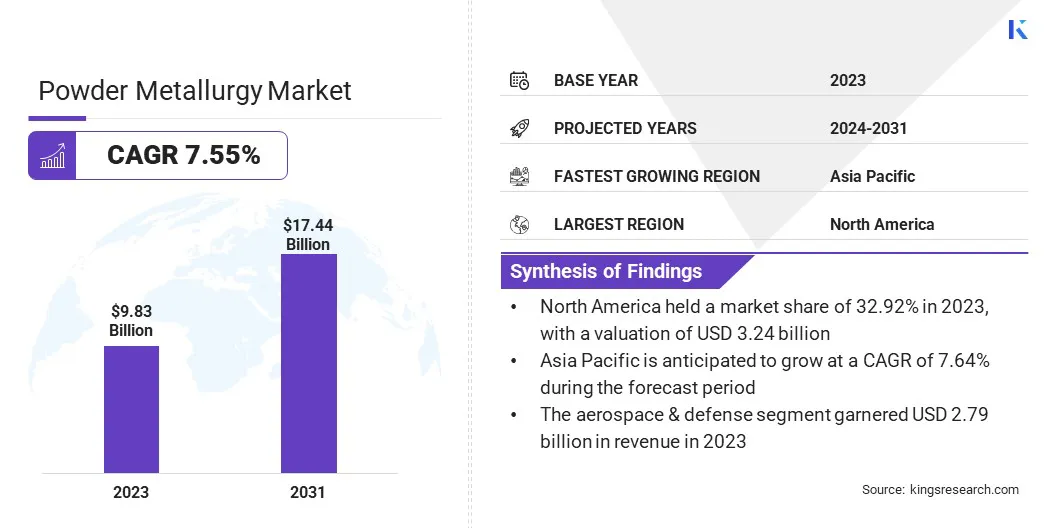

The global powder metallurgy market size was valued at USD 9.83 billion in 2023 and is projected to grow from USD 10.47 billion in 2024 to USD 17.44 billion by 2031, exhibiting a CAGR of 7.55% during the forecast period.

The global market is experiencing steady growth, driven by the increasing demand for advanced materials in high-performance industries such as automotive, aerospace, and healthcare. The market is characterized by a shift toward lightweight and durable components, which are essential for improving fuel efficiency and reducing emissions in transportation.

Major companies operating in the powder metallurgy market are GKN Powder Metallurgy, AMETEK Inc., Advanced Technology & Materials Co., Ltd., POLEMA, Sandvik AB, Höganäs AB, Rio Tinto Metal Powders, RusAL, Liberty House Group, Desktop Metal, Inc., Sumitomo Electric Industries, Ltd., ATI Inc., H.C. Starck Tungsten GmbH, and others.

Additionally, the rise of electric vehicles (EVs) has created a significant opportunity for market growth, as EV manufacturers seek innovative solutions for battery components, electric motor parts, and other critical systems. Emerging markets in Asia-Pacific, particularly China and India, are further contributing to this expansion due to rapid industrialization and urbanization.

However, the industry faces challenges such as high initial costs and environmental regulations. Despite these hurdles, the growing emphasis on sustainability and the development of new materials and technologies present lucrative opportunities for market players to innovate and capture a larger market share.

- In 2023, global electric vehicle registrations reached nearly 14 million, bringing the total EV fleet to 40 million. Sales grew 35% year-over-year, adding 3.5 million more units than in 2022, which is over six times the volume recorded in 2018, underscoring the sector’s rapid expansion and accelerating market penetration.

Key Highlights:

- The powder metallurgy industry size was recorded at USD 9.83 billion in 2023.

- The market is projected to grow at a CAGR of 7.55% from 2024 to 2031.

- North America held a share of 32.92% in 2023, valued at USD 3.23 billion.

- The ferrous segment garnered USD 6.76 billion in revenue in 2023.

- The automotive segment is expected to reach USD 5.22 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 7.64% over the forecast period.

Market Driver

"Rising Demand for Lightweight Components"

The rising demand for lightweight components is contributing significantly to the growth of the powder metallurgy market, particularly in industries such as automotive, aerospace, and electronics. Lightweight materials are essential for improving fuel efficiency, reducing emissions, and enhancing overall performance.

Powder metallurgy enables the production of high-strength, low-weight components that meet these requirements, making it a preferred choice for manufacturers. For instance, in the automotive sector, PM is used to create lightweight engine parts, transmission components, and structural elements, supporting the development of more efficient vehicles.

Furthermore, in aerospace, PM-produced parts reduce aircraft weight, leading to lower fuel consumption and operational costs. This growth is further aided by stringent environmental regulations and the global shift toward sustainability, which promote the adoption of advanced materials and manufacturing techniques such as powder metallurgy.

Market Challenge

"Difficulty in Producing Complex Geometries"

A major challenge impeding the growth of the powder metallurgy market is the difficulty in producing components with highly complex geometries.

Traditional PM processes, such as compaction and sintering, often face limitations in achieving intricate designs and fine details, which can restrict their application in advanced industries such as aerospace and medical devices. This challenge is further compounded by the need for high precision and consistency in these sectors.

This issue can be addressed by advancements in additive manufacturing, particularly 3D printing using metal powders. By leveraging layer-by-layer fabrication, manufacturers are producing complex geometries with greater accuracy and flexibility.

Additionally, hybrid manufacturing techniques that combine traditional PM with additive methods are emerging as effective solutions to overcome these limitations, enabling the production of highly customized and intricate components.

Market Trend

"Advancements in 3D Printing Using Metal Powders"

Advancements in 3D printing using metal powders are revolutionizing the powder metallurgy market, offering significant opportunities for innovation and customization. This trend is supported by the ability of additive manufacturing to produce complex, high-performance components with minimal material waste.

Industries such as aerospace, healthcare, and automotive are increasingly adopting 3D printing to create lightweight, durable parts that were previously unfeasible or cost-prohibitive. For instance, in healthcare, 3D-printed titanium implants are tailored to individual patient anatomy, improving outcomes and reducing recovery times.

In aerospace, 3D-printed components are used to optimize fuel efficiency and reduce aircraft weight. The integration of advanced metal powders, such as nickel-based superalloys and titanium, further enhances the mechanical properties and thermal resistance of 3D-printed parts, reinforcning 3D printing as a key component of modern manufacturing.

- For instance, in October 2024, researchers at Oak Ridge National Laboratory (ORNL) explored advanced powder metallurgy-hot isostatic pressing (PM-HIP) techniques to address the challenge of manufacturing large metal components (weighing over 10,000 pounds). This innovative approach offers a viable alternative to traditional casting and forging, with the potential to revitalize U.S. production across sectors such as aerospace, defense, and clean energy.

|

Segmentation

|

Details

|

|

By Material

|

Ferrous (Iron, Steel), Non-Ferrous (Aluminum, Copper, Nickel, Cobalt, Tungsten, Titanium, Chromium, Molybdenum)

|

|

By Application

|

Aerospace & Defense, Automotive, Medical, Electrical & Electronics, Industrial, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Material (Ferrous and Non-Ferrous): The ferrous segment earned USD 6.76 billion in 2023 due to its extensive use in automotive, industrial machinery, and construction applications. Additionally, the increasing adoption of powder metallurgy for producing automotive transmission gears, bearings, and structural parts has propelled the growth of the segment.

- By Application (Aerospace & Defense, Automotive, Medical, Electrical & Electronics, Industrial, and Others): The aerospace & defense segment is expected to record a remarkable CAGR of 7.63% over the forecast period, driven by the rising adoption of powder metallurgy in producing high-strength, lightweight components.

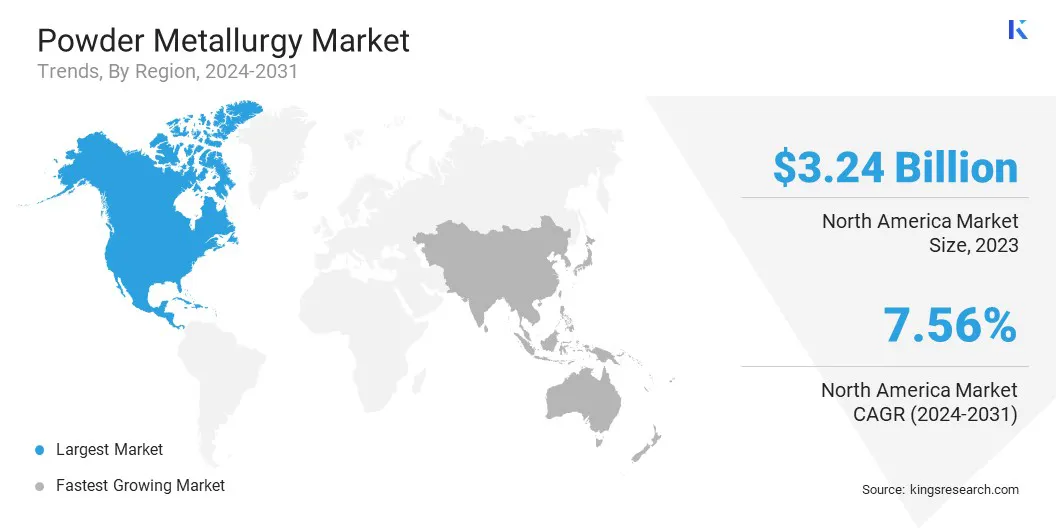

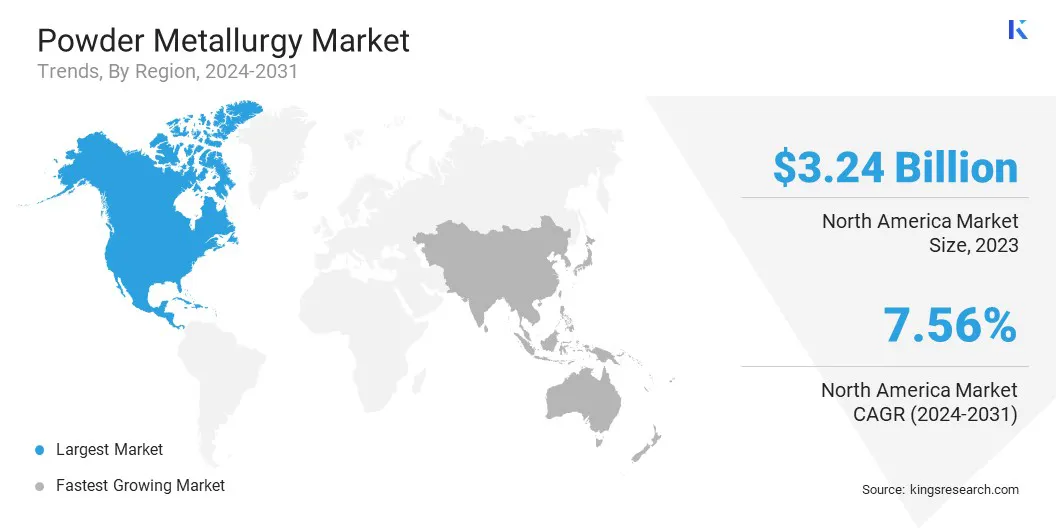

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America powder metallurgy market accounted for a share of around 32.92% in 2023, valued at USD 3.24 billion, supported by strong demand across automotive, aerospace, and industrial applications.

The regional market benefits from a well-established manufacturing base, extensive R&D activities, and technological advancements in powder metallurgy techniques, including metal injection molding (MIM) and additive manufacturing.

The automotive sector, particularly in the United States, is a contributing significantly to this growth, as major automakers increasingly adopt powder metallurgy to produce lightweight, high-strength components that improve fuel efficiency and reduce emissions.

Additionally, the region’s robust aerospace & defense industry, with increasing investments in next-generation aircraft and defense equipment, has fueled the adoption of powder-based materials for high-performance applications. Moreover, favorable government policies promoting sustainable manufacturing and material efficiency are boosting regional market expansion.

Asia-Pacific powder metallurgy industry is set to grow at the highest CAGR of 7.64% over the forecast period, propelled by rapid industrialization, expanding automotive production, and increasing adoption of advanced manufacturing technologies.

Countries such as China, India, Japan, and South Korea are at the forefront of this growth, characterized by rising demand for lightweight, high-performance components in the automotive, aerospace, and medical sectors.

The surge in electric vehicle (EV) production in China and India has highlighted the urgent need for powder metallurgy-based components, such as high-strength gears, bearings, and battery parts.

Additionally, the increasing focus on sustainable manufacturing and the shift toward cost-effective, waste-minimizing production methods are fueling regional market expansion. The rise of 3D printing using metal powders and government initiatives supporting local manufacturing further support domestic market expansion.

- For instance, in August 2024, the Powder Metallurgy Association of India (PMAI), in collaboration with Malvern Panalytical and the University of Pune, hosted a workshop on the impact of particle size and shape in powder metallurgy and advanced manufacturing. The event highlighted key quality control and R&D technologies, including laser diffraction and analytical imaging.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the powder metallurgy sector is primarily regulated by agencies such as the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA). The EPA enforces regulations concerning air emissions and waste management to mitigate environmental impacts. OSHA sets workplace safety standards to protect employees from occupational hazards associated with metal powders. Additionally, the Bureau of Industry and Security (BIS) under the Department of Commerce oversees export controls, particularly for materials with potential military applications, as outlined in the Export Administration Regulations (EAR).

- The EU imposes stringent environmental and safety regulations on the powder metallurgy industry through directives such as the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) and the Waste Framework Directive. REACH mandates the registration and assessment of chemical substances, including metal powders, to ensure their safe use. The Waste Framework Directive emphasizes waste reduction and recycling, impacting the disposal and recovery processes in powder metallurgy. Individual member states may have additional regulations complementing these directives.

- UK has established its own regulatory frameworks mirroring the EU's standards. The UK REACH regulation governs the management of chemical substances, requiring manufacturers and importers to register substances and assess risks. The Health and Safety Executive (HSE) enforces workplace safety regulations pertinent to the handling and processing of metal powders.

Competitive Landscape:

The powder metallurgy industry is characterized by a number of participants, including both established corporations and emerging players. The competitive landscape of the market is characterized by intense rivalry among key players, bolstered by their focus on innovation, strategic partnerships, and geographic expansion.

Companies are investing heavily in research and development to enhance material properties, such as strength, durability, and thermal resistance, to meet the evolving demands of automotive, aerospace, and healthcare industries. Strategic collaborations with end-users and technology providers fuel co-developed solutions and competitive advantages.

Additionally, mergers and acquisitions strengthen market presence and product portfolios. Key growth imperatives include the adoption of sustainable manufacturing practices, the integration of additive manufacturing technologies, and the exploration of emerging markets in

Asia-Pacific and Latin America. Key players focus on cost optimization, operational efficiency, and customer-centric approaches to maintain agility in a dynamic market.

List of Key Companies in Powder Metallurgy Market:

- GKN Powder Metallurgy

- AMETEK Inc.

- Advanced Technology & Materials Co., Ltd.

- POLEMA

- Sandvik AB

- Höganäs AB

- Rio Tinto Metal Powders

- RusAL

- Liberty House Group

- Desktop Metal, Inc.

- Sumitomo Electric Industries, Ltd.

- ATI Inc.

- C. Starck Tungsten GmbH

Recent Developments (Agreements/Launch)

- In January 2025, AMETEK Specialty Metal Products advanced its development of tailored metal powders designed to meet complex global demands. With rising demand for customized material solutions, these advanced metal powders play a crucial role in manufacturing precision-engineered components for specialized applications across diverse industries, enhancing performance and efficiency in critical sectors.

- In January 2024, Sandvik signed a distribution agreement with KBM Advanced Materials to expand the sales and distribution of metal powders for additive manufacturing (AM) in the U.S. This partnership enhances market reach and improves access to Sandvik’s Osprey metal powders, strengthening its position in the regional AM industry.